- SEI has been eyeing $0.65 as the next key target.

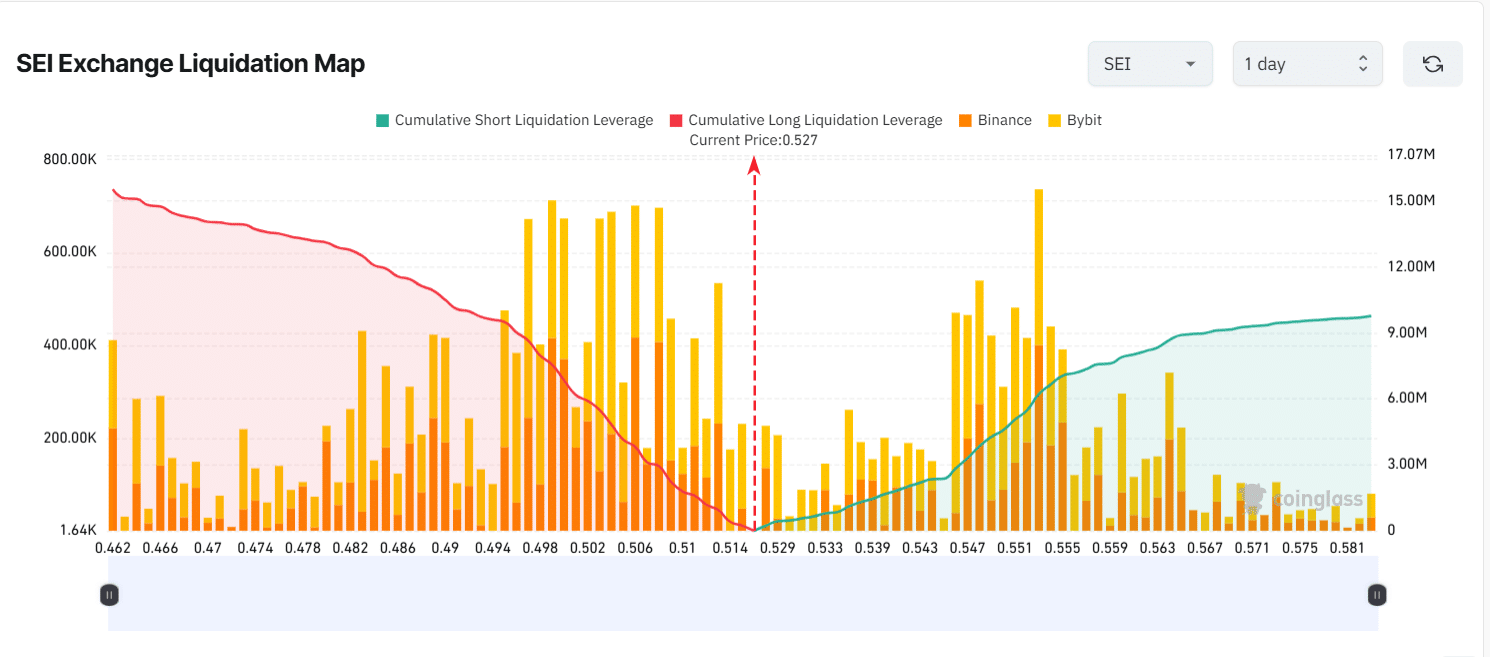

- The liquidation map showed key pressure points at $0.514 and $0.550.

As a seasoned crypto investor with years of experience navigating the ever-changing cryptospace, I find myself intrigued by the current trajectory of Sei Network [SEI]. Its impressive 60% recovery over the past two weeks and consistent trading volume of $783.84 million are undeniable signs of strong market interest.

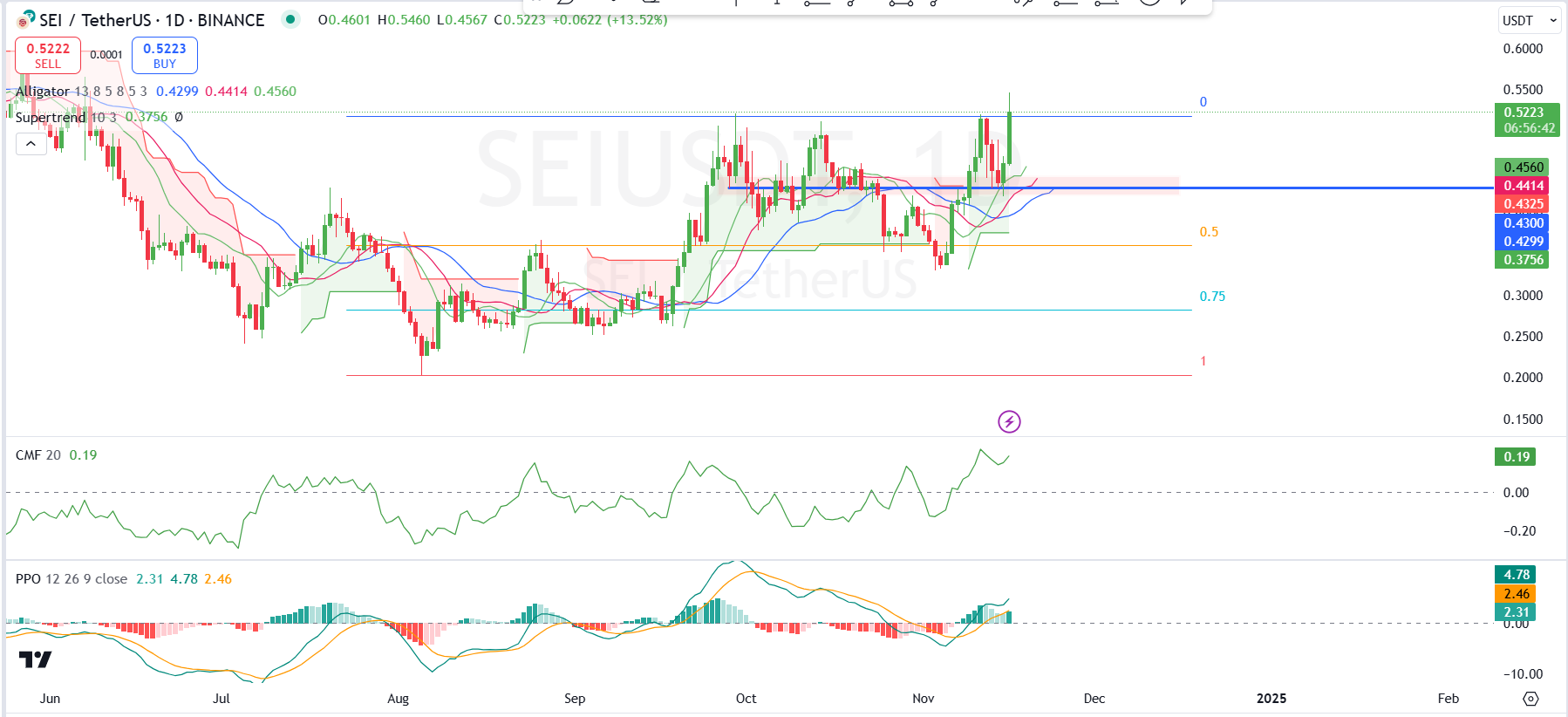

In the past fortnight, the Sei Network (SEI) has experienced a significant surge, rising by about 60%. This upward trend emerged after a brief setback that brought the currency back to around half of its Fibonacci level as depicted on the daily chart.

At the time of writing, SEI’s price was $0.5264, representing a 14% gain in the last 24 hours.

Meanwhile, the trading volume has reached $783.84 million, indicating strong market interest.

Moreover, the Total Value Locked stood at approximately $207.32 million, demonstrating a strong base of user involvement and active platform usage.

Analyst predictions

Initially, the price of SEI shot up significantly, creating a ‘flagpole’, then entered a period of sideways movement within a channel that gradually sloped downwards.

The breakout above the flag’s upper boundary now confirmed renewed bullish momentum.

At the moment of reporting, the level where the price might surge significantly was around $0.4600, and based on the pattern of a bull flag, the estimated potential price rise could reach approximately $0.65.

The estimated growth takes into account the height of the flagpole plus the breakout point, implying a strong possibility of further growth for SEI as long as the breakout persists.

SEI signals strong uptrend

Based on SEI’s day-to-day price chart, it appears that significant resistance levels have been breached, suggesting a progression towards previous high points. This could signal the possible prolongation of the upward trend.

The main obstacle was approximately $0.5460, but $0.4414 acted as an important level of support. This level coincided with the middle point of the Supertrend and the moving averages.

The gap between the Alligator lines was expanding, reinforcing a pattern showing a robust upward trend since the price consistently stayed above these lines, suggesting persistent bullish energy.

As long as the price stayed above the trendline, the SuperTrend signal indicated a strengthening bullish trend.

As an analyst, I noticed that the Chaikin Money Flow value stood at a robust 0.19 for SEI. This signifies a significant increase in buying pressure, indicating substantial capital influx into the company, which I find encouraging.

Investor utility on the rise?

Over the last year, the amount locked up or secured (Total Value Locked) in SEI has consistently climbed higher, currently standing at roughly $207.32 million.

The surge in usage clearly demonstrates the growing popularity and robust interaction among users on this platform, within the Decentralized Finance (DeFi) community.

From virtually nothing at the end of 2023, Total Value Locked (TVL) began a swift expansion in 2024, showing notable spikes in March, July, and November, hinting at crucial stages of growth or user engagement.

The growing TVL (Total Value Locked) and escalating trading activity suggest a solid base for the deployment of SEI’s Decentralized Finance solutions.

This steady growth suggests that users are keeping their funds tied up for long-term purposes, which is a good indication of the platform’s long-term sustainability and ability to handle larger operations.

Shorts under pressure

As the price climbed higher, the total short liquidation leverage (represented by green) grew, suggesting that there was growing pressure on short positions priced above $0.527.

As the price fell beneath this point, the total accumulated leverage for long positions (represented in red) also lowered, implying that there might be a greater risk for long positions when prices are lower.

In summary, the liquidation groups pinpointed significant points of attention. Particularly interesting is the cluster of prolonged liquidations near the $0.514 price point, while there was also a high volume of short liquidations positioned above the $0.550 mark.

Read Sei’s [SEI] Price Prediction 2024–2025

As a seasoned trader with years of experience under my belt, I can confidently say that any substantial price shift towards these levels could potentially set off a chain reaction of liquidations, resulting in increased market volatility. From my personal observations and lessons learned from the market’s ups and downs, I know all too well how quickly things can escalate when there’s a significant move in prices. In such situations, it’s crucial to stay vigilant and adapt quickly to maintain profitability and protect my investments.

At the current price of $0.527, SEI found itself in a pivotal position. A potential upward surge might squeeze the short sellers, while a downward trend could instigate long position closures.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-17 12:08