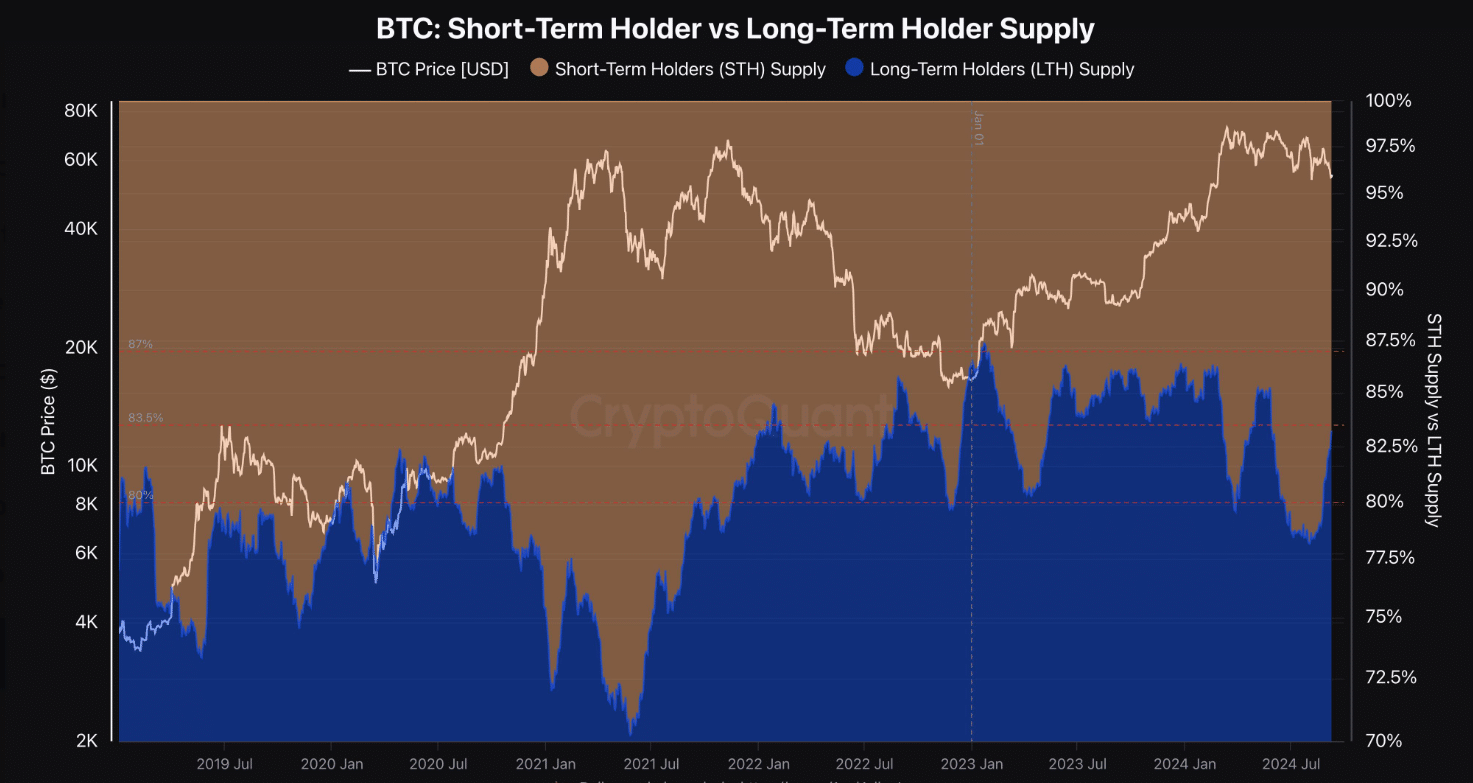

- Short-term Bitcoin holders started to sell at unprecedented rates as long-term holders accumulated.

- The shift in capital comes as traders chose to remain risk-averse.

As a seasoned analyst with over two decades of experience in global financial markets, I find myself intrigued by the current state of Bitcoin (BTC). The recent trend suggests a significant shift in capital from short-term holders to long-term investors, a pattern that I’ve witnessed in various asset classes throughout my career.

At the moment of this writing, Bitcoin [BTC] was being traded at $58,200, marking a 2.8% rise. This surge in price occurred after the disclosure of U.S. inflation data, causing traders to invest based on the expectation that the Federal Reserve might reduce interest rates in the upcoming week.

However, despite these gains, Bitcoin was still facing challenges. CryptoQuant author IT Tech noted that short-term holders were exiting the market.

Over the past fortnight, this group has reduced its overall Bitcoin holdings by both selling for a profit and incurring losses.

During that timeframe, it’s been observed that long-term Bitcoin investors have increased their coin holdings noticeably, indicating a substantial change in wealth distribution.

As a market analyst, I can observe that short-term Bitcoin holders significantly influence the price fluctuations due to their quick buying and selling actions. When these holders decide to sell, it creates temporary instability in the market, leading to choppy or erratic price movements.

Consequently, the continuous buying by long-term investors might lead to price consistency, paving the way for an upward trend.

Bitcoin holders exit

The reduced interest in Bitcoin can be seen in its separation from gold’s performance, as gold has just set a new record high.

In simpler terms, Julio Moreno, who leads the research team at CryptoQuant, pointed out that when Bitcoin and gold consistently move in opposite directions for an extended time, it typically indicates a cautious investment climate.

It showed that traders were willing to hold less volatile assets such as gold.

Additionally, Bitcoin’s performance was less than stellar during times when the U.S. dollar was weak, indicating increased caution and doubt in global financial markets. This decreased appetite for digital assets as well.

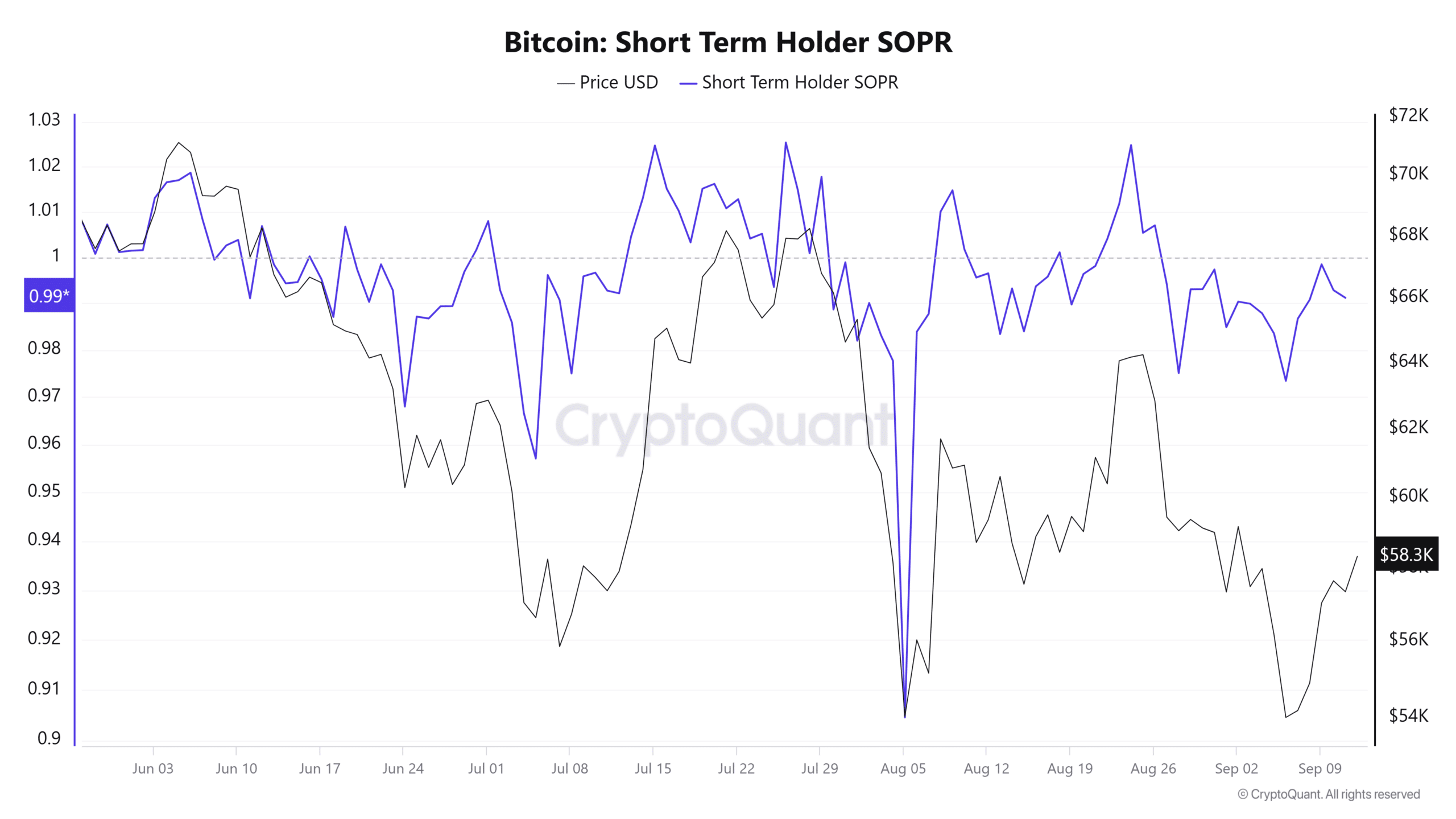

In simpler terms, it appears that individuals who recently purchased Bitcoin have been incurring losses, as indicated by the Spent Output Profit Ratio (SOPR), which has remained less than 1 since the 27th of August. This suggests a trend of short-term holders selling at a loss.

As a crypto investor, I’ve noticed that those who’ve held Bitcoin for less than five months (155 days) appeared ready to sacrifice potential gains and sell off their holdings, fearing a possible further price decline. This trend underscores the intensity of the prevailing bearish mood in the market.

Price outlook

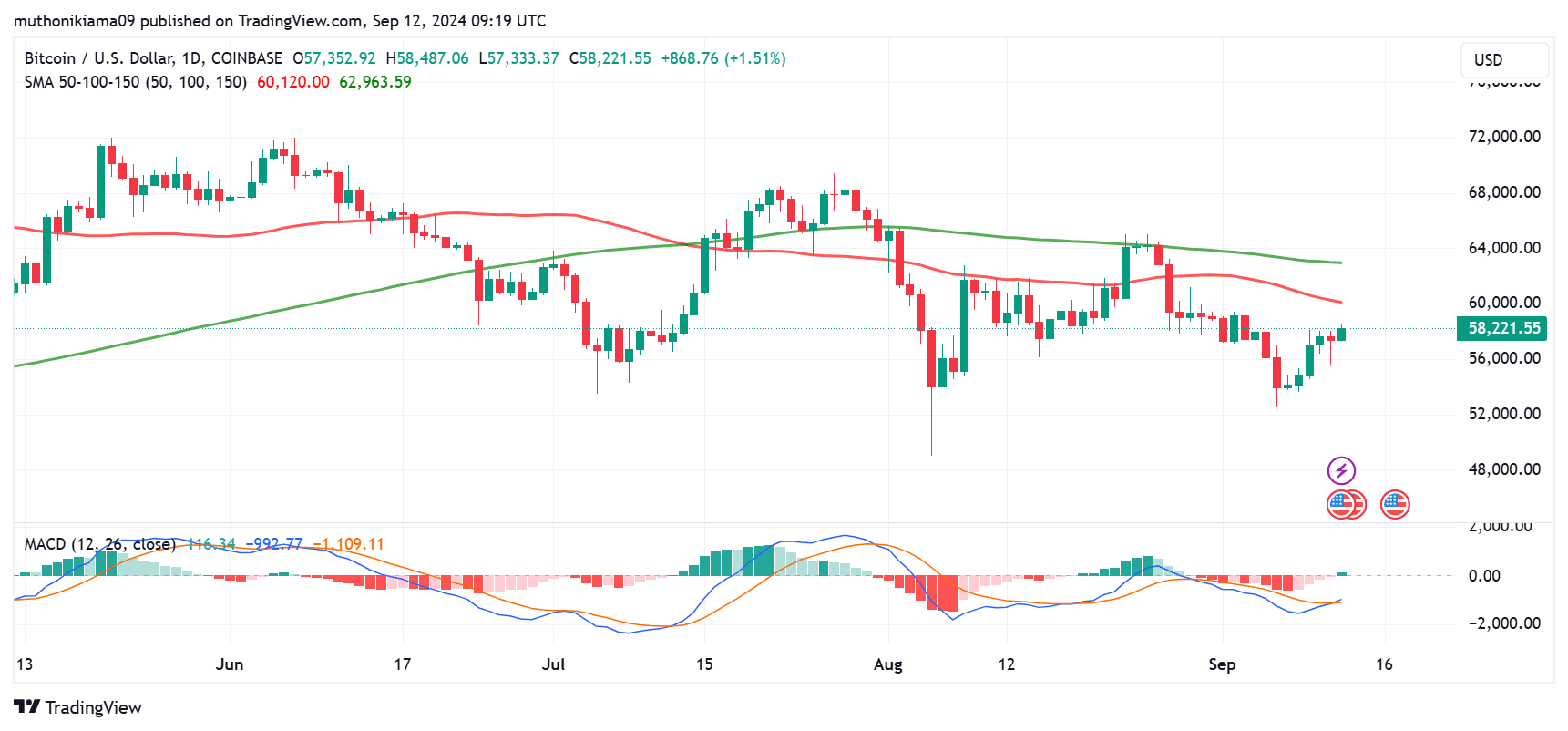

The short-term and long-term sentiment toward Bitcoin remained bearish, as the price trailed below the 50-day and the 100-day Simple Moving Averages (SMAs).

At the current moment, the 50-day Simple Moving Average (SMA) stands at around $60,000 for Bitcoin (BTC). Should the price touch or surpass this point, the short-term outlook could become increasingly optimistic, leaning towards a bullish trend.

However, for a more sustained rally, Bitcoin needs to reclaim $63,000.

The MACD indicator hinted at a slight increase in bullish strength as the MACD line surpassed the signal line, and the MACD bars now appear green.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This pattern seems to indicate that bulls could be preparing for action. But for the uptrend to persist, it’s important that the Moving Average Convergence Divergence (MACD) line changes to a positive value.

Even though Bitcoin has recently made progress, its Fear and Greed Index standing at 31 indicates a sense of apprehension among investors. This may lead to persisting decreases in demand.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-13 02:16