-

Shiba Inu’s current price action showed a slight bearish edge, but hopes for a recovery are still alive.

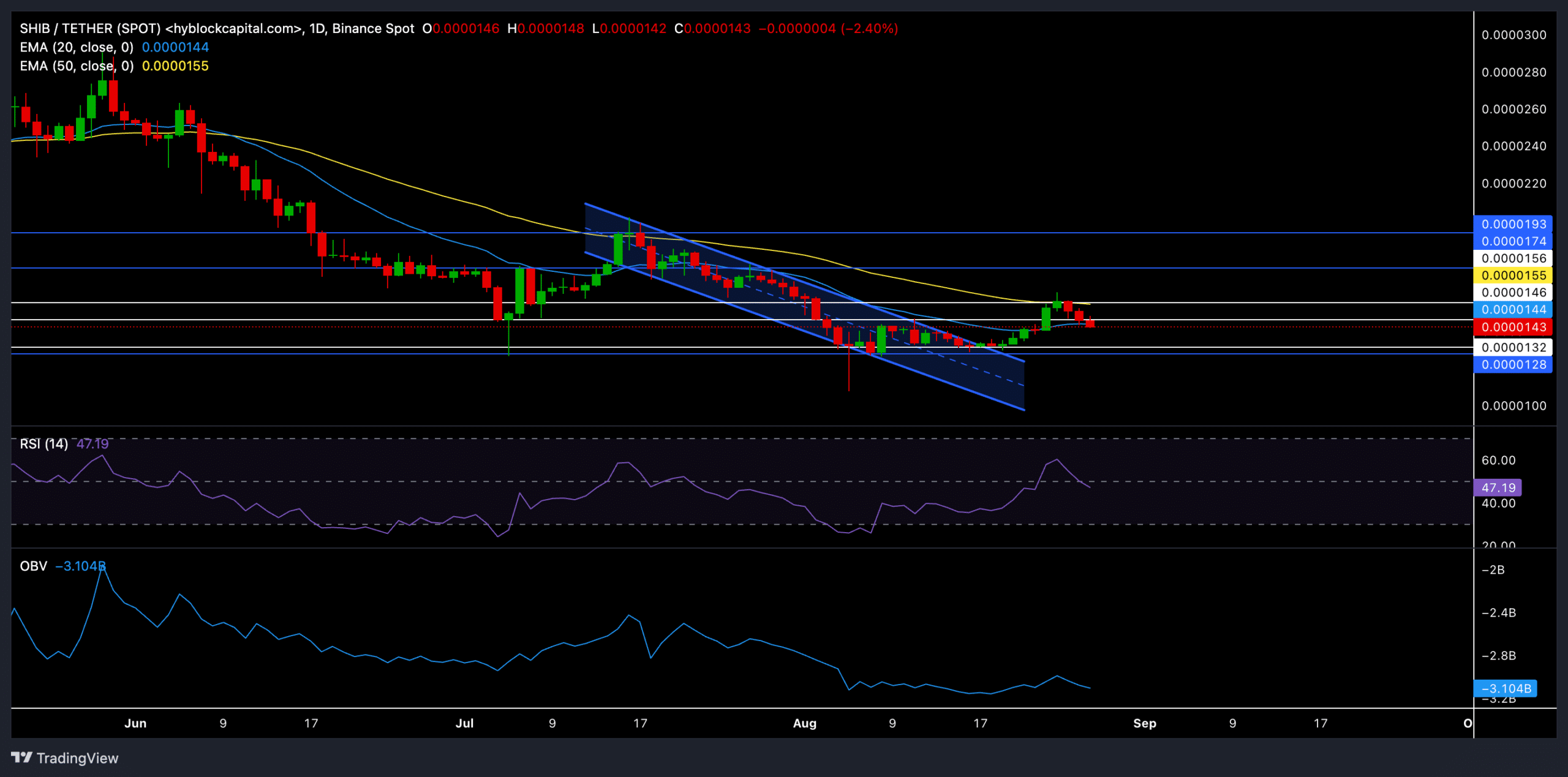

For SHIB bulls to regain control, the memecoin need to hold above the $0.0000144 level and reclaim the $0.0000156 resistance.

As an analyst with years of experience navigating the volatile world of cryptocurrencies, I must admit that analyzing Shiba Inu [SHIB] is always an intriguing challenge. The token’s recent price action has been a rollercoaster ride, and at this point, it feels like predicting whether a dog will bark or wag its tail next!

Shiba Inu (SHIB) is currently facing strong selling forces, and it hasn’t been able to maintain the upward trend following its bounce off the 50-day Exponential Moving Average (EMA).

Although there was a temporary increase, the token’s price trend demonstrated instability, finding it challenging to keep its value above the short-term average lines.

Shiba Inu bulls struggle to break the 50-EMA barrier

The Shiba Inu daily graph indicates that the memecoin has been following a prolonged downward trend since it observed a falling pattern within a channel.

128 nanocents’ worth of backing significantly fueled a robust recovery for SHIB, propelling it beyond its descending trendline. However, the 50-day Exponential Moving Average has proven formidable, causing the price to retreat and erasing recent advances.

The altcoin traded at $0.0000144 at press time, down nearly 2% in the last 24 hours.

At the moment of writing, there was a slight downward trend observed for both the 20 Exponential Moving Average (represented in red) and the 50 Exponential Moving Average (in cyan), suggesting a mildly bearish inclination.

If the bears continue to hold their position, they might push forward a short-term decrease in price. In such a scenario, it’s crucial to keep an eye on the potential support zone, which lies between 0.0000132 and 0.0000128. Should the price drop below these levels, it could lead to additional downward movements.

The Relative Strength Index (RSI) was close to 47, indicating a neutral-to-bearish outlook. If it falls beneath the median line, this might intensify the downward trend and potentially drive SHIB prices lower.

The On-Balance-Volume (OBV) trend is pointing downwards, suggesting more shares are being sold than bought. Yet, a substantial increase in the OBV might hint at a possible bullish contradiction, potentially giving optimism to the buyers.

Investors should keep an eye on the possibility of a bounce back at the $0.0000132 support point. If this level isn’t maintained, it might cause a more significant drop. On the other hand, surpassing the $0.0000155 resistance could indicate a turnaround, potentially driving SHIB up towards the $0.0000174 mark in the near future.

Derivatives market sentiment

The information on derivatives offered valuable perspective about the present market mood. On the other hand, the open interest related to SHIB decreased by 5.55%, amounting to approximately $32.16 million, which indicates lessened enthusiasm for speculation.

Although the total amount grew by approximately 12.66%, reaching $88.86 million, the balance between long and short positions still fell short of 1, registering a 24-hour ratio of 0.7455. This implies that there were more short positions taken compared to long ones in the past day.

In simpler terms, the data shows that more long positions are being sold off within an hour and a day, which reinforces the idea that the market is trending downward.

Paying close attention to the fluctuations in Bitcoin and the broader market’s general opinion will also play a significant role in predicting Shiba Inu’s next action.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Elden Ring Nightreign Recluse guide and abilities explained

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-08-28 09:44