- SOL bulls maintain dominance, pushing past resistance, leaving a trail of short liquidaitons.

- Open interest soars to levels last seen in April, underscoring strong activity in the derivatives segment.

As a seasoned analyst with over two decades of trading under my belt, I’ve seen markets rise and fall, bulls and bears come and go. The recent surge in Solana [SOL] is nothing short of impressive, especially considering the bearish sentiment that had been brewing earlier this week.

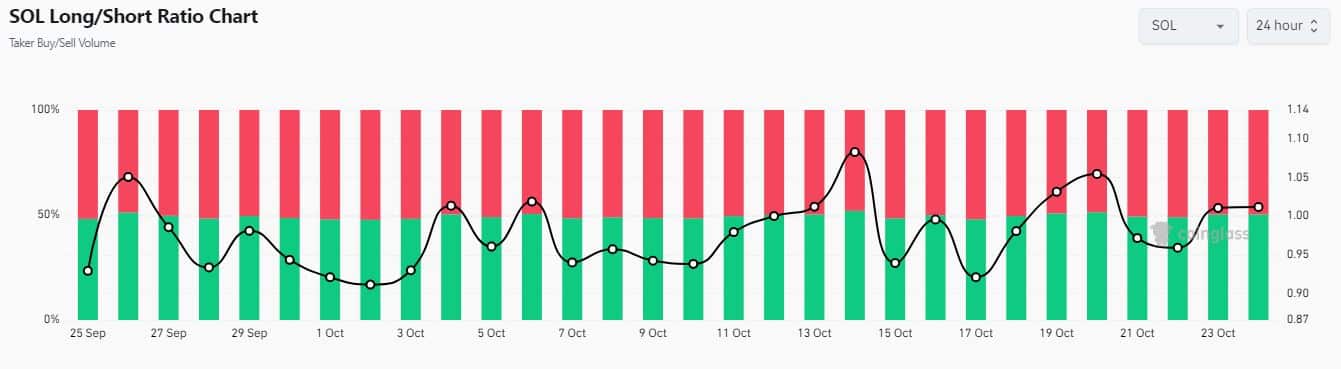

Over the past fortnight, supporters of Solana (SOL) have held sway, leading many to expect a spike in selling activity this week. Indeed, there has been an increase in short positions and subsequent liquidations, as traders foresee a potential pullback.

Over the past five days, there’s been an increase in demand to sell SOL, possibly due to investors looking to cash in on its recent gains over the previous two weeks. This increased selling activity could be indicative of growing profit-taking sentiments, which may have contributed to a rise in short positions.

In the past day, information from Coinglass showed that approximately $7 million worth of short positions were forcefully closed due to market conditions. Moreover, short positions accounted for around 64.54% of all positions during this time frame, while long positions held the remaining 35.46%.

On September 20th, SOL’s long/short ratio dropped significantly from 1.05, reaching 0.95. Since then, it has increased to 1.1 over the past 22 hours.

Since October 20th, we’ve seen a drop in the SOL long/short ratio, indicating a significant increase in the number of short positions relative to long ones. This development wasn’t unexpected, given several factors at play.

Since October 20th, many leading cryptocurrencies have yielded to selling pressure, causing a temporary decrease in their values. Moreover, Solana (SOL) recently tested a short-term resistance level approximately at the same period.

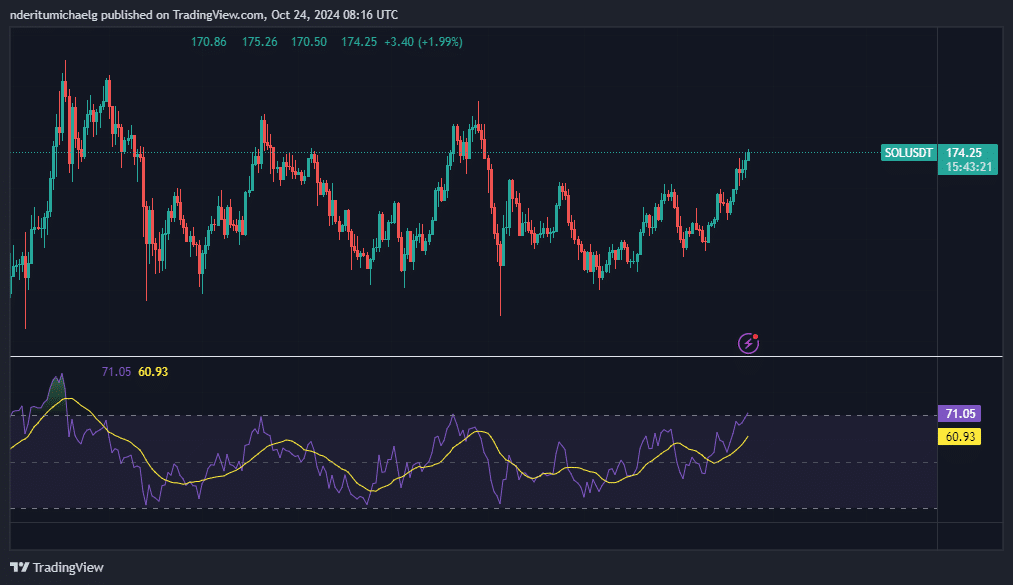

Solana aims for the next resistance zone as bulls retain dominance

As an analyst, I observed that the resistance range for the asset under examination was situated between $161 and $163. However, it defied expectations by breaking through these levels and escalating further. Notably, a significant increase in short liquidations has transpired above this resistance range.

Currently, SOL has risen to $174, as indicated by recent reports, and the Relative Strength Index (RSI) suggests it’s overbought at this moment.

In simpler terms, when a market becomes ‘overbought’, it means there’s been a lot of buying and less selling, which can indicate increased selling pressure might occur. Yet, there could be further price increases in the upcoming days. For the cryptocurrency SOL, its next potential resistance point is around $185.

The unexpected rise in the SOL price created a situation where traders who had bet on a fall were forced to buy, leading to a “squeeze” scenario. This is particularly noteworthy given the significant increase in open trades that we’ve seen this week.

Read Solana’s [SOL] Price Prediction 2024–2025

In the past day, open interest reached an impressive $3.26 billion – a figure not seen since early April.

The upward surge in SOL indicates a strong breakout trend that could motivate more traders to invest long term. Yet, it’s important to note that this momentum might signal a possible shift towards liquidation of long positions once the current short-term liquidation wave ends.

Read More

2024-10-25 04:07