-

Solana outperformed Ethereum in terms of fees paid out to validators.

Usage on the Ethereum network declined, as the price of ETH fell.

As a researcher with extensive experience in the blockchain industry, I’ve closely observed the dynamics between Solana (SOL) and Ethereum (ETH). Based on recent data, it appears that Solana has surpassed Ethereum in terms of fees paid out to validators. This is an impressive feat for a relatively new player in the smart contract platform space.

The growing appeal of the Solana [SOL] network has led to a significant influx of users, resulting in heightened network activity.

Gas is paid

As more transactions occurred on the Solana network, the compensation given to legitimate validators increased.

Ethereum’s [ETH] reign as the leading platform for smart contracts has been uncontested for some time. However, Solana’s growing appeal, particularly if it continues to offer affordable fees compared to Ethereum, may potentially erode Ethereum’s market supremacy.

This weakens Ethereum’s position as the go-to blockchain for developers and users.

The Ethereum network has been experiencing difficulties. Over the past month, there has been a noticeable decrease in the number of daily active addresses using the Ethereum network.

Based on Token Terminal’s data analysis, I found that the user base decreased by approximately 2.9 percent over the past month.

Additionally, there was a substantial decrease of 81.6% in the typical earnings brought in by the network over this timeframe.

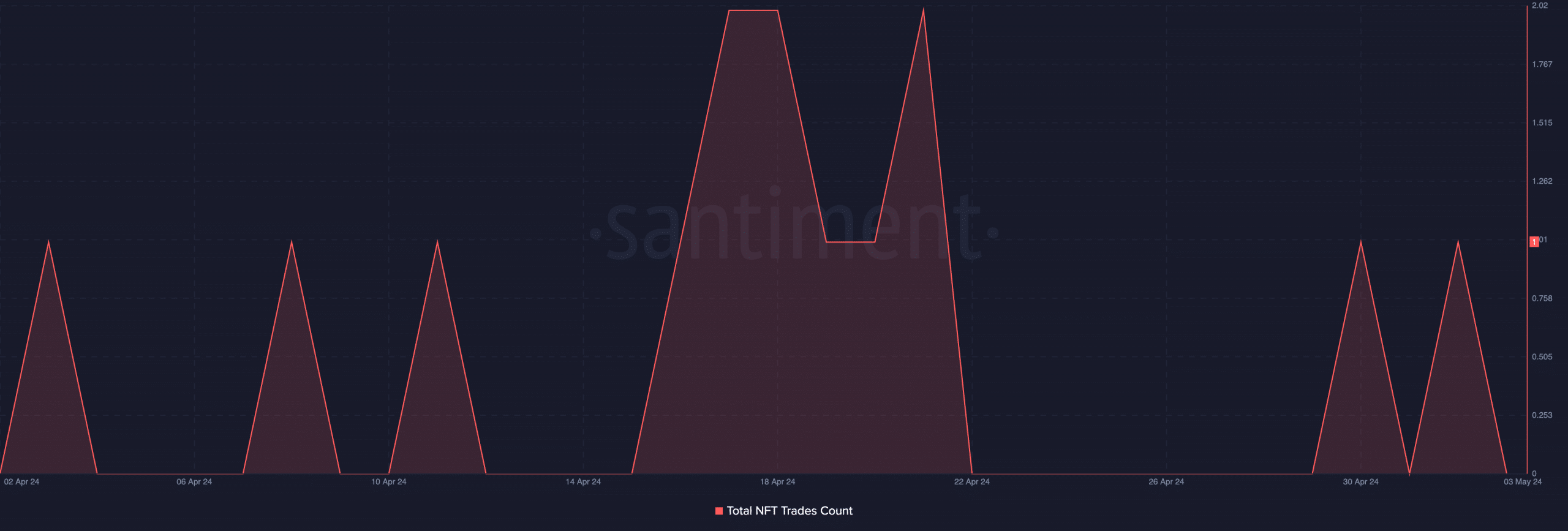

The NFT trades on the Ethereum network also declined significantly over the last month.

As a researcher studying the digital art market, I’ve noticed an increasing trend toward NFTs (Non-Fungible Tokens) being created on alternative blockchains like Bitcoin [BTC] and Solana [SOL]. The allure of these platforms is starting to draw a significant number of users away from Ethereum [ETH], potentially impacting its dominance in the NFT space.

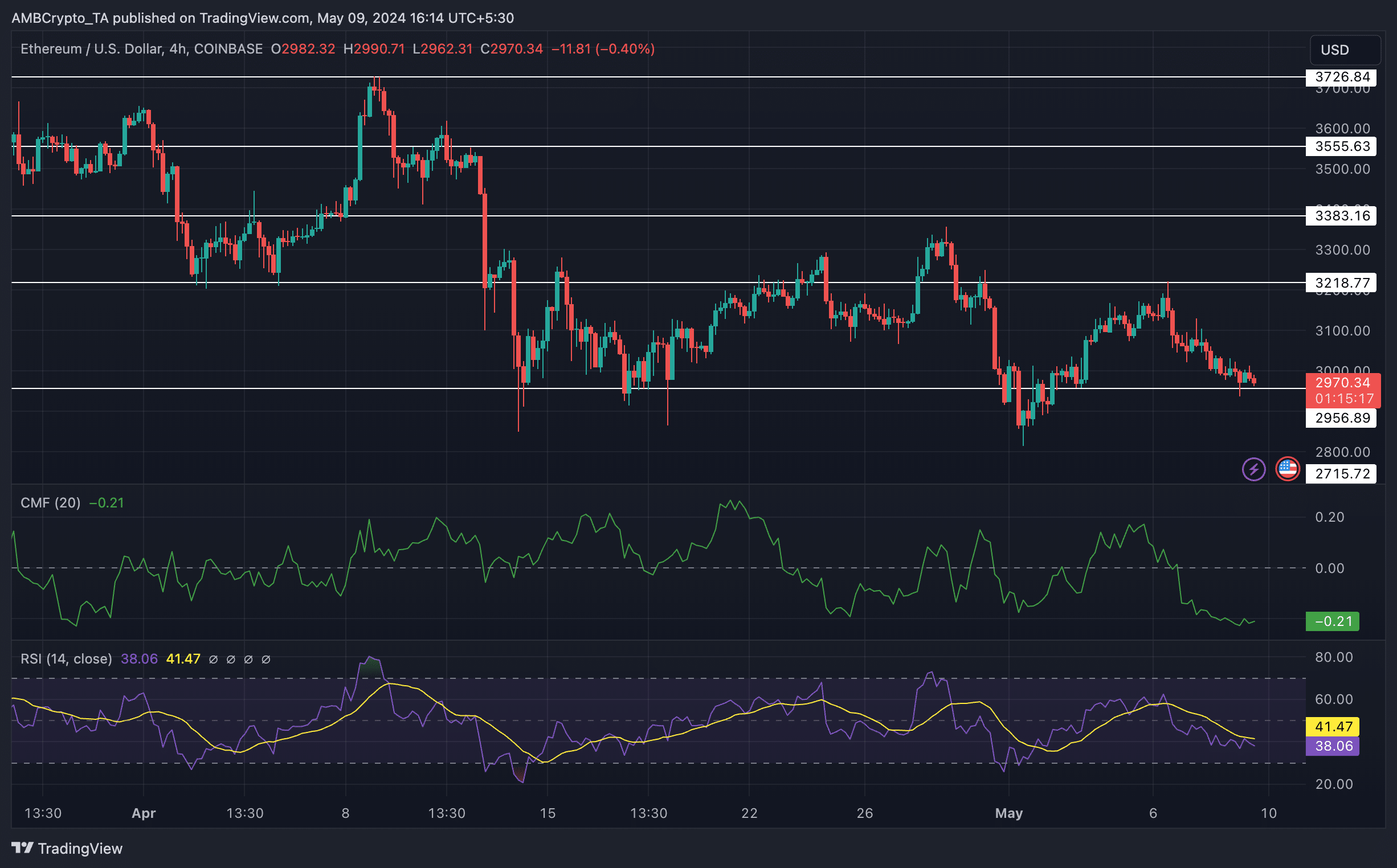

ETH’s price performance has been disappointing since the 8th of April. The cryptocurrency has shown a downward trend with several successive lower lows and lower highs on its price chart, signaling a bearish market.

As an analyst, I’ve observed a notable decrease in the Chaikin Money Flow (CMF) for Ethereum, which dropped to a value of -0.21 within this timeframe. This signifies that there has been a substantial reduction in the amount of money flowing into Ethereum over the past few days.

During this timeframe, the RSI (Relative Strength Index) for Ethereum decreased, suggesting that selling pressure, or bearish momentum, was more prominent than buying pressure, as observed at the point of making this statement.

Read Ethereum’s [ETH] Price Prediction 2024-25

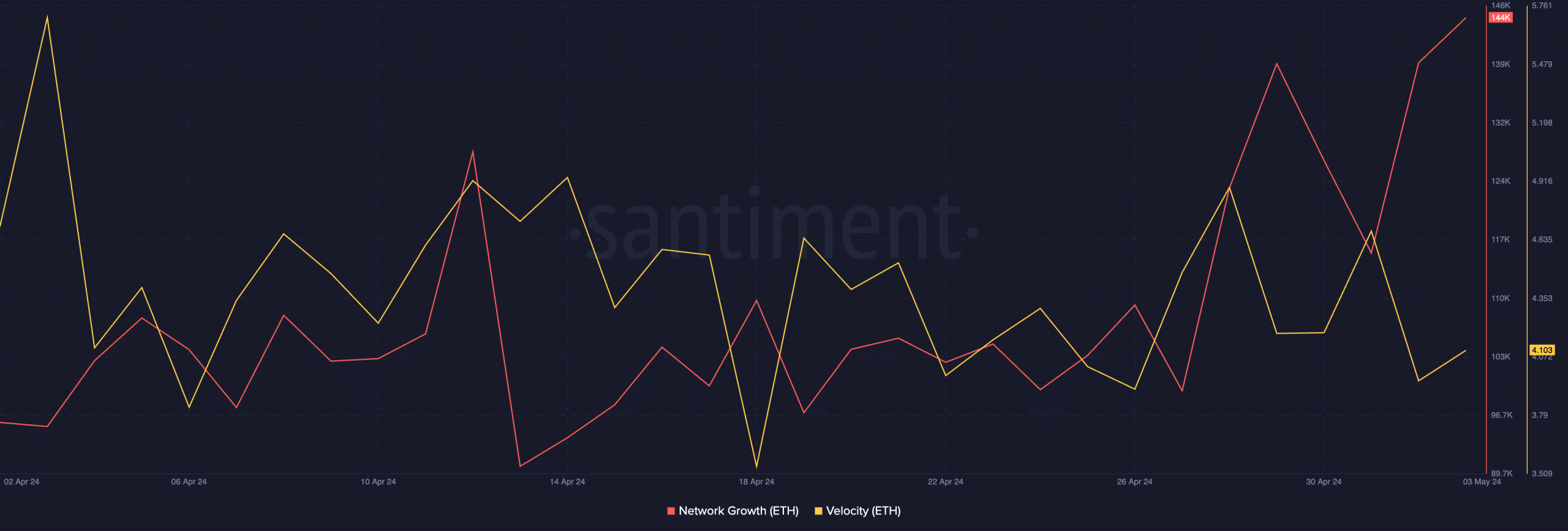

New addresses grow

At the same time, the speed of Ethereum (ETH) decreased, signaling fewer transactions. Contrastingly, Ethereum’s network expansion experienced substantial growth.

This meant that new addresses continued to show interest in the ETH token.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-10 09:43