-

The significant decline hinted at a cooling interest in Solana-based memecoins.

SOL’s price might test the lower support levels around $145.90 if interest continues to decline.

As an experienced analyst, I believe that the significant decline in Solana-based memecoin trading volume and Solana decentralized exchange (DEX) volume is a clear indication of waning interest in the Solana ecosystem. This trend could potentially lead to further downside for SOL‘s price if it continues.

On Solana’s decentralized exchanges, the daily trading volume, as observed by AMBCrypto on May 26th using Artemis’ dashboard, amounted to approximately $984 million. This represents a decrease compared to previous days.

As a researcher, I’ve noticed an intriguing trend in the Solana blockchain’s recent performance. Three days prior to the current observation, the total figure surpassed $1.5 billion. This decline, however, contrasted starkly with the blockchain’s impressive feat in April. During that month, the decentralized exchange (DEX) volume hit an all-time high of a staggering $60 billion.

With May coming to a close and the market experiencing a downturn lately, it’s plausible that the monthly trading volume will decrease compared to previous levels. This surge in activity might have been driven by the meme coin craze that swept through the network recently.

No memecoins, no party

Consequently, the decrease in usage could indicate that engagement with memecoins deployed on Solana has waned compared to before. Moreover, the ongoing development appeared to negatively impact SOL, the native token of the ecosystem.

Currently, the cost of SOL is $161.49 at the time this statement is being made. Not too long ago, its value came very near to touching $190. If trading volumes on Decentralized Exchanges (DEX) keep decreasing, it’s possible that SOL could experience a similar trend.

As a researcher investigating the cryptocurrency market, I’ve discovered that the demand for certain cryptocurrencies is closely linked to memecoin trading. For those who may not be familiar, while some memecoins can be exchanged for stablecoins like US Dollar Coin (USDC), the majority require Solana (SOL) for transactions.

If the demand for memecoins wanes, it’s reasonable to anticipate that bids for Solana (SOL) will follow suit. However, there are other factors that can influence Solana’s price trend as well. In their analysis, AMBCrypto examined these indicators.

SOL has become weak

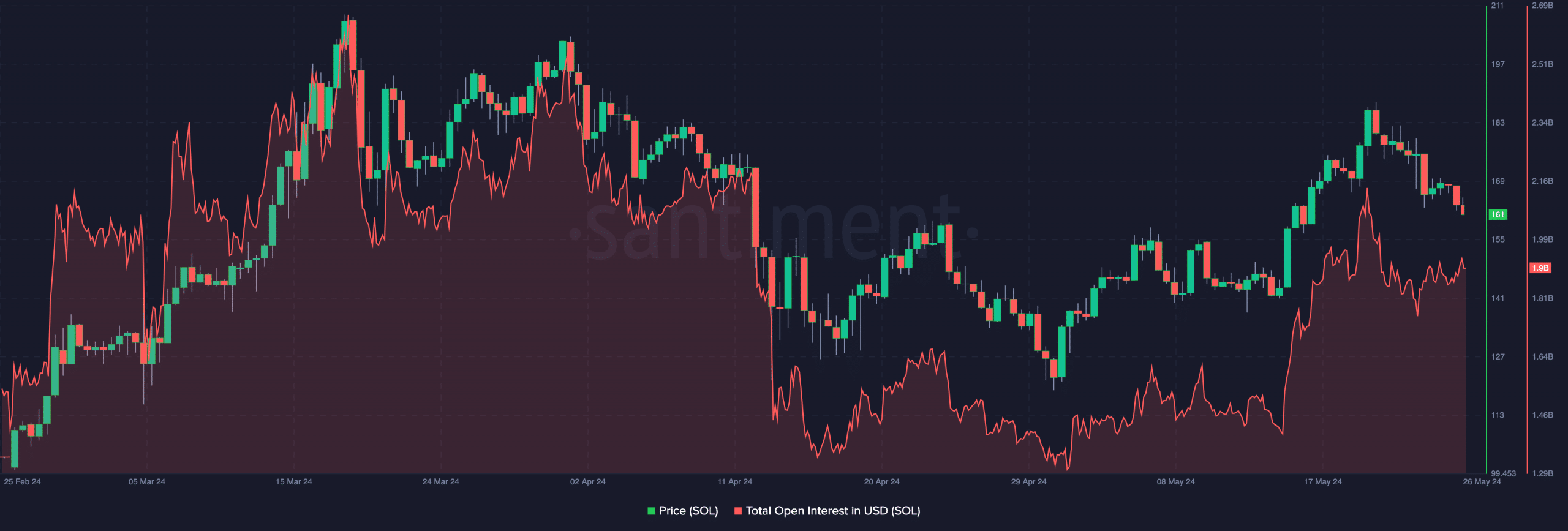

An additional metric we examined was Solana’s Open Interest (OI), which had decreased to approximately $1.90 billion based on Santiment’s figures. In comparison, this figure stood at around $2.20 billion as of May 20th.

As a researcher studying financial markets, I would describe Open Interest (OI) as the total number of outstanding contracts with no offsetting position. An uptick in OI implies that new positions are being established and more capital is flowing into the market. This trend can function as a bullish indicator.

As a researcher examining the data presented in the chart, I noticed an intriguing trend: the SOL price surged to reach $188.45, coinciding with a significant increase in Open Interest (OI). However, it’s important to acknowledge that this rise in OI also resulted in a reduction of liquidity within SOL contracts.

Should the waning power for an uptrend in SOL‘s price hold, there is a risk that the cryptocurrency may continue declining. A potential drop down to $145.90 might ensue under such circumstances.

As a crypto investor, I’ve noticed that Solana has recently been underperforming compared to other blockchains based on the latest report from AMBCrypto. Projects like Aptos (APT) and Sui (SUI) have been gaining traction and posing a significant challenge to Solana’s position in the market.

Realistic or not, here’s APT’s market cap in SOL terms

It’s unclear if these projects can sustainably process more transactions than Solana on a regular basis.

Should this event transpire, the value and price of Solana could experience a decline. Contrarily, if it doesn’t occur, there’s a possibility for Solana to regain its success.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-27 08:07