-

Smart money strategized on WIF’s dip to accumulate before the timing waned.

However, this could also be a double-edged sword for WIF.

As a seasoned analyst with years of experience navigating the tumultuous crypto markets, I find myself intrigued by WIF‘s current trajectory. Smart money indeed seemed to have spotted an opportune moment to accumulate during WIF’s dip, a strategy that has proven successful in many instances. However, this could also be a double-edged sword for WIF, as the uneven distribution of tokens might curb any potential rally if major holders decide to cash out.

To start off October, Dogwhathat [WIF] exhibited a bearish trend in September, following a rally in August that pushed its price up to $2. Currently sitting at $1.553, it has now recorded three consecutive green candles, suggesting a potential recovery. There’s growing optimism due to the anticipated Federal Reserve rate cut, which has already propelled Bitcoin over the $60K mark.

It’s worth noting that when Bitcoin reached its all-time high in March, the price of WIF jumped over $4. However, since then, both Bitcoin and WIF have seen a decrease, but WIF has fallen more significantly.

As a researcher delving into this subject matter, I find myself increasingly convinced that we might be witnessing the turning point in the downward trend of WIF. A series of significant triggers seem to be lining up, hinting at a possible breakthrough.

Smart money strategized on WIF dip

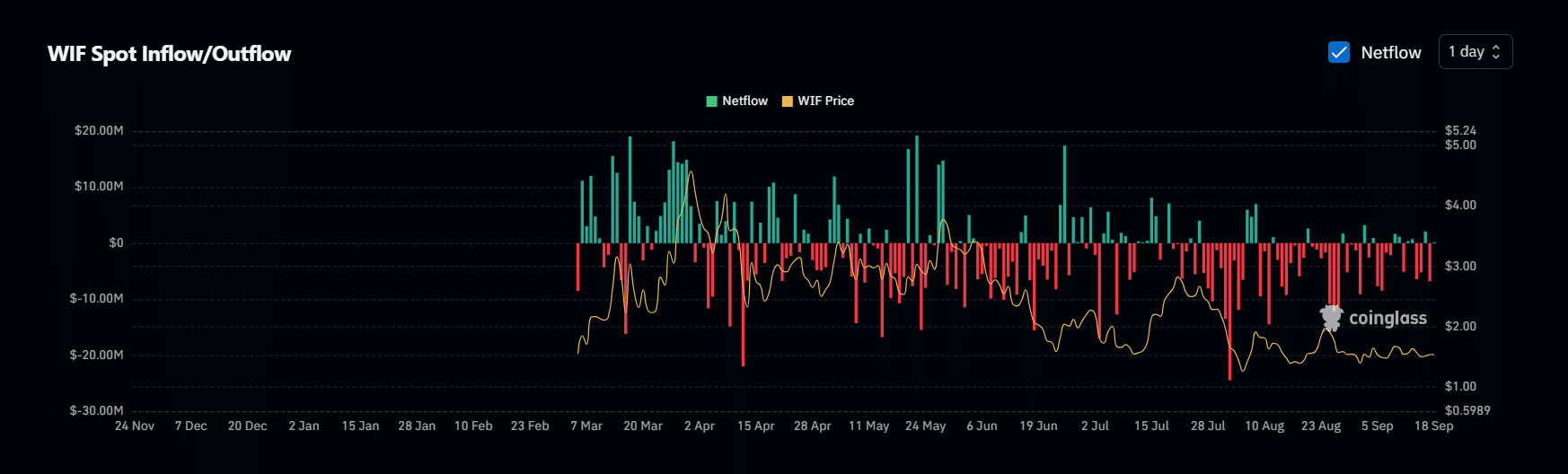

When I noticed the price of my crypto testing the $4 ceiling, it was soon followed by a surge in positive net inflow, peaking at around $19 million. This kind of situation often lines up with day-trader tactics, as investors like myself capitalize on the profits before the momentum starts to wane.

Source : Coinglass

Despite the significant outflows that occurred subsequently, WIF persisted in its downward trend, ultimately reaching a low of $1.

As I delved into my research, AMBCrypto’s analysis caught my attention. It seems this anomaly could be revealing a concealed pattern. Interestingly, while WIF‘s price mirrored Bitcoin’s downturn, the significant withdrawals suggest it might have been during an accumulation phase. This observation subtly points towards strategic financial maneuvers by seasoned investors, potentially preparing for a forthcoming market surge.

Essentially, shrewd investors probably took advantage of WIF‘s lower prices to counteract selling pressure and position themselves for the token’s future price surge at its market high point.

Given that the market has bounced back following a consolidation period, is there a possibility that the accumulation might drive WIF‘s price up to approximately $2, before potentially returning to its previous All-Time High (ATH)?

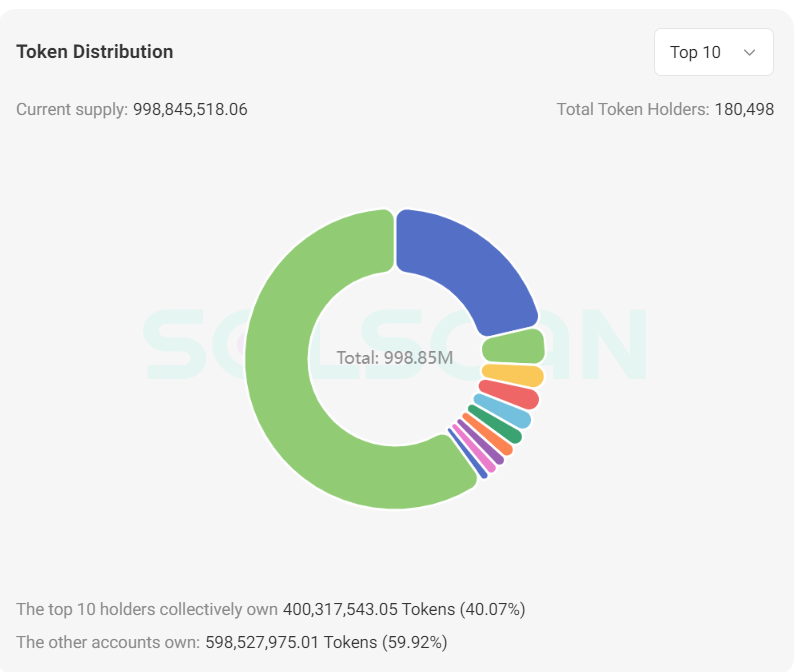

Uneven distribution may curb the rally

With a market capitalization of around $1.5 billion, roughly 998 million WIF units are currently in circulation. According to data from SolScan, the distribution appears to be rather centralized, as the top ten holders control more than 40% of the total supply.

Source : SolScan

As a crypto investor, I’ve noticed that the concentrated ownership of WIF tokens could work both ways. During market dips, it may provide stability by limiting sell pressure. However, if large-scale investors lose faith, this concentration could potentially obstruct a bullish rally.

Nevertheless, as large investors have focused on the lower end of WIF, they tend to remain hopeful for an uptrend. However, if the memecoin reaches its potential $2 ceiling, their optimism could potentially waver, but it remains achievable.

A crucial road ahead

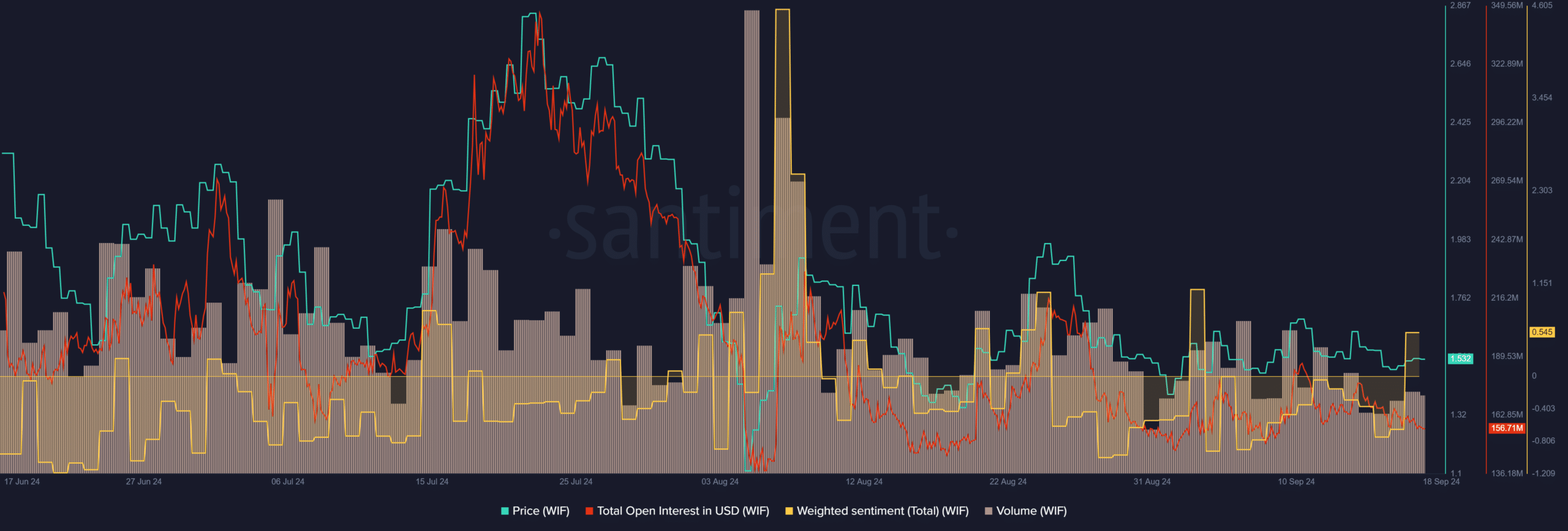

Although amassing resources kept WIF from falling beneath $1, this alone may not trigger a significant bullish upswing, as suggested by the chart presented below.

Source : Santiment

Contrasting with the strong rally in mid-July, the current growth pace doesn’t match up to that period’s intensity. The Open Interest (OI) in USD stands at $156 million, significantly lower than the $356 million observed during the surge.

Realistic or not, here’s WIF’s market cap in BTC’s terms

Nevertheless, the timing matters quite a bit. The bullish trend of Bitcoin (BTC) has sparked a more favorable outlook towards WIF, reflecting an increase in the community’s enthusiasm. If we see a doubling in trading activity, it could potentially fuel the current momentum even further.

Generally speaking, interest in this memecoin is increasing significantly. Should the current trend persist and savvy investors maintain their confidence, it’s possible that WIF might reach a value of around $2.

Read More

2024-09-18 17:12