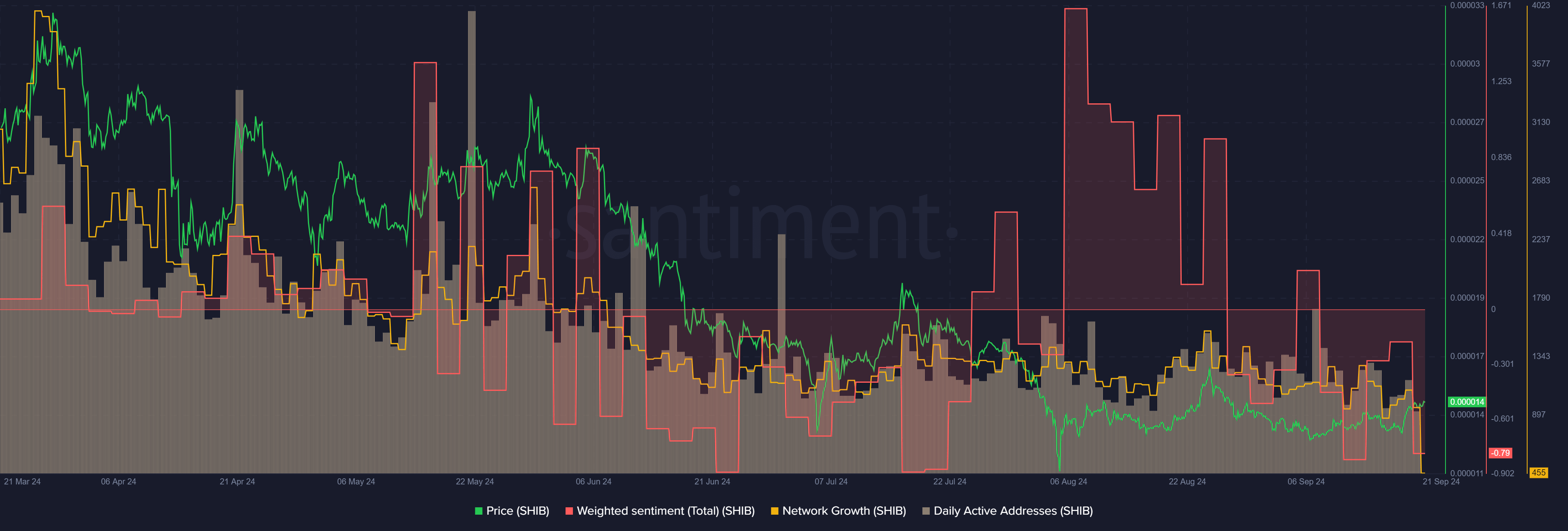

- The network activity has been in decline in September.

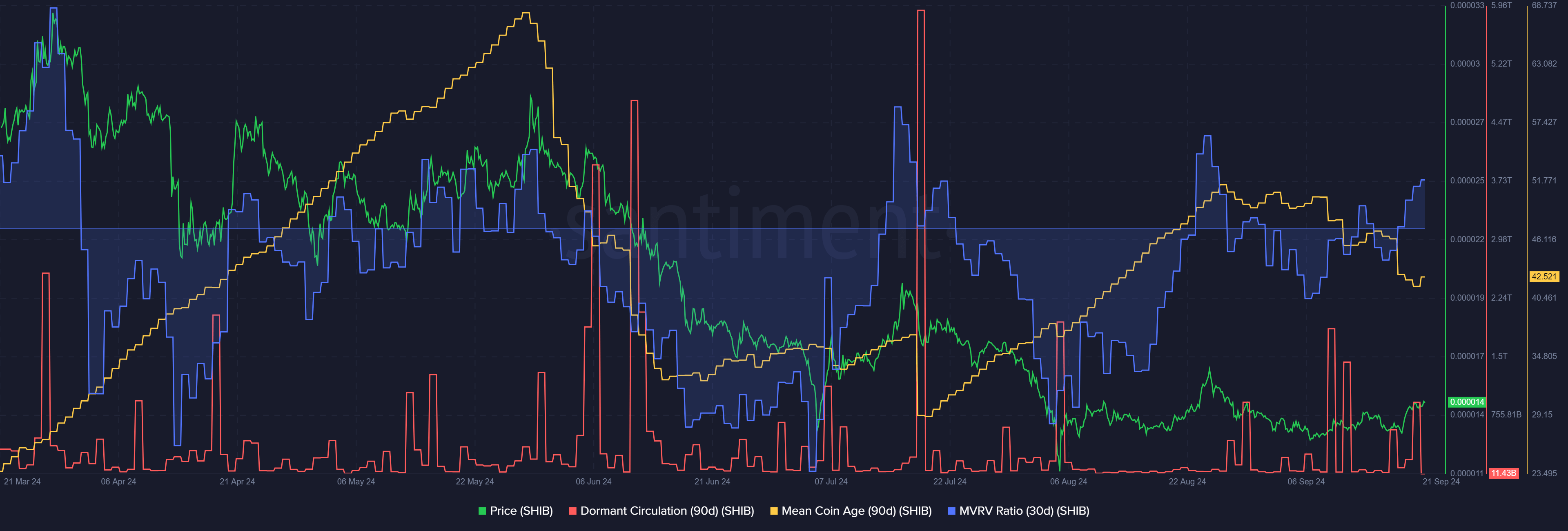

- Mean coin age and MVRV showed short-term bearishness.

As a seasoned researcher with years of experience in the crypto market, I’ve seen my fair share of ups and downs. The recent trend with Shiba Inu [SHIB] has been intriguing, to say the least. While the broader market has been bullish since September 16th, SHIB managed a notable 8% move higher, breaching its local resistance at $0.000014.

For approximately 75 days, Shiba Inu (SHIB) has been moving within a triangle-shaped trading formation. There’s anticipation that it may deliver robust returns in the upcoming months following its breakout from this triangle pattern just recently.

Starting from September 16th (Monday), the overall cryptocurrency market has displayed a bullish trend, with approximately 7% growth observed. Shiba Inu in particular experienced an 8% surge upward. The breaking of the $0.000014 local resistance suggests that another potential rise of 7%-8% may follow.

Network activity has been in decline

From May through July, there was a decrease in the number of daily active addresses. However, this trend started to level off towards the end of August. Activity saw a surge at the beginning of September, but since then, it has dipped down again.

1) In terms of daily activity, we’ve seen a recent drop that brings us back to the minimum levels experienced since early February this year. Similarly, the network growth has decreased consistently since the last week of August.

As a researcher, I observed that the weighted sentiment toward Shiba Inu was overwhelmingly positive in August, but similar trends such as active addresses and network growth experienced a setback in September. Regrettably, it appears that Shiba Inu’s immediate future does not seem promising in terms of increased demand due to growing user counts.

Short-term bearish sentiment for SHIB

In simpler terms, the 30-day MVRM (Market Value to Realized Value) ratio was higher than usual. The last time a significant increase like this occurred was on August 24th, which was followed by a substantial drop in price of around 12% within the next three days.

On September 20th, there was a significant increase in dormant activity, indicating a possible short-term drop in price. Simultaneously, the average coin age has been decreasing over the last month, suggesting coins are being distributed more broadly within the network.

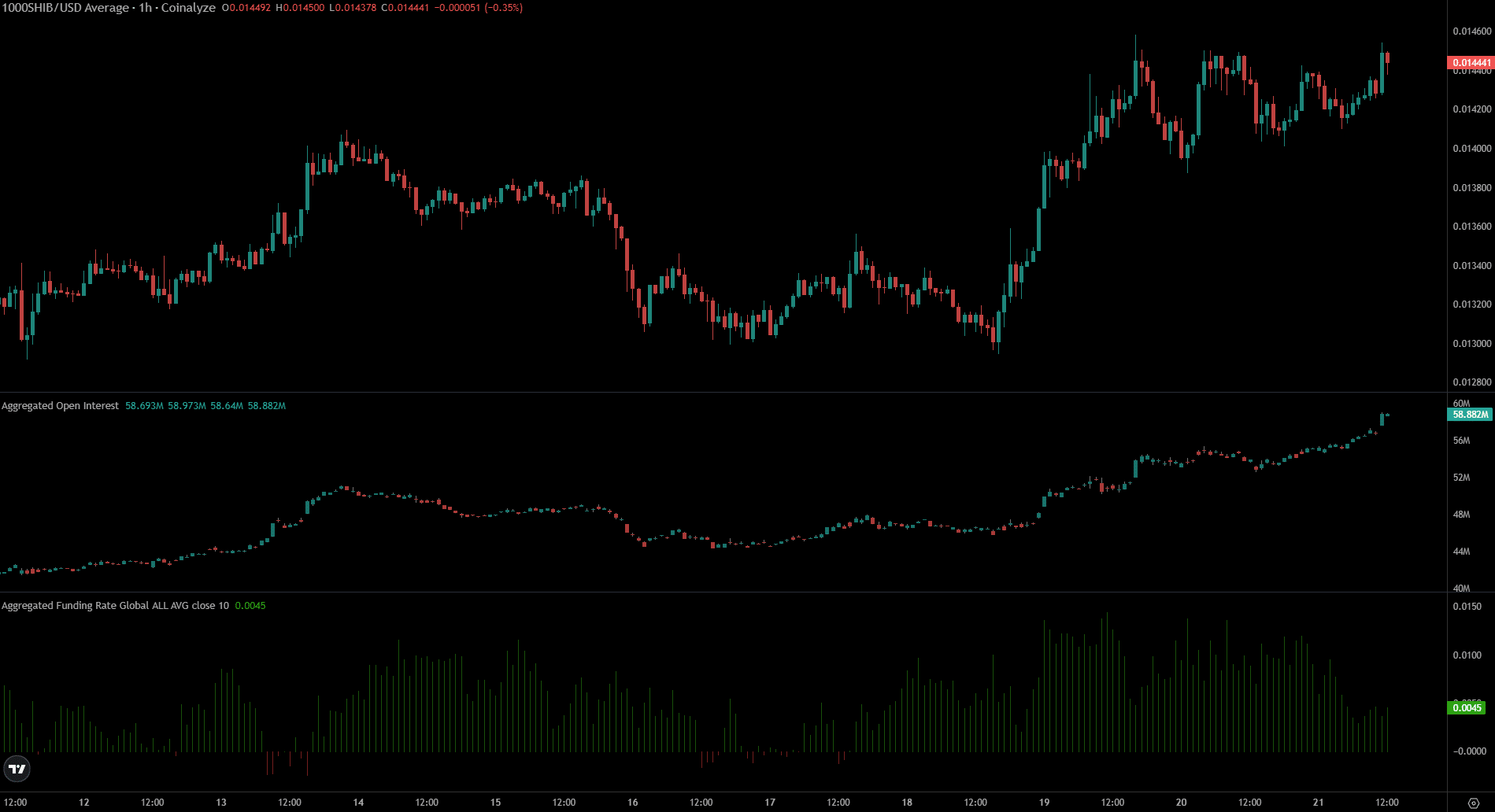

Over the last seven days, I’ve observed a notable surge in open interest, mirroring a similar rise in asset prices. This trend suggests robust optimism among market participants, indicating a bullish sentiment. Interestingly, the funding rate was remarkably positive but has experienced a noticeable decline over the past 24 hours.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

The decrease in funding rate indicates a decline in the long/short imbalance, although long positions remain preferred. In essence, the on-chain data suggests that a brief period of selling pressure might occur.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Here’s What the Dance Moms Cast Is Up to Now

2024-09-22 10:15