- Shiba Inu continued to trend downward, losing a key support zone in the process

- The selling volume has been muted, giving bulls some hope of a recovery later on

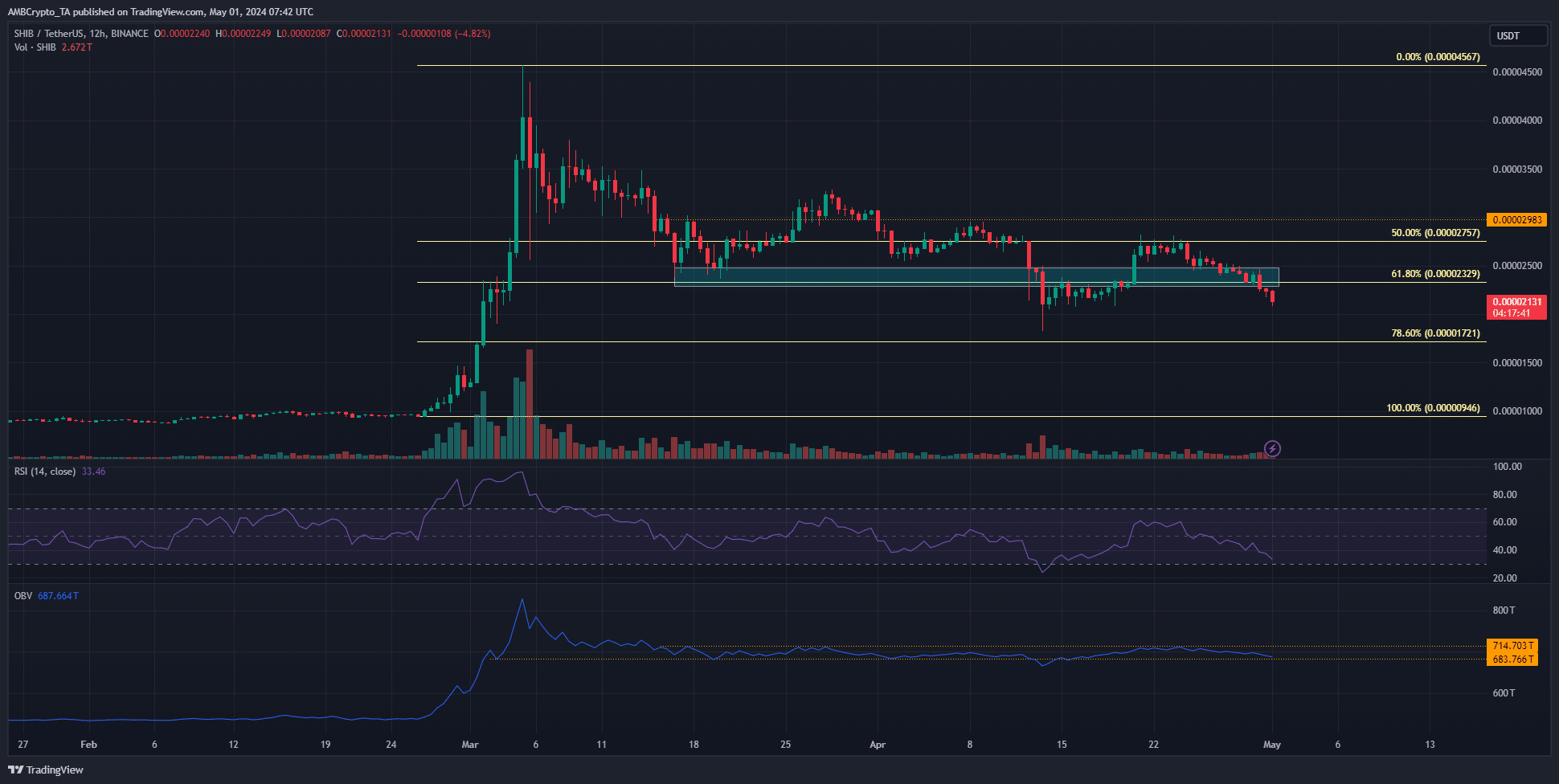

As a researcher with a background in cryptocurrencies and experience in analyzing market trends, I’ve been closely monitoring the recent developments in the Shiba Inu [SHIB] market. My analysis shows that SHIB continued to trend downward, losing a key support zone at the $0.000024 region.

At the $0.000024 mark, SHIB (Shiba Inu) dipped beneath a significant level of buying interest. The selling force remained strong in this situation, even as there was a decrease in the amount of SHIB tokens being held on cryptocurrency exchanges.

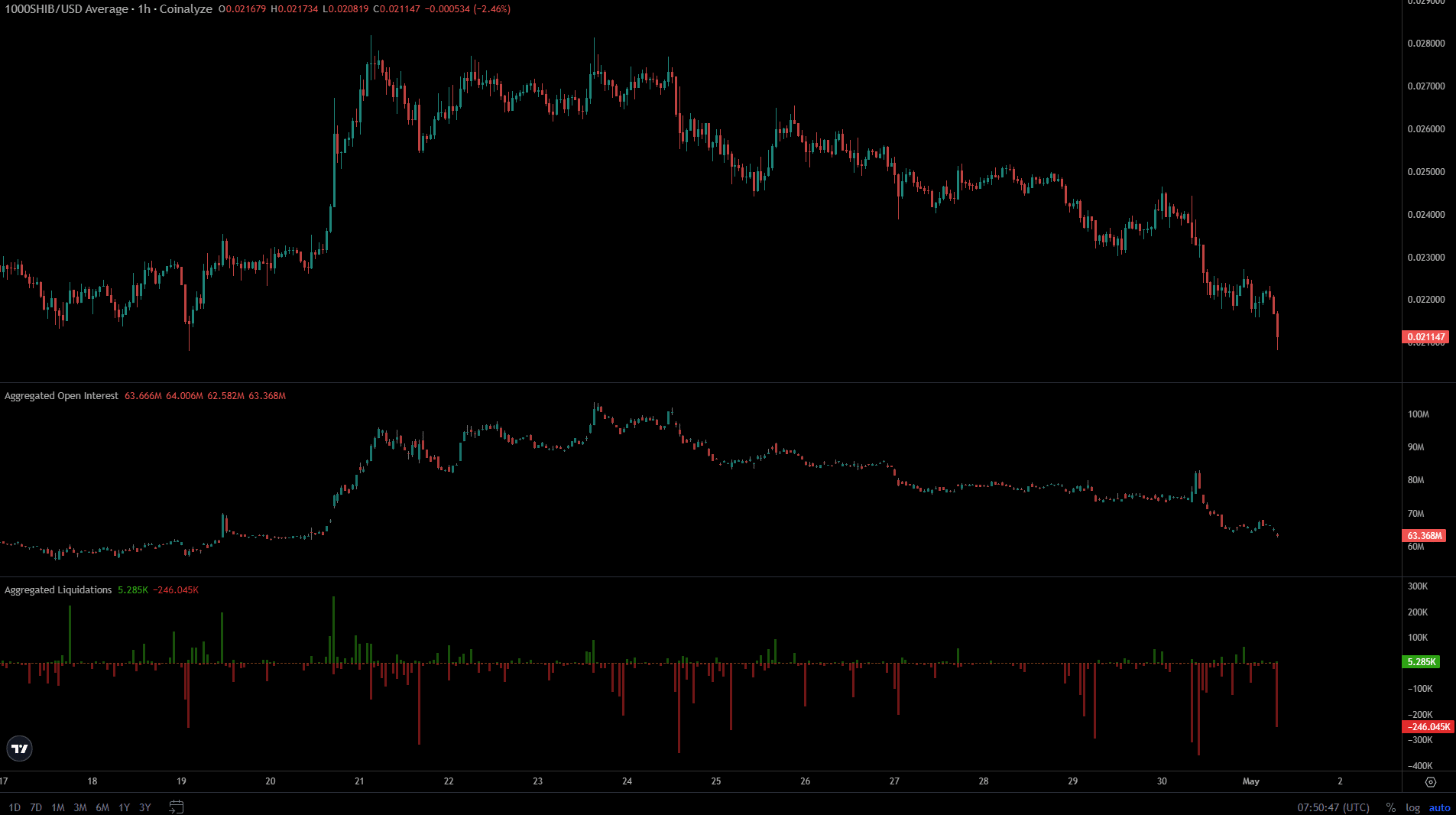

Liquidated long positions have also contributed to accelerating the recent losses.

If Bitcoin (BTC) dropped below $59,000, it’s plausible that the price of Shiba Inu would pull back to its subsequent Fibonacci support point.

The balance of buying and selling was surprising

On the 12-hour chart, the Relative Strength Index (RSI) stood at 33, signaling robust downward momentum. A slight dip below the 30 threshold was imminent, suggesting the market may be overbought. However, reaching oversold status doesn’t automatically signal a rebound.

The trend of Bitcoin and other markets may cause SHIB to drop an additional 19%. The upcoming support level for SHIB, as indicated by Fibonacci retracement levels (pale yellow), is located at $0.0000172.

Around the 15th of April, the $0.0000212 mark acted as a base of buying pressure. A potential rebound could occur if this level is revisited again. Despite the declining trend in April, the On-Balance Volume (OBV) remained fairly stable within its range.

This suggested that selling pressure wasn’t overwhelming.

If the OBV (On-Balance Volume) doesn’t break below its lower support level, Shiba Inu bulls can look forward to potential recoveries at the two indicated support points.

The effect of liquidations on Shiba Inu coin price

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

Over the last ten days, Open Interest figures have dropped significantly, suggesting a strong bearish trend. The declining prices further underscored this pessimistic outlook, causing reluctance among speculators to invest in SHIB price increases.

Over the last two days, prolonged sell-offs led to numerous price surges for Shiba Inu coins. These sudden increases indicated widespread forced selling, intensifying the decline in coin value.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-05-02 04:07