- Solana did not see heightened buying pressure during its month-long range consolidation.

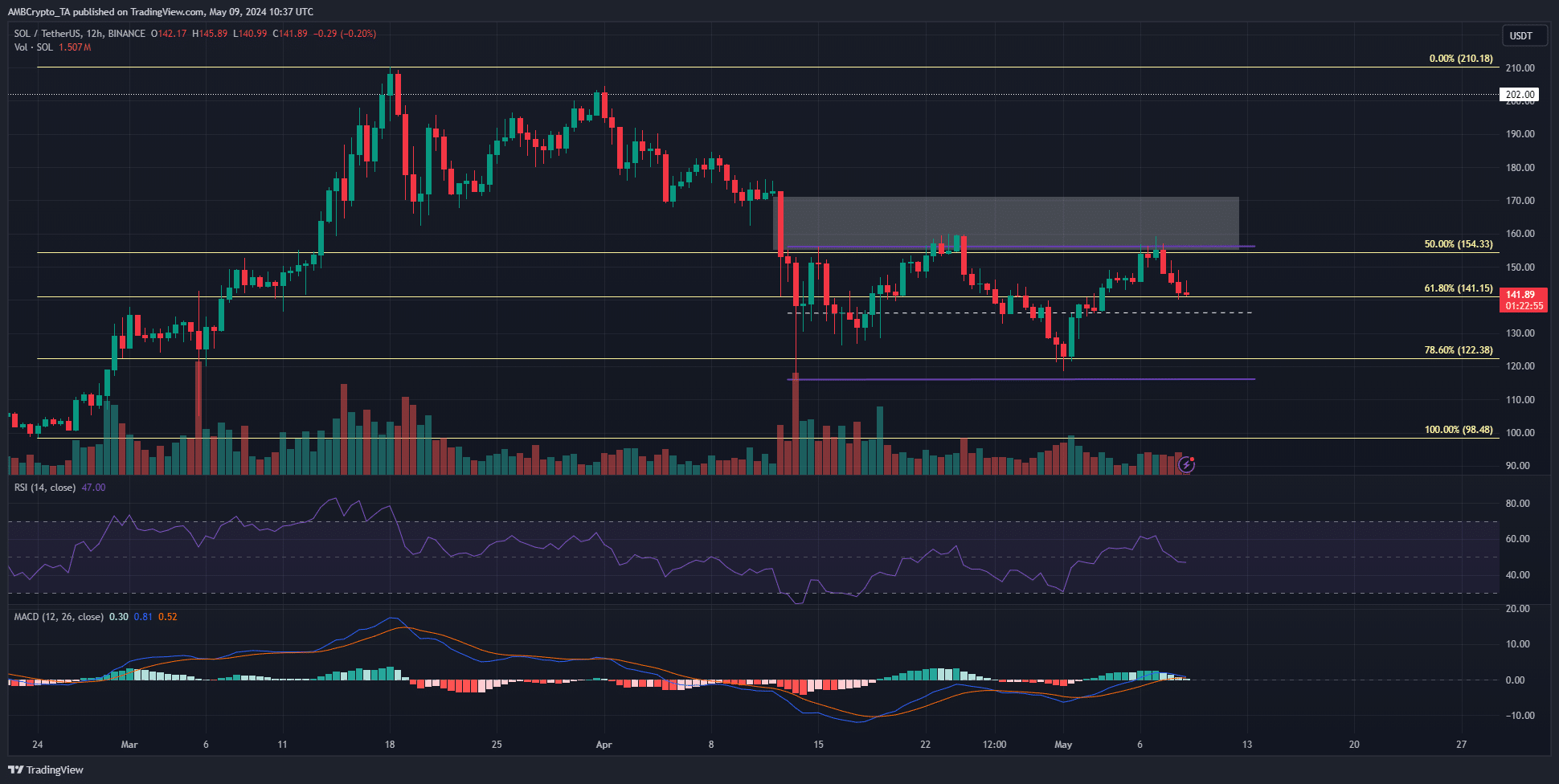

- The rejection at $160 underlined how crucial that resistance level has been in recent weeks.

As a seasoned crypto investor with a few battle scars from past market swings, I’ve learned to read between the lines of price charts and on-chain data. Solana [SOL] has been a rollercoaster ride lately, and its latest rejection at $160 was yet another reminder of the importance of resistance levels.

Solana [SOL] was forced to retreat from the $160 resistance region again.

As a market analyst, I’d rephrase the statement as follows: Based on my analysis of the previous AMBCrypto report, it seems that Solana (SOL) may trend back within its month-long price range unless the cryptocurrency can successfully flip the $165-$170 region into a support level.

An alternate take on a recent report reveals that the amount of on-chain activity related to Solana (SOL) has been decreasing. This decline suggests less engagement and desire for SOL among users. As a result, market participants may anticipate the ongoing price stability to persist.

Will the range high rejection see the lows revisited?

The middle point of the variation in price between $116 and $156 is $136. Furthermore, the Fibonacci retracement levels at $141 and $122 may serve as potential areas of support.

The rejection on Monday the 6th of May was followed by a 10.8% drop.

As of the current moment, the $141 level served as a line of defense, but it remained uncertain whether this would be enough to keep the bears at bay throughout the rest of the week.

On the 12-hour chart, the Relative Strength Index (RSI) has dipped beneath the 50-mark, signaling a potential buildup of downward pressure.

In simpler terms, the MACD indicator indicated a build-up of bullish energy over the last few days, yet this momentum took a turn and weakened within the previous 48 hours. Currently, the MACD is neither bullish nor bearish but is showing signs of potentially becoming bearish.

At the $136 mark, which serves as a mid-level support for traders, they may encounter a small rebound. However, the trading activity has been consistently light over the past fortnight. If this trend persists, there is a strong possibility of further declines, potentially reaching the $122 price point.

Speculative activity grinds to a halt

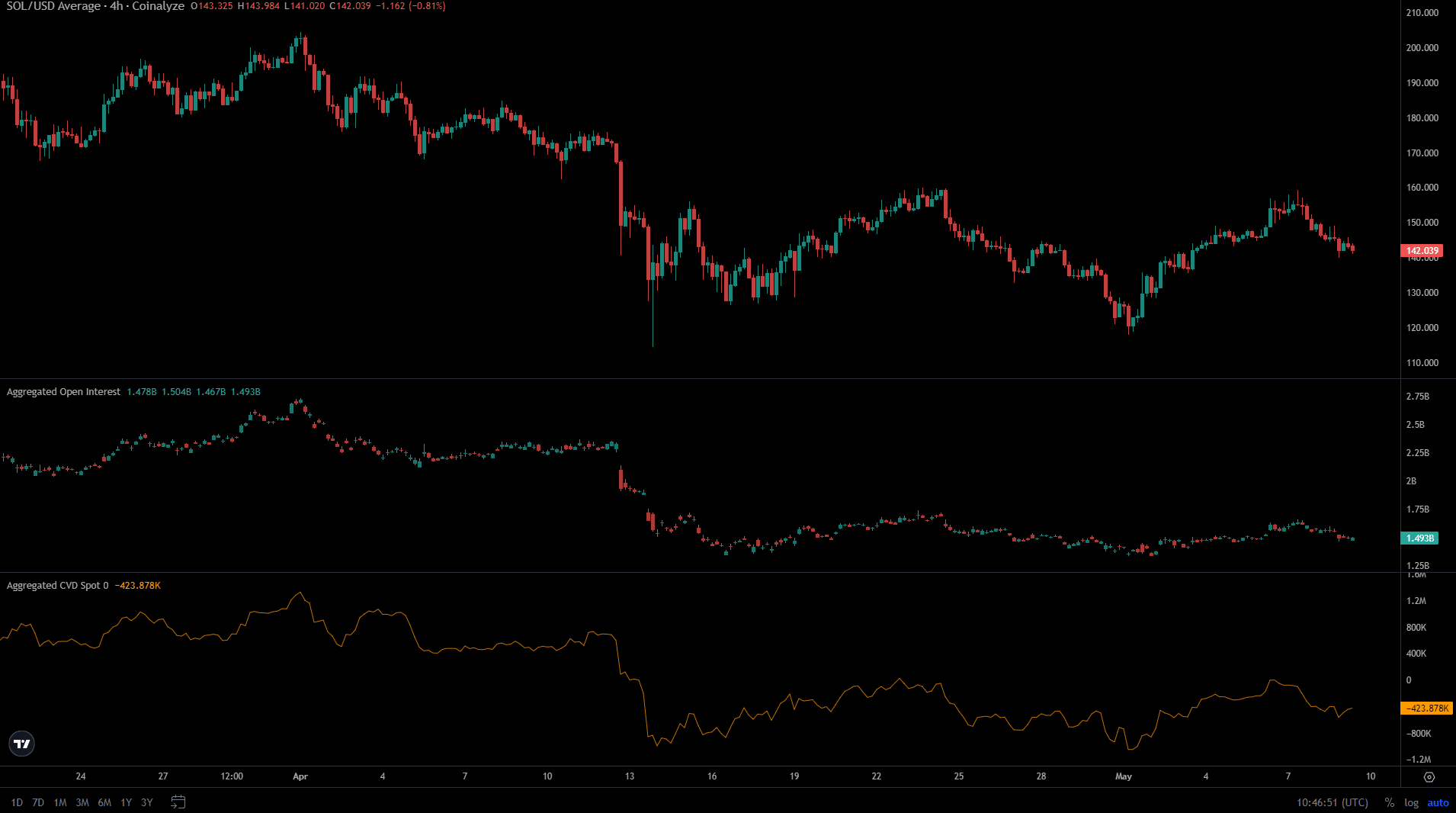

Over the past month, the cost of Solana fluctuated within a particular price band, yet its Open Interest remained fairly steady. There were small declines and recoveries that coincided with the price swings between the upper and lower limits of this range.

This indicated a lack of bullish conviction from futures market participants.

Realistic or not, here’s SOL’s market cap in BTC’s terms

As an analyst, I’d interpret the formation of a range in the spot Cardiovascular Diseases (CVD) market as a positive sign for long-term bulls. This consolidation period indicates stability and potential for future growth. Ideally, from a buyer’s perspective, we would prefer to see the trend in the spot CVD price gradually rising during this consolidation phase.

Amidst the market instability and apprehension, it’s reassuring that the CVD spot price hasn’t started decreasing yet.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

2024-05-10 04:07