- Ethereum ETFs saw a rebound, bringing relief to the 17 million holders in the red.

- ETH will need to step up to stay ahead in the competitive altcoin race.

As a seasoned researcher with years of market analysis under my belt, I must say that the crypto landscape at the beginning of 2025 is as captivating as ever. The recent inflows into Ethereum ETFs are indeed a positive sign, indicating a potential shift in investor sentiment towards diversification and perhaps a renewed interest in altcoins. However, the road ahead for Ethereum remains challenging, with a significant rebound to $4,000 still seeming like a distant dream at this point.

Currently, there’s a lot of excitement surrounding the start of the new year, and this is particularly noticeable in the Bitcoin [BTC] market as it strengthens its position on the charts. Traditionally, the first quarter has been a favorable period for the cryptocurrency market, often providing conditions that encourage investors to allocate their funds towards altcoins.

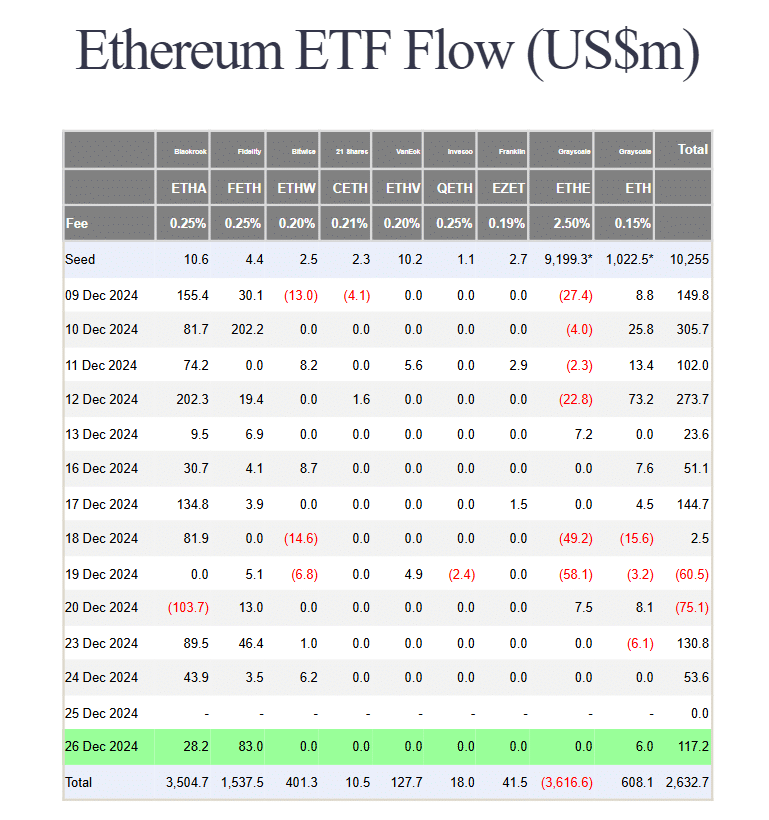

As an analyst, I’m observing a surge of interest in Ethereum [ETH] Exchange-Traded Funds (ETFs), which is quite noteworthy. For instance, Fidelity’s Ethereum ETF (FETH) attracted $83 million in net inflows recently. This trend suggests that investors are keen on diversifying their portfolios as we step into 2025.

Although it’s still premature to make definitive assumptions, Ethereum’s 1.04% price increase appears to hint at a developing trend that could be worth monitoring closely.

For Ethereum, it’s a long road ahead

After the “Trump pump,” the market has undergone various changes in direction. A powerful bull run that appeared to be on track, with Bitcoin reaching $100k by year-end, seems to have slowed down. Consequently, a sense of high risk is making investors exercise caution.

Just like other cryptocurrencies, Ethereum hasn’t escaped the recent market trend. Following an initial rise, its price has dropped to nearly where it was a month ago, wiping out many of the gains that came from the election. Now, with roughly 17 million Ethereum wallets showing losses, there’s growing demand for a price recovery.

Amid all the market turbulence, it’s reassuring to report a net inflow of $117 million into Ethereum ETFs. This influx provides some welcomed respite in these uncertain times.

Today’s development is encouraging, especially following two days with increased institutional involvement – It suggests that Ethereum might yet show signs of recuperation.

It appears that reaching $4,000 again is quite distant, considering it would call for a 18% increase from its current level. Given its recent trends over the past month, such a jump might appear overly optimistic in the near future.

There are other players in the race for dominance

Similar to Ethereum, many alternative cryptocurrencies are upgrading their fundamental technology to provide potential investors with attractive long-term opportunities. Among these, XRP particularly catches the eye.

At the moment, the day-to-day fluctuations of XRP suggest a period of stabilization. Heavy trading activity, characterized by both buying and selling, is causing a stalemate. This back-and-forth has caught the eye of major investors, who see opportunities for substantial profits with XRP.

Boasting significant triple-digit returns, practical applications integrated into everyday life, and substantial support from large investors (whales), XRP appears poised to challenge Ethereum for the limelight as the market recovers – a development worth keeping an eye on in the near future.

Read Ethereum [ETH] Price Prediction 2025-2026

From my perspective as an analyst, it’s worth noting that Ethereum’s price action has been quite dynamic. In just the last ten days, we witnessed a peak at $4,106 – a significant yearly high. However, in the subsequent week, ETH experienced a substantial 21% drop, which is a clear sign of increased volatility. While a recovery could potentially occur, it’s been slow-moving so far, suggesting that immediate buying interest from the market might be limited at this time.

Moving forward, the upcoming days may significantly impact Ethereum. While additional funding might cause Bitcoin to stabilize, which could advantage altcoins such as Ethereum, the current instability in Ethereum’s pricing makes a quick rebound doubtful.

Additionally, the rivalry among alternative cryptocurrencies is intensifying, meaning Ethereum needs to demonstrate greater stability in order to maintain its leading position within this competitive group.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-28 06:15