-

The SHIB downtrend paused briefly.

SHIB has remained in a strong bear trend.

As a researcher with experience in analyzing cryptocurrency trends, I have closely monitored the recent developments in Shiba Inu’s (SHIB) price trend. While it is true that SHIB experienced a brief pause in its downtrend during the previous trading session, it is essential to note that this trend has remained strong since early June.

As a researcher studying the cryptocurrency market, I’ve observed that Shiba Inu‘s price has been on a downward trend for several days. However, there was a brief respite during the last trading session. With this temporary halt in the slide, I’m curious if there are any other relevant indicators suggesting that Shiba Inu might regain momentum and potentially experience further growth.

SHIB’s downtrend takes a pause

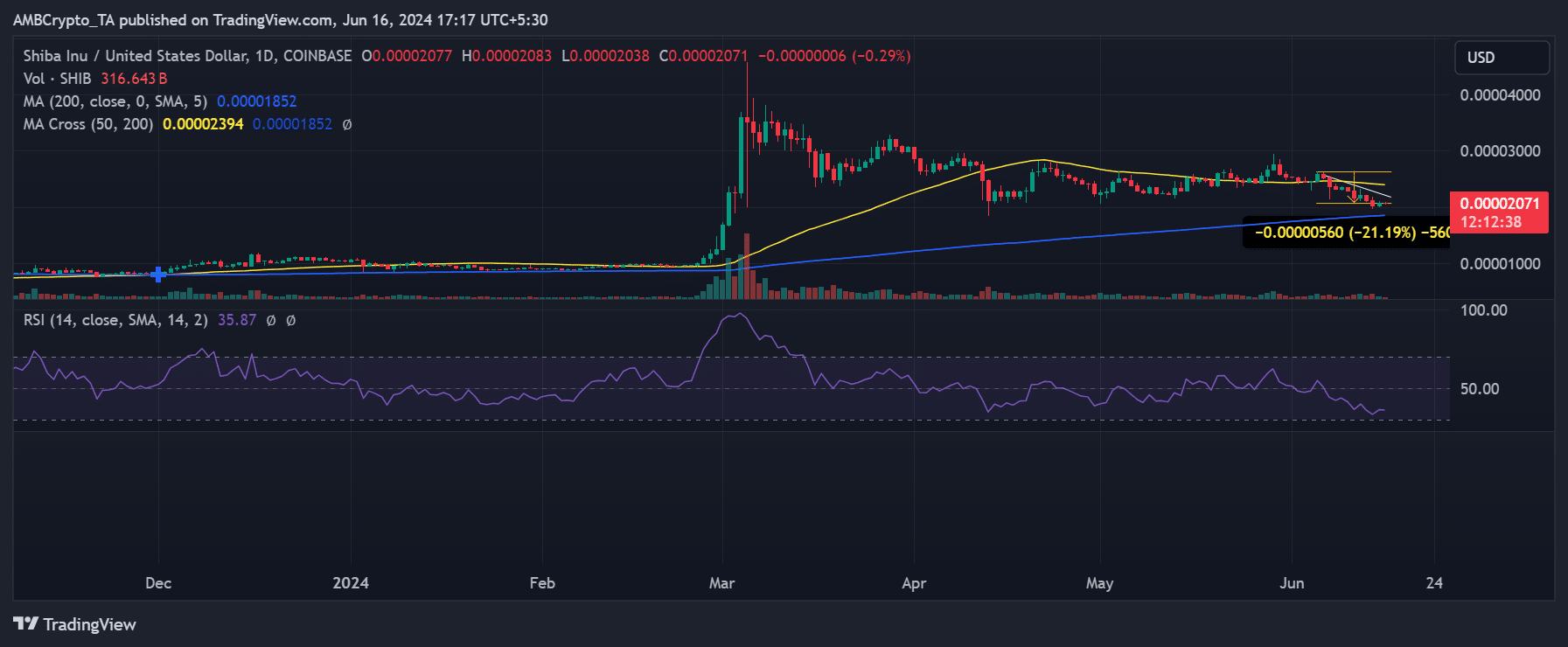

The price pattern of Shiba Inu was examined, revealing a downward trend that began as early as the 5th of June, without any substantial rebound since then.

From the onset of its decline up until now, Shiba Inu has experienced a loss of approximately 21%.

On the 15th of June, Shiba Inu experienced a 2.37% growth and was valued approximately at $0.000020 during trading. At present, its price has marginally decreased but remains within the same price bracket.

An examination of its Relative Strength Index (RSI) revealed a minor uptick as a result of the price surge. However, the RSI continues to suggest a dominant downward trend. At present, the RSI hovers around 35, signaling a robust bear market.

A drop in Shiba Inu’s address momentum

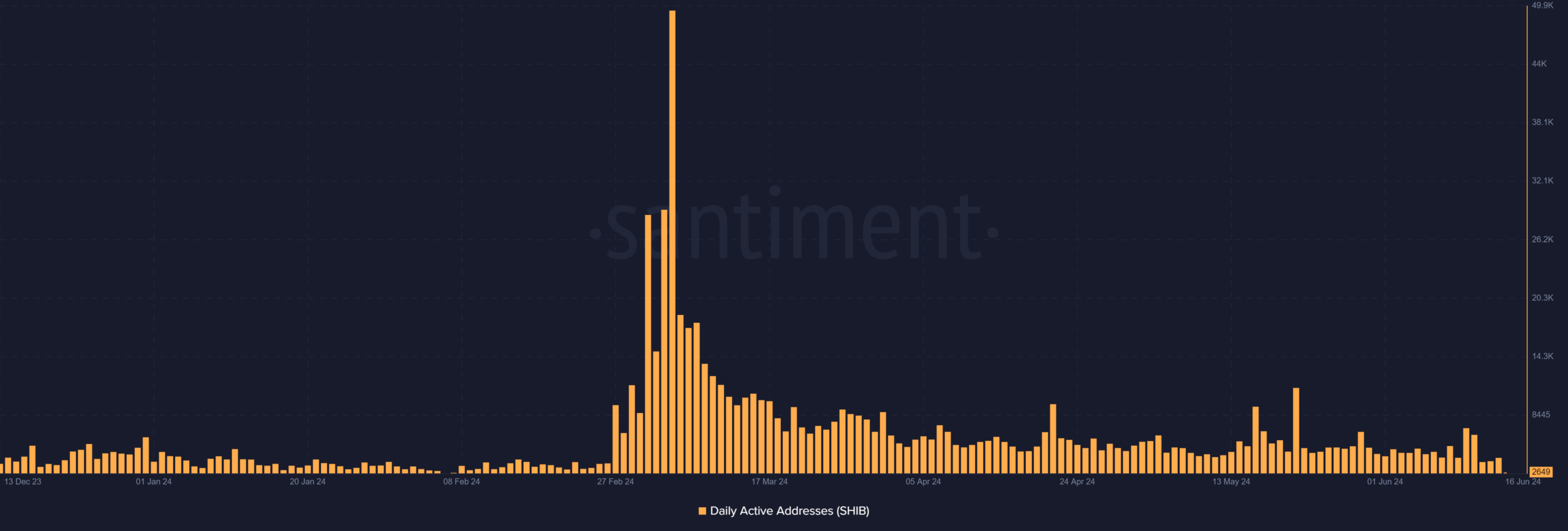

As a diligent analyst, I’ve taken notice of Shiba Inu’s momentary respite from its downward trend. This pause has piqued my curiosity and led me to explore alternative metrics for insights. Among these, daily active addresses have caught my attention. By examining this metric closely, I aim to gauge the level of activity on the Shiba Inu network, thereby providing valuable context to interpret the current market situation.

As an analyst, I’ve examined the daily active address data from Santiment. Over the past few weeks, there has been a noticeable decrease in this metric. Specifically, the chart reveals that between the 11th and 12th of June, the number of active addresses dropped from approximately 7,000 to around 6,000.

The initial figure was approximately 4,000, but subsequent decreases brought it down to around 3,700. At present, there are roughly 2,500 daily active addresses.

At present, the relatively small number of active addresses may not be sufficient to instigate significant price fluctuations.

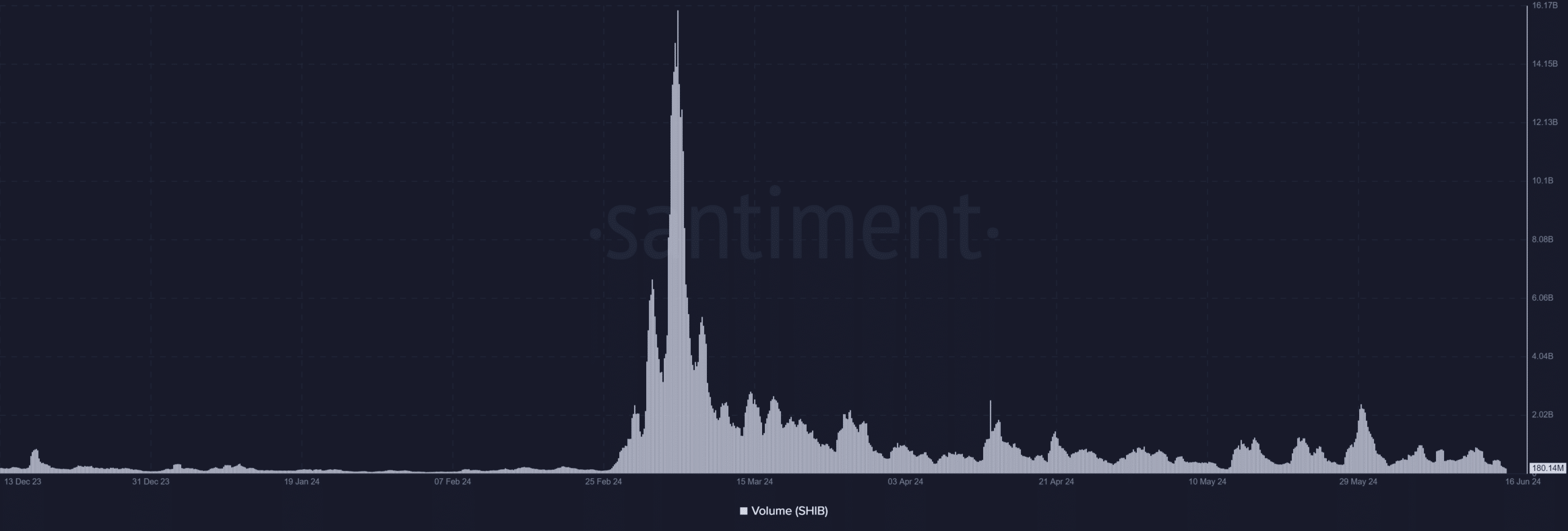

Shiba’s volume drops

The recent decrease in Shiba Inu’s trading volume aligns with the downturn in its daily active addresses, according to the analysis. At present, the volume hovers around $180 million based on the chart.

As a researcher analyzing trading data, I’ve observed an interesting trend: the trading volume exceeded $300 million in the last session, while it surpassed $400 million in the session prior to that.

As an analyst, I’ve observed that the current volume levels aren’t sufficient to influence the price trend. A more pronounced increase in volume is required for a noticeable effect on the market movement.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-17 09:11