- Key metrics reveal a deeper story behind BTC’s recent dip, highlighting both risks and potential opportunities for accumulation.

- As bearish sentiment grows, insights from HODL Waves and SOPR charts suggest this could be a pivotal moment for strategic investors.

The current trend in the Bitcoin market is generating a lot of conversation, as its value has been decreasing and pessimistic opinions about its future are becoming more common.

For short-term investors, it might appear they’re incurring losses currently, but past trends indicate that this period could present a beneficial chance for purchases instead.

This piece delves into the factors influencing future market trends, using data from Realized Cap HODL Waves, Short-Term Holder Sentiment Oscillator (SOPR), and Bitcoin price graphs for analysis.

Current Bitcoin market sentiment: Rising bearishness

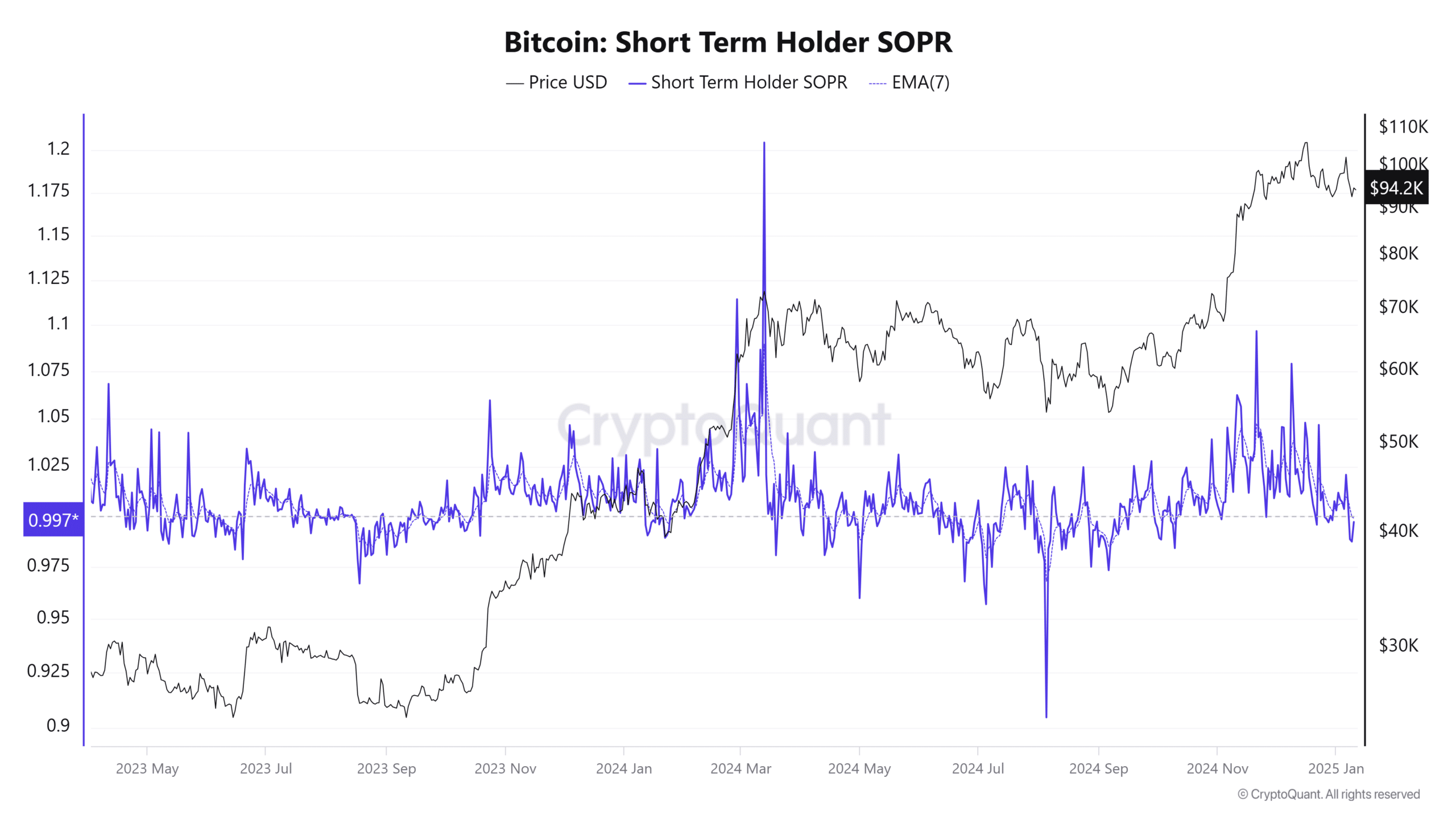

The current sentiment in the cryptocurrency market appears to be negative, with an uptick in short-term sellers. This trend is supported by the Short-Term Holder SOPR Chart, which shows a drop to 0.987, hinting that numerous investors are offloading Bitcoin at a financial loss.

Historically, when the SOPR (Spent Output Profit Ratio) has been less than 1.0, it’s frequently indicated periods of accumulation. During these times, shrewd investors have seized opportunities to invest at reduced prices.

This pessimistic outlook is being strengthened more and more due to the rising tide of negative comments on social media and frantic transactions that seem to be motivated by fear.

The growing negativity on social media and widespread panic-selling are only serving to reinforce this bearish viewpoint.

Or even simpler:

People’s pessimistic feelings about [the topic] are being boosted by the increasing number of negative posts on social media, along with panicked selling.

On the other hand, the trend shown on the SOPR chart suggests that periods of decline are typically followed by recovery, indicating that bear markets might signal potential accumulation chances.

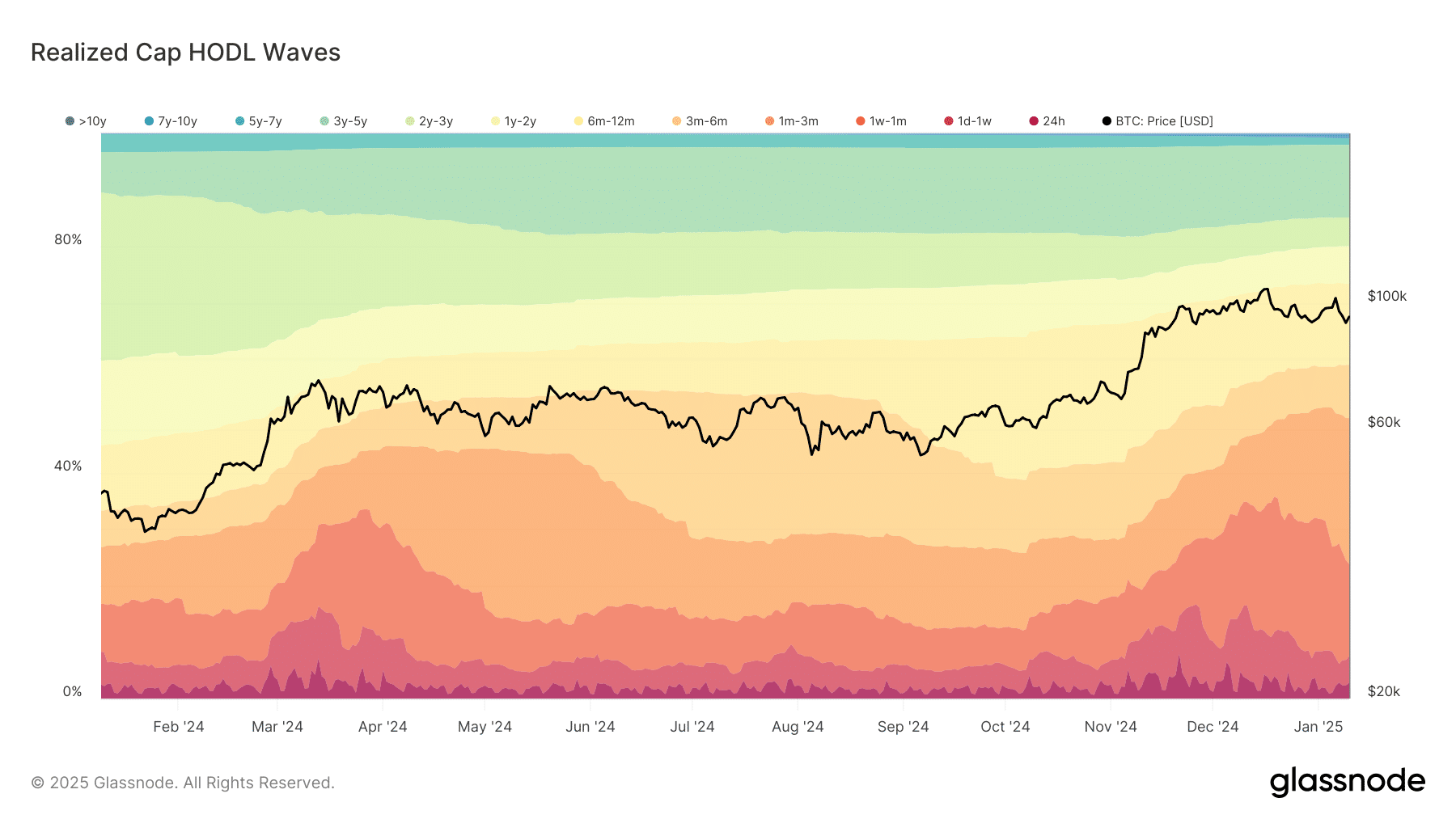

Distribution by mature investors and the role of new demand

The Realized Cap HODL Waves Graph demonstrates a substantial change in Bitcoin’s liquidity arrangement. Currently, coins that are less than three months old make up approximately 49.6% of the network’s total liquidity. This suggests that seasoned investors have largely dispensed with their holdings.

This trend suggests that experienced investors are selling off their investments following the upward trend, while fresh demand from new investors is counteracting the selling pressure on the market.

Historically, these types of redistributions tend to steady the market because new funds are injected. This additional capital serves as a cushion against potential further drops, indicating that the market might be moving towards a period of consolidation instead of a catastrophic collapse.

Short-term Bitcoin SOPR analysis: A historical perspective

As an analyst, I find that the Short-Term Holder SOPR (Spend Output Profit Ratio) Chart provides valuable insights into market sentiment. Currently, the chart indicates a value of 0.987, suggesting that short-term holders are selling their assets at a loss. This pattern is often observed during times when fear is heightened in the market, providing a useful tool for understanding current market dynamics.

It’s worth noting that when the SOPR (Spent Output Profit Ratio) falls below 1.0, it usually indicates market low points. In other words, even though fear is widespread, experienced investors might view this time as a prime opportunity for amassing assets.

The Bitcoin SOPR graph demonstrates a recurring pattern, indicating that past loss stages typically precede subsequent recovery periods.

Price action and key levels to watch

The BTC Price Graph offers valuable information about the present price trends. At the moment, Bitcoin’s value is roughly at $94,330, which is slightly under its 50-day average ($97,470), but still well above its 200-day Moving Average (MA) of $73,293.

This MA provides key resistance and support levels for traders.

As a crypto investor, I find myself noting that the Relative Strength Index (RSI) currently stands at 45.93, suggesting that Bitcoin may be nearing oversold territory. In the past, such oversold readings have often preceded price recoveries.

As an analyst, I would advise keeping a keen eye on the price levels of $95,000 and $92,000. These key points could potentially act as either strong resistance or solid support, depending on the direction of the market movement. Any significant breakthrough in these areas might suggest a potential shift in the trend.

Is this a crash or a buying opportunity?

Despite the pessimistic outlook and selling from short-term investors, there are signs of strength in the underlying data. The fact that new investors are stepping in to absorb the selling pressure, along with the historical tendency of SOPR for recovery, suggests that this could be more about consolidation rather than a full-blown crash.

In simpler terms, the graphs showing Bitcoin’s Realized Cap HODL Waves and Short-Term SOPR, along with price points, present a blend of signs. For long-term investors, this could be an excellent moment for amassing more Bitcoins. However, short-term traders should stay cautious, as there might be fluctuations that require careful monitoring.

– Read Bitcoin (BTC) Price Prediction 2025-26

In simpler terms, the Bitcoin market right now is a tricky mix of apprehension and prospects. Though most people seem pessimistic (bearish), the patterns shown by the SOPR and HODL Waves graphs hint towards an upcoming market upturn.

Investors should consider these indicators in light of the bigger economic picture, and then make well-thought-out choices based on their findings.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-12 04:08