- Shiba Inu has a bearish market structure in the near term and is likely headed for more losses.

- The range formation from earlier this month might be defended, allowing swing traders to enter.

As a seasoned researcher with a background in financial markets and cryptocurrencies, I have closely monitored Shiba Inu’s [SHIB] price action over the past few weeks. Based on my analysis of the current market structure, I believe Shiba Inu has a bearish outlook in the near term and is likely to experience further losses.

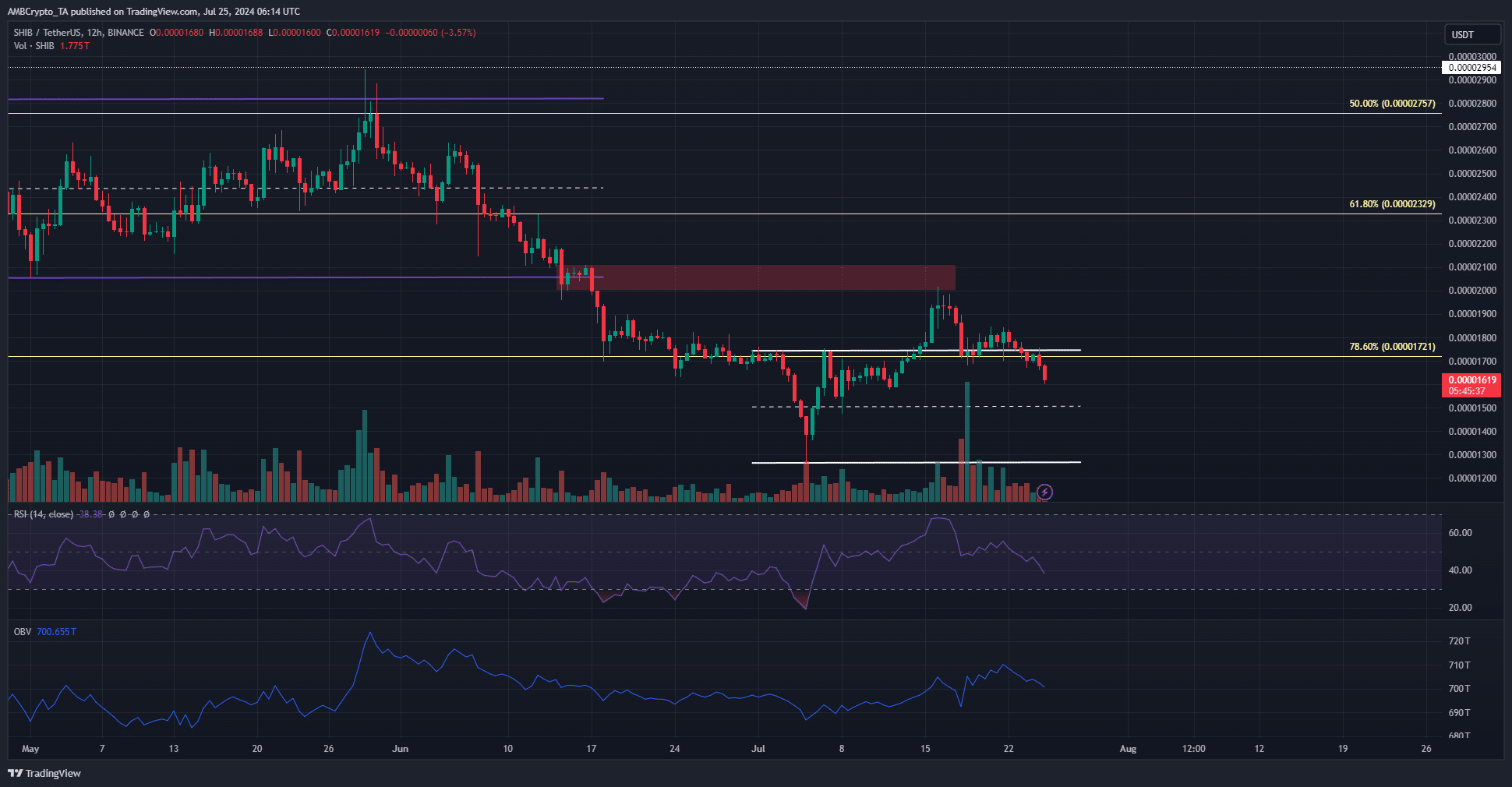

The price of SHIB, or Shiba Inu, encountered rejection at a prior level of resistance and subsequently retreated to a price band established earlier in the month. An examination of the coin’s on-chain data revealed a surge in selling activity.

As a crypto investor, I’ve experienced a significant setback with a nearly 20% price decrease after hitting a roadblock at $0.0000205 last week. The momentum and purchasing pressure were waning, raising concerns about potential additional losses.

Back into July’s range formation

Back in April to mid-June, the meme coin frequently traded within a specific price range with $0.0000205 as its lowest point. This area served as a resistance zone. On July 14th, however, the coin managed to surpass this range for the first time, marked in white on the chart.

As of the moment this report is being compiled, the price was under the $0.0000172 mark, acting as a key support level. The Relative Strength Index (RSI) signaled increasing bearishness in the market. Meanwhile, the On-Balance Volume (OBV), which had made an effort to bounce back over the previous two weeks, was showing signs of weakening.

As a crypto investor, I’ve noticed that the mid-range price of $0.0000151 and the range low of $0.0000127 for this particular token are potential levels we might encounter soon based on recent price movements. However, other popular meme tokens have managed to hold onto their gains from the past ten days more effectively.

As a crypto investor, I’ve noticed that Shiba Inu failed to hold its ground after Bitcoin surged from $59k to $68k, sinking back down to its previous levels. This is a concerning sign for me as a long-term holder, suggesting potential weakness in the coin’s price action.

Unraveling the mixed signals from the futures market

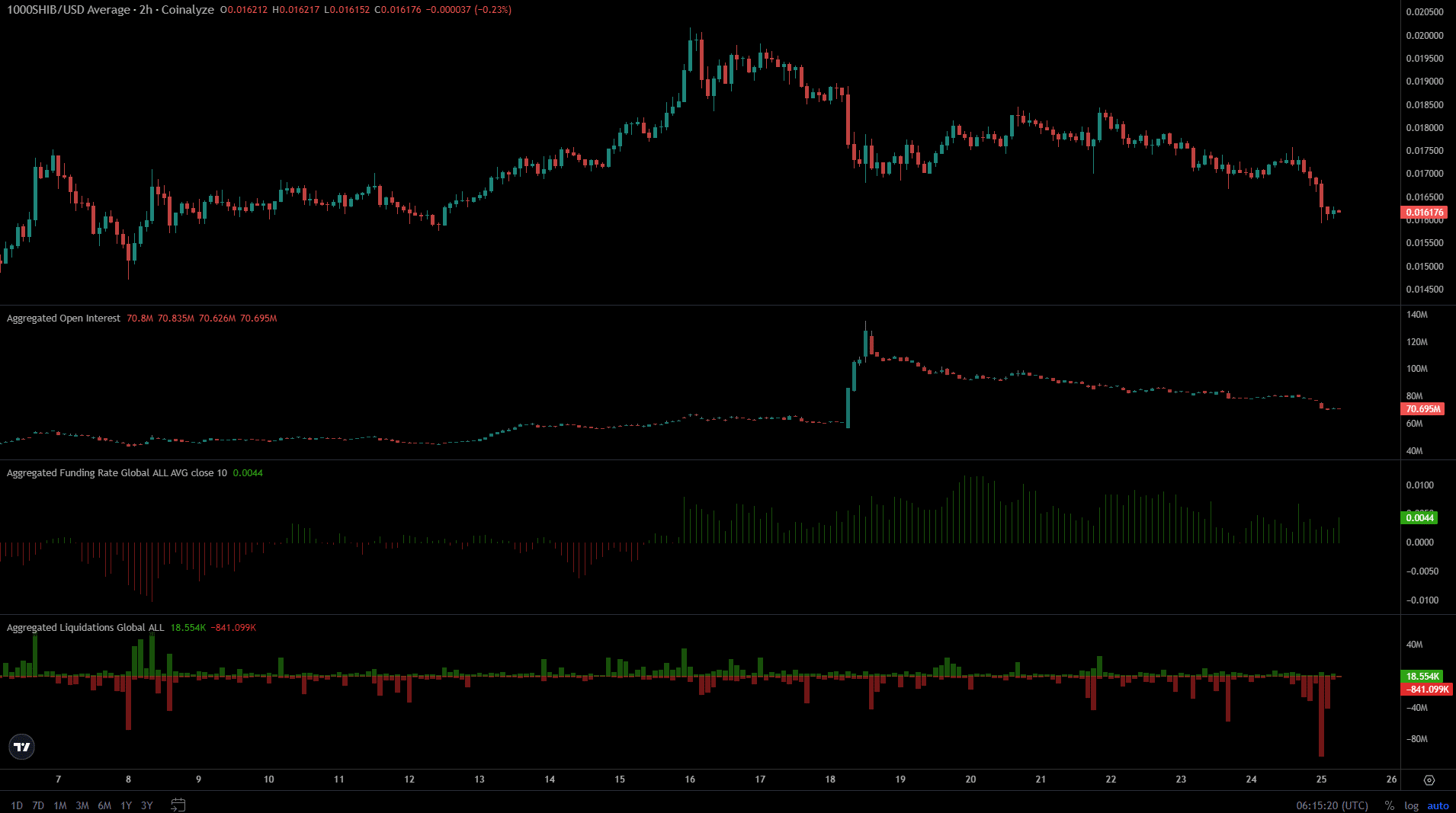

During the 17th and 18th of July, when SHIB prices were significantly dropping, Open Interest surged from $57 million to an astounding $127 million. This surge signified a considerable number of investors short selling at that moment, along with heightened bearish market feelings.

The long liquidations the drop caused fueled the bearish bias.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

After that point, the metrics have yet to bounce back. The on-balance volume (OI) persisted in dropping, indicating that pessimistic views remained dominant.

With a barely favorable funding rate, the recent surge in long liquidations has left speculators and swing traders cautious about entering long positions for the time being.

Read More

2024-07-25 18:15