- Shiba Inu has a strongly bearish outlook, but the range formation might see some consolidation.

- Despite presenting a buy signal, the selling pressure was too high for bulls to overcome.

As a researcher with experience in analyzing cryptocurrency markets, I have been closely monitoring the price trend of Shiba Inu [SHIB]. Based on my analysis of the charts and technical indicators, I believe that Shiba Inu has a strongly bearish outlook. However, it’s important to note that the recent price action suggests some consolidation within a range formation.

On June 14th, the value of Shiba Inu [SHIB] dipped below its prolonged price range and hasn’t recovered since. Despite this bearish price action, investors have an opportunity to benefit from the present situation as the meme coin seems to be establishing a trading range.

Based on a recent price analysis I conducted, it appears that Shiba Inu is expected to experience significant decreases in value, potentially reaching double-digit percentages over the upcoming weeks.

In simpler terms, the shorter-term charts supported this viewpoint and offered additional insights into the anticipated price trend for Shiba Inu.

Shiba Inu price prediction

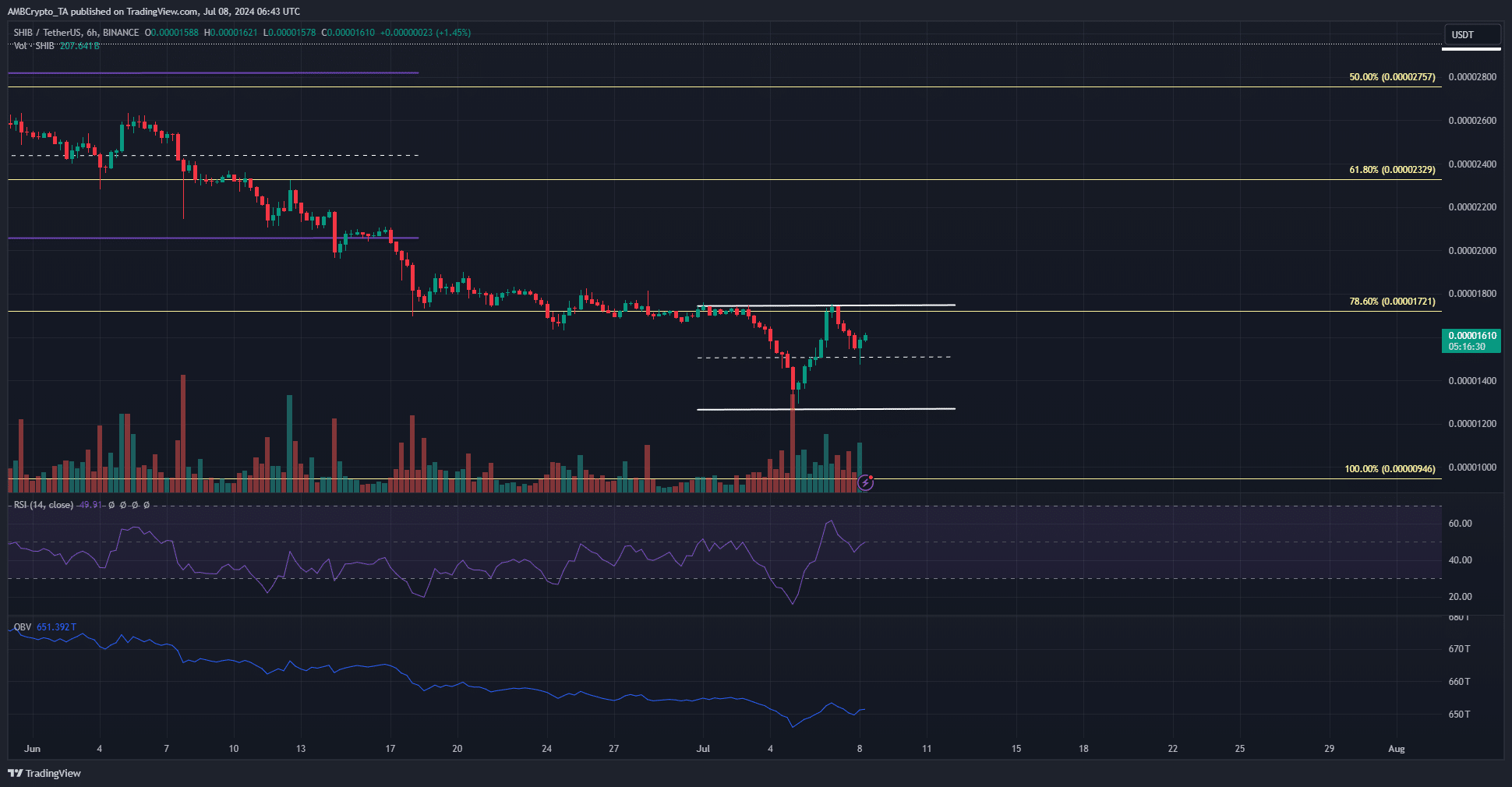

Over the last ten days, I’ve noticed that Shiba Inu has been trading within a range, with prices bouncing between approximately $0.0000174 and $0.0000126. Prior to hitting send on this message, I observed that the midpoint of this range, around $0.000015, had been providing support in the hours leading up to now.

As an analyst, I’ve observed that following the dip to the lows, there was a noticeable uptick in trading activity during the subsequent bounce. Yet, this surge in volume alone may not be sufficient to drive a lasting recovery.

The OBV has been trending downward since June, and its trend has not shifted yet.

As a crypto investor, I’ve noticed that the Relative Strength Index (RSI) on the 6-hour chart has remained below the neutral level of 50 since early June. However, it broke above 60 on the 6th of July, signaling potential overbought conditions in the market.

A potential indication of a change in direction may present itself, but without the price surpassing its current limits, a rebound seems unlikely to occur.

Should participants continue to buy?

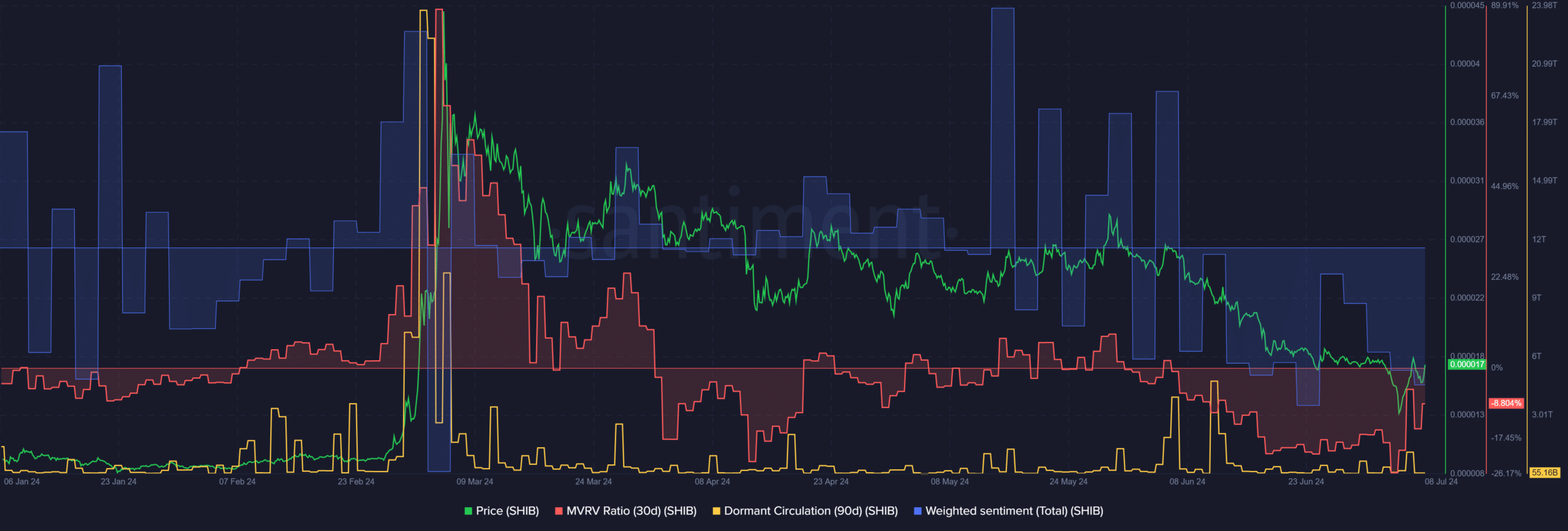

As a financial analyst, I’ve observed that the Memecoin’s 30-day Moving Average to Realized Value (MVRV) ratio has been underperforming since late May. This indicator typically suggests that the token is undervalued when it turns negative. However, the prices have continued to decline despite this signal.

The Weighted Sentiment was also firmly negative.

As a crypto investor, I’ve noticed some activity in the previously dormant circulating supply over the last ten days. The most significant surge occurred on June 11th.

In simpler terms, it might not be the ideal moment for investors to buy back Shiba Inu stocks. However, traders could potentially hold on and look for an opportunity to sell once the price hits the resistance highs again.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-07-08 16:07