-

SOL bulls prepare for another run as bears run out of steam.

Bitcoin dominance slides, paving the way for altcoin season hopes, but can SOL capitalize?

As a seasoned crypto investor with over five years of experience under my belt, I’ve seen my fair share of market volatility and trends. The recent price action of Solana [SOL] has me optimistic, especially considering its impressive performance in the past 12 months.

In the past year, Solana [SOL] has been among the leading performers among cryptocurrencies. Only a handful of other coins have managed to match its impressive returns, and even after significant market downturns, it has consistently recovered well. However, the question remains: Will this pattern repeat itself in the current scenario?

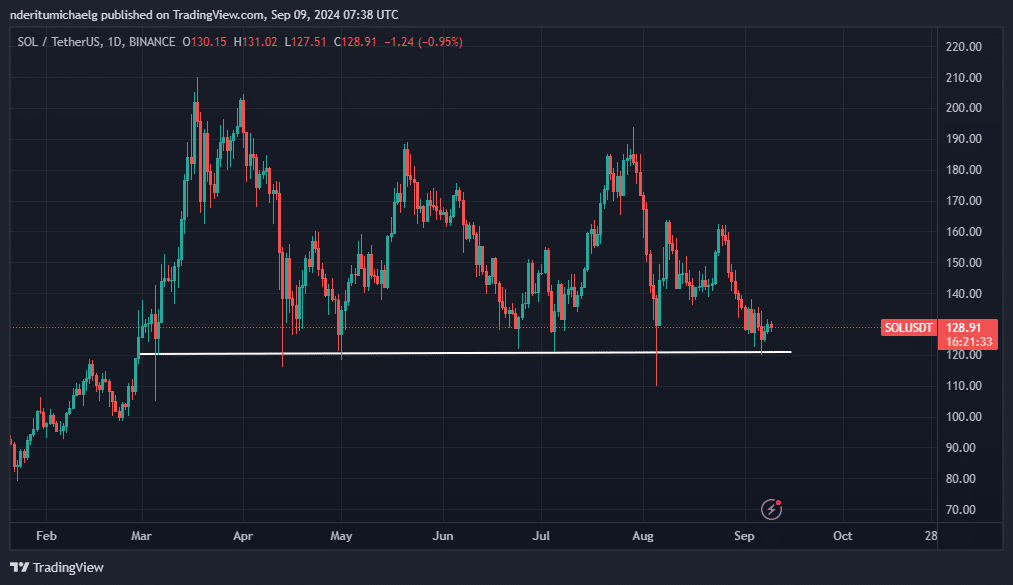

In the past week, Solana (SOL) has been leading the crypto market due to a drop in overall sentiment. This dominance has propelled SOL towards a significant price point, approximately $120, which has functioned as a reliable support level for at least the previous 6 months.

Additionally, the price of SOL has shown signs of holding steady at a particular level during the initial week of September. Notably, selling activity seems to have decreased, implying that there may be some buying or accumulation happening.

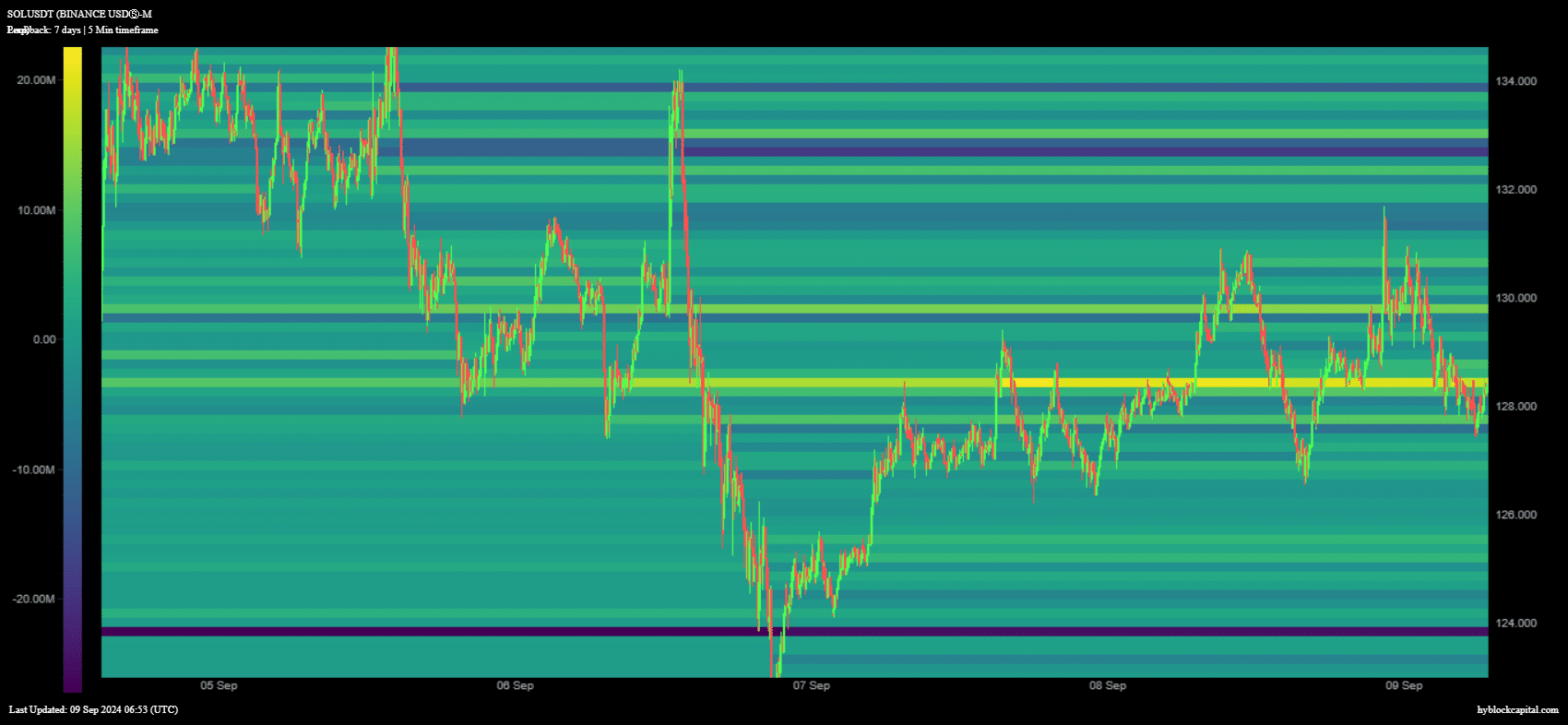

It appears that the analysis of SOL demand showed an increase in the total number of long positions, exceeding 18 million, when the price was at $128. This indicates a change in investor sentiment, suggesting that the bullish trend might be strengthening.

Despite this, it underscores the potential for significant sell-offs that could drive prices even lower due to heavy liquidations. A potential ‘leverage squeeze’ might have transpired two days back when the price dipped beneath $128, plummeting all the way down to the support level.

Can SOL bounce back strong as altseason trends?

Beyond the noted concentration, SOL could experience an influx of funds now that the altcoin market is gaining momentum. The dominance of Bitcoin has decreased over the past five days, suggesting a rising interest in alternative cryptocurrencies.

This year, SOL has caught the attention of many investors as one of the most captivating altcoins, making it a prime target for those seeking top-tier investment opportunities.

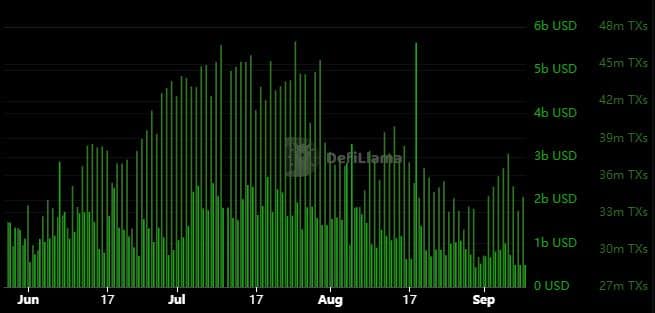

Transactions and on-chain activities related to Solana have been decreasing since late August. Nevertheless, there’s been an uptick in on-chain actions, particularly transaction growth as we approached the end of last week.

During the same timeframe, there was an increase in volume as well. Solana’s price showed signs of bearishness during this period, potentially suggesting a surge in buying activity.

If altcoin season begins, it could lead to a revival of action on the Solana network. Consequently, this might cause an increase in transaction volume, along with heightened interest and demand for SOL within the network’s DeFi environment.

Realistic or not, here’s SOL’s market cap in BTC’s terms

This development might open up the path for a robust rebound similar to what Solana (SOL) has experienced recently. A potential surge could push prices by around 15% to 20% from the present level, reaching the next significant resistance point.

This means price may rally above $160 in the next few days in the event of a strong bullish move.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-09-09 13:43