- Solana’s $100 billion monthly DEX volume and $11 billion transactions YTD highlight growing adoption.

- Bullish liquidations and steady development reinforce confidence for sustained upward price movement.

As a seasoned crypto investor with a knack for recognizing promising opportunities, I find Solana’s (SOL) recent achievements truly remarkable. The record-breaking monthly DEX volume and impressive transaction numbers speak volumes about its growing adoption and technological prowess.

For the month of November 2024, Solana [SOL] has shattered records by achieving over $100 billion in monthly decentralized exchange (DEX) volume. Furthermore, it has executed an impressive 11 billion transactions year-to-date, showcasing its swift growth and robust technological capabilities. These achievements underscore its rapid adoption and technical prowess within the industry.

Currently, Solana is being traded at $240.77, representing a decrease of 2.58% over the past day, following its annual high of $267 reached earlier in June. This leaves traders speculating whether this trend will lead to a prolonged price increase or if more adjustments are imminent.

Price analysis: Can SOL maintain its support levels?

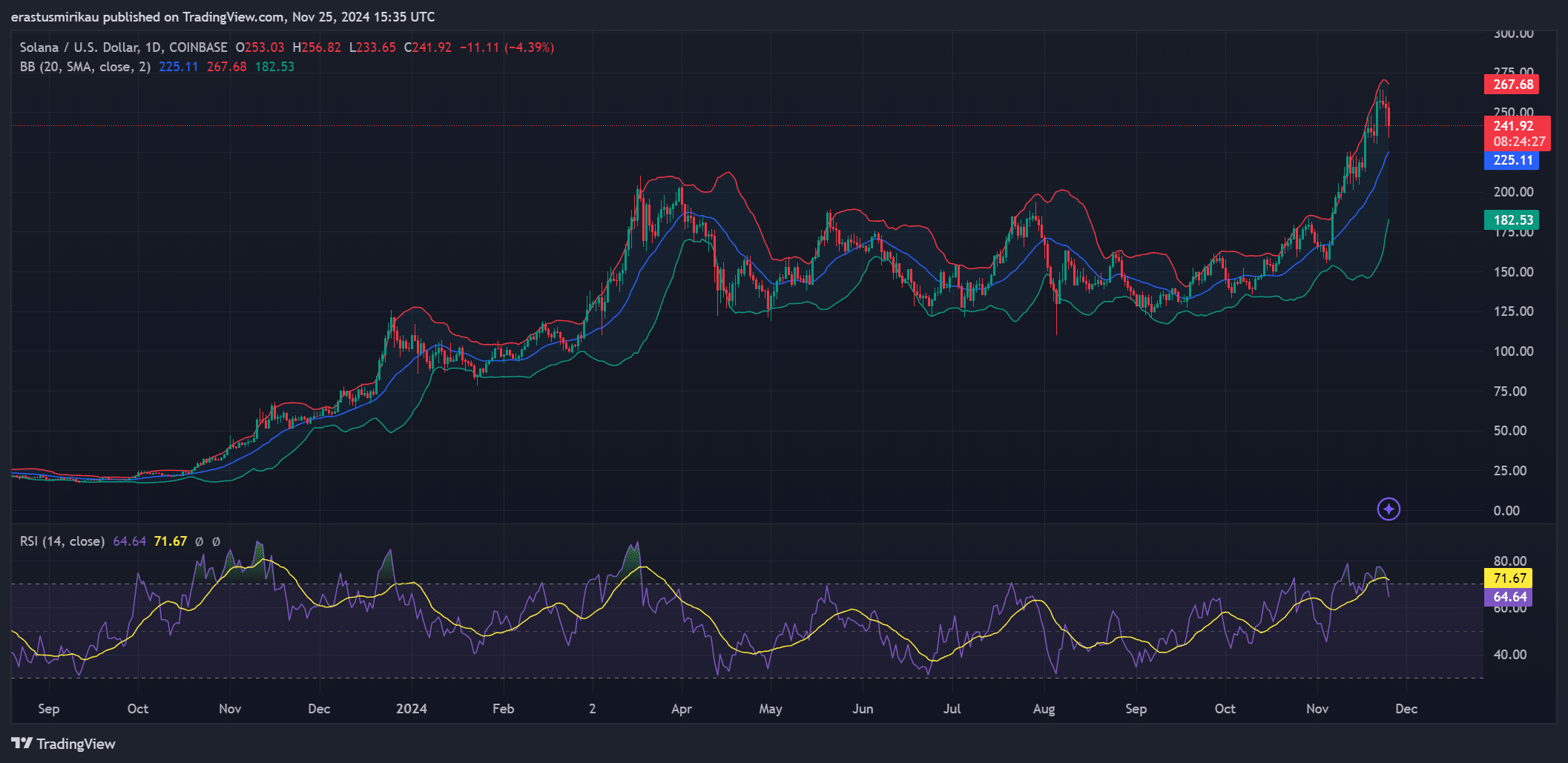

Even though there’s been a slight dip, Solana’s (SOL) latest price movements suggest resilience after its substantial surge earlier in the month. The Bollinger Bands (BB) signal that the price is correcting from oversold levels.

The upper BB sits at $267.68, while the middle band provides critical support at $225.11. Additionally, the RSI is at 71.67, signaling a cooling-off phase as Solana consolidates near overbought territory.

If the SOL price doesn’t surpass $225, there’s a possibility it may drop back down to around $182.53. Conversely, if it manages to hold above $225, it could gather strength for another climb toward its resistance at $267.

Therefore, this zone is critical for future price movement.

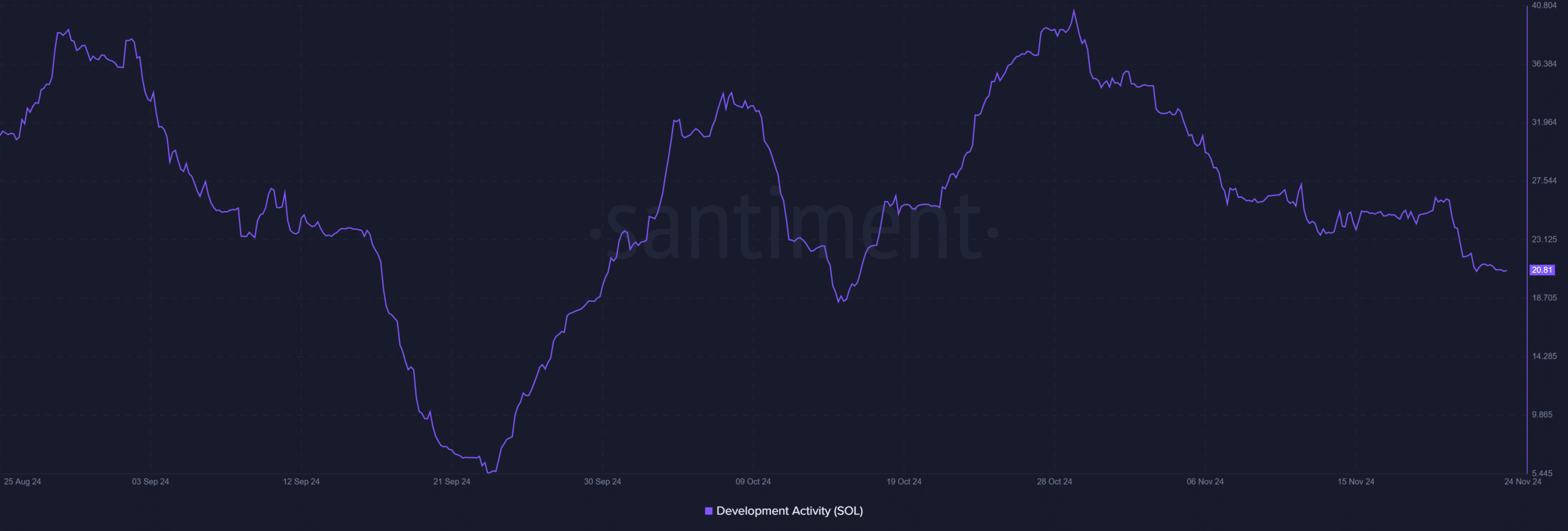

Steady development activity supports long-term growth

Beyond its strong market results, Solana consistently showcases active development. As of November 24, the activity level stands at approximately 20.81, which is somewhat lower compared to past months.

Yet, the continuous advancement clearly demonstrates SOL’s persistent dedication towards improving its environment. As a result, such sustained growth establishes a robust base for lasting acceptance and price equilibrium.

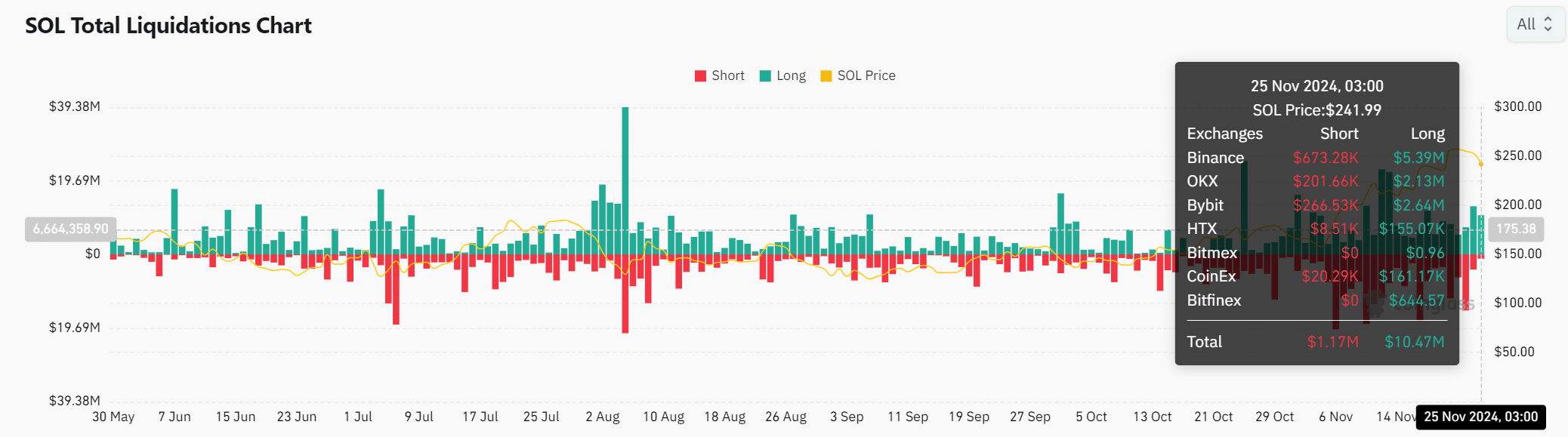

Liquidations reveal bullish sentiment

Data on Solana’s liquidations suggests a positive outlook within the market. Specifically, on November 25th, there was a significant amount of long positions ($10.47 million) being liquidated compared to the relatively small number of short positions ($1.17 million). This imbalance underscores a robust bullish attitude among traders, demonstrating their belief in the growth potential of Solana.

It seems that even with temporary price drops, most market participants anticipate Solana’s growth trend will persist, possibly reaching or surpassing its past peak levels in the near future.

Is SOL poised for another rally?

The remarkable achievements Solana has made in terms of adoption and transaction volume, coupled with its robust technical and market foundations, indicate that it is primed for continued expansion.

Should SOL maintain its current support at $225, it’s quite possible that we might see another test towards $267 or even higher prices. But if this level weakens and isn’t maintained, a brief correction could occur. At present, the optimistic market outlook and robust underlying factors suggest a potential price surge for SOL within the upcoming weeks, favoring an upward trend.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

- Masters Toronto 2025: Everything You Need to Know

2024-11-26 11:35