-

Dogecoin, at press time, led the charts with the highest number of short-term traders

DOGE’s price action seemed poised for a higher move after the breakout

As a seasoned crypto investor who’s been through the Dogecoin rollercoaster since its inception, I can’t help but feel a sense of deja vu when I see DOGE leading the charts again. The meme-token sector is always an exciting ride, and it seems like DOGE is gearing up for another round of thrills.

The behavior of short-term investors significantly impacts meme coins, particularly because these digital currencies are largely fueled by excitement and speculation. At present, Dogecoin (DOGE) is the frontrunner in this category due to its high volume of active short-term traders.

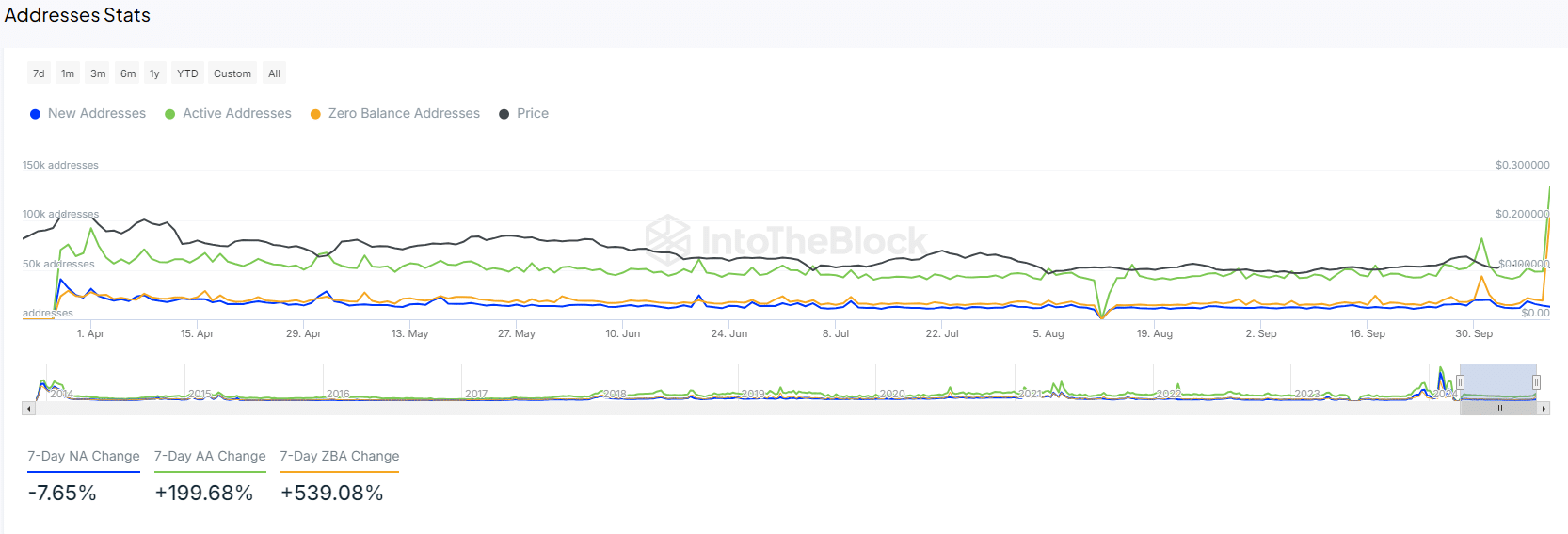

As an analyst, I’ve observed that, based on data from IntoTheBlock, Dogecoin (DOGE) has been leading the pack with more than 110,000 short-term traders over the past week. This heavy participation positions DOGE favorably within the meme coin sector, potentially setting it up for strong performance.

As a crypto investor, I’ve noticed an interesting pattern on the charts: Dogecoin (DOGE) is closely trailed by Shiba Inu (SHIB) and Degen (DEGEN). Surprisingly, while Shiba Inu boasts a larger market cap, Degen has managed to reach its 23k value. In fact, Degen seems to be outperforming other mid-sized memecoins in the market too.

DOGE looks ready to pop

Looking at Dogecoin’s (DOGE) chart over the weekly timeframe, it appears that an upward trend might be on the horizon. After reaching $0.75 in 2021, DOGE has been experiencing a prolonged correction period, with occasional brief upticks.

Lately, the DOGE/USDT pair has surpassed a downward sloping trendline, suggesting it might be poised for an upward movement in the coming days.

As a dedicated Dogecoin investor, I’m excited about the potential breakthrough we’re seeing in the market. This surge could potentially propel DOGE to hit $0.4 if the bullish momentum continues and the sentiment remains supportive. With the key resistance levels successfully breached, we’re now on the lookout for confirmation of this breakout. Let’s stay optimistic and see where this ride takes us!

Growing on-chain metrics

There’s growing signs that Dogecoin could experience a substantial price increase, as indicated by the surge in its on-chain activities. Notably, the number of active wallets has reached all-time highs since April 1st, with a 199% rise in weekly transactions.

Furthermore, it’s worth noting that the daily average number of addresses with a balance has reached a new peak, hovering around 6.6 million over the past month.

In March 2024, the downward trend in adoption rates showed signs of improvement. Now, a rate exceeding 26% offers increased assurance about DOGE, suggesting a potential increase in its price.

The combination of these indicators appears to imply that Dogecoin might experience prolonged growth. This is particularly true when considering larger time periods.

DOGE & BTC’s cyclical moment

Historically, the value of Dogecoin tends to surge the most when Bitcoin is experiencing a steep upward trend.

As Bitcoin surpassed its previous record-breaking resistance level, Dogecoin responded with an especially vigorous surge. At the moment, Dogecoin finds itself in a comparable stage of its cycle, suggesting that Bitcoin might be gearing up for another significant upward trend.

Should history follow a familiar pattern, it’s plausible that Dogecoin could witness another rise. This potential increase might be driven by its robust underlying factors and heightened trader enthusiasm.

Despite the volatile nature of the market, it’s evident that Dogecoin (DOGE) could ascend even more. Traders are advised to stay attentive to crucial resistance points and observe the general market mood for signs of a strong bullish trend continuation.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-10-12 07:07