- The cryptocurrency has hit resistance that is expected to weigh on its price and delay any significant upward movement.

- A short-term pullback seems inevitable.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I must admit that the current state of Polkadot [DOT] leaves me cautiously optimistic. While the short-term decline is undeniably concerning, I’ve seen this dance before—the market gyrating between bullish and bearish sentiment like a jitterbug on steroids.

Although there remains a bit of optimism about it, Polkadot (DOT) hasn’t demonstrated much robust movement in different periods. After experiencing a 2.18% decline during daily trades, the trend seems to be tilting towards further decreases.

The expected drop in value is primarily due to a decrease in purchasing interest among traders, as their overall optimism wanes. Yet, there’s an undercurrent of positivity suggesting that if market circumstances become more favorable, there could be a subsequent recovery.

DOT charts short-term decline amid supply zone pressure

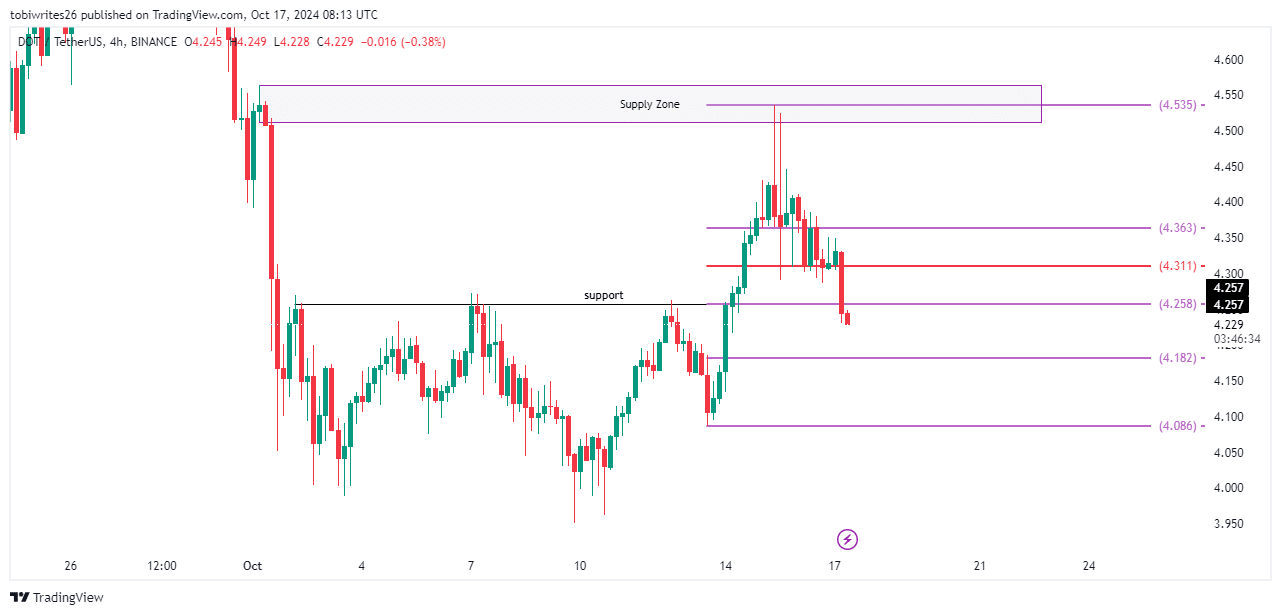

currently experiencing a temporary drop on the graphs, even though it’s still moving inside an overall upward trending channel – a positive sign. Lately, the asset hit a middle-range supply area that stretches from approximately $4.512 to $4.563, which has likely caused its current price drop.

As a researcher, I’ve observed that the pressure has caused DOT to drop below its initial support level at $4.258, which coincides with the Fibonacci retracement level at this point. Currently, the price is approaching the next potential support level at $4.182, as suggested by the Fibonacci levels.

Should the selling momentum strengthen, it’s possible that the value of DOT might dip down to around $4.086. After this potential drop, it may stabilize and possibly resume its upward trajectory.

It appears that the ongoing selling trend might continue, as data from the blockchain indicates that traders are generally pessimistic about this particular asset.

Ripple effect on Polkadot as trader confidence fades

Based on on-chain data, it seems like traders’ trust in DOT might be decreasing, which could potentially lead to a dip in its value over the immediate future.

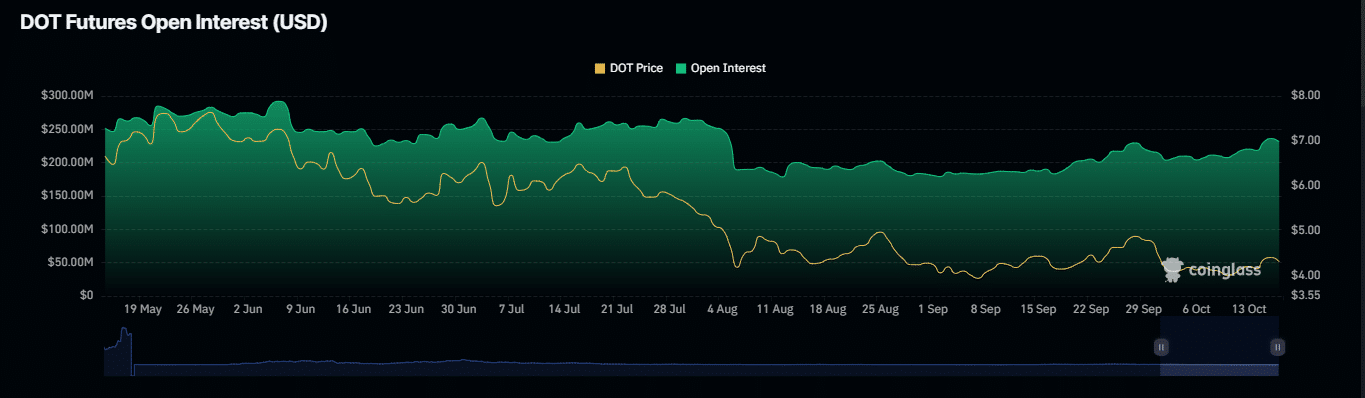

Based on information from Coinglass, there has been a significant drop observed in the number of outstanding derivative contracts, particularly futures agreements, as indicated by the Open Interest (OI) figure.

Lately, the Open Interest (OI) of DOT at the Department of Transportation decreased by 1.43%, now standing at approximately $229.07 million. This trend indicates an uptick in short positions, as traders seem to be wagering on a potential fall in DOT’s price value.

Data on liquidations indicates a rising trend in losses for long traders, as they were initially hopeful about an upward price movement but are currently experiencing the impact of intensifying pessimism (bearish sentiment).

Out of the total $136,720 traded positions that were closed, it was long traders who accounted for approximately $123,210, since the market trend has largely moved towards favoring short positions.

Are bulls seeking more profitable entry points?

As a researcher, I’m observing that the DOT token is maintaining a positive trajectory, moving within the confines of an ascending triangle – a technical pattern often indicative of potential price surges ahead. Intriguingly, AMBCrypto has pointed out another bullish indicator, which adds credence to the persisting signs of robustness in this market.

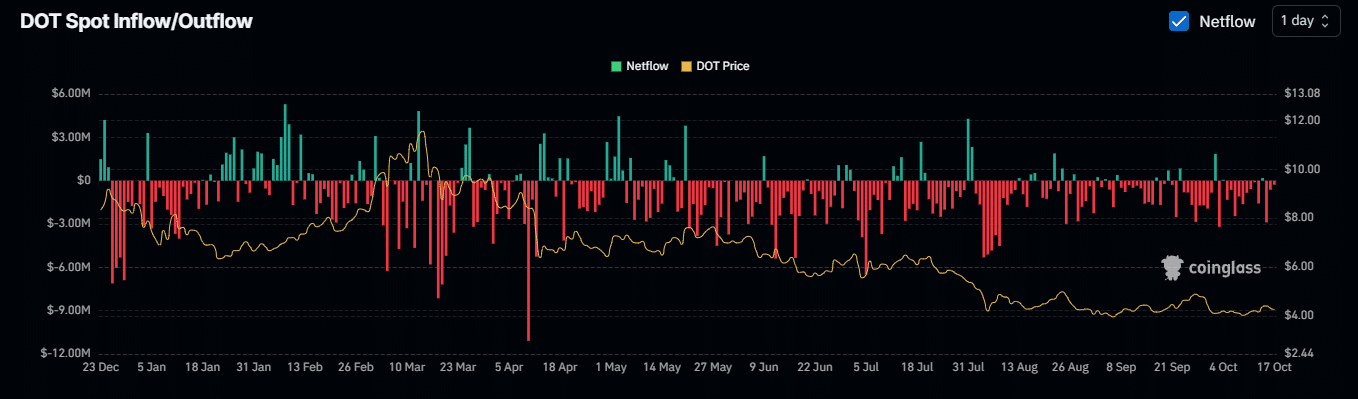

Currently, as I’m typing this, data from Coinglass indicates that the net flow (the difference between inflows and outflows) on cryptocurrency exchanges has been mostly going down on both a daily and weekly basis.

A negative net flow usually means traders are taking out more assets from exchanges than they’re putting in, which could imply they plan to keep these assets instead of selling them, potentially signaling a bullish trend.

Read Polkadot’s [DOT] Price Prediction 2024–2025

Based on the net flow of $274,820 and $3,590,000 on a daily and weekly basis in the exchange, respectively, the general market outlook continues to be optimistic or “bullish.

It’s possible that the recent drop in price is due to the bulls looking for the best time to buy (optimal entry point), with the intention of buying large quantities of DOT.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-18 04:08