-

SOL is headed for a critical support level.

If the bulls fail to defend that level, the coin’s price will fall below $115.

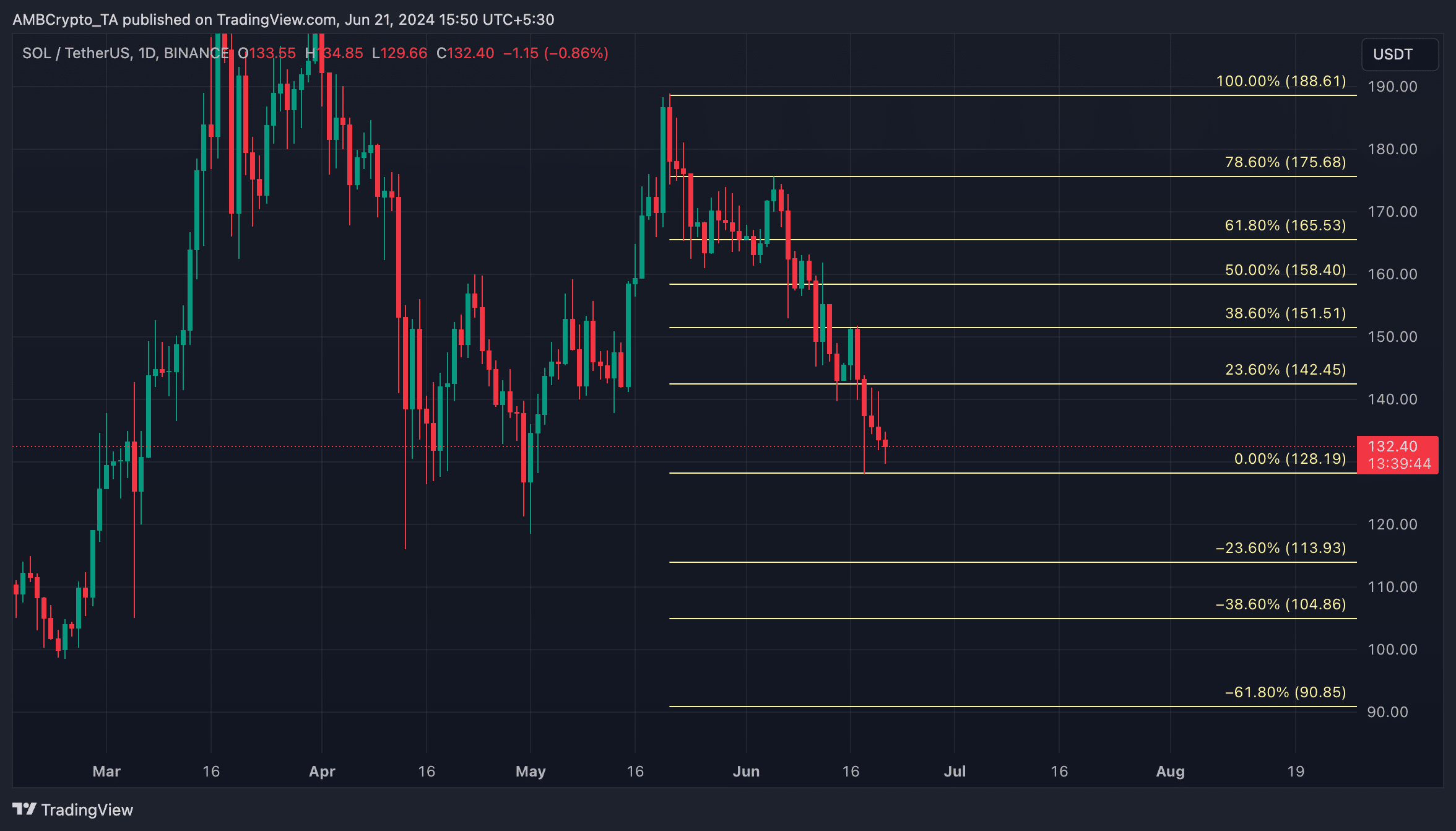

As a researcher with experience in analyzing cryptocurrency markets, I believe that Solana (SOL) is at risk of experiencing further price declines if the bulls fail to defend the critical support level around $128.49. This level has been tested multiple times in recent trading sessions, and a breakdown below it could trigger a bearish trend continuation towards the next significant support level at $113.943.

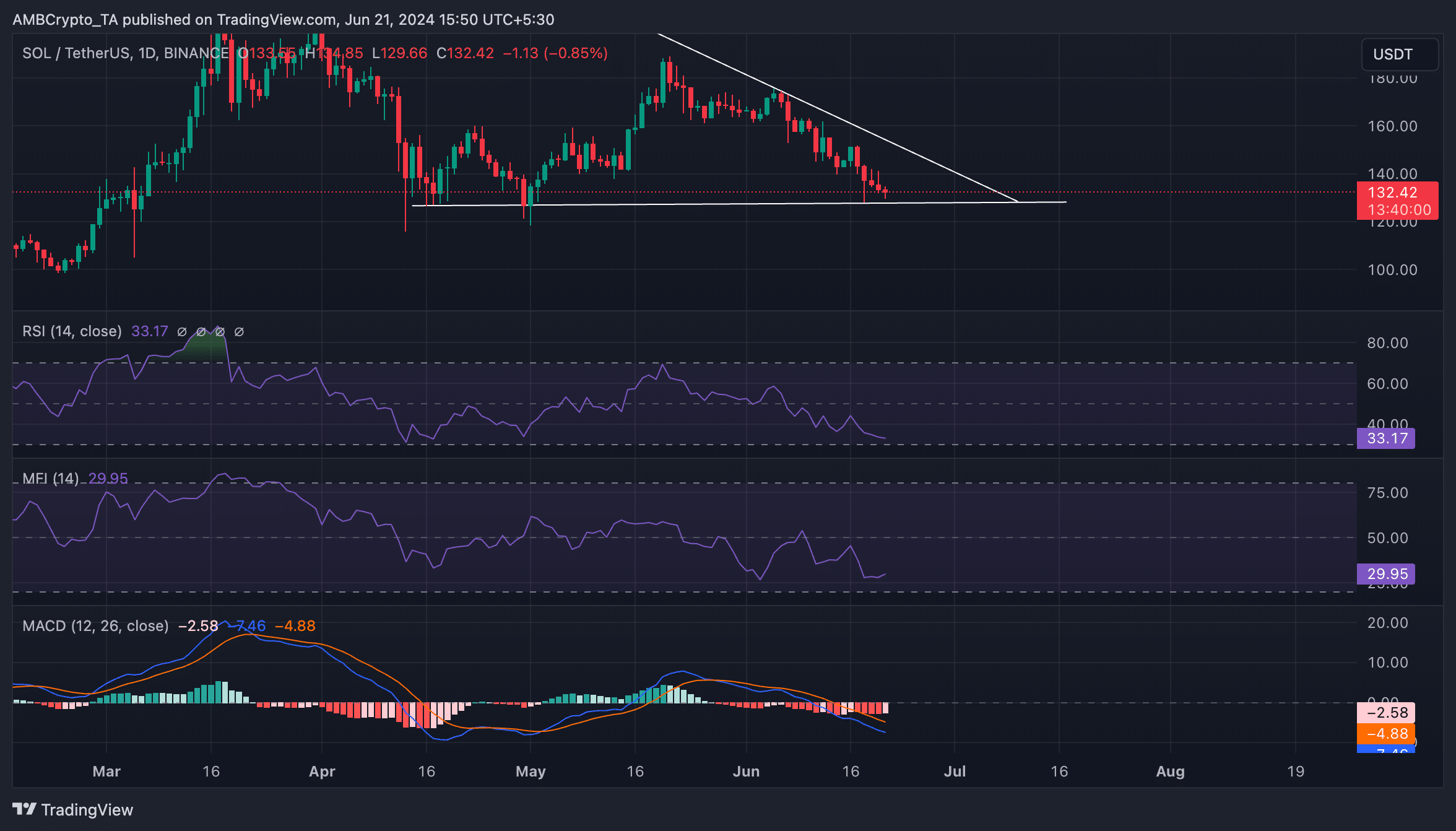

On May 20th, Solana (SOL) reached its highest point of $186.70 in the past 30 days for a closing price. Subsequently, there was a significant sell-off which resulted in a descending triangle pattern in the coin’s price chart.

I’ve noticed that at the current moment, Solana (SOL) is priced at around $132.23 based on the latest data from CoinMarketCap. Unfortunately, its value has dropped by nearly 30% over the past month.

Solana bulls have to lock in

If an asset’s price chart demonstrates a descending triangle pattern, this is a bearish indication of significant selling pressure within its market. This pattern emerges when the asset’s price repeatedly forms lower highs while rebounding from a stable horizontal support level.

The $128.49 mark has emerged as a significant support point for SOL based on recent findings from SOL’s analysis. Normally, if a descending triangle pattern takes shape and the buyers are unable to prevent a price drop when it reaches the horizontal support line, this could indicate a bearish breakout, heralding an extension of the downward trend.

It means that the sellers have overpowered the buyers, and the asset’s price will continue to fall.

As a crypto investor, I’ve been closely monitoring Solana’s market performance, and recent assessments have indicated some promising possibilities for this digital asset. For instance, its Relative Strength Index (RSI) and Money Flow Index (MFI) readings stood at 33.17 and 29.95, respectively, at the current moment in time. These low values suggest that Solana might be considered oversold based on these technical indicators. However, it’s important to remember that these readings don’t guarantee future price movements and should be used as a part of a comprehensive investment strategy.

As a crypto investor, I keep a close eye on the oscillators that help me determine an asset’s buying and selling opportunities based on its price movements. These tools measure the asset’s level of overbought or oversold conditions, ranging from 0 to 100. When the value surpasses 70, it indicates that the asset is overbought and might experience a correction. Conversely, when the value dips below 30, it suggests that the asset is oversold and could potentially bounce back.

Based on their present readings, the RSI and Money Flow Index for SOL imply that the interest in this altcoin from market players is relatively low. These indicators indicate that sellers have been more active than buyers in the SOL market.

Additionally, the MACD analysis of the Solana coin indicated that investors were more inclined towards selling, as shown by the MACD line being beneath both the signal and zero lines at present.

As a researcher studying financial markets, I’ve observed that when an asset’s Moving Average Convergence Divergence (MACD) indicator presents in a particular configuration, it is a bearish signal for me. This setup typically prompts traders to consider exiting their long positions and potentially entering short positions instead.

Should the price of Solana (SOL) drop to its support level and buyers fail to prevent it, the token could potentially slide down to a value of $113.943. Conversely, if market sentiment changes and there is increased demand for SOL, its price may surge upwards towards $142.45.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-22 05:11