- Solana was testing a multi-month support level at press time, after persistent selling pressure and a lack of buyer interest.

- Despite weakening price, on-chain data remained positive, with development activity on Solana soaring 33% month-on-month.

As a seasoned researcher with years of experience in the crypto market, I find myself constantly intrigued by the enigmatic dance between price action and on-chain metrics. Solana [SOL] is no exception to this rule.

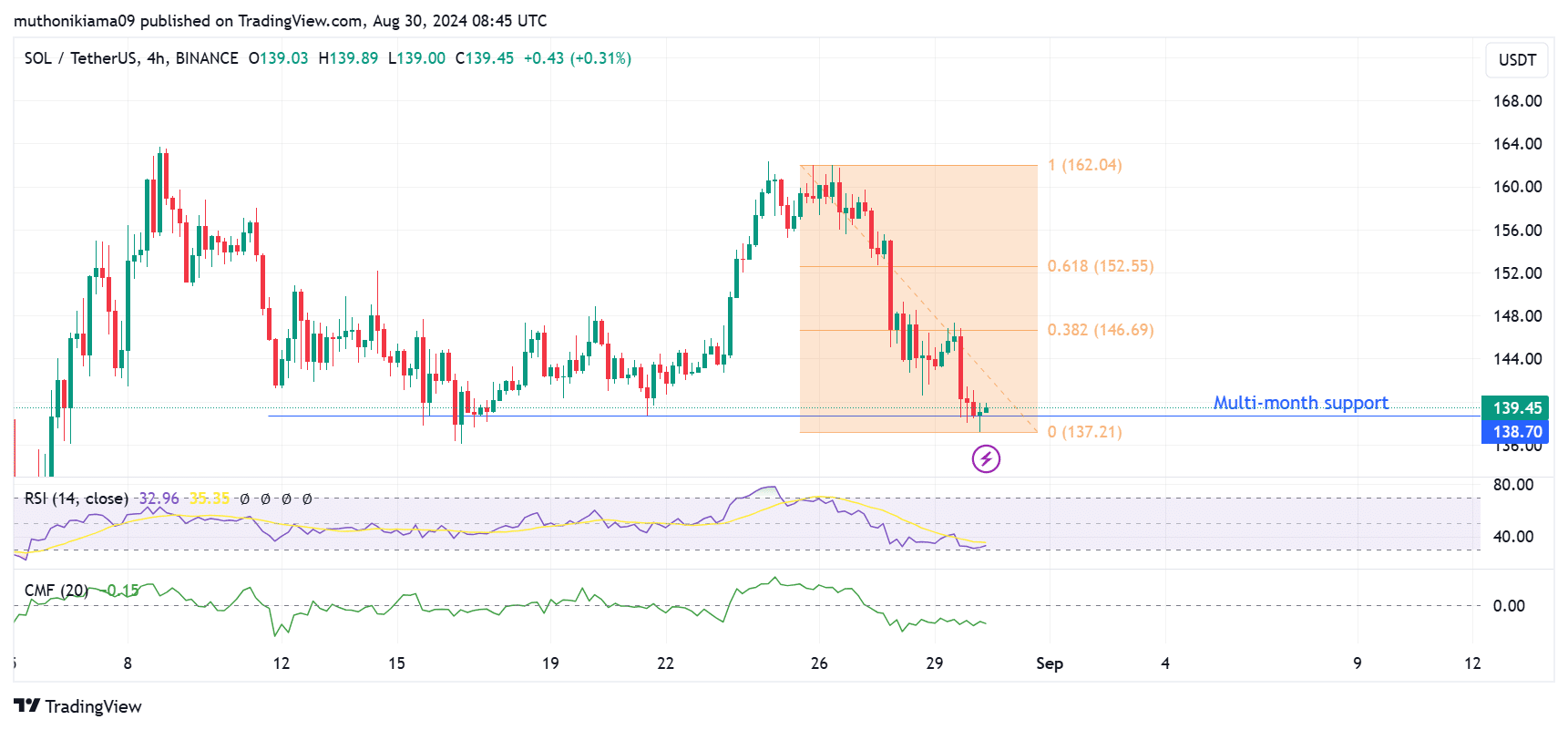

As I analyze the current state of the crypto market, it’s clear that Solana [SOL] has seen a dip of almost 4% over the past 24 hours. The overall bearish sentiment in the crypto space seems to be adding more pressure on the token. At the moment of my writing, SOL is being traded at $139.

1. Among the top ten biggest cryptocurrencies by market value, SOL experienced the most significant decline, according to recent reports. Additionally, trading activity has decreased by approximately 12%, as indicated by CoinMarketCap data, which may point towards a decrease in market enthusiasm and hesitation among traders.

Is there an indication that Solana might soon experience a bullish turnaround after testing a significant support level over several months, or will it continue to follow a bearish trajectory?

Diminished buyer interest

On Solana’s charts, signs suggest a decreased interest from buyers. Since the beginning of this week, the Chaikin Money Flow (CMF) has been fluctuating in the negative zone.

This pattern shows continuous selling force, with no sufficient buying enthusiasm to buy up the coins flooding the market.

The weak buying momentum around SOL is also seen in the Relative Strength Index (RSI). The index was at 33 at press time, meaning that a bearish momentum was at play.

Over the last seven days, the Relative Strength Index (RSI) has been creating successively lower troughs, suggesting bears are currently in control. Yet, it’s trying to break above the signal line, indicating a potential bullish reversal might be on the horizon.

The concurrent occurrence includes a pair of successive bullish candles, which followed a rebound from a significant multi-month support point at $138 for Solana. This particular support level has been maintained by Solana since the middle of August.

If Solana recovers from its current support, similar to how it has done so previously, traders may aim for the nearby resistance at approximately $146, which is a Fibonacci level.

Another important point to consider is that if Solana (SOL) can surpass the $152 mark, it would suggest a confirmed uptrend. However, if this uptrend does not hold, Solana might instead stabilize and move within a price range before determining its next direction.

Solana shows strength

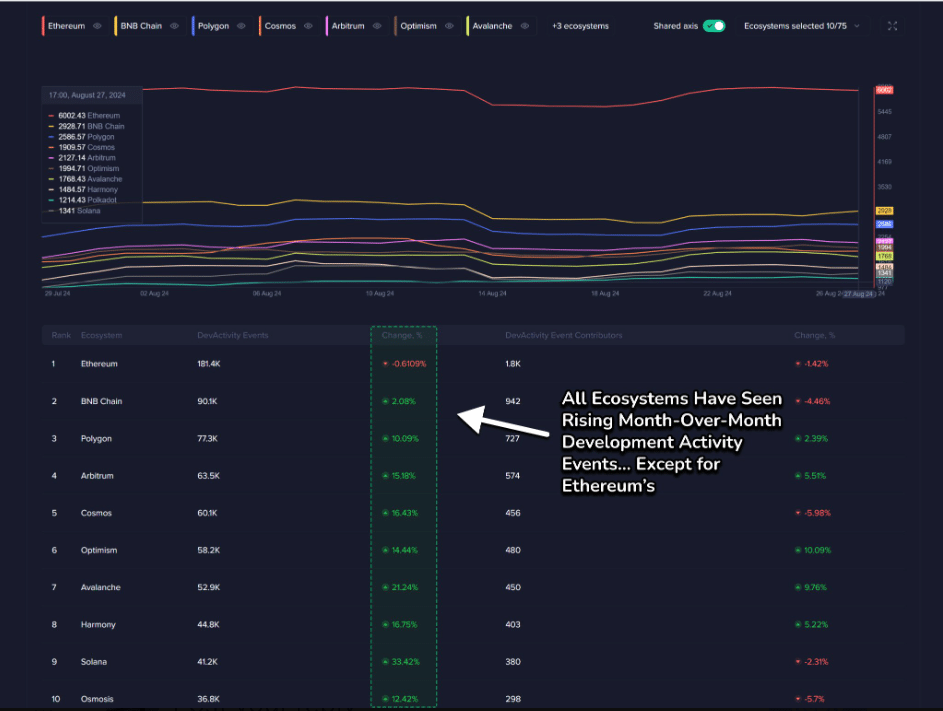

While the price action remains bearish, Solana’s on-chain metrics painted a bullish picture.

As per a recent update from what was once known as Twitter (now referred to as X), it’s been reported that the Solana network experienced the most significant increase in overall development activity when compared to previous months.

This activity soared by 33%, which is a positive sign of the network’s growth and improvement.

Data from DeFiLlama also showed an over $1 billion increase in Solana’s Total Value Locked (TVL) over the past month, despite the price headwinds.

Read Solana’s [SOL] Price Prediction 2024–2025

Nevertheless, the positive network metrics were not doing much to convince long traders.

Furthermore, when the Long/Short Ratio on Coinglass fell below 1, it indicated that short traders had a significant influence over Solana’s price movement throughout much of the week.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-31 11:04