-

A large percentage increase in the SHIB token burn was seen on the 11th of August

The price impact was slight, and the meme coin maintained its bearish long-term outlook.

As a seasoned crypto investor with battle scars from navigating through numerous market cycles, I must admit that the recent surge in Shiba Inu [SHIB] token burn rate was quite intriguing, especially given the relatively minor price impact. The 38199412.62% increase in burned tokens on August 11th was undeniably noteworthy. However, as we all know too well, the crypto market can be as unpredictable as a roller coaster ride in a funhouse mirror maze.

On August 11th, a significant Shiba Inu [SHIB] token burning event took place, resulting in the destruction of approximately 38,812,544 or 38.8 million tokens. This represents a massive increase of over 38,000,000% compared to the amount burned the day before.

After the recent surge, the rate at which SHIB is being burned has significantly slowed down. According to Shibburn, a decline of nearly 96% in the daily burn rate was observed following the spike yesterday.

What is the burn mechanism?

The aim behind incinerating any cryptocurrency token is primarily to maintain its rarity and combat potential inflation. To illustrate, Ethereum [ETH] achieves this goal by destroying ETH derived from transaction charges, which can be broken down into two parts: the base fee and the priority fee.

Just like Shiba Inu, it too possesses a comparable burn mechanism. With every transaction made on the network, a certain proportion of the transaction charge is forwarded to the burn address.

These special addresses, known as burn or null addresses, are capable of receiving Shiba Inu tokens, but they cannot send them back. Sending tokens to these addresses results in their removal from the circulating supply, as they are essentially ‘burned’ and no longer available for reuse within the ecosystem. The Shiba Inu blockchain currently has three such addresses.

Price impact of SHIB’s burn rate hike?

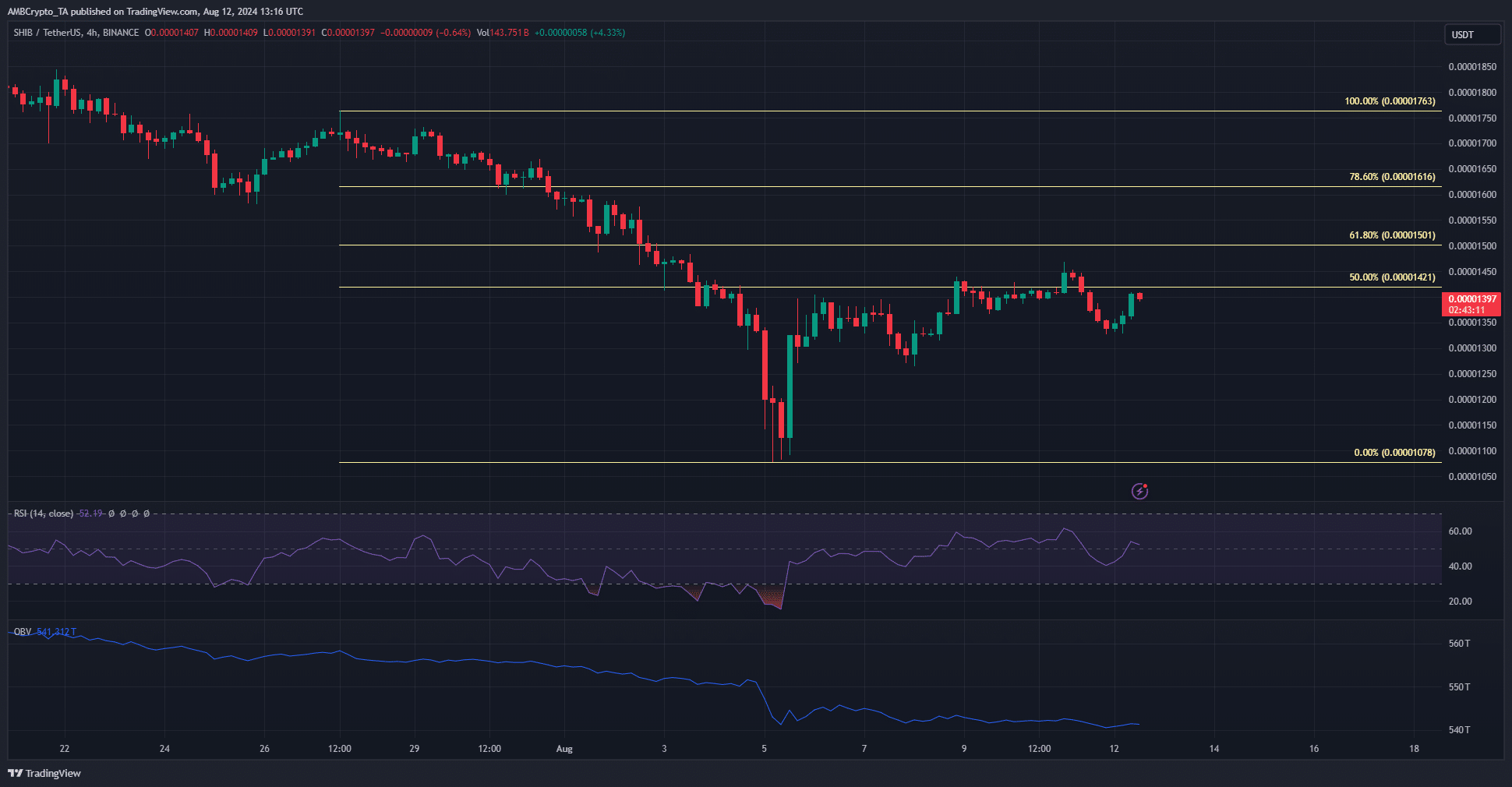

In simpler terms, over the weekend, cryptocurrencies as a whole experienced a drop of approximately 5%. Although the short-term trend suggested bullishness, the long-term outlook appeared to be quite bearish.

As a seasoned trader with years of experience under my belt, I have learned to read charts like a book. The Relative Strength Index (RSI) showing neutral momentum around the 50 level is a familiar sight, one that often signals caution but not necessarily doom and gloom. Meanwhile, the On-Balance Volume (OBV) moving southward, albeit at a slower pace over the past four days, raises some red flags. While I have seen situations where such trends can lead to significant market movements, I always remind myself that every market has its own unique story to tell. So, while I am mindful of these technical indicators, I also keep an open mind and wait for further confirmation before making any major decisions. After all, the market is a tricky beast, and it never ceases to surprise even the most seasoned traders.

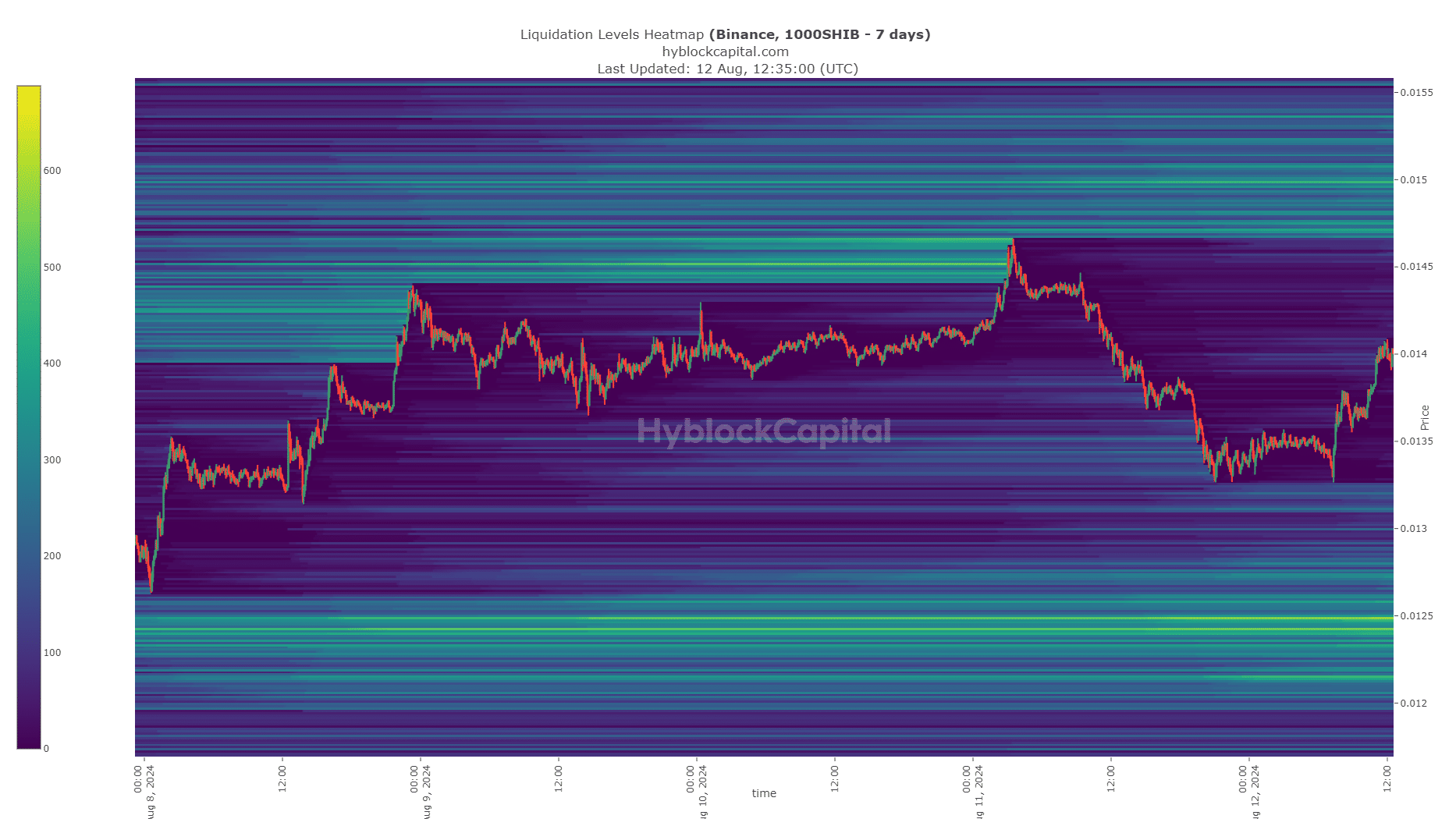

Last week’s liquidation heatmap highlighted that the levels at $0.0000125 and between $0.0000145 and $0.000015 were key points to focus on.

Realistic or not, here SHIB’s market cap in BTC’s terms

As someone who has navigated through multiple market cycles and witnessed numerous cryptocurrency trends, I find it challenging to predict with certainty which short-term liquidity pockets will initially attract SHIB. However, based on my past experiences, I believe that a reversal could potentially start from one of these areas. The crypto market is known for its volatility and unpredictability, but keeping a close eye on these liquidity pools and analyzing the overall market sentiment could provide valuable insights. It’s essential to stay adaptable and be prepared for any eventualities in this fast-paced environment.

In simpler terms, if there’s not much interest or demand and this area has more liquidity (money waiting to be traded), it could be the place where the price drops first, indicating a bearish trend.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-08-12 16:55