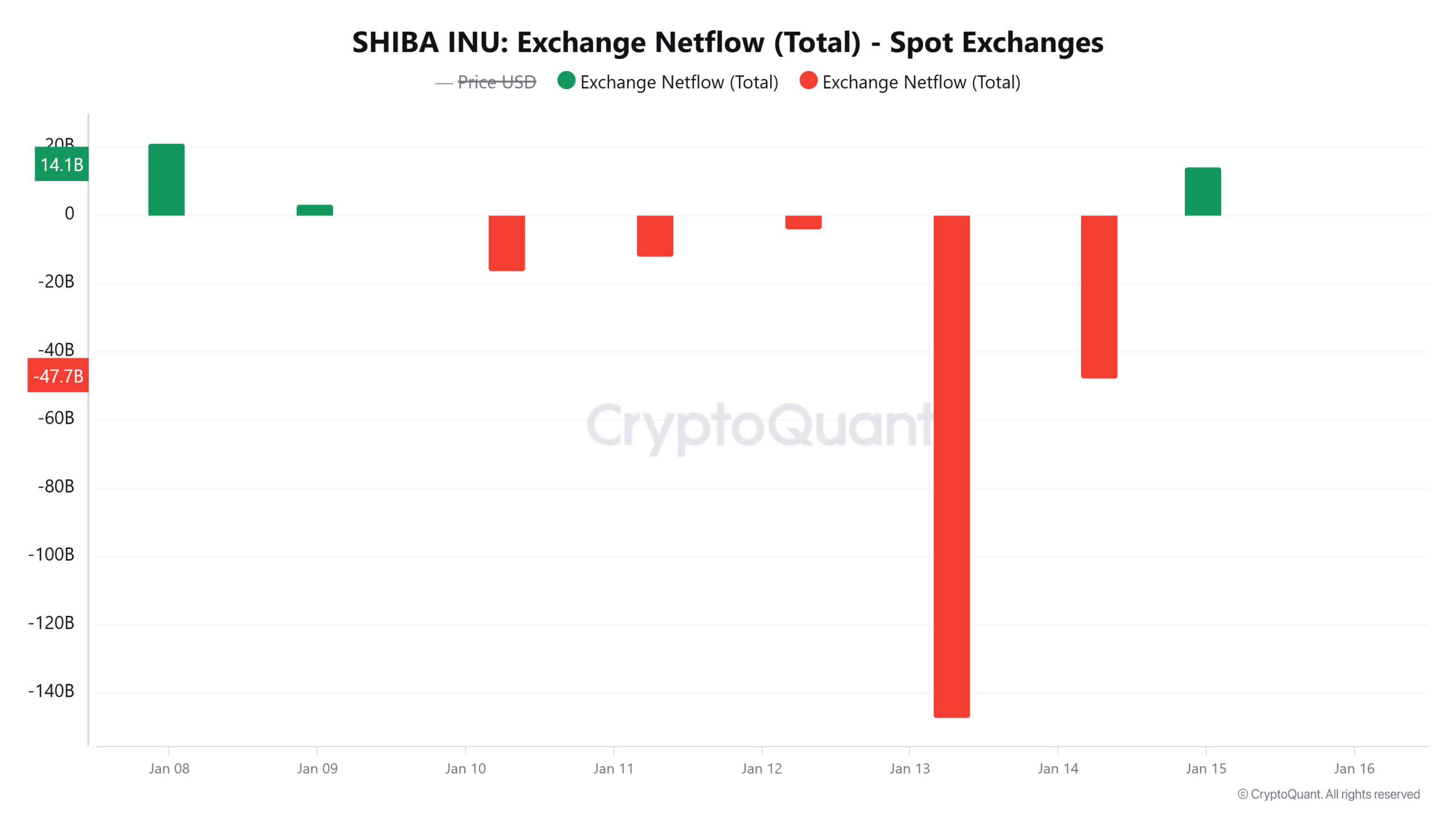

- More than 194B SHIB tokens have been withdrawn from spot exchanges within two days.

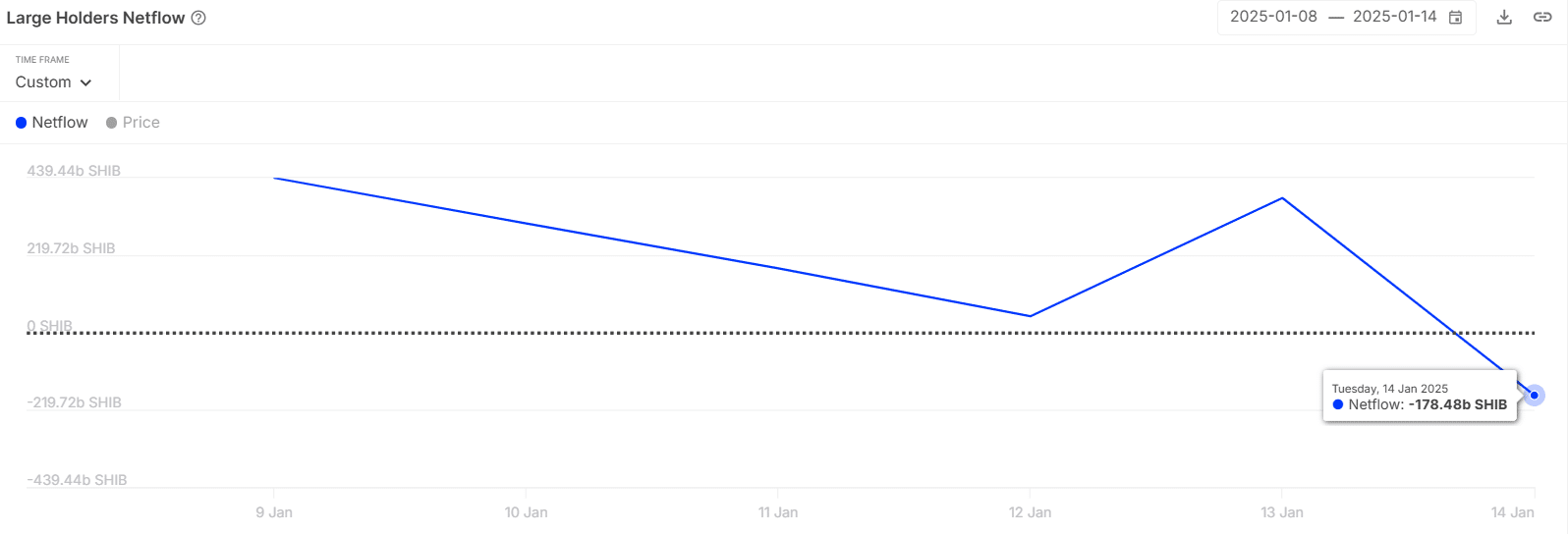

- Whales seem to be behind these outflows after large holder netflows flipped negative.

After experiencing a decrease of 1.17% over the past day, Shiba Inu [SHIB] found itself under bearish influence. At the moment of reporting, it was being traded at approximately $0.0000212, accompanied by a 25% reduction in trading activity.

As a crypto investor, I’ve noticed some underwhelming performance lately, but I’m keeping an optimistic outlook. Several key indicators suggest a potential trend reversal and a short-term surge could be on the horizon.

Selling pressure eases

According to information from CryptoQuant, approximately 194 billion SHIB tokens were taken out of trading platforms between the dates of January 13th and 14th.

These withdrawals suggest a decrease in buying enthusiasm, potentially leading to a less aggressive downward trend.

It seems that the majority of these transactions originate from whale accounts or significant Shiba Inu coin holders. As reported by IntoTheBlock, there’s been a change in the flow of coins held by large holders, shifting from a net increase to a net decrease. The amount of SHIB owned by large holders has dropped from 382 billion to -178 billion.

The inflow of Shiba Inu tokens into exchanges is decreasing, implying that significant wallets are keeping less SHIB on trading platforms.

When whales transfer their cryptocurrency holdings off exchanges, it often signals a build-up or accumulation stage. Typically, these large addresses purchase when prices are low and sell when they reach their peak. Given that whales are amassing Shiba Inu coins at the current price, this might suggest that Shiba Inu has possibly reached its lowest point (bottomed).

However, the easing selling pressure has not benefited SHIB, which is still showing bearish signs.

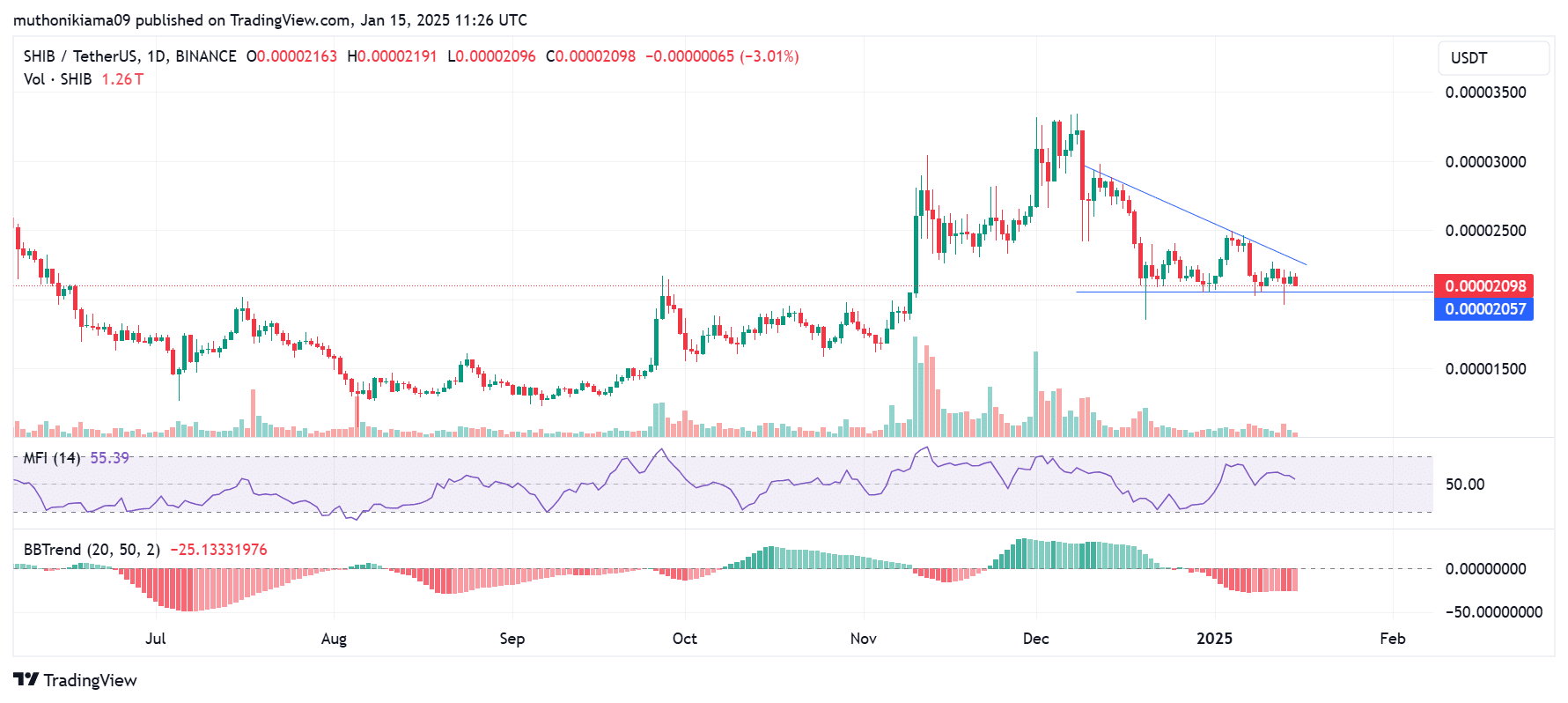

SHIB’s descending triangle shows a bearish outlook

As an analyst, I’ve observed that my analysis of Shiba Inu’s one-day chart points towards a consistent bearish movement. This digital currency seems to be trapped in a descending triangle formation, which is typically suggestive of a robust downtrend in the market.

The Money Flow Index (MFI), currently at 55, is trending downward, suggesting that the buildup of whale purchases hasn’t yet counteracted the selling pressure.

An equally pessimistic perspective can be observed on the BBTrend indicator as well, since it’s currently red and displaying a negative reading, thus reinforcing a negative overall feeling.

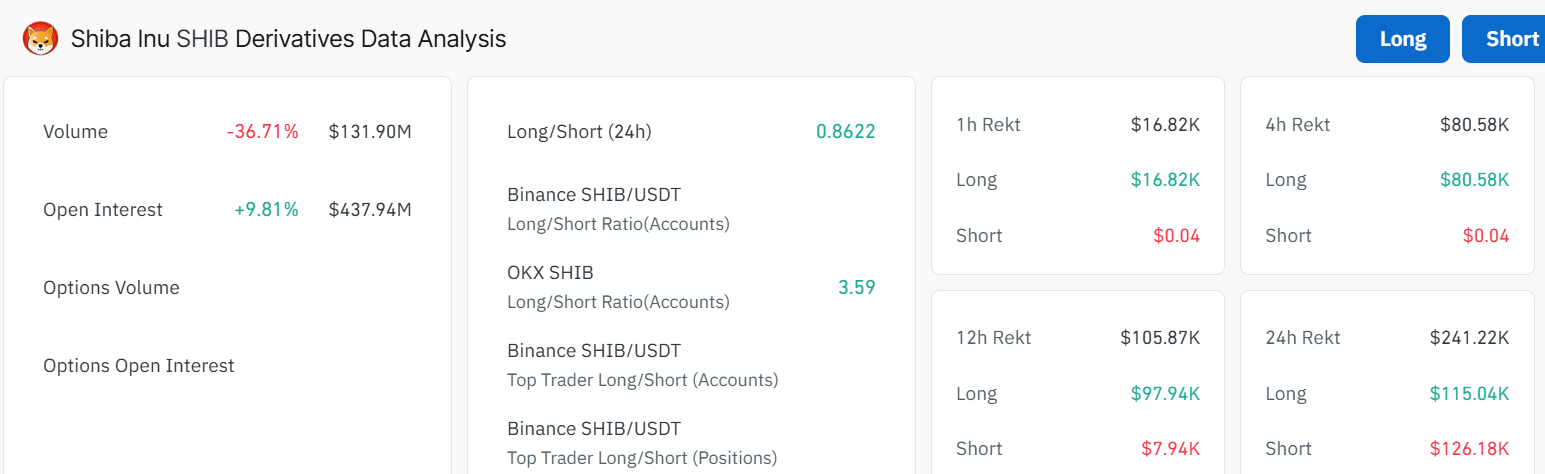

Derivatives data analysis

According to data from Coinglass, the Open Interest has slightly increased to approximately $984 million. This growth indicates an influx of new derivative market positions being opened.

On the other hand, it seems that many of these positions are held by investors who believe the value of the memecoin will decrease even more due to their short-selling strategy.

Read Shiba Inu’s [SHIB] Price Prediction 2025-26

The number of investors taking short positions is clearly reflected in the Long/Short Ratio, which has decreased to 0.86. This suggests that as more traders opt for short selling, there seems to be a prevailing pessimism among market participants.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-16 17:41