- Large SHIB transaction volume spiked to its highest in weeks.

- The SHIB price has continued to rise since the spike.

As a seasoned analyst with years of market observation under my belt, I find myself intrigued by Shiba Inu’s recent surge in large transactions and subsequent price rise. This trend is not unlike watching a dog chasing its tail – it may seem circular, but the outcome can be quite unpredictable!

Recently, there’s been a surge in significant transactions involving Shiba Inu [SHIB], accompanied by a substantial uptick in the overall volume of transactions being processed.

The pattern has sparked curiosity about the potential impact on Shiba Inu’s price due to these fluctuations, since large volumes of transactions may indicate heightened market interest or substantial transactions by big investors (whales).

Examining the current increase in activity, together with Shiba Inu’s (SHIB) recent trends in pricing, could provide valuable clues about its possible future price movements.

Shiba Inu sees large transactions surge

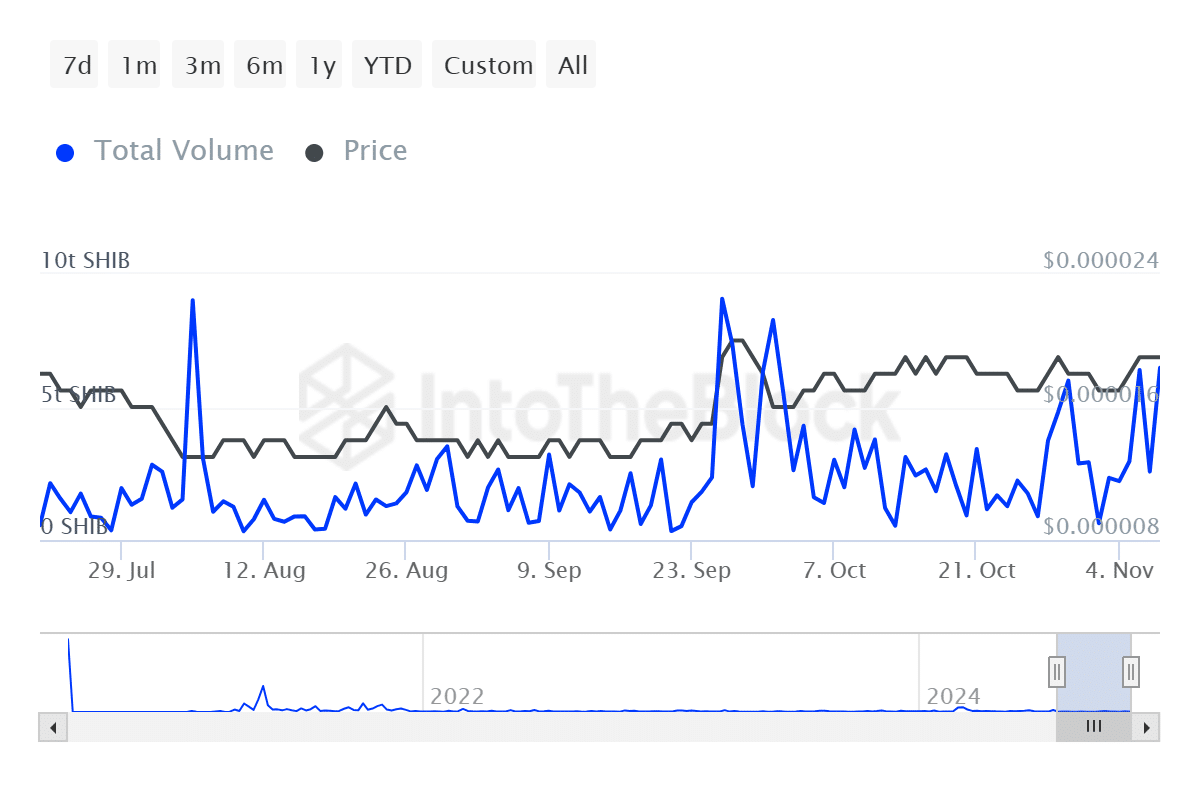

As shown on the graph provided by IntoTheBlock, there was a significant increase in larger transactions involving Shiba Inu towards the end of September. This trend persisted occasionally up until November, exhibiting notable spikes around early October and early November.

As a researcher, I observed an escalation in transaction volume towards early November, signifying heightened market activity. Remarkably, by the 8th of November, this significant transaction volume peaked at approximately 6.47 trillion SHIB.

The steady increase indicates that these significant transactions likely played a role in the latest rise in prices.

Price trend after large volume spike

The cost of Shiba Inu has been steadily rising ever since it surpassed the $0.000018 barrier. In just the last day, this surge has pushed the price up to more than $0.00002221, representing a 8.24% growth.

On November 8th, an analysis revealed a downward trend in the price as it handled over 6 trillion in transactions. Yet, since then, the price has consistently shown an upward movement.

In early October, the 50-day moving average surpassed the 200-day moving average, which could indicate a possible increase in optimistic trends.

Significantly, Shiba Inu held its ground above the $0.0000178 mark, which served as a base for it to gather strength before surging beyond $0.000022.

Currently, as we speak, the Relative Strength Index (RSI) stands at 72.22, signaling that Shiba Inu (SHIB) could be approaching the overbought zone. This warning should encourage traders to exercise caution when making trades.

If the positive trend persists for SHIB, it might challenge the upcoming resistance levels approximately at $0.000023 and $0.000025. On the flip side, a potential pullback could find support around $0.000018, a location where previous consolidation took place.

Potential implications of large transaction volume

A rise in significant trades might signal a rising curiosity among heavy-duty traders. Alternatively, it could be big investors (often referred to as “whales”) amassing Shiba Inu tokens, potentially suggesting faith in SHIB’s future value.

Yet, this action might cause increased market turbulence since major stakeholders could potentially control price movements.

As Shiba Inu (SHIB) nears important resistance points, its high trading activity might lead to a surge or a possible reversal, contingent upon whether major investors choose to purchase or offload coins at these thresholds.

As a crypto investor, I’ve noticed that the rising number of big transactions in Shiba Inu is creating a blend of optimism and prudence regarding its price trend. Keeping an eye on transaction volumes and Relative Strength Index (RSI) levels could provide valuable insights into Shiba Inu’s short-term prospects, helping me make informed decisions about my investment strategy.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-11 02:15