-

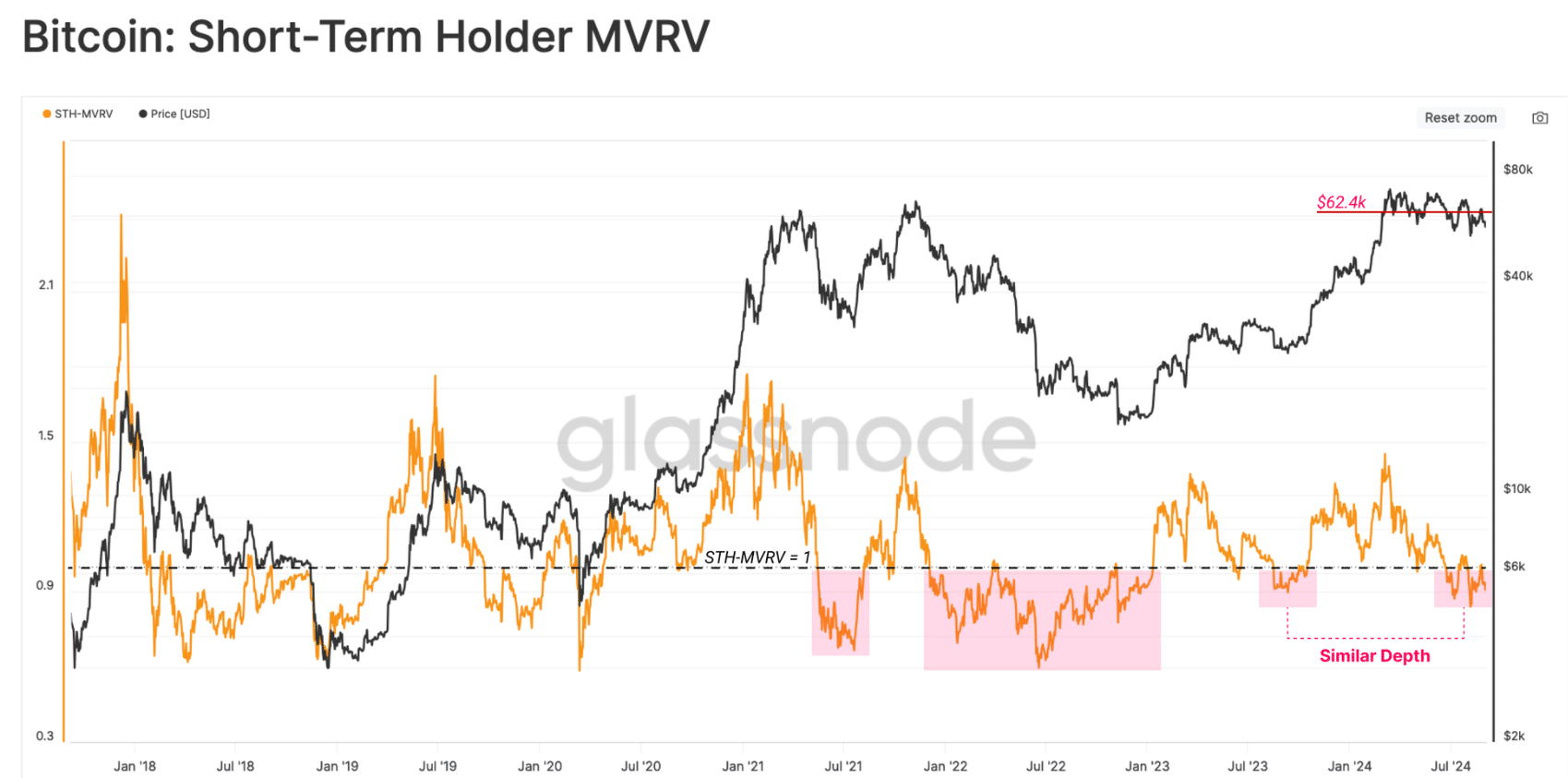

Short-term Bitcoin holders were heavily underwater per Glassnode, and they pose a significant risk to BTC if they choose to sell.

However, loss-taking activities by these traders remain below bear market levels despite fear gripping the market.

It seems like you have provided a compelling analysis of the current state of Bitcoin (BTC) market. Here are my insights based on my personal experience as a crypto investor:

Bitcoin [BTC] was down 22% from its all-time high above $73,000. The price decline has seen short-term Bitcoin holders, who bought during the early 2024 rally, sit on a substantial amount of unrealized losses.

In their latest on-chain analysis, Glassnode highlighted that the Market Value to Realized Value (MVRV) ratio for short-term holders fell below the breakeven point of 1.0

This indicates that the average new investor is yet to break even.

This group of investors stands to regain their profitability when Bitcoin surpasses $62,400. Currently, Bitcoin is exchanging hands at approximately $56,785, which translates to a 9% increase for these investors to start seeing profits again

Short-term Bitcoin investors could potentially harm Bitcoin’s value by selling it at a loss. However, these unrealized losses haven’t yet followed the pattern of past bear markets; instead, they are showing signs of volatility or choppiness

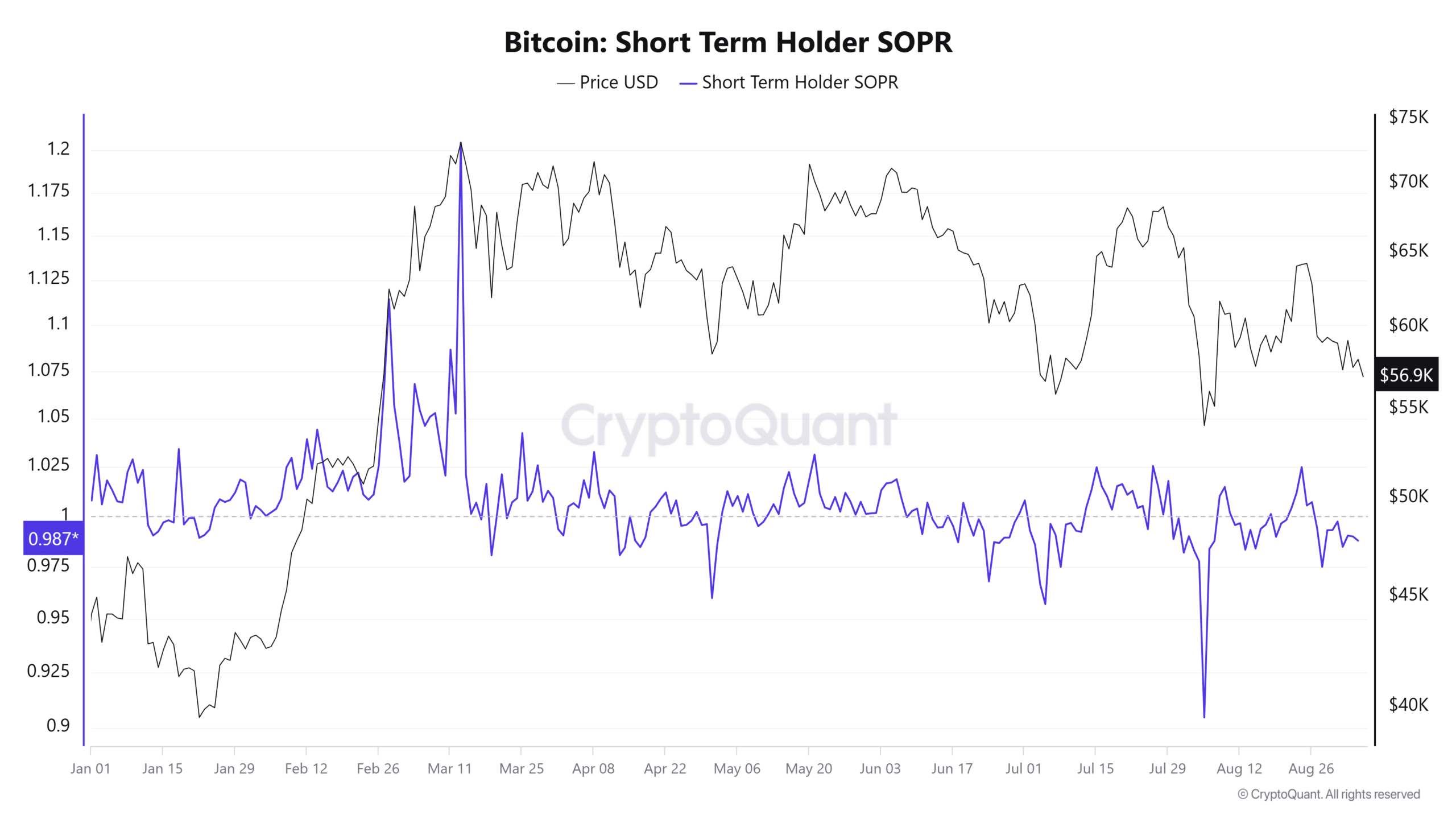

Selling activity remains below bear market levels

Some Bitcoin owners are not acknowledging potential losses, instead choosing to sell to reduce potential downside risk. As per Glassnode’s actions, instances of selling have escalated noticeably, with more investors offloading their Bitcoins the moment they form a higher low

Even though recent crypto sell-offs haven’t surpassed the intense drops experienced during the 2021 and 2022 bear markets, it’s worth noting that the Bitcoin Fear and Greed Index is currently at 29, indicating a high level of fear among investors. As a crypto investor, I find myself watching the market closely, hoping for a return to more optimistic times

It seems that the language used in this text is designed to reflect the short-term thinking of certain traders, as well as their readiness to sell at a loss. This metric, often referred to as the Spent Output Profit Ratio (SOPR) on CryptoQuant, indicates a willingness among some traders to sell their output at a loss. The language used in this text is designed to reflect the short-term thinking of certain traders, as well as their readiness to sell at a loss. This metric, often referred to as the Spent Output Profit Ratio (SOPR) on CryptoQuant, is below 1, indicating that some traders are willing to sell their output at a loss

Here’s an example of a paraphrase in easy-to-read English for expressing the idea that more traders might be ready to hold Bitcoin (BTC). The paraphrase is a figure of speech that communicates the notion that additional traders may prefer to own Bitcoin (BTC) as their preferred cryptocurrency. This is because the concept of Bitcoin (BTC) suggests a digital asset that has properties that make it more attractive for trading compared to other cryptocurrencies, such as its fast transaction speed and low fees. The ratio here indicates that the interest among traders in owning Bitcoin (BTC) might be higher than in other cryptocurrencies due to these advantages. This is because the paraphrase implies a communication of the idea that more traders might find it more appealing to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The figure here suggests that the number of potential traders for Bitcoin (BTC) may be greater than for other digital assets due to these advantages. This is because the paraphrase implies a communication of the idea that more traders might be willing to hold Bitcoin (BTC) as their preferred cryptocurrency, given its speed and low fees. The paraphrase here indicates a figure of speech expressing the notion that additional traders may prefer Bitcoin (BTC) over other digital assets due to its speed and low fees. This is because the paraphrase suggests a communication of the idea that more traders might find it more appealing to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase implies a figure of speech expressing the notion that additional traders may prefer to own Bitcoin (BTC) as their preferred cryptocurrency, due to its fast transaction speed and low fees. This is because the paraphrase suggests a communication of the idea that more traders might be ready to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase here indicates a figure of speech expressing the notion that additional traders may prefer Bitcoin (BTC) over other digital assets due to its speed and low fees. This is because the paraphrase implies a communication of the idea that more traders might find it more appealing to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase suggests a communication of the idea that more traders might be willing to hold Bitcoin (BTC) as their preferred cryptocurrency, due to its speed and low fees. This is because the paraphrase implies a communication of the idea that more traders might find it more appealing to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase here indicates a figure of speech expressing the notion that additional traders may prefer Bitcoin (BTC) over other digital assets due to its speed and low fees. This is because the paraphrase suggests a communication of the idea that more traders might be ready to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase implies a figure of speech expressing the notion that additional traders may prefer to own Bitcoin (BTC) as their preferred cryptocurrency, due to its fast transaction speed and low fees. This is because the paraphrase suggests a communication of the idea that more traders might be willing to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase here indicates a figure of speech expressing the notion that additional traders may prefer Bitcoin (BTC) over other digital assets due to its speed and low fees. This is because the paraphrase implies a communication of the idea that more traders might find it more appealing to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase suggests a communication of the idea that more traders might be willing to hold Bitcoin (BTC) as their preferred cryptocurrency, due to its speed and low fees. This is because the paraphrase implies a communication of the idea that more traders might find it more appealing to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase here indicates a figure of speech expressing the notion that additional traders may prefer Bitcoin (BTC) over other digital assets due to its speed and low fees. This is because the paraphrase suggests a communication of the idea that more traders might be ready to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase implies a figure of speech expressing the notion that additional traders may prefer to own Bitcoin (BTC) as their preferred cryptocurrency, due to its fast transaction speed and low fees. This is because the paraphrase suggests a communication of the idea that more traders might be willing to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase here indicates a figure of speech expressing the notion that additional traders may prefer Bitcoin (BTC) over other digital assets due to its speed and low fees. This is because the paraphrase implies a communication of the idea that more traders might find it more appealing to hold Bitcoin (BTC) as their preferred digital asset, given its speed and low fees. The paraphrase suggests a communication of the idea that more traders might be willing to hold Bitcoin (BTC) as their preferred cryptocurrency, due to its fast transaction speed and low fees

Over time, long-term Bitcoin investors have become more cautious with their earnings, reducing the rate at which they sell their coins. Notably, the amount of Bitcoin these traders hold has grown substantially, a pattern that often signals an approaching shift towards a bearish market

According to Glassnode, the decrease in both losses and profits indicates that the market may be nearing its peak price point, potentially leading to a surge in market volatility in the near future

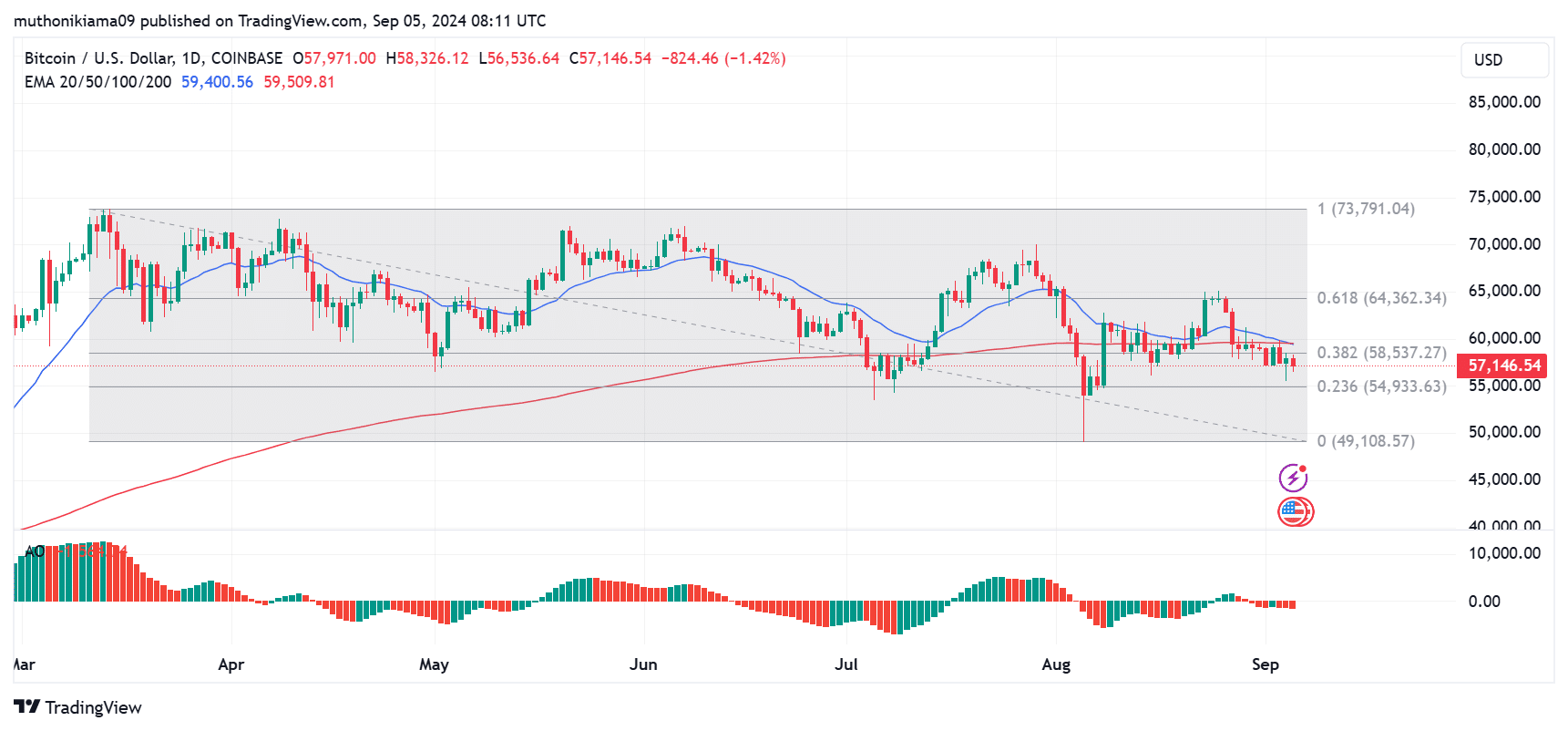

Bears continue to dominate BTC price

Translated: Over the last six months, Bitcoin has formed lower highs on the daily chart. Despite periods of buying activity, bears have continued to control the market

It seems that I am merely an amateur, or at best, an enthusiast. I can be found in the land of the free

The 20-day Exponential Moving Average (EMA) has converged with the 200-day EMA from above, which shows a weakening of the short-term momentum.

Yesterday’s price chart demonstrated that Bitcoin encountered rejection near the $58,530 resistance point, suggesting a decrease in demand. This could potentially lead to Bitcoin falling towards the anticipated resistance levels around $54,900 or the 0.236 Fibonacci retracement point

To prevent any additional decline, Bitcoin (BTC) should maintain its current support level. Interestingly, history shows that whenever this support level is tested, Bitcoin tends to experience modest increases, hinting at an accumulation of buy orders around this price point

Read Bitcoin’s [BTC] Price Prediction 2024–2025

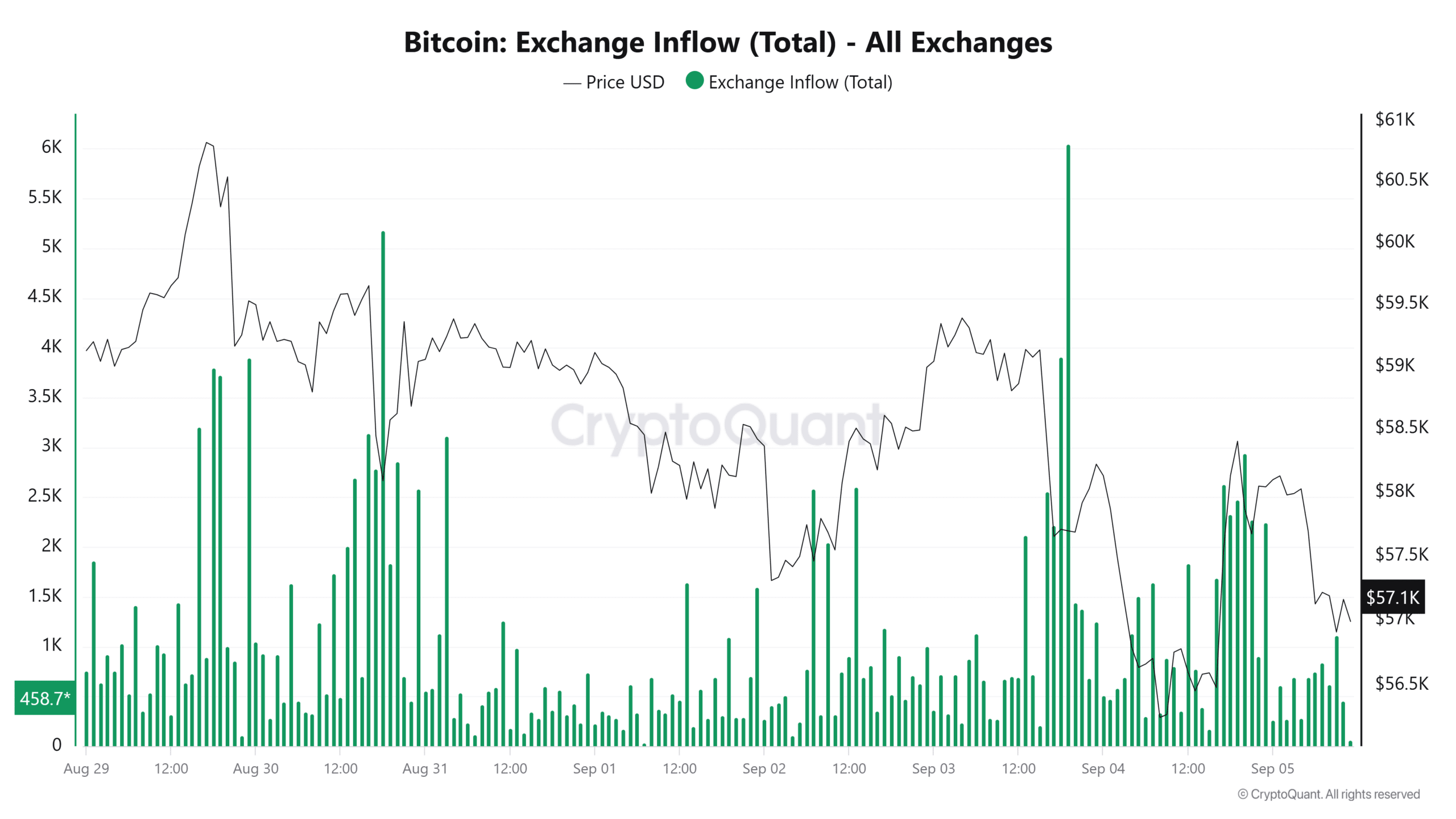

Nevertheless, Bitcoin holders should still be cautious as the market suggested selling behavior.

Based on Paraphrase CoinQuant, Bitcoin (BTC) exchange inflows surged on September 4th, indicating a bullish outlook among traders who expect additional price drops

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-09-05 22:18