-

Shibarium network recorded a milestone as transactions surged by 70%.

However, a key factor could undermine SHIB’s deflationary model.

As a seasoned researcher with years of experience observing the cryptocurrency market, I find myself intrigued by the current state of Shiba Inu [SHIB] and its layer 2 network, Shibarium. The recent surge in transaction volume is indeed noteworthy, but it’s the underlying factor that could potentially undermine SHIB’s deflationary model that piques my interest.

Shiba Inu‘s [SHIB] token finds itself at a pivotal moment, given the significant increase in gas fees on its network, Shibarium, which has skyrocketed approximately 2,024%. This dramatic rise poses crucial questions regarding the future of the SHIB token.

BONE on Shibarium might pose a threat

Over the past period, Shibarium has reached a notable achievement as transaction volume has increased by an impressive 70% – rising from 4,537 to 7,715 transactions. Additionally, there’s been a substantial growth in active accounts, soaring by approximately 157.14%, with the number of active accounts jumping from 42 to 108. These findings are based on data provided by ShibariumScan.

In simpler terms, the cryptocurrency called BONE is used to carry out transactions within the Shiba Inu system’s network known as Shibarium. Essentially, if you’re transacting on Shibarium, you’re using BONE.

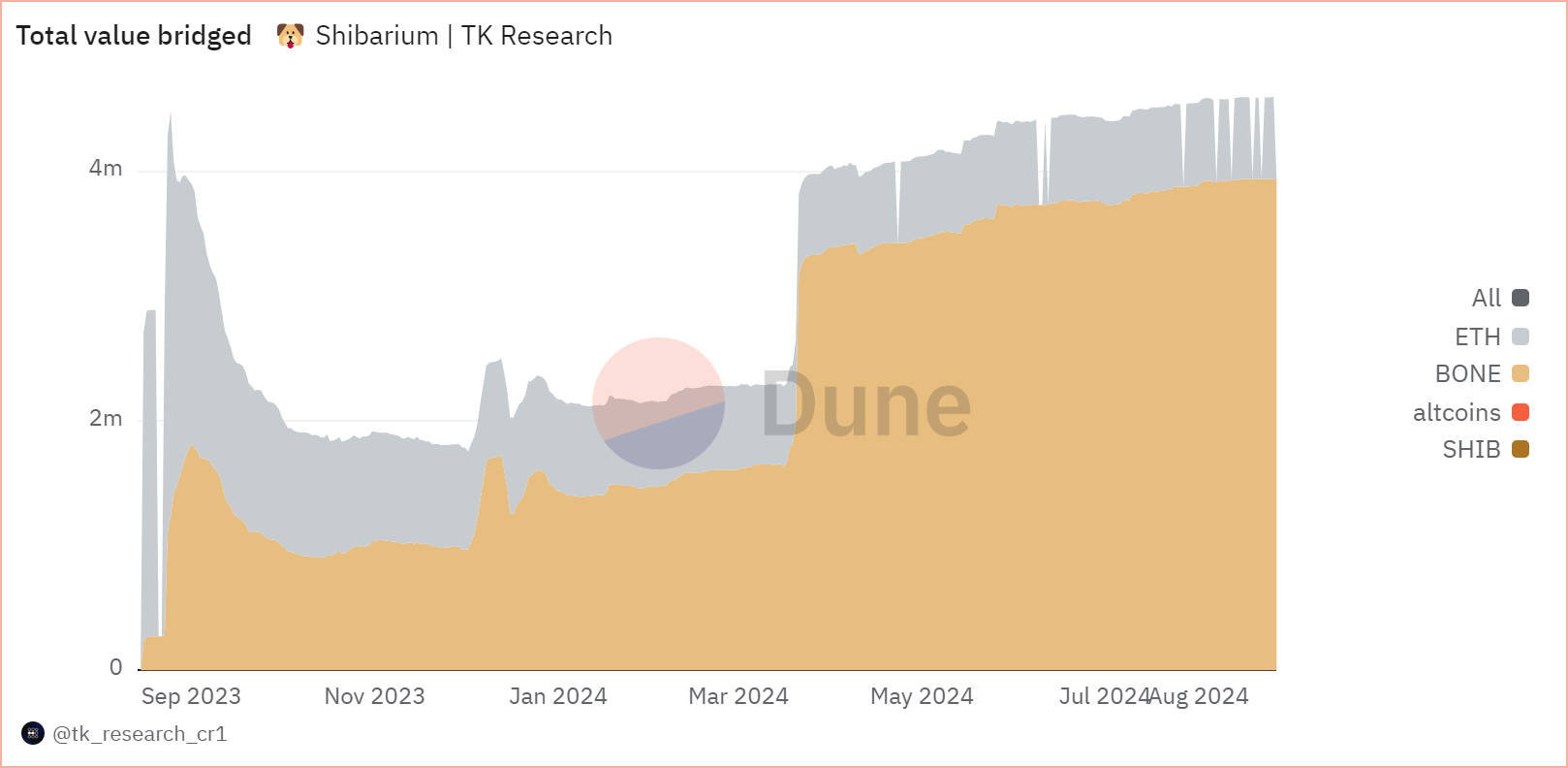

Source : Dune

Due to recent developments, BONE experienced a rise of around 3% over the past 24 hours, currently worth $0.425079 at this moment. This upward trend underscores an enduring hurdle for SHIB‘s deflationary strategy, which strives to control the supply.

In simpler terms, the Shibarium developers carry out a regular token-destruction process by transferring tokens to wallets that can’t be accessed, a tactic intended to influence the token’s worth.

On the Shibarium platform, users exchange some of their BONE tokens for SHIB, transferring them to inactive accounts. But if transaction costs surge by an astronomical 2024% due to this process, it could discourage investors, possibly affecting the overall worth of SHIB indirectly.

Where is SHIB at the moment?

In simple terms, Shiba Inu (SHIB) has consistently posted upward candles on its daily price chart, registering a rise of more than 5% in the last week. Interestingly, most of this growth can be attributed to Bitcoin‘s positive trend over the past four days.

As an analyst, I find it noteworthy that only around 240,000 SHIB tokens were burned recently, marking a significant drop of about 85% from the initial 1.7 million. The fact that the Shibarium network is experiencing high gas fees could raise eyebrows among stakeholders, as this situation might be indicative of underlying issues within the network.

This thesis could be validated if transactions on Shibarium slow down, leading to fewer SHIB burns.

If the attractiveness of network activity remains strong even with high gas fees, it could mean that the Shiba Inu community has fewer concerns to deal with.

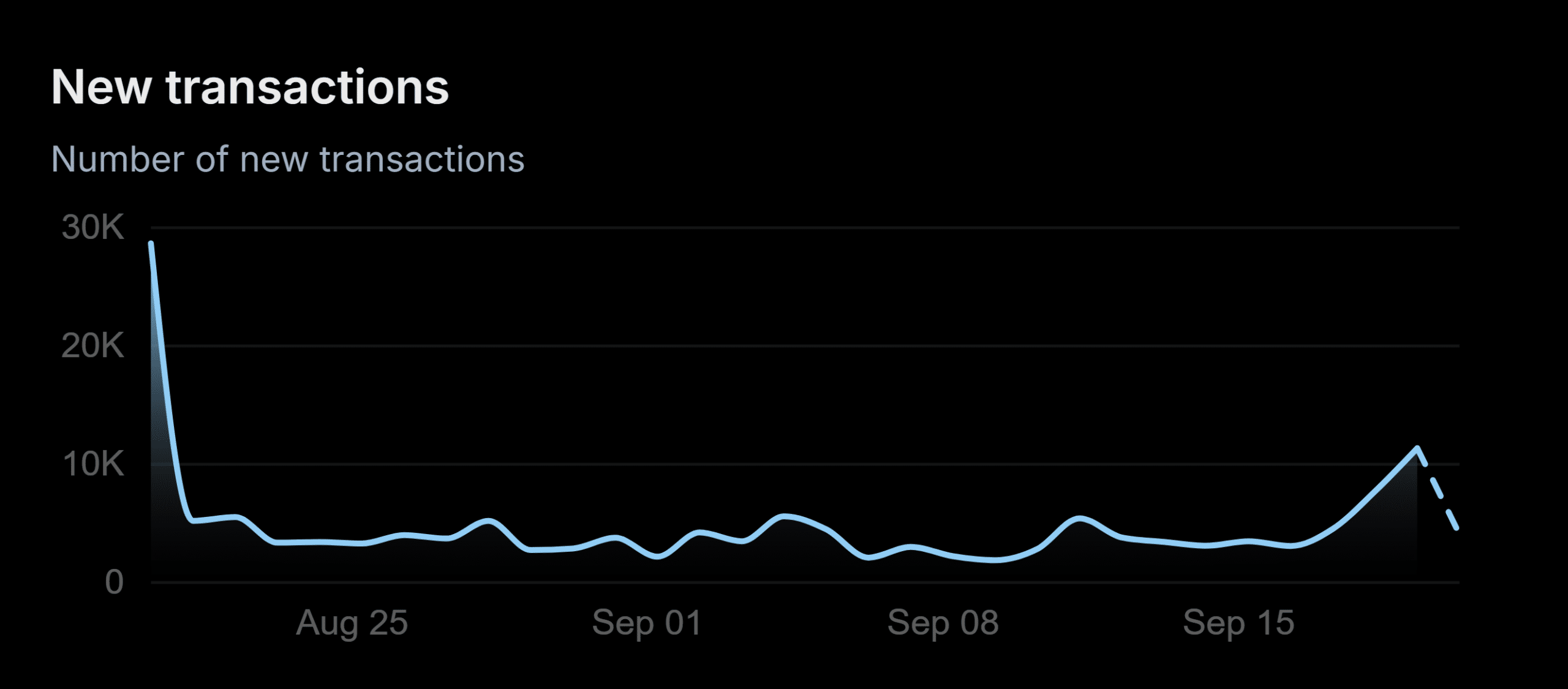

Source : ShibariumScan

Although the network is currently reaching record levels with a total of 416.785 million transactions, it’s worth noting that the daily transaction volume has significantly decreased. It dropped from approximately 30,000 in mid-August to just 11,000 as of press time.

In simpler terms, high transaction costs on Shibarium might discourage new investors from using it. If these high costs persist over time, it could potentially reduce the value of SHIB in the future, as suggested by AMBCrypto.

Right now, Shiba Inu’s popularity is largely tied to Bitcoin’s price holding at around $64,000. If the rate of Shiba Inu tokens being burned decreases, there might be a drop in its value following this.

Briefly, as the Shibarium network reaches a significant point, excessive gas fees might negatively impact Shiba Inu’s future prospects if their deflationary strategy isn’t executed quickly.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-09-21 06:16