-

POPCAT maintained a bullish market structure and the pullback has been minor.

A deeper correction is anticipated, but the selling pressure was weak at press time and such a drop could take time.

As a seasoned crypto investor with a few bear market cycles under my belt, I’ve learned that every significant gain comes with its fair share of volatility and potential corrections. POPCAT‘s impressive 482% rally from mid-April to late April was no exception.

From the 17th to the 26th of April, Popcat [POPCAT] experienced a significant increase of 482%. At the moment of reporting, its market capitalization stood at approximately $406 million.

Recent advances have drawn significant attention, leading investors to eagerly jump on board in pursuit of lucrative returns.

Based on my expertise in technical analysis, the trends and patterns indicated a bullish outlook for the market. However, there’s a possibility of a bearish shift in the short term.

After the significant rally it experienced earlier this month, the market may experience a more pronounced pullback in the upcoming weeks.

Plotting the Fibonacci retracement levels

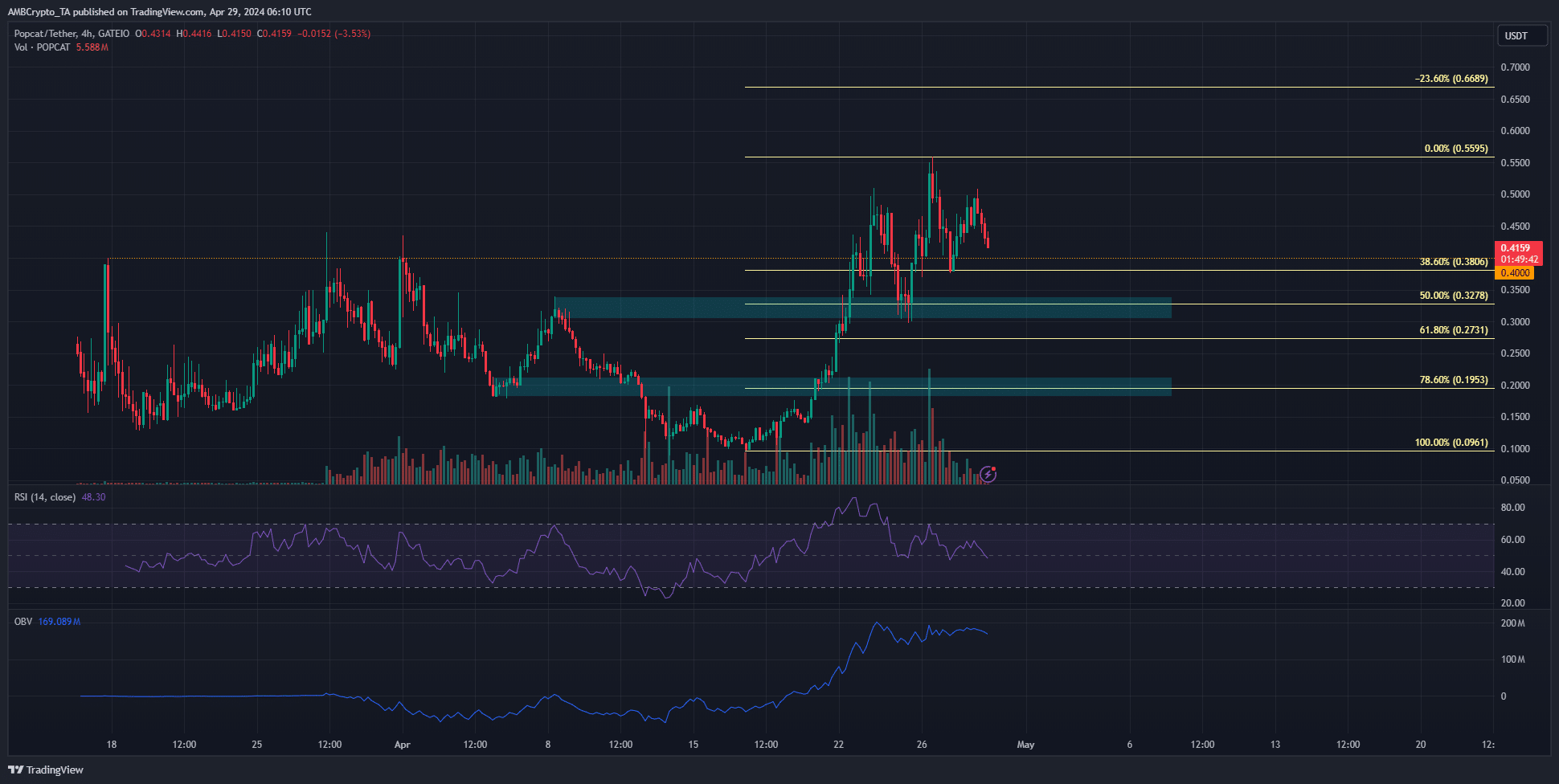

As a crypto investor, I’ve noticed a robustly bullish market structure on the 4-hour chart. The impressive rallies led to nearly 500% price surges, but took a brief pause at the $0.328 mark. This level holds significance as it was once a resistance zone that has now transformed into a support area.

Additionally, the Fibonacci retracement levels, denoted by the pale yellow lines, have highlighted the significant support zones at $0.328 and $0.195. These levels align with areas of previous price action during the current month.

On the 4-hour chart, the Relative Strength Index (RSI) stood at 48, indicating a possible move towards bearish territory. Concurrently, the On-Balance Volume (OBV) continued its upward trajectory, defying the recent price decline from $0.555.

To the north, $0.669 is also a resistance level of interest.

Sentiment was beginning to weaken again

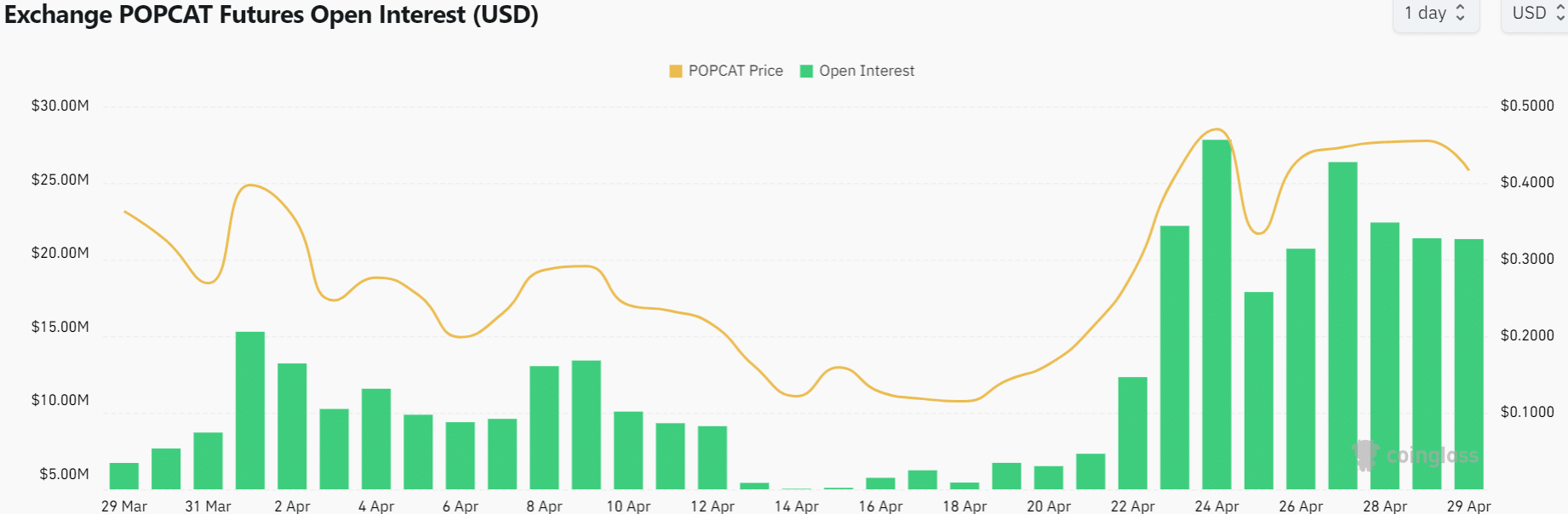

Ten days ago, the robust performance of POPCAT led to a massive influx of funds in the futures market, as investors eagerly jumped on the bandwagon. Lately, however, the price has started to retreat, giving way to growing pessimism among traders.

Realistic or not, here’s POPCAT’s market cap in BTC’s terms

The waning confidence in the short-term bullishness of the meme token was causing Open Interest to gradually decrease, and this trend is anticipated to persist.

A more substantial pullback in price near the $0.2 support level prior to another upward trend is beneficial. This pause allows the market to collect itself following recent advancements.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-04-29 16:07