- Solana’s vote transactions make up 85% of activity, raising concerns over validator costs and network decentralization.

- Failed transactions cost users thousands in fees, while larger validators benefit from Solana’s voting system.

As a seasoned crypto investor who has witnessed the rise and fall of numerous blockchain projects, I find Solana’s current state both intriguing and concerning. Coming from a background in Cardano development and decentralized exchanges, I can appreciate Dave’s analysis on Solana’s transaction distribution.

Recent data has brought attention to Solana’s [SOL] network, particularly regarding its transaction distribution and the challenges faced by validators.

A review presented by Dave, who is passionate about Cardano‘s development and decentralized exchanges, pointed out that a significant number of vote transactions on the Solana network are disproportionately high, sparking concerns about its impartiality.

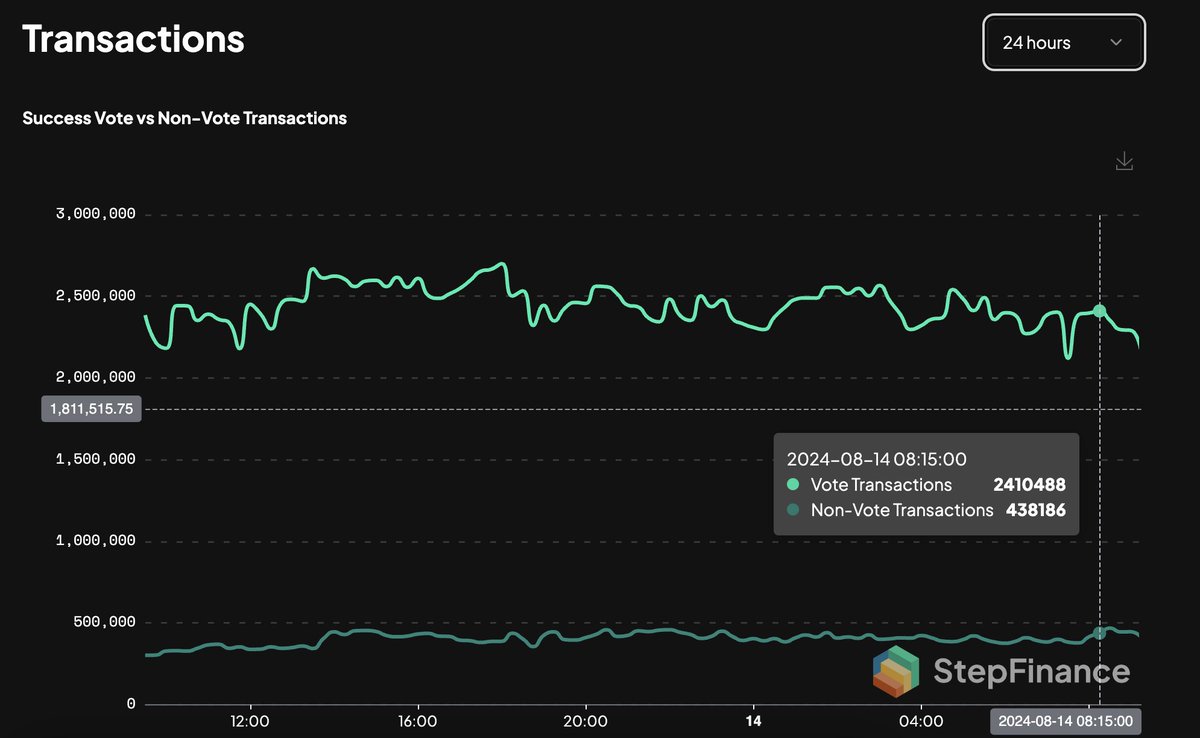

During this timeframe, around 2.4 million vote transactions on Solana were handled by Dave’s estimate, making up about 85% of the overall transaction volume.

The remaining 15%, around 438,000 transactions, were non-vote transactions.

The distribution of events led to debates concerning the genuine transaction volume on the Solana network, as some analysts expressed doubts about real user interactions compared to system-initiated transactions.

Dave highlighted that for the blockchain to work effectively, it’s crucial that vote transactions occur, yet these tend to unfairly advantage larger validator entities.

He compared this system to a “Ponzi-like” structure, where new validators are required to submit a high volume of votes, thereby generating fees that are mainly collected by more established validators.

He noted,

It’s quite intriguing how the voting structure in Solana resembles a common Ponzi scheme, as new validator participants are expected to cast their votes to join the network.

Dave further explained that,

“This dynamic contributes to the network’s long-standing super minority issue.”

He referenced the fact that only 17 validators currently control 33% of Solana’s staked assets.

“Rich get richer” phenomenon

Validators on Solana are expected to cast a large number of votes to ensure optimal performance.

As per Dave’s examination, an optimal validator should cast roughly 216,000 votes every day, amounting to about 6.48 million votes monthly.

If you calculate the cost per vote transaction as approximately 0.000005 SOL, that amounts to about 32.4 SOL in a month. At current market rates, this is roughly equivalent to $4,728.29 USD.

Smaller validators are often strained by this cost, as it favors larger validators who keep reaping transaction fees, which could lead to an even stronger hold of the network by these larger entities.

Detractors claim that this situation fosters an unequal growth pattern, where established and wealthier validators have an edge over emerging and less affluent ones, as they struggle to keep up due to steep operational expenses.

Responding to Dave’s tweet, DBCrypto pointed out that Solana categorizes multiple system-related actions, including oracle queries and compute expenses, under transaction umbrella.

This, according to DBCrypto, inflates the network’s transaction volume.

He added that when these system-generated transactions are excluded, Solana’s effective transaction throughput might be significantly lower, with estimates ranging between 20 and 40 transactions per second (TPS).

Solana’s transaction failures and user fees

A point brought up in the latest conversation centers on issues with transactions not going through successfully on the Solana network.

Over the past 24 hours, the Decentralized Exchange Aggregator, known as the Jupiter Aggregator, encountered a high failure rate of approximately 83%.

Of the 10.31 million transactions handled, about 8.56 million did not go through successfully, meaning that users had to pay fees even though their trades were unsuccessful.

It was pointed out by Dave that a total of $6,334.4 was accumulated as fees from users due to unsuccessful transactions, sparking concerns about the dependability of Solana’s network when it comes to practical, real-world uses.

The problem has sparked closer examination within the Solana community, as some suspect that bots and validators could be contributing to the elevated failure rate.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Here’s What the Dance Moms Cast Is Up to Now

2024-08-15 18:59