-

SHIB’s price has dropped by almost 10% in the past seven days.

Its key technical indicators confirm the possibility of a further price drop.

As a crypto investor who has seen my fair share of market volatility, I can’t help but feel a sense of unease as I watch Shiba Inu (SHIB) continue its downward trend. The past seven days have not been kind to SHIB holders, with the memecoin shedding nearly 10% of its value.

The seven-day downturn of SHIB (Shiba Inu) may persist, given the decreasing interest and demand in this popular memecoin.

Currently, the most popular meme cryptocurrency is priced at $0.000022 during this report. Based on information from CoinMarketCap, there’s been a nearly 10% decrease in its value over the past week.

SHIB holders lose interest

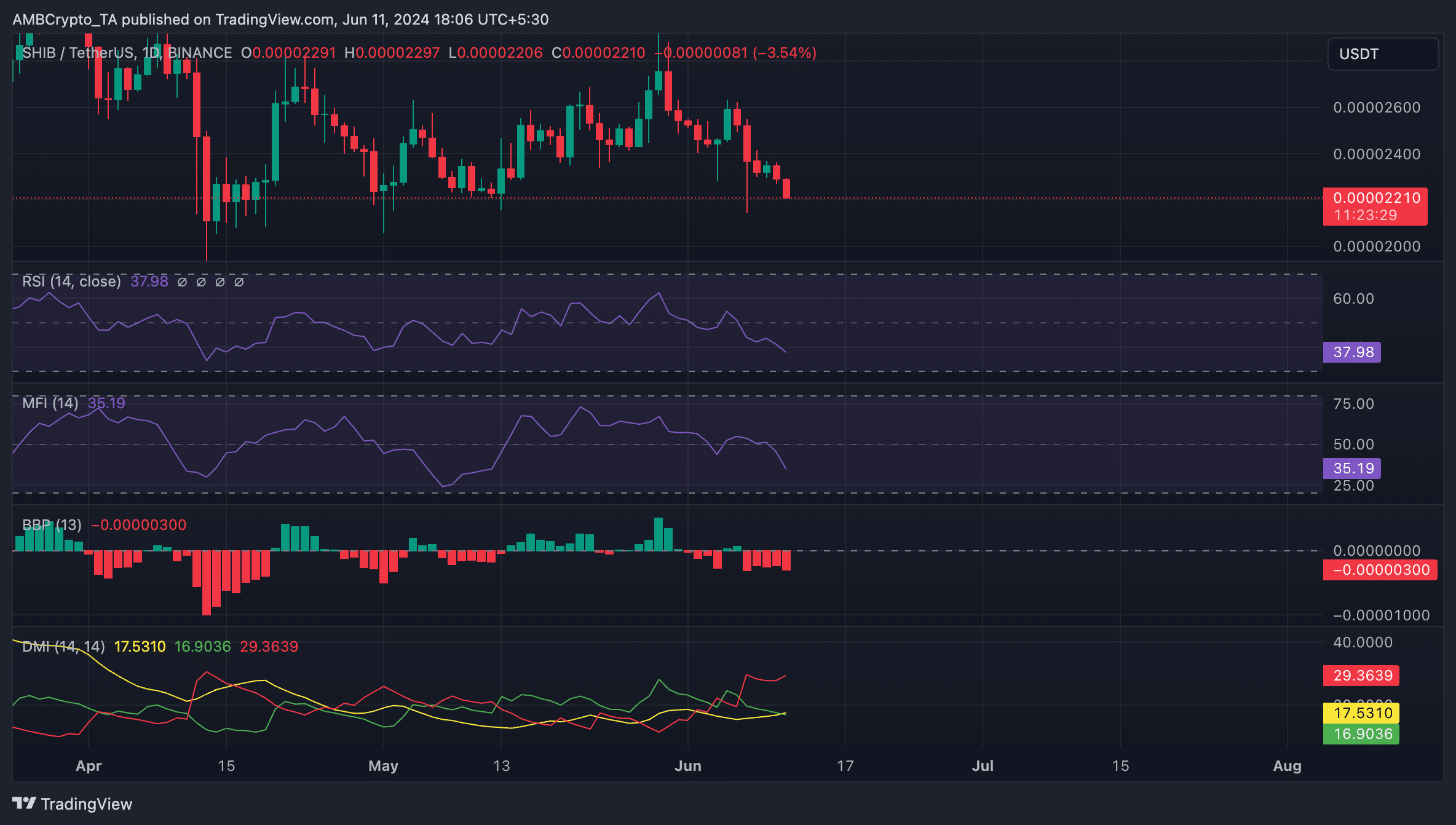

Based on an analysis by AMBCrypto, SHIB‘s crucial momentum indicators showed a declining trend and were situated below their respective midlines.

As a researcher studying the cryptocurrency market, I observed that Shib’s Relative Strength Index (RSI) stood at 38.27, and its Money Flow Index (MFI) was recorded at 35.21.

These metrics help determine if an asset’s price is overbought or oversold based on its recent trend and fluctuations.

Values for the asset span the interval from 0 to 100. A reading above 70 implies the asset has been bought too heavily, potentially signaling an overbought condition, while a value below 30 indicates the asset may have been sold excessively, possibly suggesting an oversold situation ripe for correction.

SHIB’s present RSI (Relative Strength Index) and MFI (Moving Average Convergence Divergence) readings indicate strong selling activity in the market. However, these same indicators may signal an upcoming price recovery.

Although the initial evaluation suggested a strong bull market for the meme coin, subsequent analysis of other indicators revealed that its strength was actually quite weak. Consequently, there’s a good chance that the coin’s value could decrease significantly in the near future.

For example, SHIB’s Elder-Ray Index was -0.0000000303 at the time of writing.

As a Shiba Inu (SHIB) crypto investor, I’d describe this indicator as follows: This metric reveals the balance between the buying and selling forces in the SHIB market. If its value is negative for me, it signifies that sellers have more power than buyers currently.

For context, SHIB’s Elder-Ray Index has been negative since 7 June.

At the given moment, the bearish sentiment towards the altcoin was quite prominent. This was further emphasized by the findings from its Directional Movement Index (DMI), which indicated that the size of the red band (representing the negative directional index) surpassed the green band (representing the positive directional index).

When these trend lines are arranged in such a way, the selling force is stronger than the purchasing momentum. This implies that the bears hold the reins of the market, while the interest in the asset keeps declining.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

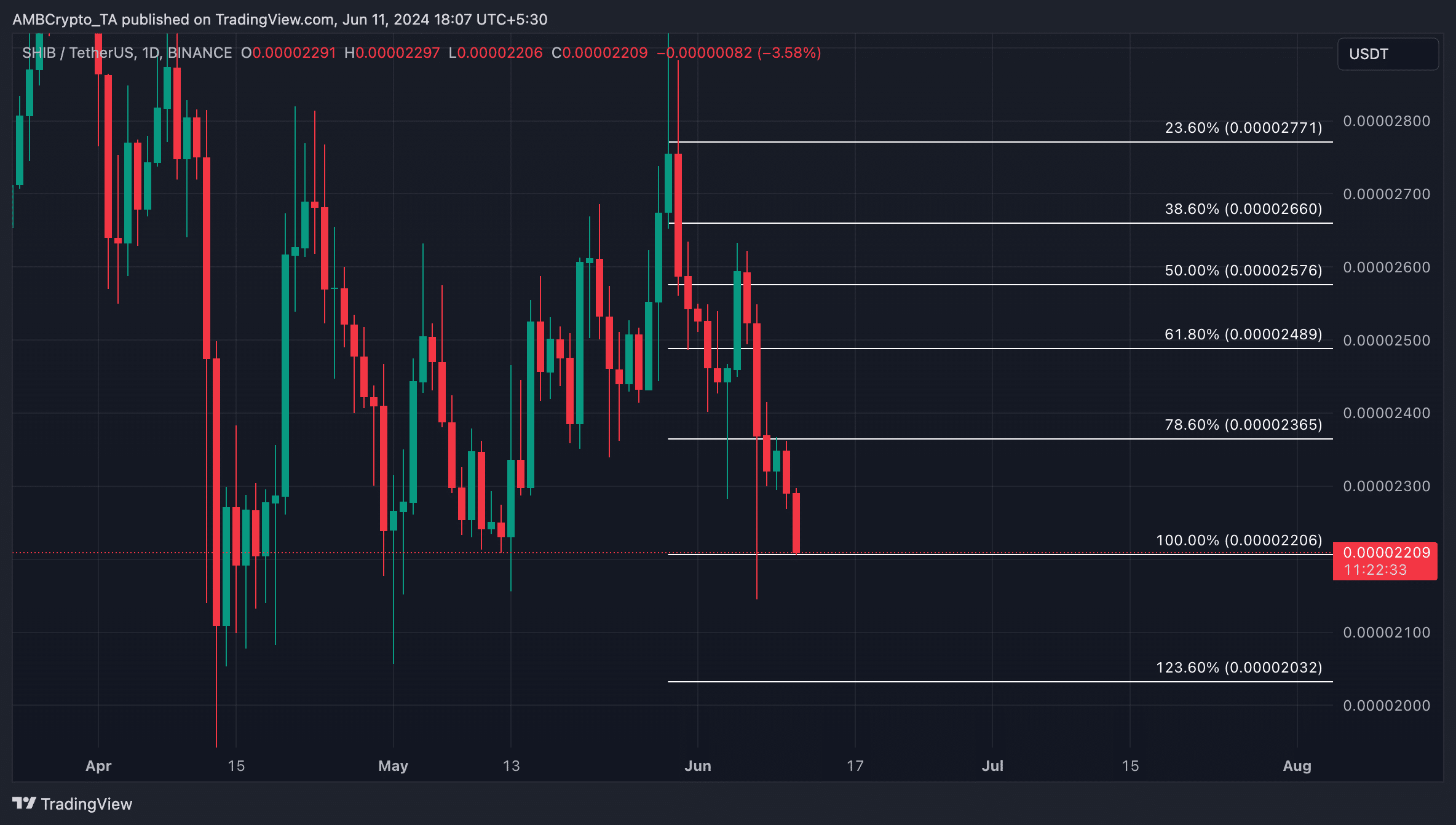

If the selling pressure for SHIB persists, its price could potentially drop down to around $0.00002 from its current level of $0.000022.

If traders’ sentiment changes and they turn optimistic, the value of the meme coin could potentially surge towards $0.000024.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-12 05:11