-

Investors’ sentiment around SOL turned bearish in the last 24 hours.

A few metrics suggested that SOL’s price might increase in the coming days.

Based on my analysis as an experienced financial analyst, Solana’s [SOL] recent price drop has raised concerns among investors about a potential further decline. However, there are some indicators that suggest a trend reversal is possible, and SOL could reclaim the $200 mark in the coming days or weeks.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastThe price of Solana’s SOL token took a significant drop within the last 24 hours, causing concern among investors about potential further declines. Yet, there were possibilities for a turnaround in this trend. If such a reversal occurs, it may lead to SOL regaining its $200 value once more.

Solana’s latest fall

The last 24 hours were not in investors’ favor, as Solana’s value fell by more than 6%.

Based on information from CoinMarketCap, as of now, Solana’s (SOL) price stands at around $134.70. Its market capitalization exceeds $60.2 billion. The significant decrease in price has influenced Solana’s social media metrics noticeably.

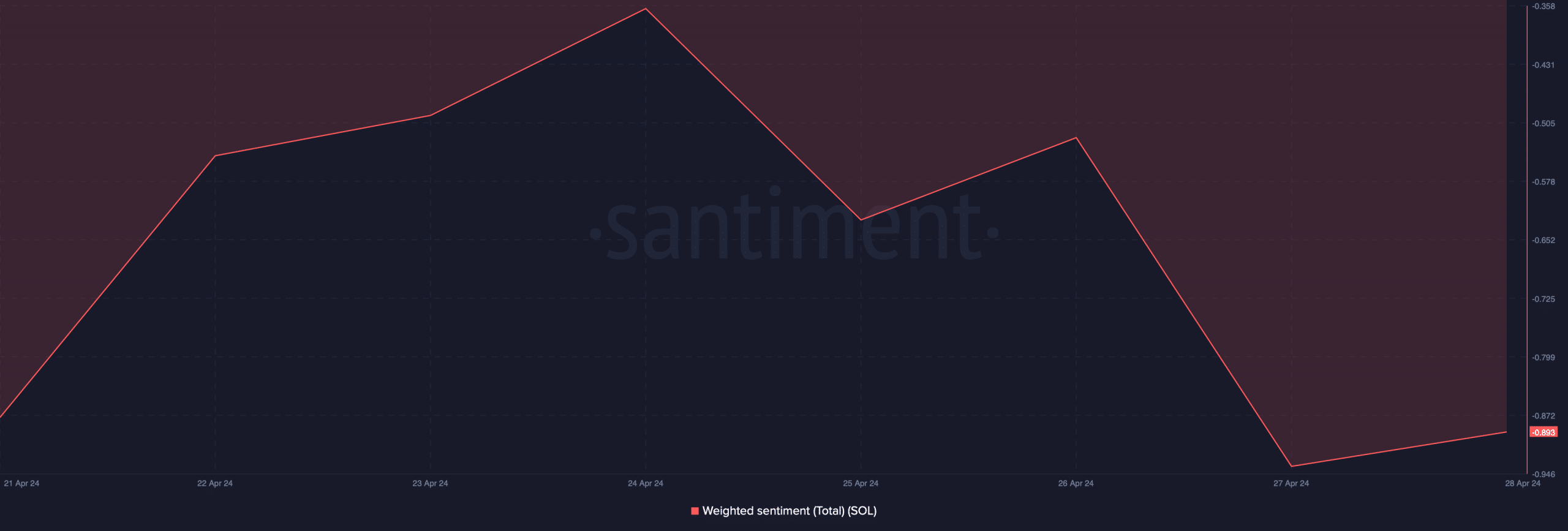

As a crypto investor, I’ve noticed a significant shift in the market sentiment towards this token. The weighted sentiment has taken a downturn, implying that negative feelings or bearishness have overpowered the positive vibes.

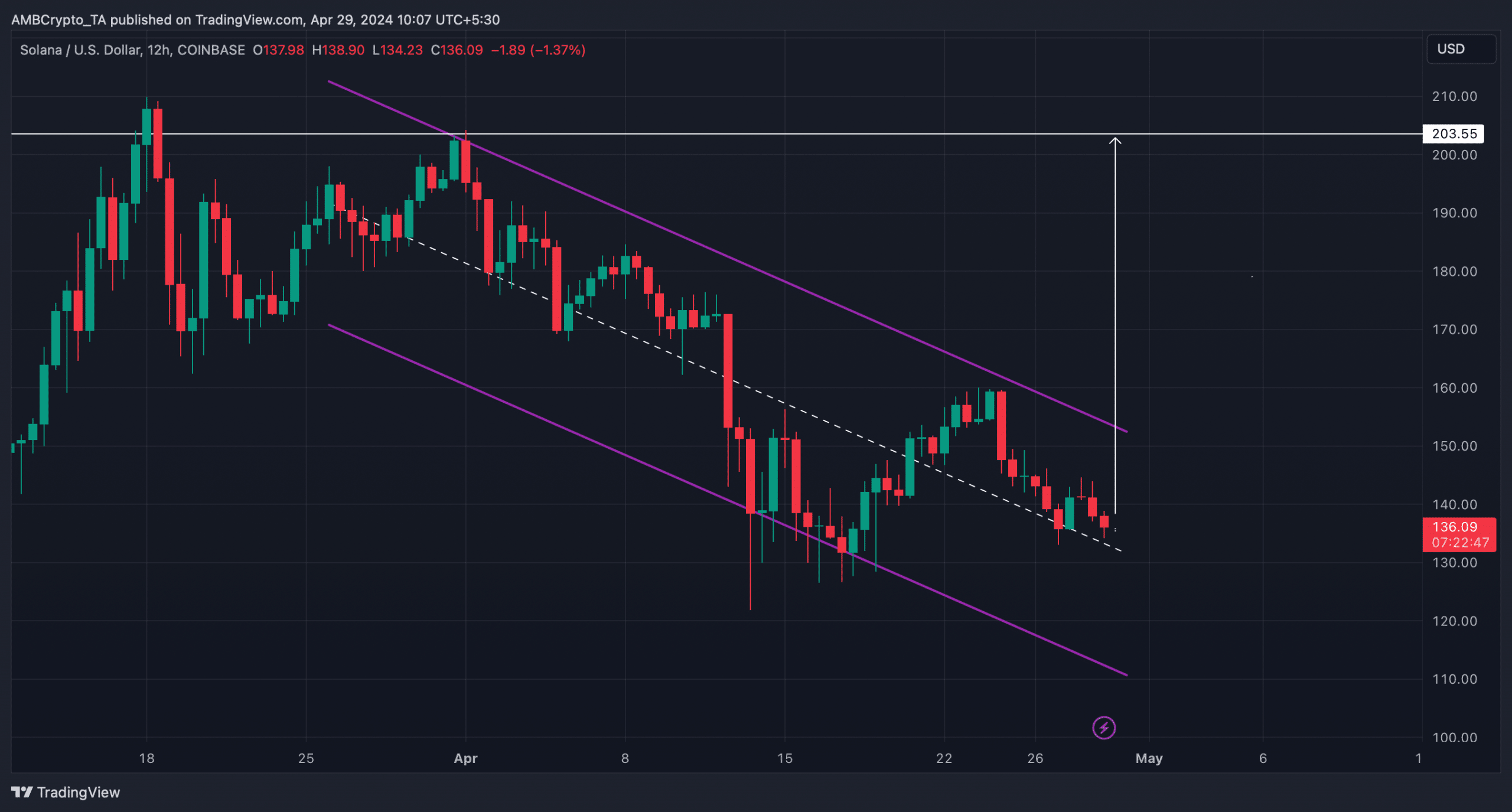

As I delved deeper into the analysis of Solana’s (SOL) price movements, I discovered that the downward trend was more complex than it initially appeared. Based on my findings from examining the 12-hour chart, SOL seemed to be following a descending channel.

As a researcher studying the cryptocurrency market, if Solana successfully validates this emerging pattern with a breakthrough, it could potentially set the stage for an uptrend in the near future. This bullish momentum might even help Solana regain its footing and surpass the $200 mark once again.

Odds of SOL touching $200

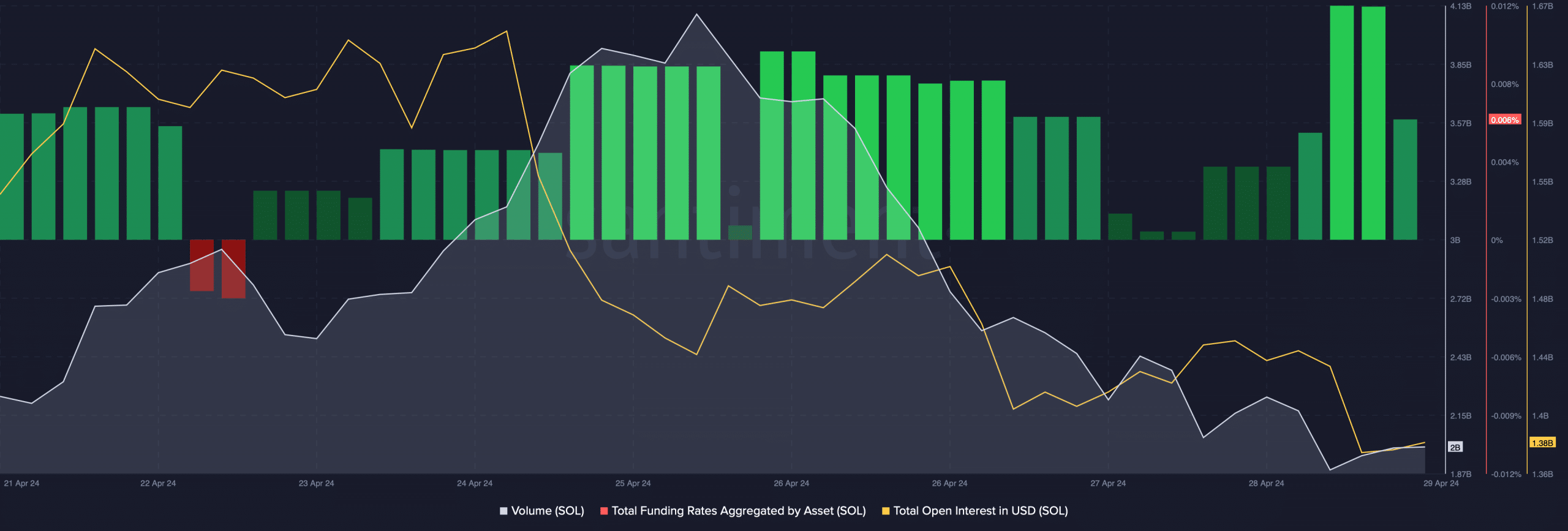

I examined Santiment’s data as an analyst at AMBCrypto to assess if Solana’s (SOL) token could disrupt its current pattern based on its on-chain data. According to my analysis, both the price and the volume of SOL experienced a significant decrease.

This suggested that the bearish price trend might not last long.

The Open Interest, like the downward trend we’ve seen, provides an indication of a potential trend reversal approaching. Yet, the Funding Rate continuing to stay elevated suggests a bearish outlook.

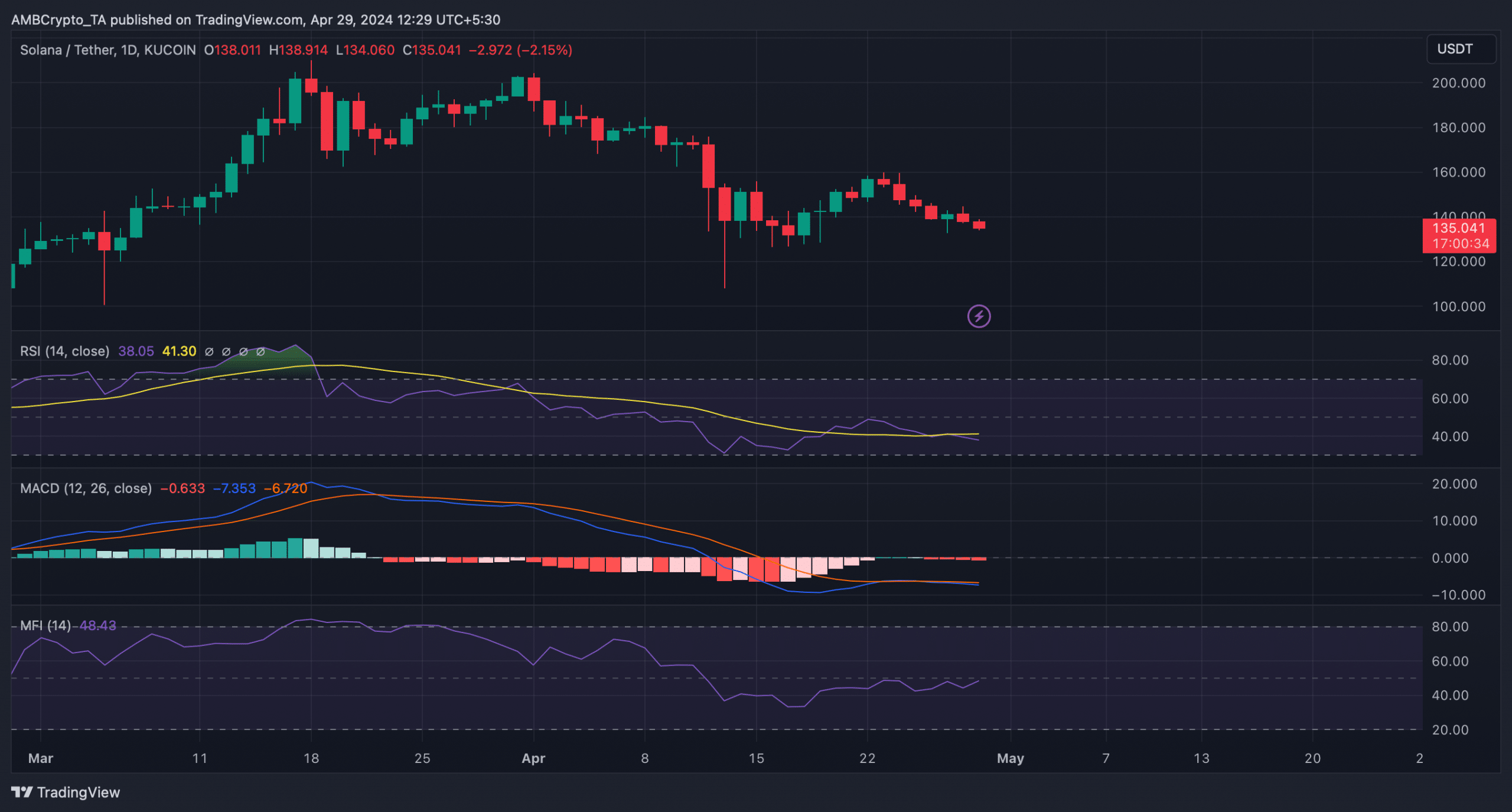

In simpler terms, the MACD technical indicator reinforced the selling position by exhibiting a bearish crossover. The RSI of SOL indicated a decrease as well, potentially suggesting further price reduction.

According to the Bollinger Band analysis, the price of SOL was situated in a less volatile region, indicating a reduced likelihood of experiencing an unexpected significant price surge.

Nonetheless, the Money Flow Index (MFI) remained bullish as it moved northward.

Despite the potential continuation of the bearish market, AMBCrypto examined Hyblock Capital’s information to identify potential resistance points for a potential bull market rally.

Read Solana’s [SOL] Price Prediction 2024-25

Based on our discovery, SOL‘s liquidation price is approximately $146. Consequently, it’s essential for SOL to surpass this threshold to maintain its bullish trend. Furthermore, the significance of $160 lies in the fact that a sharp increase in liquidation prices can be anticipated if SOL manages to breach this level.

A successful breakout above that would clear SOL’s path towards $200.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-04-29 18:15