- Solana has seen a positive bounce in the last few days.

- The positive capital flow signaled long-term bullish moves.

As a seasoned crypto investor with a knack for spotting promising trends, I find myself increasingly intrigued by Solana’s recent performance. After navigating through 2022’s bearish market, it’s refreshing to see SOL bouncing back with such vigor.

On December 24th, Solana (SOL) showed robust signs of recovery as its price surged and there was a steady flow of capital into it. At this time, the value of SOL hovered around $196, representing a 3.53% growth.

In my role as a researcher, I’ve noticed that despite the challenging market conditions of 2022, Solana has shown remarkable resilience, supported by positive technical indicators and strong market activity.

2025 looks optimistic for Solana as it consistently earns more than its expenses (net profits) and there’s growing trust in the market regarding its prospects.

Solana price action: Rebound from key support levels

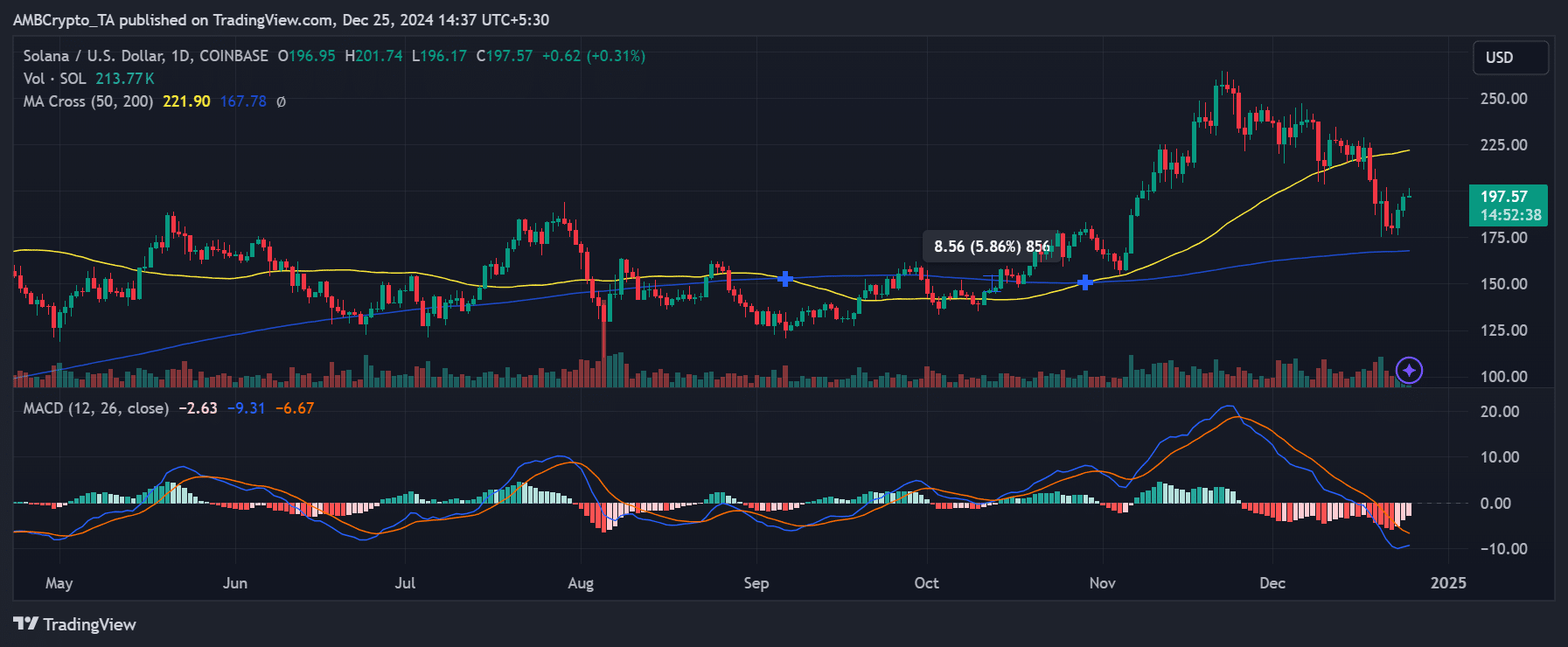

Recently, Solana’s price trend has signaled a recovery after touching important resistance at around $175, following a steep drop in its value earlier in December.

At the current moment, the rise in prices was supported by the 50-day moving average that stayed higher than the 200-day moving average, providing reinforcement.

This positive signal from this indicator suggests a possible long-term increase in market value, which aligns with the ongoing recovery trend that has been noticeable since September 2023.

Even though the market appears optimistic, it’s important to exercise caution given the warnings from the Moving Average Convergence Divergence (MACD) signal.

In simpler terms, the MACD line dropping beneath the signal line hints at a temporary downtrend (bearish momentum). But, as the MACD histogram starts to level off, it’s possible that the selling pressure could decrease.

Keep an eye on the MACD indicator as it might flip upwards, suggesting that the ongoing price surge may persist.

The trading activity has stayed high, noticeably spiking during the latest drops, indicating that many investors are actively involved in the market.

It seems like these sudden increases in volume suggest that both individual retail investors and large institutional ones have been buying up Solana (SOL), despite the temporary fluctuations in its price.

A steady stream of capital

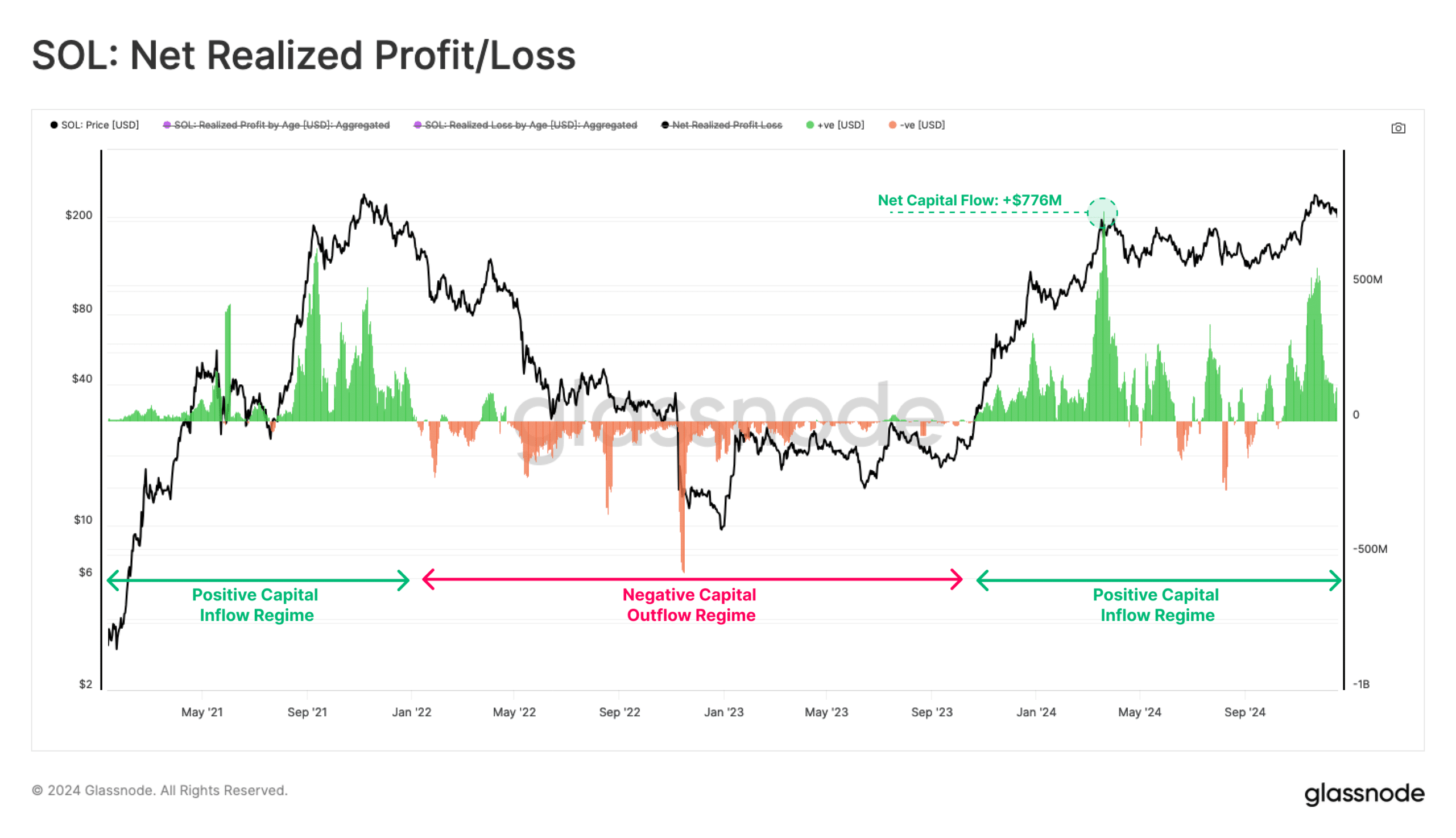

As an analyst, I’ve noticed that Solana’s price recovery is significantly bolstered by its persistent positive net realized profit or loss, a point emphasized by Glassnode’s analysis.

As a researcher, from September 2023 onward, I’ve observed that Solana consistently attracts substantial investments. Remarkably, the gains realized have consistently surpassed the losses incurred.

The consistent influx of liquidity, which has been beneficial, has served as the bedrock for Solana’s price growth, propelling its worth from under $20 at the beginning of 2023 to around $200 at present.

The graph demonstrates a maximum daily influx of approximately $776 million, emphasizing the immense amount of liquidity being poured into the system. This significant inflow underscores increasing trust from investors.

Moving from a long period (2022-August 2023) where money was flowing out, to the present situation with money coming in, has been crucial in turning around the negative market feelings and establishing conditions for continued expansion.

During this timeframe, occasional sell-offs might be due to regular profit-making, but the majority of investments point towards a robust optimism among investors, suggesting a strong bullish trend.

The inflow of capital has not just maintained price consistency, but it’s also given Solana the ability to bounce back stronger after market declines compared to other investments.

Key insights for Solana investors

The blend of increasing investments and optimistic market trends suggests a hopeful path for Solana’s development.

The “golden cross” and steady net realized profits signal a strong foundation for growth, while the MACD highlights short-term challenges.

As a researcher, I am keenly observing Solana’s performance and its potential to uphold its present inflow rate is pivotal for me. This persistence becomes particularly important as Solana nears substantial resistance around the $225 mark.

The flow of money into the capital indicates a growing acceptance of the Solana system, mainly due to its fast pace, high scalability, and affordability.

Read Solana’s [SOL] Price Prediction 2024-25

As an analyst, I’m observing a growing involvement from both institutional and retail investors, which is significantly bolstering Solana’s market standing.

If the price surpasses $225, it may trigger additional upward momentum since significant resistance levels are at play. Conversely, if it doesn’t manage to break through, there could be a temporary period of sideways movement or consolidation.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-12-26 08:08