- Solana traded within a defined consolidation range, indicating upcoming growth.

- The 200-day EMA and Fibonacci levels suggested key support and resistance points.

As a seasoned crypto investor with several years of experience under my belt, I find Solana’s recent market behavior intriguing. Based on my analysis of the current trends and technical indicators, I believe that Solana is in a consolidation phase, which could set the stage for an upcoming growth spurt.

Over the past few trading days, Solana (SOL) has gone through considerable swings in terms of market worth. Its value peaked at $172 just last week, but then took a downturn and is currently hovering around $151 as we speak.

In the previous day, this market action showed a slight uptick of 0.1%, indicating a crucial period of price stabilization which may influence upcoming price trends.

Solana: Market predictions

Expert insight from crypto analyst Altcoin Sherpa: Solana’s present market behavior is being assessed by him, suggesting a trading range of around $185 to $120 for potential price movements.

As a crypto investor, I’ve noticed that after a steep price surge, the market may enter a balanced phase. This range, as indicated by Sherpa, is not an unusual occurrence and typically signals the market gearing up for its next major shift.

The 200-day Exponential Moving Average (EMA) serves as a technical analysis tool that calculates an average price for a security over the past 200 days, continually updating it to reflect current market trends.

The Exponential Moving Average (EMA) plays a significant role in determining market trends and signaling potential areas of support. By referring to this average, traders may anticipate a short-term support level that could stimulate purchasing interest.

As a seasoned crypto investor, I closely examine the market trends with the help of advanced tools like Sherpa’s technical analysis. One such method we employ is Fibonacci retracement. By doing so, we identify crucial support and resistance levels that significantly impact price movements in the digital currency market.

As of now, the Solana price was around $138.37, marking the 0.382 retracement level and possibly acting as a significant turning point.

If the price falls below this point, the levels at 0.5 and 0.618 may serve as additional checks. At these points, the price might find support and potentially halt its decline, or even reverse direction.

Fundamental analysis

In spite of the ongoing consolidation, recent developments within Solana’s network may indicate hidden resilience.

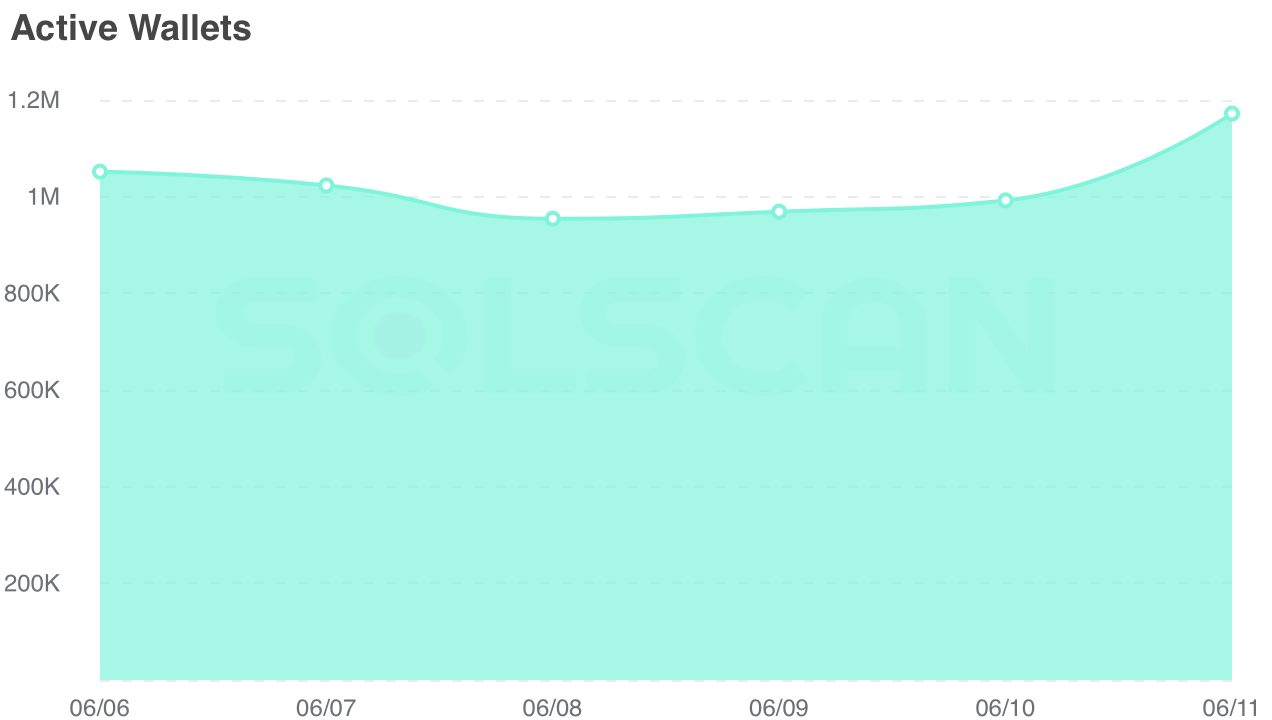

The number of Solana network addresses in use has significantly increased, jumping from under one million to over 1.1 million within the past week.

As an analyst, I would interpret an uptick in active Solana addresses as a sign of heightened user involvement or readiness for upcoming transactional activities. Consequently, this trend could potentially fuel greater demand for the Solana token.

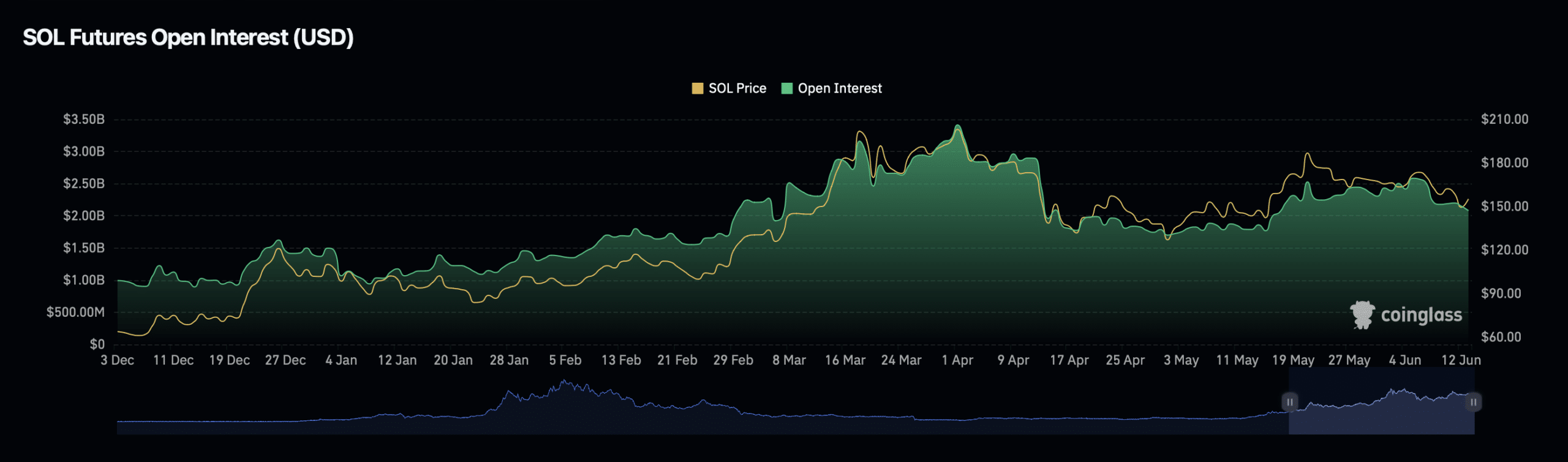

Regarding market derivatives on Solana, the Outstanding Contracts figure, which signifies the quantity of uncashed-in agreements like options and futures, displayed a captivating trend.

Although Open Interest has dipped slightly by approximately 3%, the volume of Open Interest has significantly increased by nearly 20%.

As an analyst examining the data, I noticed that although the number of open contracts had decreased, the volume of transactions in those remaining contracts was significantly higher. This observation implies a more active market with investors potentially preparing for substantial price shifts.

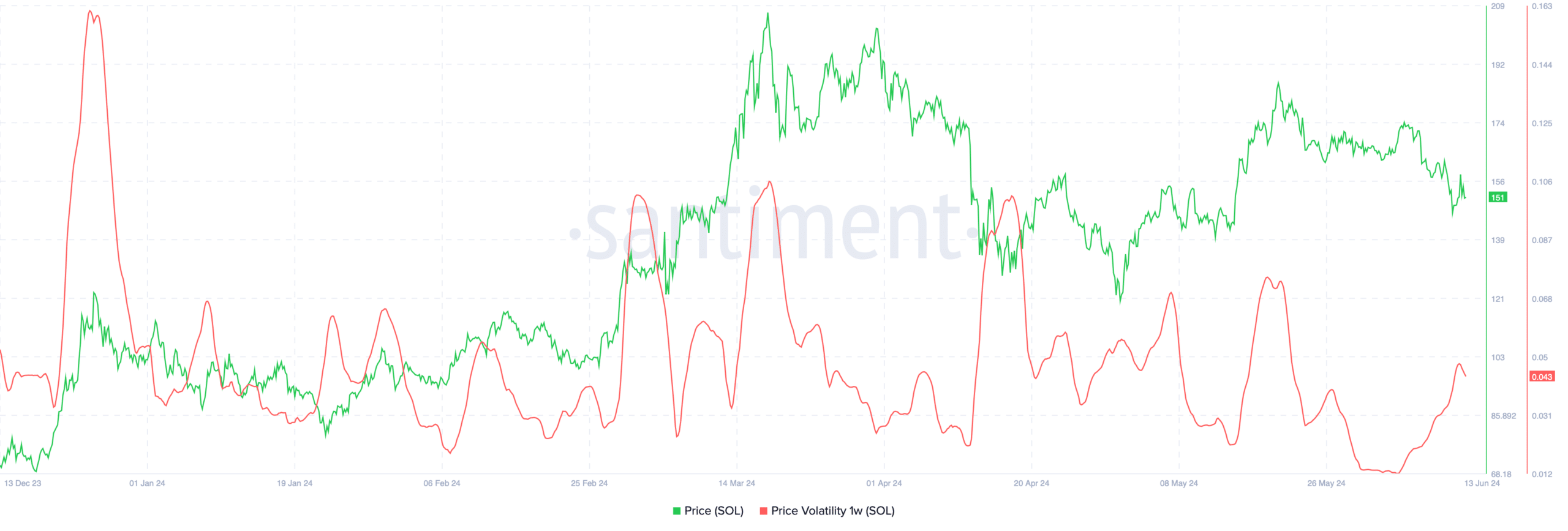

There has also been a recent spike in Solana’s price volatility, according to Santiment.

As a financial analyst, I would describe volatility as the measure of price fluctuations in a security or market. A higher level of volatility signifies larger price swings, presenting potential trading opportunities for investors and traders alike.

Recently, according to AMBCrypto’s latest report, the Money Flow Index (MFI) and Relative Strength Index (RSI) for Solana have experienced an upward trend. This indicator suggests growing buying activity and potentially leading to a price surge.

From my perspective as a researcher, while there’s an uptick in buying pressure for Solana, the Chaikin Money Flow (CMF) continues to signal bearish conditions. This implies that although investors are purchasing more, the total money flow into Solana may not be robust enough, resulting in a nuanced outlook among market participants.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-06-13 14:15