- Solana’s market cap surge, coupled with heavy liquidation activity, signals both growth and heightened volatility.

- Rising social dominance and open interest reflect strong market engagement, yet caution remains around potential reversals.

As a seasoned researcher with years of experience navigating the tumultuous crypto market, I find Solana’s current trajectory both intriguing and cautionary. The surge in its market cap to $94 billion signals a robust ecosystem and increasing investor confidence, but it also brings heightened volatility that should not be ignored.

The cryptocurrency Solana (SOL) has drawn considerable focus, boasting a substantial market capitalization of around $94.04 billion. It’s now making waves in the market. The question arises as to whether Solana can maintain its trajectory and spearhead an altcoin upsurge, or if market volatility could potentially disrupt this trend.

As more people adopt it and its ecosystem strengthens, Solana looks set for expansion. Currently priced at $199.43 per unit, it has risen by 5.66% in the latest update. Let’s delve deeper into the elements influencing Solana’s path, including liquidation rates, social influence, and general market opinion.

Is SOL set for a breakout or facing volatility?

The substantial market value of $94 billion for Solana underscores its significant standing within the cryptocurrency sector. Yet, it’s essential to recognize that this growth often brings increased price fluctuations.

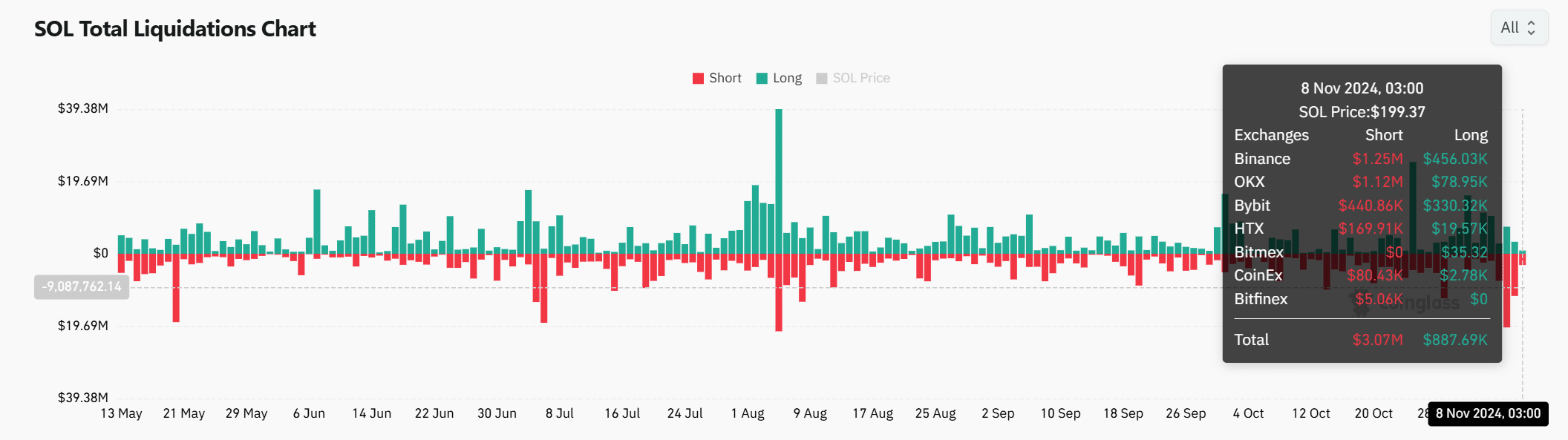

The chart for SOL Total Liquidations demonstrates a significant amount of trading happening in both short-term and long-term investments. In the most recent data, the short liquidations reached approximately $3.07 million, while long liquidations were at around $887,690.

Based on my years of trading experience, I can tell you that when the number of traders betting on a cryptocurrency like SOL is lower than usual, it often indicates a bullish outlook. However, this situation may also be accompanied by high liquidation levels, which could lead to sudden price fluctuations. This volatility is an inherent characteristic of the crypto market, something I’ve learned the hard way during my time as a trader. It’s crucial to keep a close eye on these indicators and adjust your strategy accordingly to minimize potential losses.

Consequently, although SOL’s expansion is noteworthy, investors ought to keep a watchful eye on possible market volatility.

Social dominance: Is the hype driving Sol’s price?

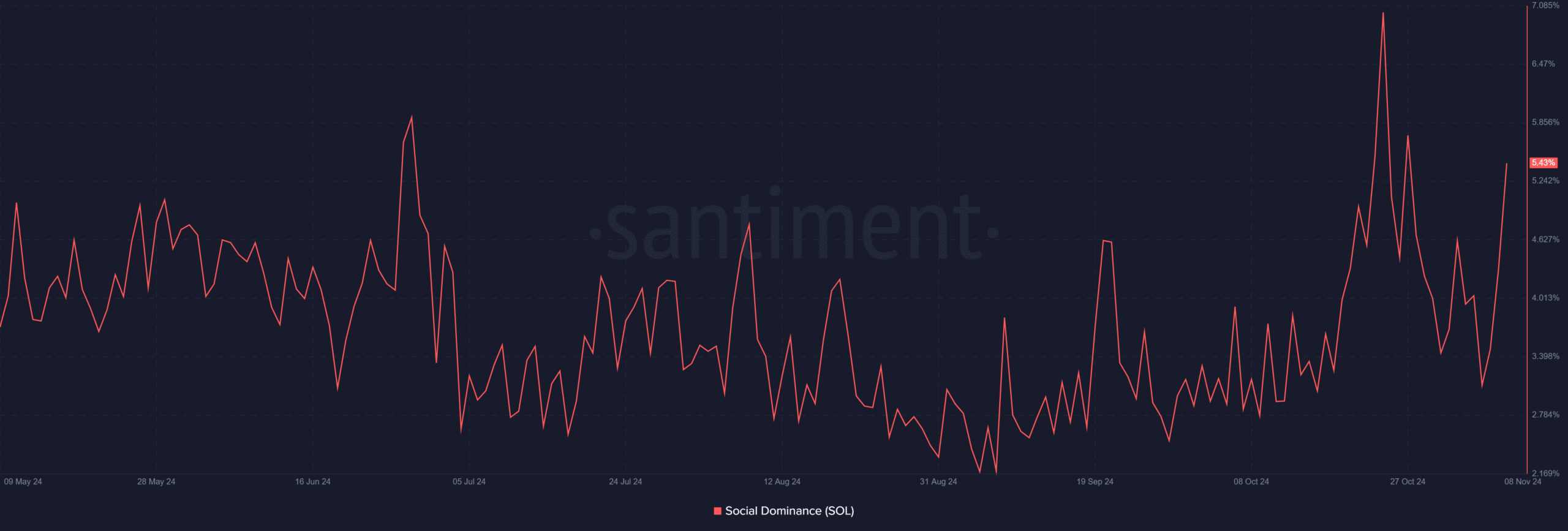

On the 8th of November, Social Dominance for Solana reached 5.43%, marking a significant surge in attention towards Solana among cryptocurrency enthusiasts, indicating a growing emphasis within the crypto community.

Historically, a rise in social dominance has frequently coincided with price increases because an enhanced presence typically draws in new purchasers.

On the other hand, growing societal attention brings potential dangers. When enthusiasm surpasses sustainable development, it often triggers temporary price surges that later correct themselves.

Consequently, although an uptick in social influence might drive up SOL’s value, investors are advised to exercise caution, as excessive speculation may distort its market movement.

Open interest: Is rising interest a bullish signal?

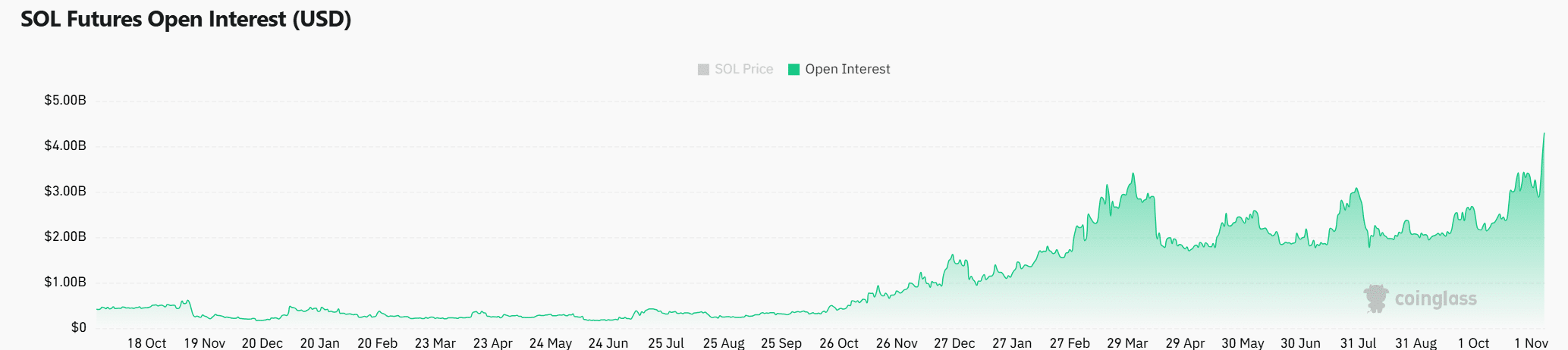

The open interest in Solana’s futures market has grown by approximately 14.24%, raising the total value to a staggering $4.38 billion. This significant expansion signifies growing optimism among investors about the potential for increased value in SOL.

Furthermore, an increase in open interest usually indicates active market participation, potentially fostering bullish trends.

As an analyst, I’ve observed that a rise in open interest can intensify price fluctuations, particularly when leveraged positions are forced to liquidate due to market stress.

Therefore, even though this signal seems positive, there’s still a high chance of quick changes, so traders ought to take these aspects into account prior to making their moves.

Read Solana’s [SOL] Price Prediction 2024–2025

Conclusion

The significant increase in Solana’s market capitalization to $94 billion and its trading price reaching $199.43 demonstrates its possible role as the front-runner in the upcoming cryptocurrency boom. Yet, the data shows conflicting signs. High liquidation levels, a spike in social influence, and increasing open interest suggest both optimistic investor feelings and potential volatility ahead.

Consequently, although Solana’s future seems bright, it might encounter market adjustments. It’s crucial for investors to remain vigilant about these fluctuations, as Solana’s subsequent actions could significantly impact wider market tendencies.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-11-08 19:04