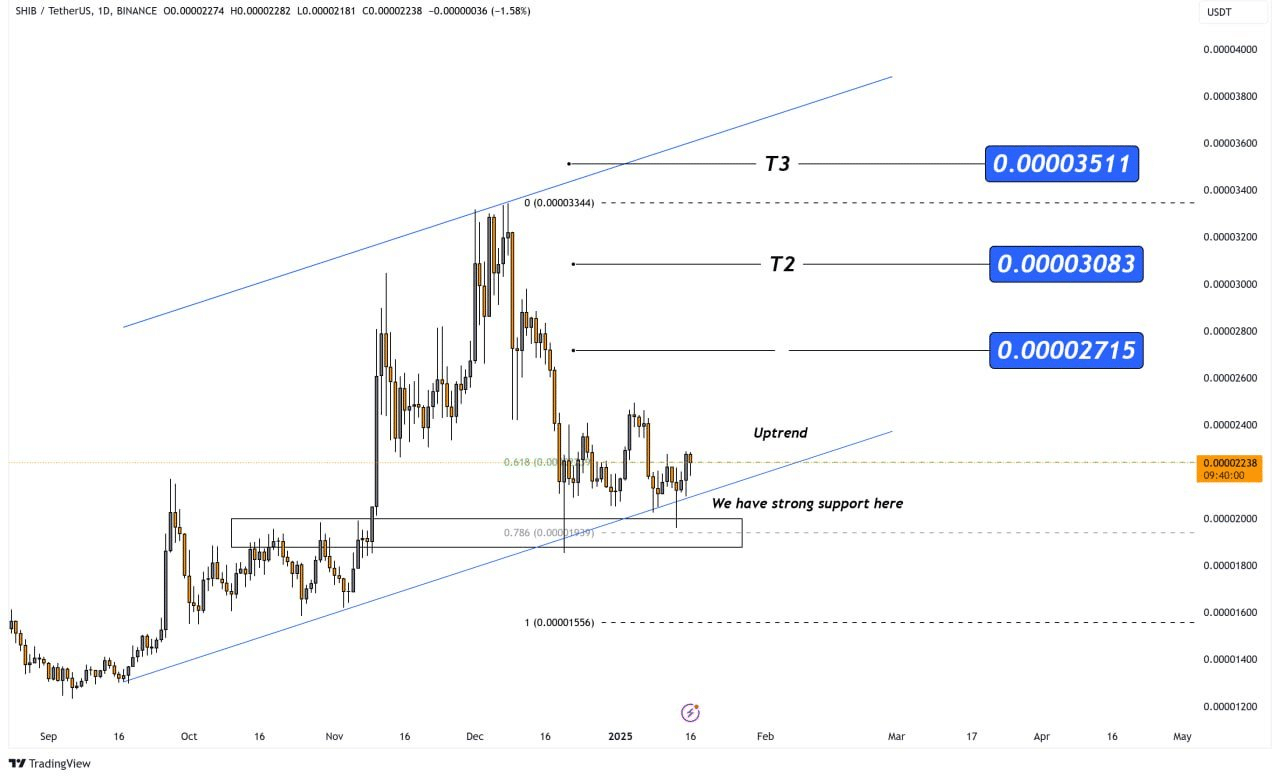

- The 0.618 Fibonacci retracement level served as a key support zone for SHIB, signaling a possible continuation of the uptrend.

- Shiba Inu’s ecosystem saw a significant drop in its burn rate, with only 9.38 million SHIB tokens burned.

Shiba Inu [SHIB] has gained attention for its recent price movements within an ascending channel.

Support at approximately $0.00002181 to $0.00002238 lines up with the 0.618 Fibonacci retracement level, suggesting a possibility of continued upward price movement.

Current price dynamics of SHIB

At the 0.618 Fibonacci retracement level, there’s a significant area of potential reinforcement, hinting that the upward trend may persist further.

After a rebound from the current level, driven by trading volume, SHIB now aims for immediate price levels at approximately 0.00002715 USD (T1), 0.00003083 USD (T2), and 0.00003511 USD (T3).

The bounce in the SHIB price, influenced by trading activity, could see it reaching short-term targets of around 0.00002715 USD, 0.00003083 USD, and 0.00003511 USD respectively.

If SHIB drops below the 0.618 level, it could trigger a test of lower support, possibly reversing the current uptrend. Keeping an eye on SHIB’s movement within its upward trending channel is essential for traders to make informed decisions.

Potential for bullish continuation

The price of SHIB is being held within an upwardly sloping channel, indicating a continuous optimistic market mood, provided the price continues to adhere to the lower boundary of this channel.

If there’s a drop beneath the current trend, it might challenge the optimistic forecast for Shib Inu, possibly pulling its price down to approximately $0.00002181 again.

Positively, adhering to this range could foster continued progress towards upcoming resistance points. Exceeding the top limit might suggest increased buying activity, possibly driving prices past $0.00003511.

Highlights on market sentiment and accumulation

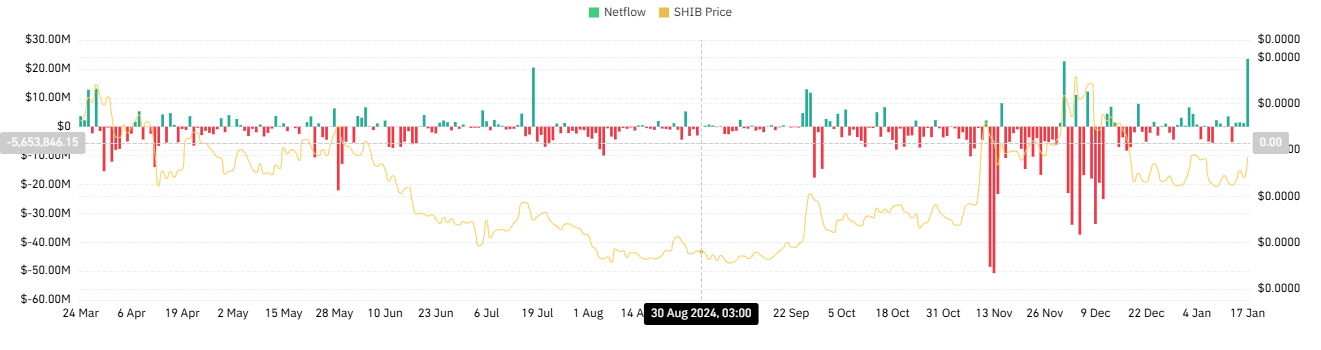

The latest figures indicate that Shiba Inu (SHIB) has a complex trend of both incoming and outgoing transactions. On one hand, brief influxes suggest short-term investors are cashing in near resistance points to secure profits. On the other hand, persistent outflows hint at long-term investors continuing to amass SHIB.

This interplay has kept SHIB’s price stable despite external pressures.

An increase in incoming funds (net inflows) that we’ve noticed recently might indicate growing selling pressure if SHIB gets close to $0.00002715. But, if net inflows remain stable or decrease while outflows persist, it could set the stage for more growth towards T2 and T3 targets.

Keep a close eye on these indicators because they offer crucial information about market emotions and trend predictions.

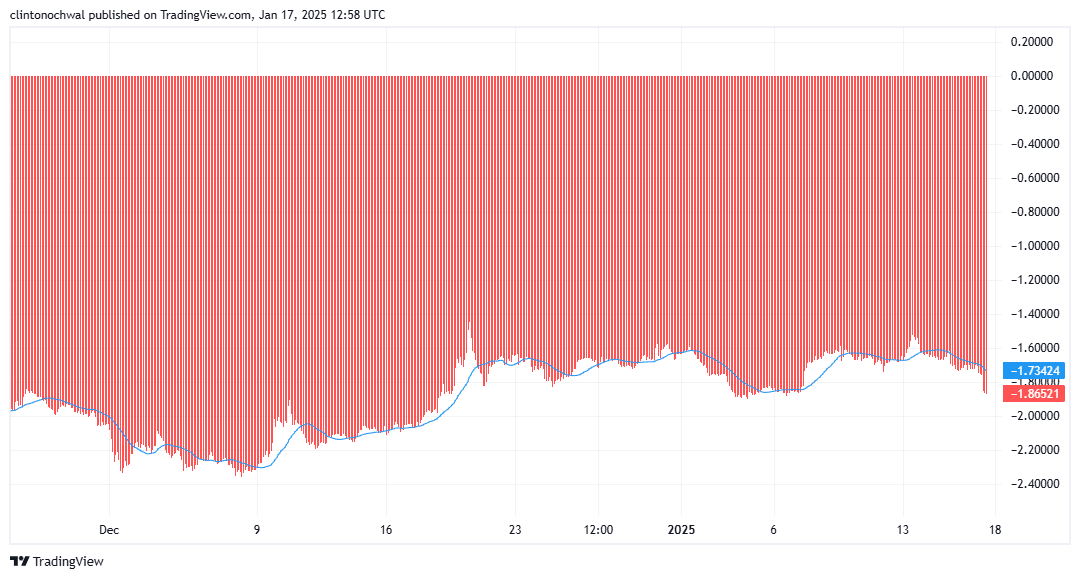

The rates for Shiba Inu (SHIB) investment have generally stayed steady or slightly optimistic, indicating a neutral-to-positive viewpoint among investors. Favorable rates typically mean that investors are prepared to overpay to keep their long positions, which underscores a bullish mindset.

In terms of SHIB, the consistent funding rates suggest that traders are exhibiting a measured optimism, mirroring its recent stable track record.

Market feelings or attitudes, as represented by indicators such as the Fear and Greed Index, are leaning towards a sense of optimism or enthusiasm (greed). This suggests that investors have a positive outlook on the market. However, traders need to exercise caution due to potential signs of assets being excessively purchased (overbought conditions).

A sharp increase in greed might trigger a temporary adjustment, particularly if Shiba Inu (SHIB) doesn’t manage to surpass $0.00002715 with strong evidence.

Implications for SHIB’s ecosystem goals

However, it’s worth noting that there was a substantial decrease in the burning pace within the Shiba Inu ecosystem on the 14th of January 2025. Compared to other days, just 9.38 million SHIB tokens were burned on this particular day.

8.91 million SHIB was burned in the largest single event, highlighting that overall burning events were relatively scarce.

Read Shiba Inu’s [SHIB] Price Prediction 2025-26

This represented a significant drop of 55% in the daily expenditure rate, causing apprehension regarding the project’s aspirations for deflation.

At the same time, Shibarium’s blockchain data showed consistent network usage, boasting more than 791 million finished transactions and recording approximately 2.095 million unique addresses.

That day saw no fresh contracts being deployed, with only one previously existing contract being verified instead. This suggests a state of consistency or equilibrium.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-01-18 07:04