- Shiba Inu may be heading for a pattern break from its long-term wedge pattern

- On-chain data critical to ascertaining where it’s time to buy

As a seasoned researcher with years of experience in the cryptocurrency market, I have seen my fair share of bull and bear runs. The latest developments surrounding Shiba Inu (SHIB) are particularly intriguing, given its long-term wedge pattern and current downward trend.

Over the past fortnight, Shiba Inu (SHIB) has shown a downtrend, but there’s a possibility it might soon switch to an uptrend. This meme cryptocurrency themed around dogs has been battling to secure some bullish momentum recently. Following its failed attempt in early July, the price has been edging towards its lowest point in four months.

Currently, if we step back and examine Shiba Inu’s price history, it shows a predominantly descending long-term trend since its record high of $0.000045 in 2024. But on closer inspection, the same graph indicates that Shiba Inu has been moving within a triangle or “wedge” pattern.

The recent decline in Shiba Inu’s price movement has narrowed significantly, potentially signaling a comeback of buying activity, or bulls, to the market.

Currently, Shiba Inu (SHIB) is being traded at approximately 0.0000146 US dollars – representing a 68% reduction compared to its peak price recorded in April.

Furthermore, its price appeared to be significantly undervalued based on its Relative Strength Index (RSI). The possibility of a forthcoming wedge pattern break and these other indicators suggested a potentially profitable buying opportunity.

Can Shiba Inu drum up enough bullish momentum?

At present, Shiba Inu (SHIB) stands out as a significant player within the meme coin sector. This could potentially work to its advantage, drawing focus towards its price fluctuations and possibly attracting more interest.

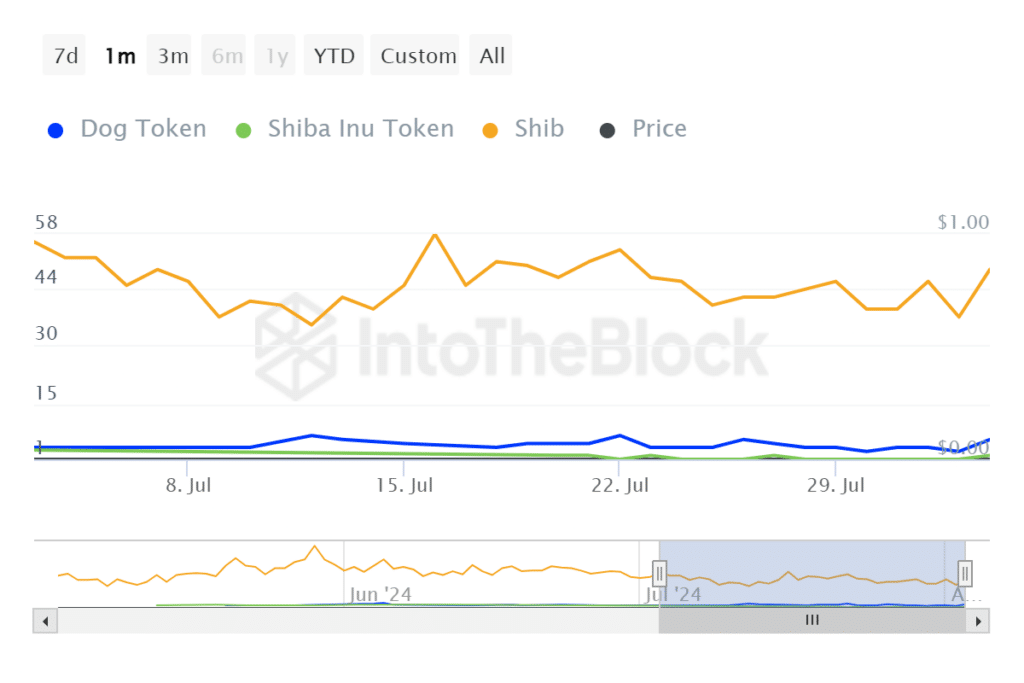

It appears that our examination has uncovered the possibility that it’s attracting interest due to its promising bullish prospects, which could explain the surge in its social trends metric over the past 24 hours.

This spike pushed the metric to its highest level in 12 days. By extension, this observation might signal a surge in its popularity in the coming days too.

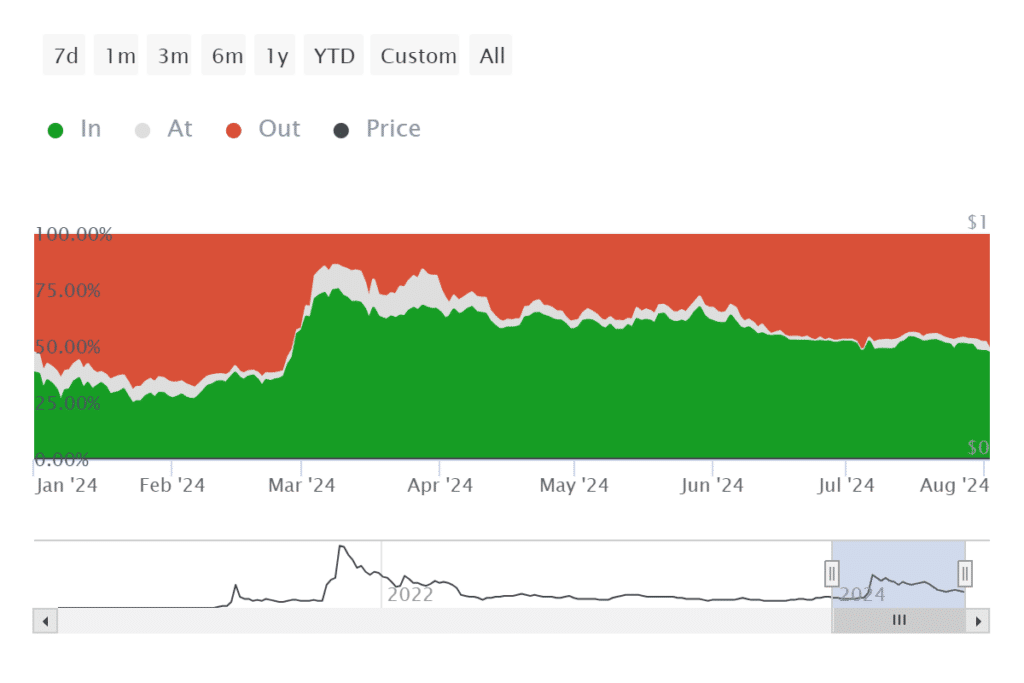

At the current price point for SHIB, it was observed that the majority of its holders were experiencing losses. Specifically, on August 2, there were about 700,000 wallets showing a loss, which accounted for approximately 51% of all active addresses.

Approximately 46.93%, equivalent to around 632,000 crypto addresses, have seen profits. It’s reasonable to assume these addresses made purchases prior to early March.

Are whales buying?

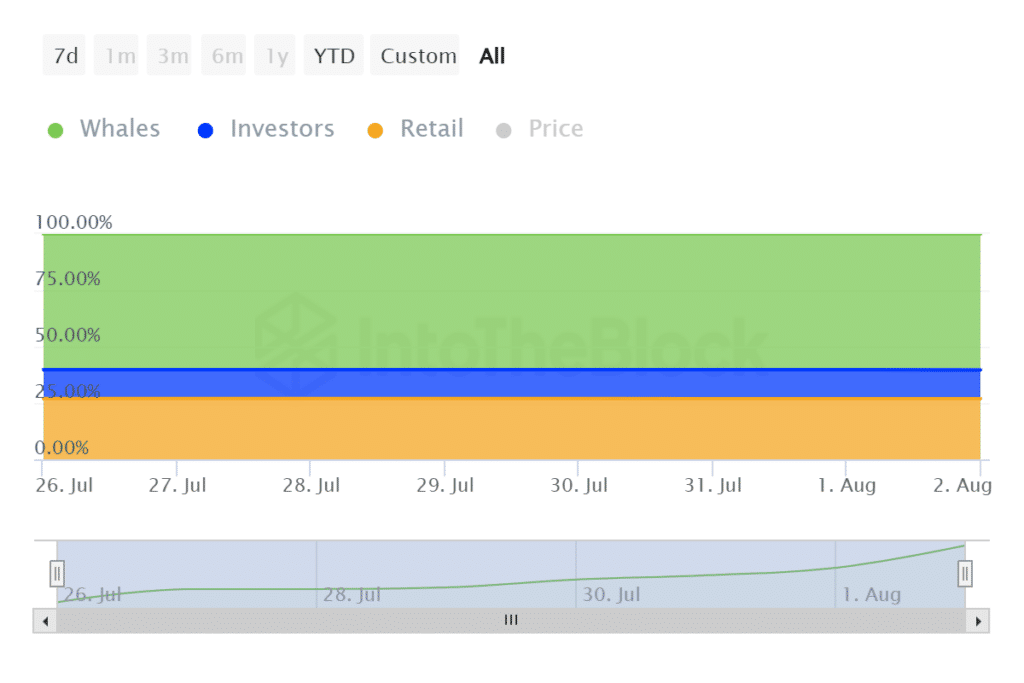

Our analysis also explored what has been happening with holders lately.

It was found that the number of significant Shiba Inu investor accounts, known as whale addresses, increased from approximately 589.86 trillion SHIB (an increase of 60.26%) to 590.01 trillion SHIB (a rise of 60.28%) by the beginning of August.

Over the past month, retail ownership of SHIB decreased by approximately 26.96% from 263.91 trillion tokens to 263.49 trillion tokens, representing a decrease of about 0.42%.

Collectively, these signs suggest that whales are progressively stockpiling at reduced rates, whereas retail holders could be hastily offloading their holdings.

We’ll monitor this data closely to determine if there’s a shift in either accumulation or selling trends. This information could help us understand current demand and predict future trends over the next couple of weeks.

Read More

2024-08-04 03:03