- Analyst Ki Young supports buying Bitcoin at $100K anticipating a $145K price.

- Multiple metrics pointed $100K as the level to propel BTC to $160K.

As a seasoned researcher with over a decade of experience in financial markets and cryptocurrencies, I find myself intrigued by Ki Young’s analysis on Bitcoin at $100K. Having navigated through multiple market cycles, I have learned that key price levels often serve as pivotal points for traders and investors alike.

Given the persisting power Bitcoin (BTC) has been demonstrating, CryptoQuant analyst Ki Young recently raised an intriguing query: Is it advisable to purchase Bitcoin when it reaches $100,000?

Ki Young’s initial point of focus in his checklist revolved around whether prospective buyers might feel remorseful later, had they not bought when the price of Bitcoin reached $145K.

Additionally, the preparedness of prospective buyers for potential market downturns, as well as their capacity to tolerate price drops exceeding 30% without promptly selling in a panicked manner.

He added that the long-term commitment was also crucial, suggesting a minimum holding period of one year.

Why $100K level is key

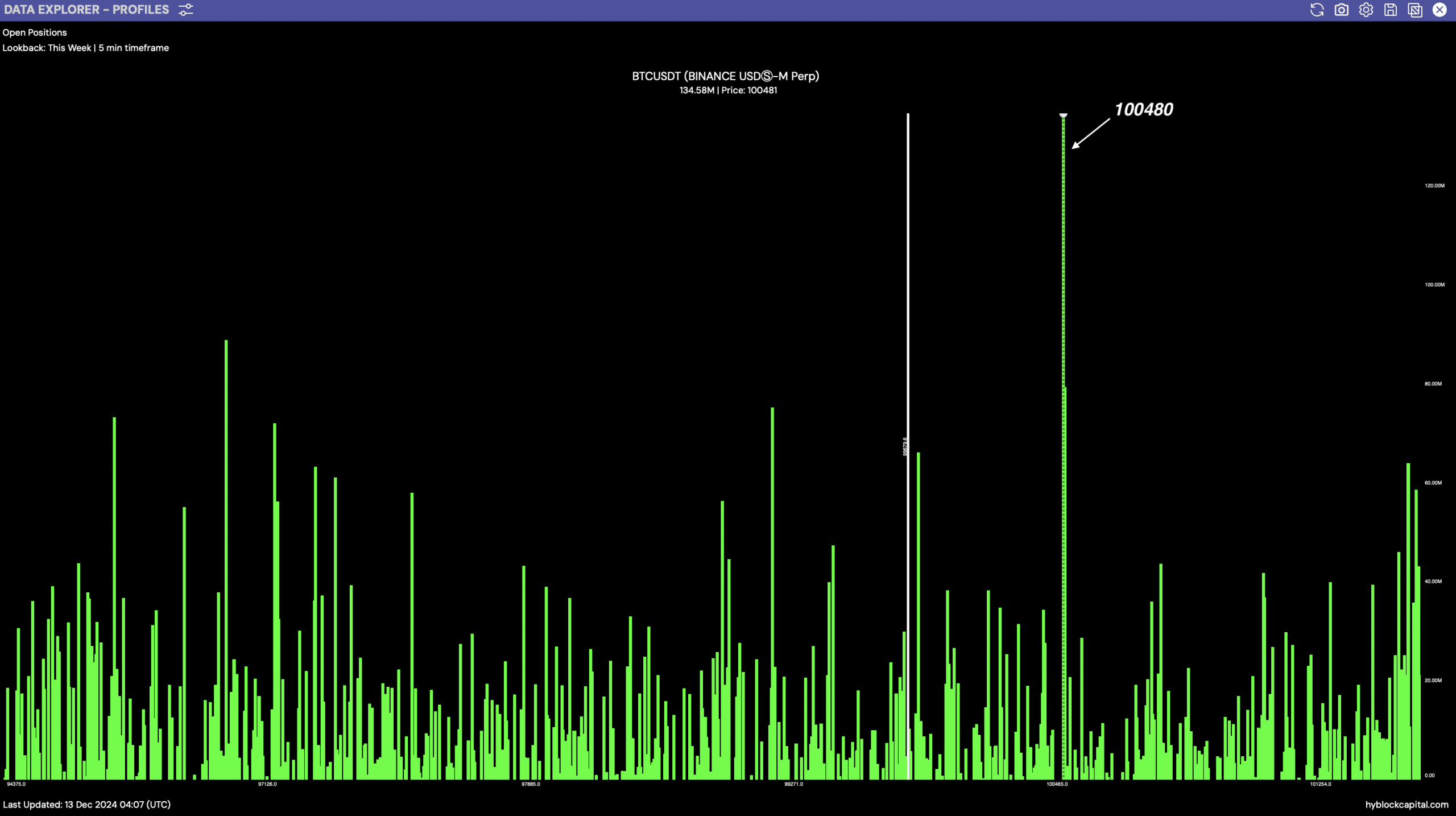

Over the last seven days, an examination of active Bitcoin positions indicates a significant focus or cluster at approximately $100,480.

This significant milestone marked the highest count of active bitcoin contracts ever, making it potentially pivotal in determining Bitcoin’s price fluctuations. The significance of this level was underscored, suggesting it as a vital spot for traders, hinting at high stakes and potential battles between buyers and sellers.

Activities at different price points showed diversity, but nothing approached the fervor observed at $100,480.

This concentration of open positions could serve as either support or resistance, influencing Bitcoin’s price movement if tested. The patterns often signaled key psychological and strategic market thresholds, where future price actions could pivot.

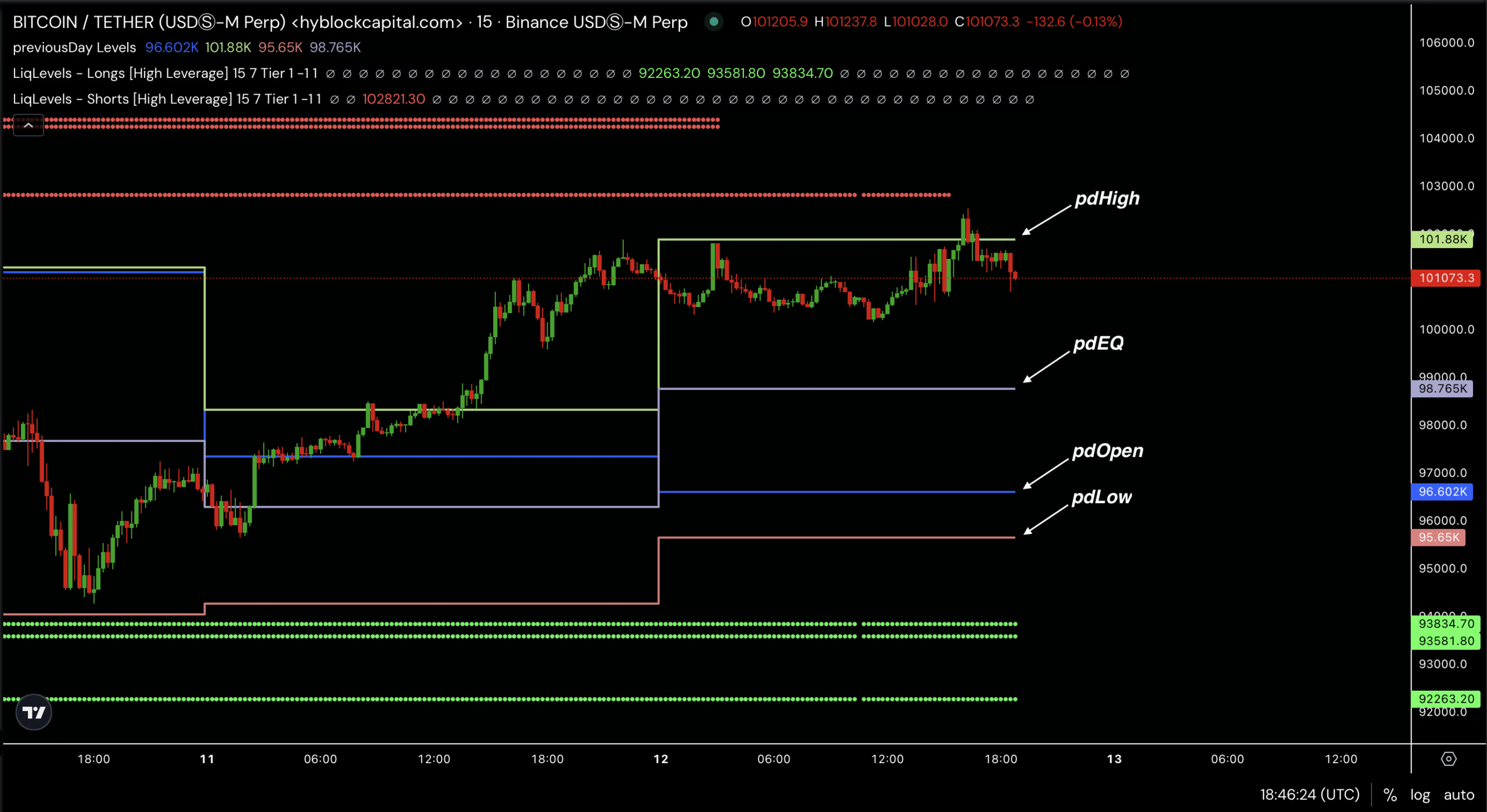

Further analysis showed that the price remained below the previous day’s high at $101,888.

At this point, coupled with the tight short liquidity zones, there emerged a region of strong resistance that Bitcoin momentarily touched but subsequently pulled back from, suggesting a difficulty in pushing beyond these heights.

The proposed liquidity figures indicated that the $100,000 mark served as a critical point, offering valuable insights to traders about profitable opportunities with favorable risk-reward ratios for strategic entry.

BTC price prediction

For approximately eight months, Bitcoin underwent a period of steady growth, setting the stage for a significant surge. This prolonged phase could be considered a prelude to Bitcoin’s breakthrough.

Previously, these trends indicated a possible continuation of upward movement. Consequently, experts hypothesized that the price of Bitcoin might surge towards $145,000 and potentially touch $160,000 during this phase.

If Bitcoin maintains its current upward trend after breaking through a key level, accompanied by growing interest from investors and positive global economic factors, it might see a significant increase in value.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As a researcher studying the cryptocurrency market, I observed a noticeable upward trajectory in Bitcoin’s price, which strengthened my belief that its prolonged consolidation phase may have been a precursor to substantial future growth.

Bitcoin’s future trajectory might involve testing significant resistance points or forming new base levels, which are crucial for a possible journey towards reaching the $160,000 mark.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-14 02:15