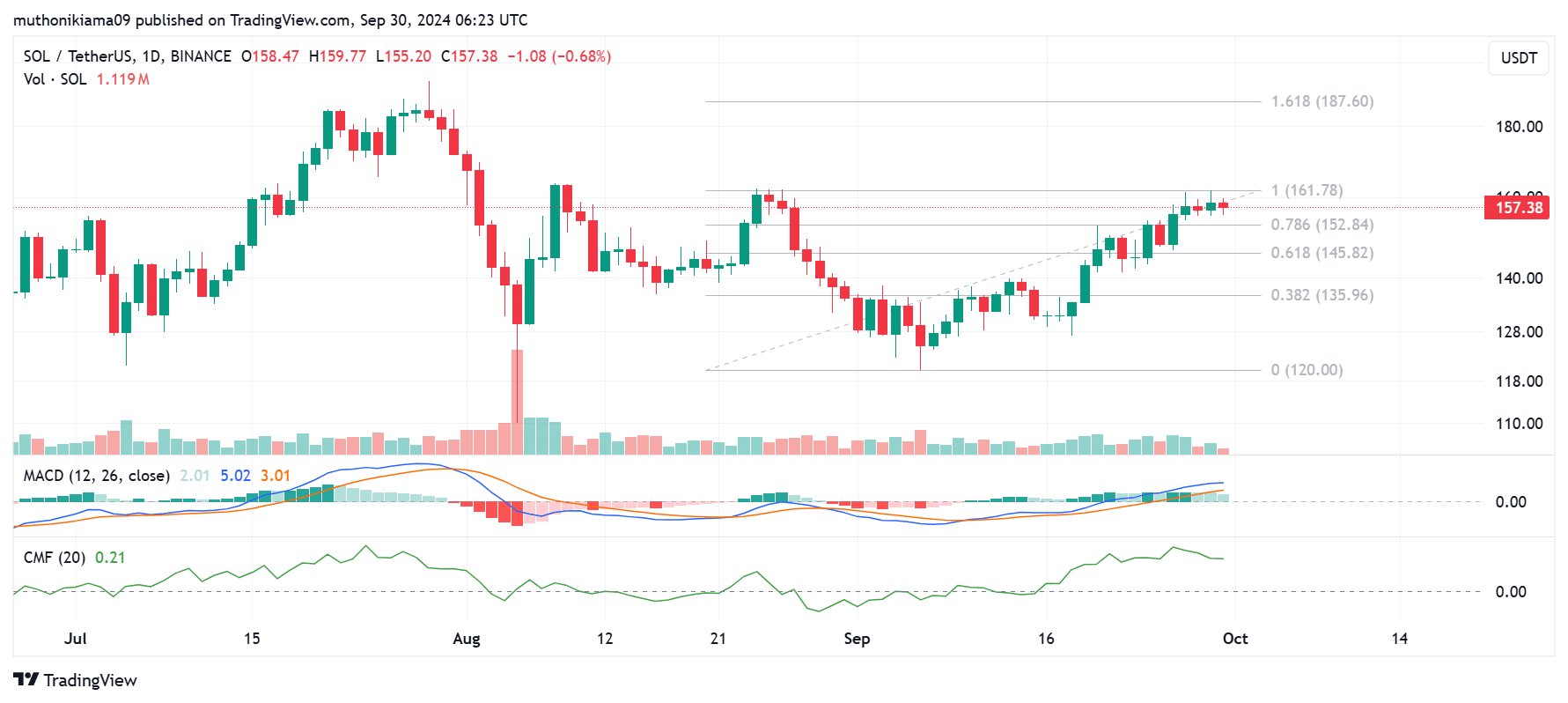

- Solana’s rally weakened after the price failed to break the $161 resistance level.

- However, the rising Open Interest and positive Funding Rates suggested overall bullish sentiment.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market of 2018, I can’t help but feel a mix of anticipation and caution when analyzing Solana [SOL]. The recent rally has been impressive, with SOL trading at $157, a 7% gain in the last seven days and 14% in the last month. However, the failure to break the $161 resistance level has me slightly worried, as it’s a pattern we’ve seen before.

At the current moment, Solana (SOL) is trading at approximately $157, marking an increase of over 7% in the last week. Notably, SOL has shown a strong rebound this month, mirroring the overall trend within the cryptocurrency market. Over the past 30 days, its value has risen by 14%.

According to data from CoinMarketCap, Solana’s trading volumes experienced a significant surge of over 45% in the past 24 hours. Yet, the red bars in the one-day chart suggest that there has been more selling activity happening within this timeframe.

Additionally, the Moving Average Convergence Divergence (MACD) signal suggested a potential downtrend, as the MACD bars became less pronounced and the MACD line levelled off.

This showed that the bullish momentum was weakening.

The Chaikin Money Flow (CMF) indicator supported the argument that the upward trend was becoming weaker, since it had started pointing downwards instead.

This showed that sellers have entered the market, with the move coinciding with SOL’s failure to overcome resistance at $161. However, the positive CMF indicator showed that buyers are still active.

As a crypto investor, I’ve noticed that if selling pressure exceeds buying activity and the Chaikin Money Flow (CMF) indicates a downward trend, Solana (SOL) might plummet to retest its support at the 0.786 Fibonacci level ($153). This level has historically demonstrated significant resistance, but it could potentially serve as a solid foundation for future growth if the market conditions improve.

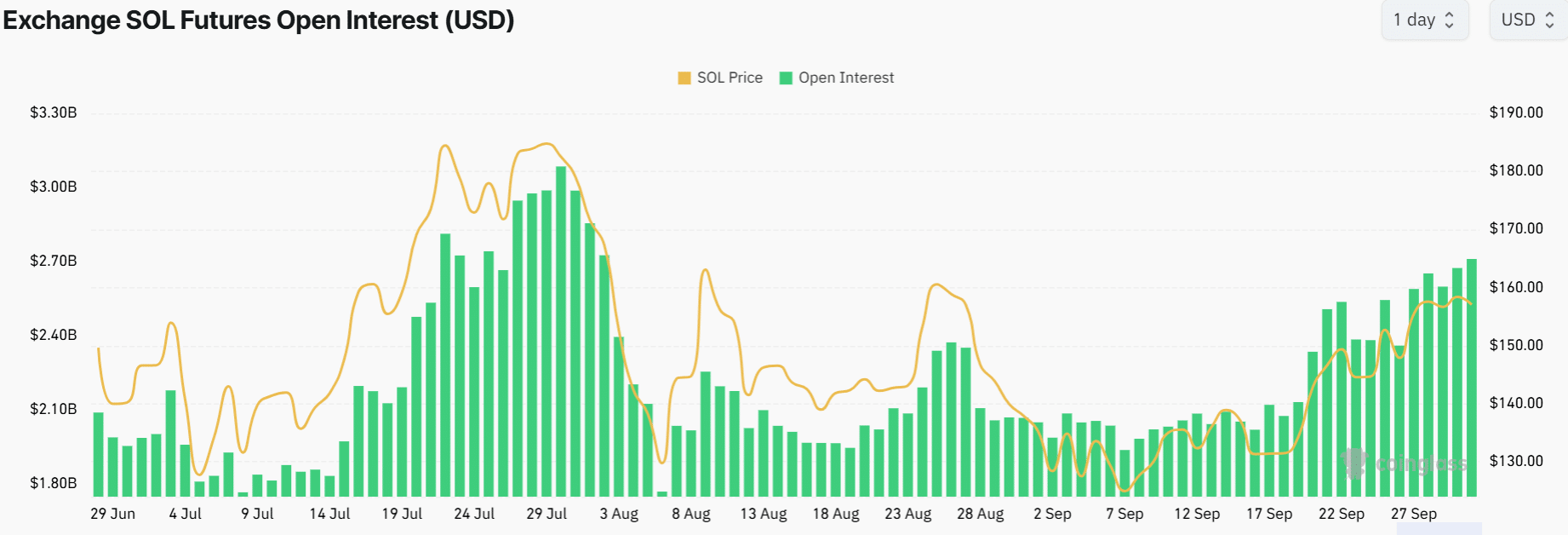

Solana Open Interest approaches high

At the current moment, data from the Futures market indicates that traders are increasing their investments in Solana. The Open Interest has reached a peak of $2.71 million, according to Coinglass.

Solana’s Open Interest was at its highest level since early August.

An increase in Open Interest indicates that traders are establishing new leveraged positions on Solana and keeping their current ones active in the market.

In addition, examining the Funding Rates, which have mainly been positive over the past two weeks, indicates that these traders probably established long positions, expecting continued price growth.

This suggests a strong bullish sentiment around Solana.

On the other hand, accumulating long positions when the price remains stable or doesn’t show substantial upward movement might indicate that the market is becoming excessively leveraged.

This could result in a sharp downtrend if these long traders choose to exit their positions.

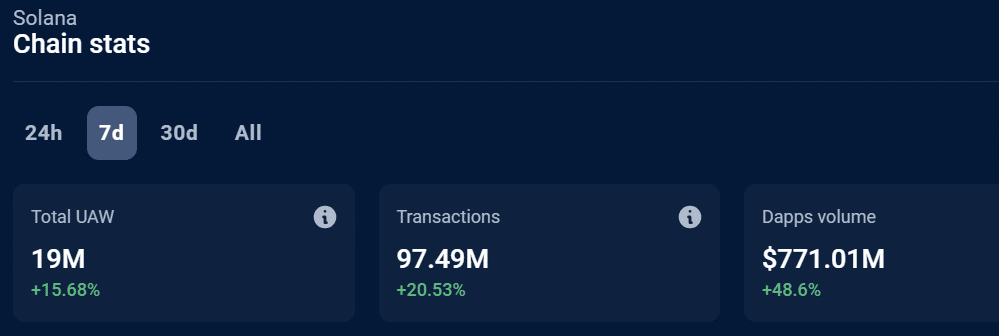

dApp volumes soar

On the Solana platform, there’s been a significant surge in user engagement. According to DappRadar, the daily average transaction volume for decentralized applications (dApps) on Solana has climbed by 48%, reaching approximately $771 million over the past week.

As I delve into my latest findings, it’s evident that decentralized application (dApp) transactions have experienced a substantial surge, rising by approximately 20%. This new peak stands at an impressive 97 million transactions. Moreover, the number of Unique Active Wallets (UAWs) has also seen a significant boost, increasing by around 15%. The new UAW count now sits at a robust 19 million.

Read Solana’s [SOL] Price Prediction 2024–2025

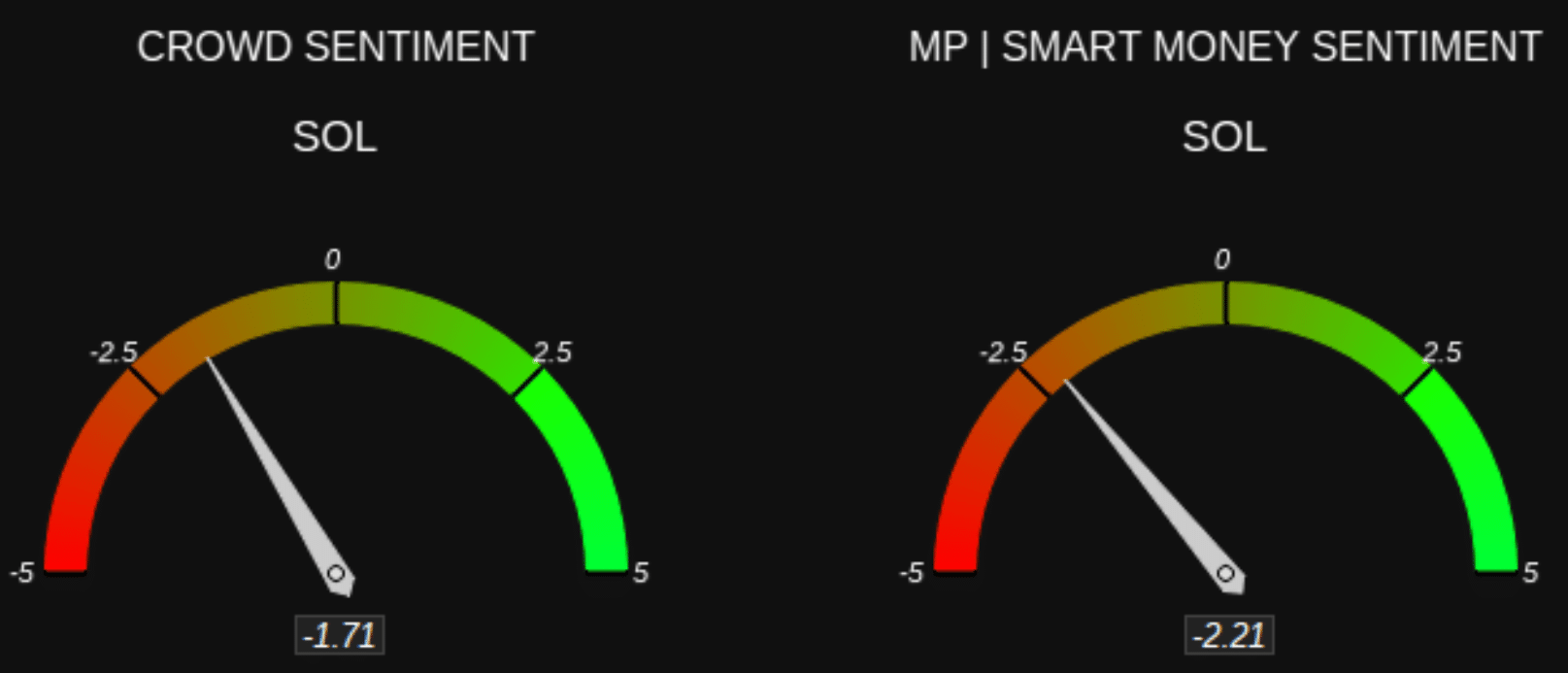

Although the increase in decentralized application (dApp) volumes is usually seen as a positive sign due to assumptions about increasing usefulness, feelings towards Solana remain negative.

According to Market Prophit’s data, both the general public and savvy investors seem pessimistic about Solana, hinting that they expect the price to continue falling.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-30 23:04