- Solana has proposed to reduce the inflation rate from 5.7% to 1.5%

- Stakers are worried that the proposal would cut their yields

As a researcher delving into the intricacies of the Solana [SOL] network, I have come across a compelling proposal that aims to lower the annual inflation rate from its current level to a more conservative 1.5%. This adjustment is primarily in response to market conditions, and it was put forth by Tushar Jain, the Managing Partner at Multicoin Capital. In his argument, he expressed concerns about the existing inflation model.

In a recent interview on the Lightspeed podcast, Jain summarized the proposal as,

Our aim is to adjust the emission rate based on market dynamics. At present, we consistently release an equal number of SOL tokens regardless of market fluctuations. We’re suggesting a flexible emission plan that could stimulate engagement and staking by responding dynamically to market conditions.

Jain stated that the present model releases an excessive amount of SOL tokens for network security, which he thinks ought to be minimized as much as possible.

More reasons to address SOL inflation

In this scenario, the main factor driving inflation is the staking or binding of Solana (SOL) by users for the purpose of maintaining network functions and operations. As compensation, these stakers receive a payment in the form of SOL tokens, thereby increasing the overall supply.

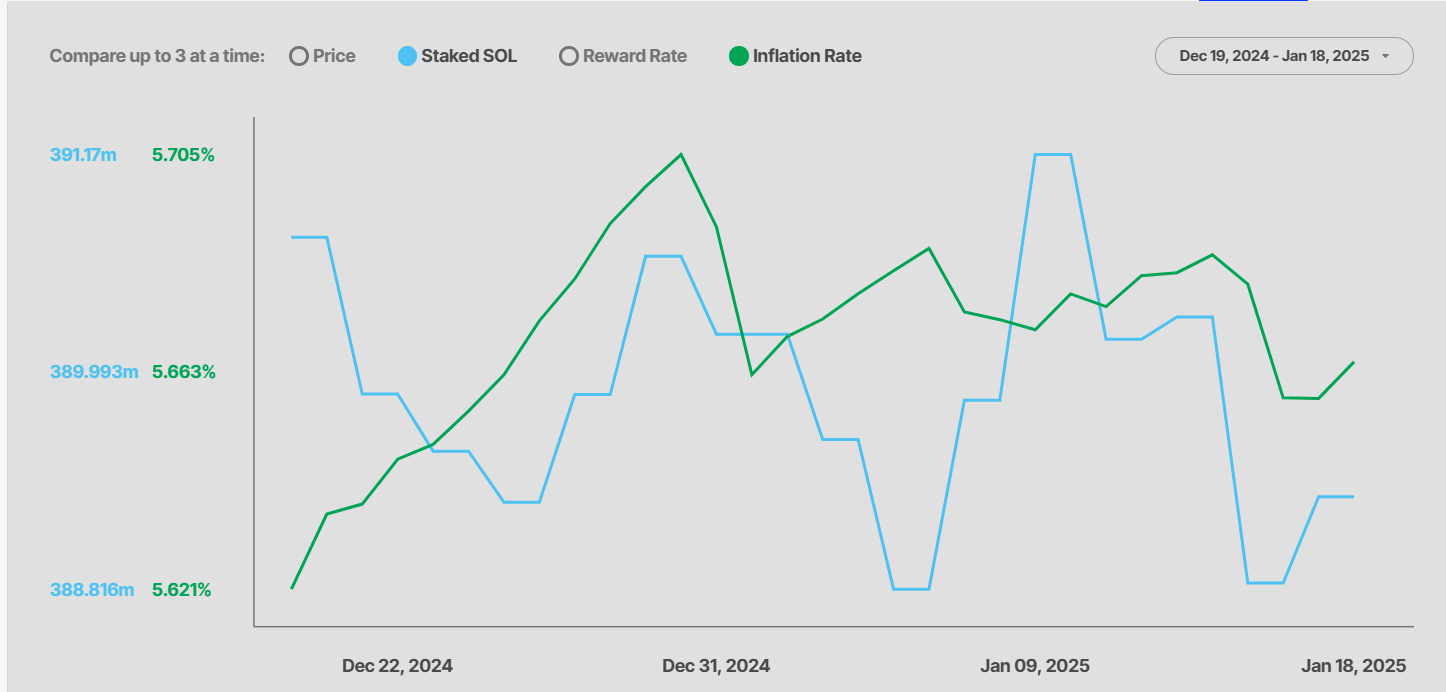

Jain explained that approximately 100 million units of SOL have been introduced into circulation since the year 2021. Out of a total supply of 592.4 million, around 391 million tokens are currently staked, accounting for about two-thirds (66%) of the entire supply.

The proposal eyes 50%-66% staked SOL, stating any more than 67% doesn’t help network security.

An increase in SOL beyond 67% doesn’t offer additional security benefits, as a majority of all SOL votes on each block, making it impossible for a long-term attack to succeed.

While less than 33% might pose a potential threat to the stability of the Solana network in terms of security, it’s noteworthy that the advantages of this proposal extend beyond just market efficiency. This plan would also alleviate selling pressure since validators might need to liquidate their tokens to fulfill their tax obligations.

Moreover, enhancing SOL’s image is crucial since high inflation might discourage others from keeping the tokens due to potential devaluation.

It’s important to mention that not everyone appears content with the proposal. An anonymous DeFi expert named Ignas has pointed out that the return on staking SOL could decrease if this proposal is implemented. In his words, “the yield from staking SOL would drop” if the proposal is adopted.

frankly speaking, I’m not hoping for the SOL Inflation Reduction Act to get approved. I understand that it likely will be, but I was quite content with the high returns of around 20% to 30% Annual Percentage Yield (APY) on $SOL multiply pools in Kamino.

As per MC’s perspective, the present model primarily advantages stakeholders while diminishing the value for non-stakeholders. A decrease in inflation could potentially bring benefits to non-stakers as well, since their assets would not lose value over time. Moreover, Multicoin Capital proposes that this reduction in inflation might stimulate Decentralized Finance (DeFi) activities within the ecosystem.

Read More

2025-01-18 15:03