- Solana could drop by 11% to reach the $156 level if it falls below the $175 mark.

- Traders over-leveraged at $182.1 on the lower side and $193.2 on the upper side.

It seems that the value of Solana (SOL), currently ranked fifth among all cryptocurrencies in terms of market cap, is gradually decreasing, primarily as a result of persistent market volatility.

Whale dumps $45.7 million worth of SOL

In the midst of the current market downturn, the blockchain-monitoring platform Whale Alert shared on their account (previously Twitter) that a large crypto investor, often referred to as a ‘whale’, transferred approximately 246,064 SOL, worth around $45.76 million, to Binance.

Currently, we’re unaware of the specific whale’s crypto wallet address, which has stirred apprehension among investors regarding a possible mass sale.

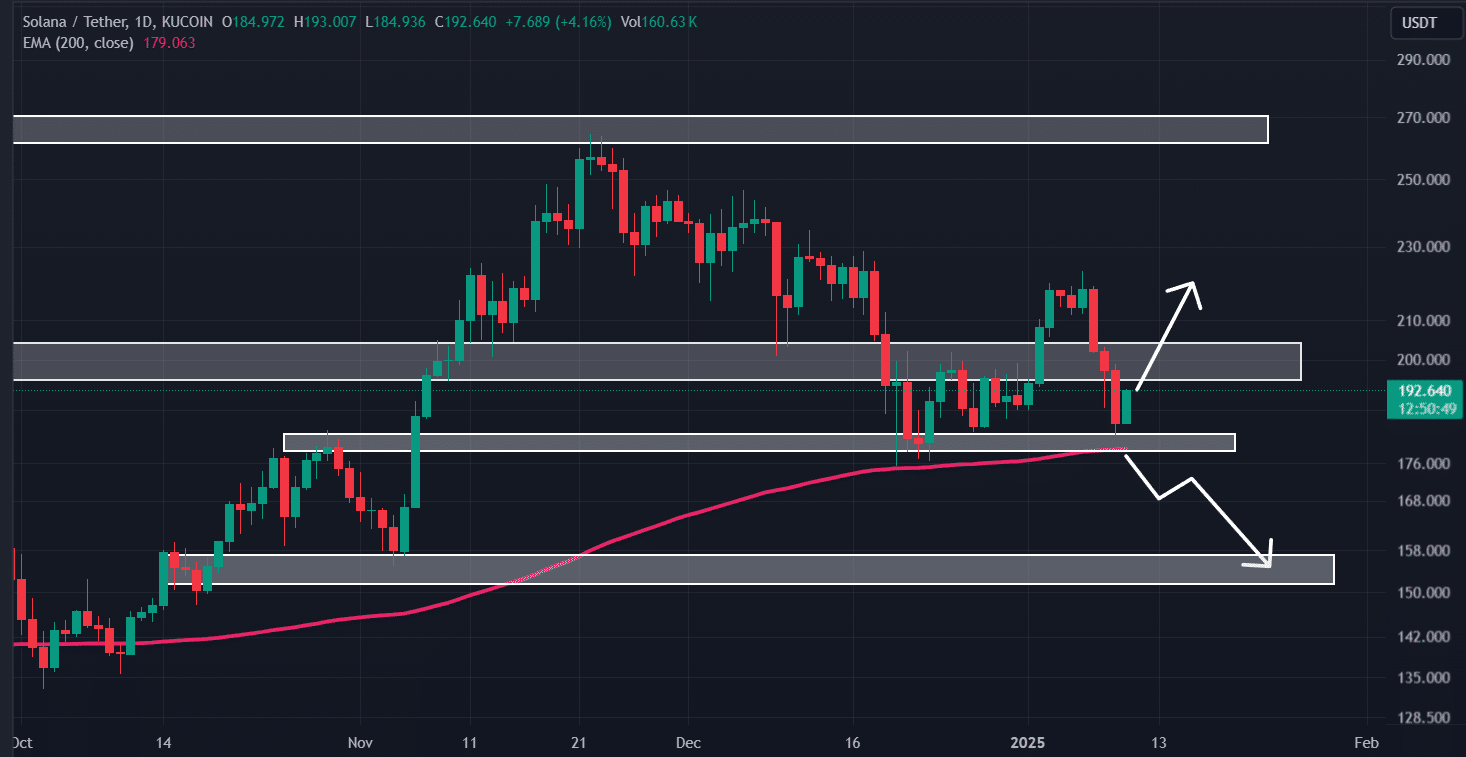

Furthermore, the substantial drop in Binance took place when Solana’s price touched an important horizontal line of support at $176 and aligned with the 200-day Exponential Moving Average (EMA).

Solana’s technical analysis and key levels

For Solana (SOL), exceeding its current critical support level could be decisive. Expert technical assessments indicate that if SOL breaks the 200 Exponential Moving Average (EMA) and ends the day below $174.5, there’s a substantial chance of a 11% price decrease following.

It could potentially reach the $156 level in the future.

Instead, if SOL maintains a position above its 200 Exponential Moving Average (EMA), it might regain bullish momentum and potentially reach the $220 level again.

On-chain metrics mixed sentiment

Examining the market mood and potential trends for SOL, it seems that investors and long-term owners are transferring their assets to exchanges, according to the data provided by Coinglass, a firm specializing in blockchain analysis.

24-hour data analysis shows a significant exit of approximately $61 million in Solana (SOL) value from crypto exchanges.

In this scenario, an increase in outflows could be interpreted as a possible warning sign for a sell-off. This surge in sell-offs may trigger more selling, which in turn might cause the price of the altcoin to drop even more.

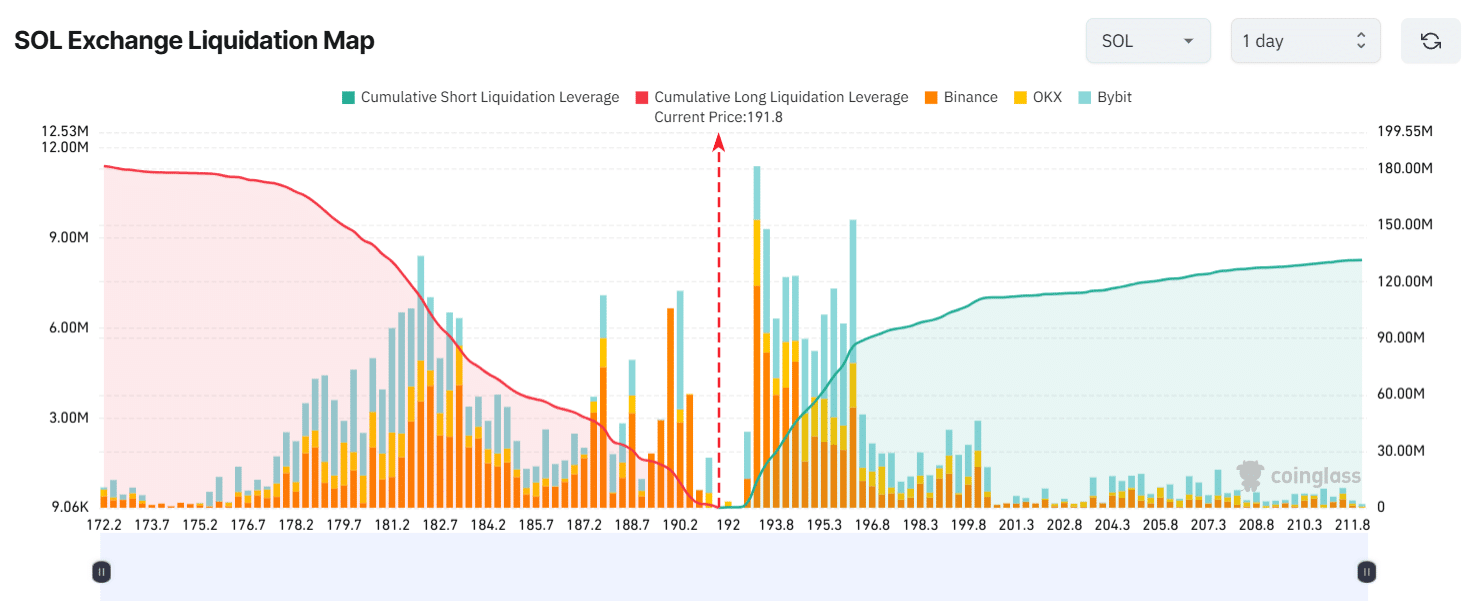

Major liquidation areas

At present, significant selling (liquidation) points stand at $182.1 on the downside and $193.2 on the upside, as suggested by Coinglass data. Traders who have heavily leveraged their positions within these ranges are active during intraday trading.

If the current market feeling stays the same and the price hits $182.1, roughly $111.61 million in long positions will need to be sold off.

If the sentiment reverses and the price increases to around $193.2, it would lead to about $14.19 million being wiped out from positions taken in a short sale.

From the analysis of these on-chain indicators, it seems that traders who have taken long positions might be more robust compared to those who have opted for short selling.

Read Solana’s [SOL] Price Prediction 2025–2026

As I analyze the current market situation, Solana (SOL) is hovering around the $192 mark at this moment. Over the last 24 hours, it has experienced a modest upward movement, with a growth of approximately 1.10%.

Meanwhile, over that timeframe, there was a 5.5% decrease in trading activity, suggesting that fewer traders and investors were involved than the preceding day.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-01-11 07:07