- Some ponderous creatures of the sea, otherwise known as whales, have whimsically decided to pile their treasure back into this curious TRUMP token while the rest of us yawn.

- The derivatives market, ever the sly puppeteer, offers a muddled sign—a riddle wrapped in a mystery, stewing in uncertain price movements.

In the last day’s turn of the hourglass, Official Trump [TRUMP] managed a modest pirouette upwards of 1.57%, which might seem humble after last week’s almost comical 79% leap—one imagines the bulls either napping or plotting next mischief.

The whales, those grand dandies of the markets, continue their gluttonous dance, ravenous in their acquisitions, while the derivatives whisper conflict in the shadows, sellers grimacing like those who missed the last supper.

Whales Gather ‘Round the Trump Banquet

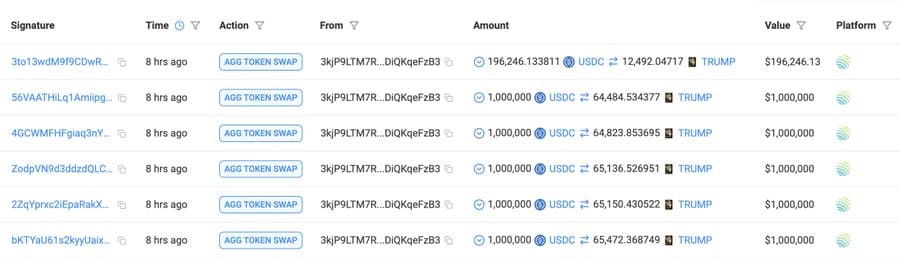

Indeed, with the announcement of Mr. Trump’s exclusive dinner—a gala surely garnished with both ego and caviar—two new leviathans surfaced, returning to feast upon the TRUMP token, a veritable buffet worth $6.42 million.

The first gourmand, having once fled the market banquet, did a quick backpedal worthy of a farce, snagging 337,950 TRUMP tokens for a princely $5.2 million after hearing the dinner bells.

The second fatted whale turned their nose up at the stinky leftovers known as Fartcoin [FARTCOIN]—a name that tickles both the senses and the funny bone—liquidating their holdings to splurge $1.22 million on TRUMP.

This renewed appetite came just as spot market sellers, weary and perhaps queasy, paused their $27.63 million sell-off, halting the downward slide with the grace of a drunken ballerina.

A Frail Truce, or Bullish Whimsy?

Yet, the derivatives market, that mischievous puppet master, showed a dance of tug-of-war; longs and shorts liquidated in near-perfect balance—$4.42 million on one side, $4.37 million on the other—a stalemate akin to two drunks clutching the same bottle.

This precarious equilibrium whispers no confident direction, leaving traders like a crowd watching a cat chase its tail—delightful but ultimately futile.

Nonetheless, the market’s mood, measured by that elusive OI-Weighted Funding Rate, leans slightly bullish, like a cat perched uncertainly on a fence—careful but hopeful, giving us a timid waltz toward rising prices with a faint 0.0116% cheer.

But Beware the Bearish Shadows

Alas, the pessimists persist. The Funding Rate lingers in the negatives, dipping to -0.0019, whispering that short sellers, those gamblers paying fees with the reckless abandon of poker players bluffing on a bad hand, maintain their quiet siege.

With short positions perched like hawks, and derivatives trading volume stubbornly below 1, the bears lounge comfortably, perhaps sipping nonexistent tea, confident in their dominion.

The Long-to-Short Ratio, that simple tally of buyers versus sellers, tips in favor of the sellers—those invisible hands guiding TRUMP’s price downward like an elevator out of service.

Should this delicate balance falter, one fears the bulls’ hunger will again wane, leaving a feast of decline for those comfortable in shadows. How long will their appetite last? That, dear reader, remains the dinner conversation of the century.

Powered by Pollinations.AI free text APIs. [Support our mission](https://pollinations.ai/redirect/kofi) to keep AI accessible for everyone.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2025-04-28 03:09