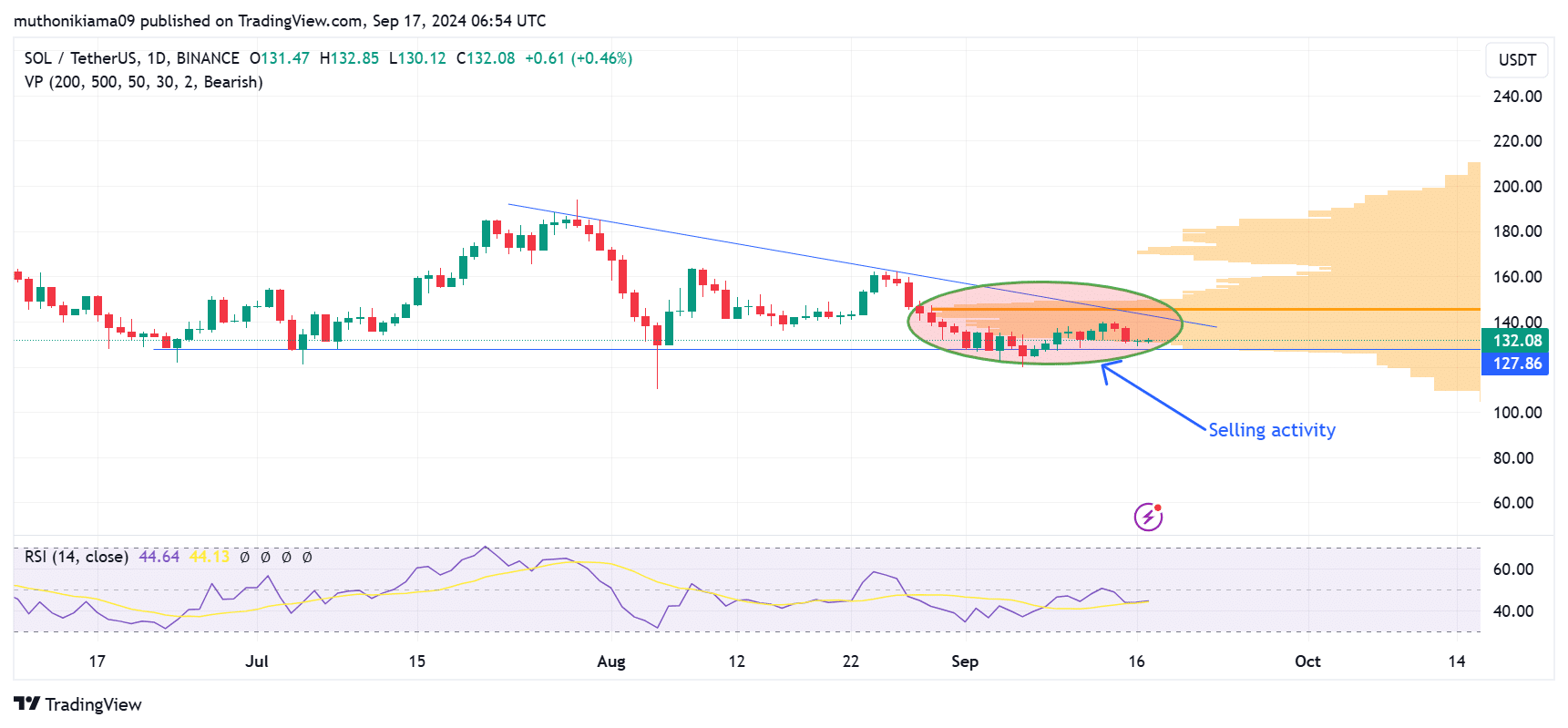

- Solana has traded within a falling wedge pattern for an extended period with the narrowing range suggesting waning selling momentum.

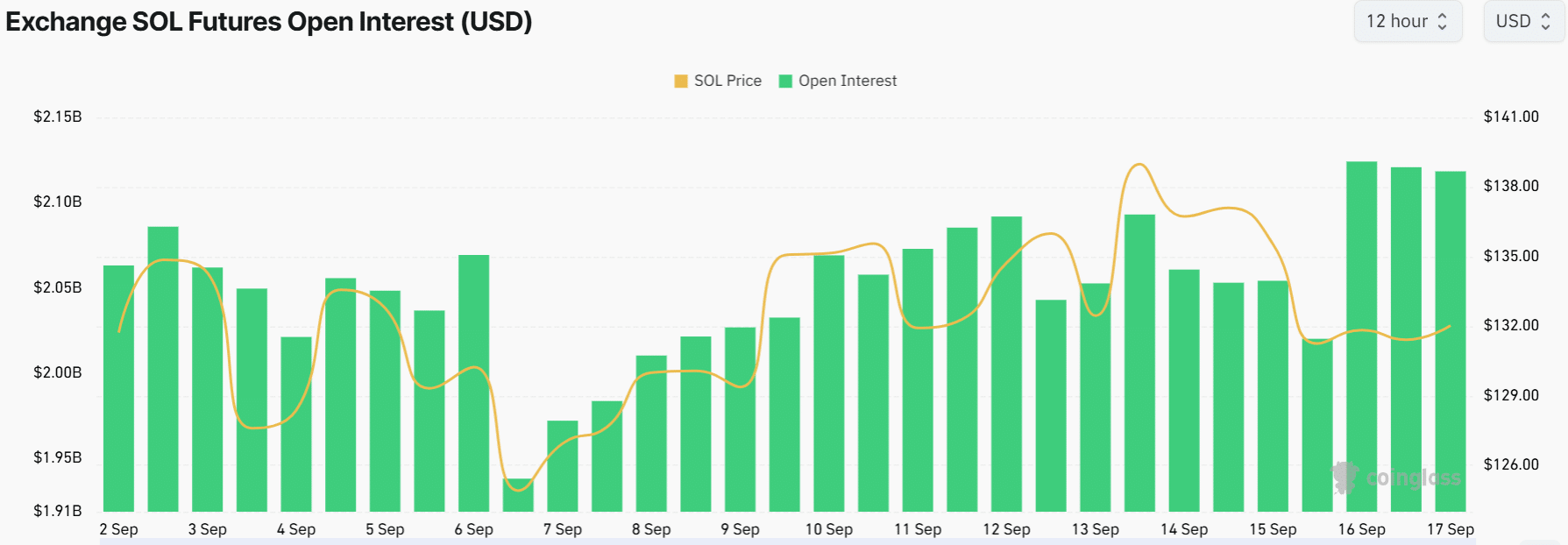

- A spike in open interest and fund flows could support a bullish breakout.

As a seasoned crypto investor with years of market observation under my belt, I find myself cautiously optimistic about Solana (SOL) at present. The extended period of trading within a falling wedge pattern suggests waning selling momentum, which is a positive sign for a potential bullish breakout. However, SOL needs to surmount the resistance at $139, a level it has repeatedly encountered due to an influx of sellers, before we can truly celebrate.

At the moment, the value of Solana (SOL) exhibited a slight fluctuation, given that trading volumes have decreased in the cryptocurrency market because of the unpredictability surrounding the effects of potential interest rate reductions later in the week.

At the point of this writing, Solana (SOL) was valued at approximately $132, marking a minor 0.5% increase. According to CoinMarketCap, trading volumes have noticeably decreased, seeing a drop of around 10% over the past day.

As a researcher observing the trading patterns of Solana, I’ve noticed it has been confined within a falling wedge for quite some time without showing signs of a bullish breakout. Interestingly, the shrinking width of this pattern indicates that the selling pressure might be subsiding. This contraction suggests that an upward breakout could be imminent.

Despite the current situation, it’s clear that for a breakout to occur with SOL, it must first surmount the resistance at $139. The reason for this is that, as indicated by the volume profile data, Solana has faced multiple rejections at this price point due to a significant number of sellers in the market.

Previously heavy sales occurred when Solana neared $139, implying that this level could be serving as a period of distribution. This suggests that traders are liquidating their positions because they’re uncertain about the continuation of the upward trend.

For a bullish breakout above the upper boundary of the descending triangle (falling wedge), it’s crucial that buying pressure resumes. At the moment, the Relative Strength Index (RSI) stands at 44, indicating there are more sellers active compared to buyers in the market.

In simpler terms, when the Relative Strength Index (RSI) line meets up with the Signal line, it’s important because this event is often seen as a confirmation of a crossover. If the RSI then moves above the Signal line, it might suggest a potential buy signal. On the flip side, if it goes below, it could signal a sell opportunity that may lead to SOL falling towards significant support at $127.

Open interest and fund flows fuel optimism

Data from Coinglass showed a gradual rise in Solana’s open interest. At press time, the open interest was at $2.12 million, the highest level this month.

An increase in open interest indicates that investors dealing with derivatives are creating and maintaining positions related to Solana. Such activity brings more funds into the asset, potentially fueling volatility and contributing to an upward price trend (bullish momentum).

Furthermore, it’s been observed that there’s growing interest among traders towards Solana investment tools, as suggested by a recent report from CoinShares.

Over the past week, investments into Solana-related products amounted to approximately $3.8 million, whereas there were outflows of around $19 million from Ethereum (ETH) products. This indicates that Solana’s investment products are experiencing greater demand compared to other alternative coins.

Read Solana’s [SOL] Price Prediction 2024-25

This increased demand may counteract the selling trend related to Solana, potentially leading to an upward trend or rally.

To add to that, it’s plausible that the surge in activity on the Solana network could contribute to a growth spurt for SOL prices. According to DappRadar, the number of Unique Active Wallets (UAWs) on Solana has skyrocketed by over 300% within just a month’s time, which indicates an uptick in blockchain usage.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

2024-09-18 03:03