- Shiba Inu bears dominated this week, making it one of the top losers.

- SHIB wedge pattern underscores breakout possibility but on-chain data reveals weak demand.

As a seasoned researcher with years of experience delving into the intricacies of the crypto market, I have to say that the recent performance of Shiba Inu [SHIB] has piqued my interest. While it’s true that it concluded the week as one of the top losers, the wedge pattern it’s forming hints at a potential bullish comeback. However, the on-chain data suggests otherwise, revealing weak demand that might be a cause for concern.

Shiba Inu (SHIB) ended the week as one of the greatest decliners in the top 20 digital currencies. Yet, this downward trend offers intriguing insights that could signal a robust bullish recovery ahead.

Over the past week, Shiba Inu experienced a drop exceeding 12%, making it the second-most negatively impacted coin among the leading digital currencies ranked by market capitalization, as reported by CoinMarketCap.

Earlier this month, it had made significant progress, but more recently, it has largely erased those advancements, leaving it just 5% above its starting price in October.

The remarkable display by the Shiba Inu was due to its memecoin being in a wedge formation, having previously compressed into a narrow trading range. The recent drop came close to touching its rising support line, suggesting a potential new surge upward.

At the point of this writing, SHIB had already rebounded by 6.15% to its current price of $0.000016, showing a strong increase in demand over the past 24 hours. This rise could potentially signal an upcoming bullish recovery.

Earlier in late September, Shiba Inu showed a significant surge. Yet, the formation of a wedge shape indicates reasons for the limited advancements following that period. However, there’s a good chance this pattern could break soon, potentially leading to broader rallies.

Evaluating the state of Shiba Inu accumulation

The Shib wedge pattern theoretically hints at some action that could suggest a potential rebound and breakout, or alternatively, a different outcome.

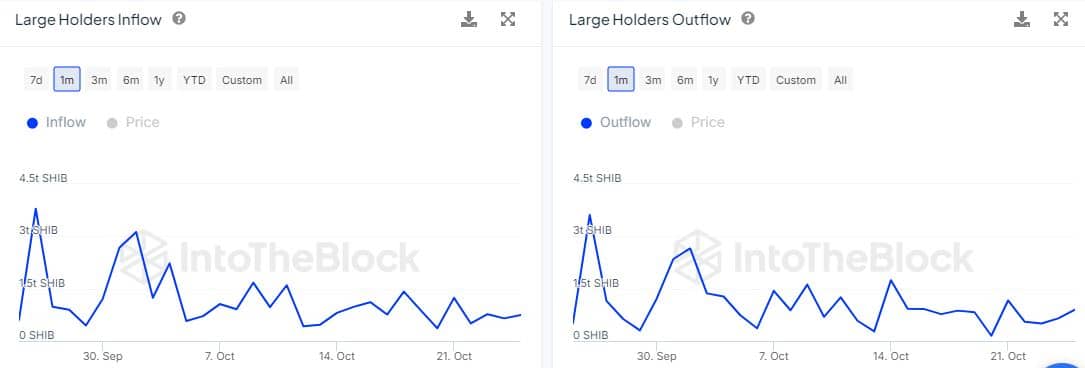

Recent data shows a trend of Shiba Inu tokens being transferred out of larger holders’ wallets more frequently, as opposed to an increase in the addition of these tokens by larger holders.

747.75 billion SHIB were inflowed into large holders on October 25th, without any significant accumulation in the preceding days last week. Conversely, there was a substantial outflow of 898.96 billion SHIB over the past three days, with a noticeable increase in outflows before that.

Read Shiba Inu [SHIB] Price Prediction 2024-2025

During the same period, significant inflows were observed in the large wallets, aligning with historical data on concentration. Upon examination, it was found that the proportion of holdings by whales had decreased from 60.03% at the beginning of the month to 59.74% as of October 25th. This suggests that whales have slightly reduced their balances this month.

Over the past three weeks, there was a noticeable lack of demand as both investor and retail trader accounts saw only modest increases. Specifically, investor balances climbed from 13.24% to 13.31%, while retail traders experienced a slight gain from 26.73% to 26.75%. In other words, the growth in these balances was minimal.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-27 11:03