Solana 💀

- Solana’ recovery is under pressure from large-scale sell-offs and weak sentiment.

- Beyond technical, Solana found itself embroiled in controversy.

Solana [SOL] has plunged 36% this month, ranking as the worst-performing top asset. A 2% uptick in trading volume, coupled with an oversold RSI and a bullish MACD crossover, signals potential dip buying around $120. 🤷♀️

However, with risk appetite still low, can SOL bulls leverage technicals alone to stage a recovery? 🤔

Beyond the charts: Key factors at play

Pumpfun continues to fuel selling pressure on Solana, recently transferring 196,370 SOL worth $25.3 million to Kraken. 💀💀💀

In total, it has deposited 2,629,656 SOL worth $511 million at $194 and offloaded 264,373 SOL for $41.64 million USDC at $158, contributing to the ongoing downturn. 🤑💸

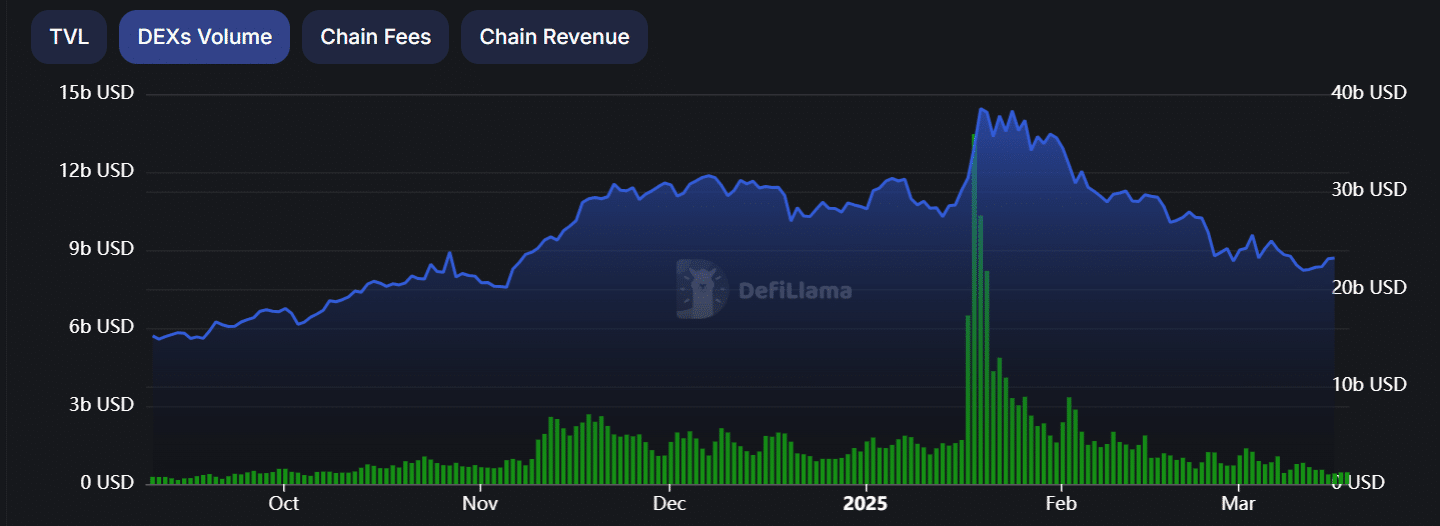

With increasing sell-side liquidity in a risk-off market, a rebound looks uncertain. Meanwhile, Solana’s DEX volume and TVL have slipped back to pre-election levels, signaling weakening network activity. 📉

Historically, Solana’s recovery phases have been marked by double-digit growth in TVL and DEX volume, often signaling a market bottom.

However, on the 15th of March, its DEX volume dropped below $1 billion, raising concerns about a potential trend reversal.

Unless traders step in with strong buy-side momentum, further downside remains likely. Adding to the uncertainty, Solana now faces backlash over a controversial advertisement on X (formerly Twitter).

The ad, which amassed 1.2 million views, was met with overwhelming negativity, forcing Solana to delete it. 🙈 However, the damage was done, impacting market sentiment.

Compounding bearish signals, Weighted Sentiment has flipped negative, reinforcing the lack of bullish confirmation and suggesting investors remain cautious about a potential rebound.

Assessing Solana’s next move

Solana’s price action highlights a persistent supply-demand imbalance. While Bitcoin consolidates, Solana has yet to see strong capital inflows from strategic investors.

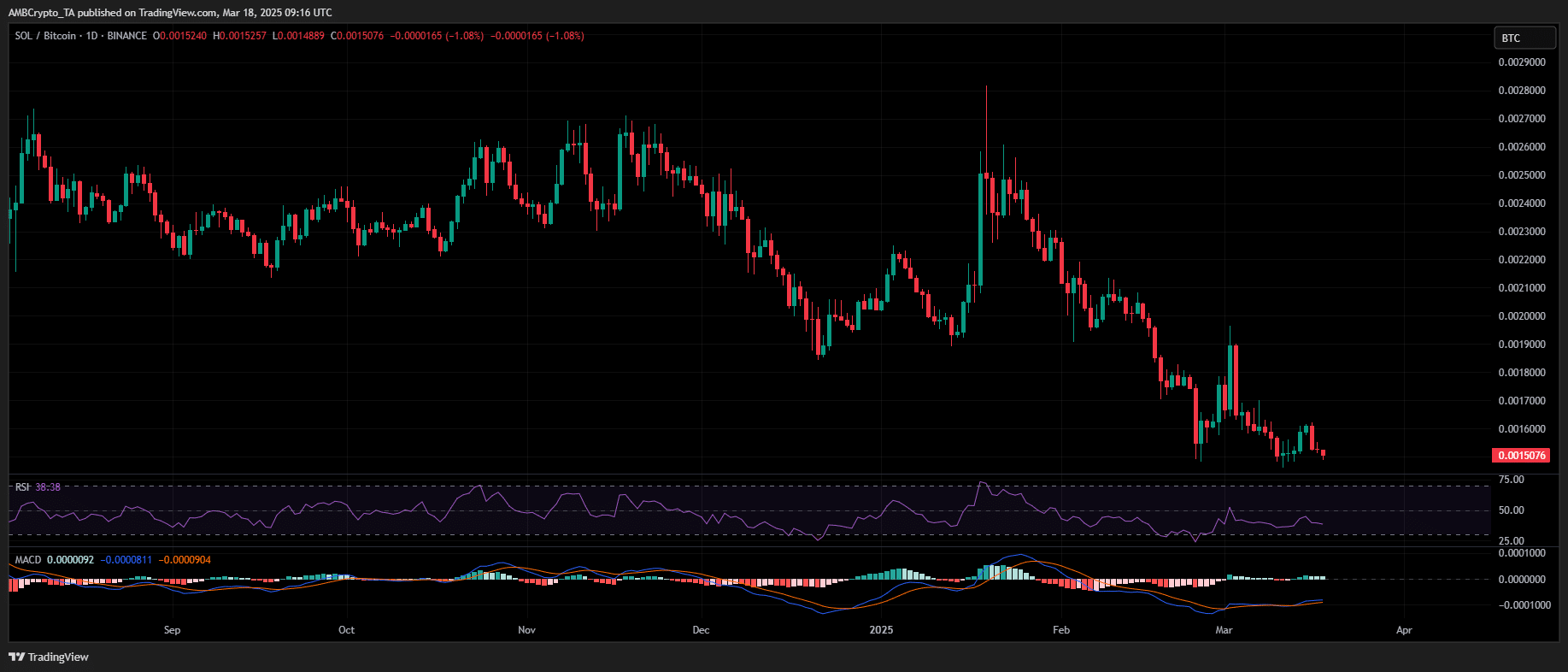

Despite a 30% monthly decline, discounted prices have not triggered strong accumulation. The SOL/BTC pair continues to print lower lows, recently plunging to a two-year low, signaling weakening relative strength.

With large-scale sell-offs and bearish sentiment dominating

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2025-03-18 20:10