- Solana surpassed Bitcoin and Ethereum in gains, marking a strong Q3 start.

- VanEck and 21Shares filed for Solana ETFs, influencing market sentiment.

As a seasoned crypto investor, I’ve witnessed my fair share of market ups and downs. However, the recent surge in Solana (SOL) has caught my attention with its impressive gains outpacing both Bitcoin and Ethereum. With a 7.50% increase within 24 hours and an 18% growth over the last week, SOL is certainly making waves in the crypto community.

As a crypto investor, I’m thrilled to start Q3 with optimism after witnessing the upbeat beginning of the cryptocurrency market. Bitcoin (BTC) and several alternative coins have been trending upward, indicating a promising bullish momentum.

Solana in the limelight

At present, Solana (SOL) has drawn significant attention with a noteworthy gain of 7.50% in the past 24 hours. This impressive rise surpassed both Bitcoin (BTC) and Ethereum (ETH), which experienced more modest growth during the same time frame. Furthermore, SOL prices have escalated by approximately 18% over the last week.

It’s intriguing to note that the Solana memecoin market experienced robust buying interest. As per CoinGecko data, the market capitalization of these memecoins was $7.73 billion on July 1st, signifying a noteworthy 10.4% surge over the past day.

Remarking on the same, an X user – Borovik (formerly Twitter) noted,

“Welcome to the Solana cycle.”

Solana ETF in the pipeline

As a researcher, I’ve noticed an intriguing development in the cryptocurrency world. Two asset management companies, VanEck and 21Shares, have recently submitted filings with the Securities and Exchange Commission (SEC) to introduce Solana exchange-traded funds (ETFs). These ETFs will allow investors to gain exposure to Solana through a more traditional investment vehicle. This aligns with my ongoing research on the growing interest in cryptocurrencies among institutional investors, as they seek diverse ways to invest in this evolving market.

Based on the latest news, VanEck took a major step on June 27th by submitting an application to the U.S. Securities and Exchange Commission (SEC) for a Solana Spot ETF.

On the subsequent day, specifically on June 28th, 21Shares submitted an application for a Spot Solana Exchange-Traded Fund (ETF) of their own. This filing revived optimism amongst investors regarding the potential launch of a Solana ETF.

Impact on the upcoming US election

As a researcher studying the political landscape leading up to the presidential election, I’ve noticed that the announcement of this news was warmly received. The significance of this development became particularly noteworthy given the starkly contrasting stances of the two candidates regarding cryptocurrencies.

As an analyst, I’ve observed notable differences in the public stances towards cryptocurrencies between former President Donald Trump and current President Joe Biden. Trump has been outspoken about his pro-crypto sentiments, frequently expressing his approval for the industry. In contrast, President Biden’s viewpoint appears more skeptical towards digital currencies, with fewer instances of advocating for them.

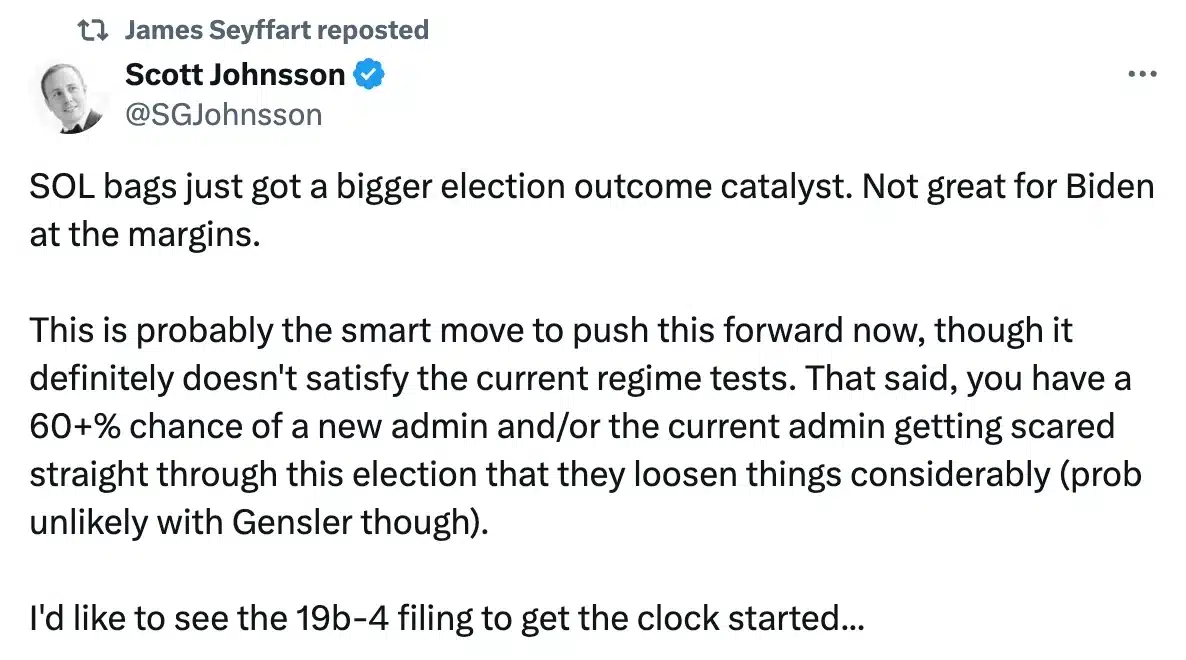

Speaking about this matter, Scott Johnsson, the managing partner at Van Buren Capital, commented that the announcement of a potential Solana Exchange Traded Fund (ETF) could negatively impact President Biden’s electoral prospects, particularly among undecided or marginal voters.

Yet, James Seyffart, an ETF analyst at Bloomberg Intelligence, expressed a differing perspective prior to 21Shares applying as the second Solana candidate.

“I think VanEck’s filing is a sort of call option on the November election.”

He added,

As a researcher examining the current regulatory landscape for crypto Exchange-Traded Funds (ETFs) under the SEC, I’ve observed a history of approvals and denials. Given this context, it seems unlikely that a Solana ETF would be approved due to the absence of a federally regulated futures market. However, with a new administration in the White House and a potentially more crypto-friendly SEC administration, the calculus could shift significantly.

SOL’s price action

Although there were conflicting reactions, news of a possible Solana ETF led to a substantial price increase of over 10% for SOL.

The latest data suggest a positive outlook for SOL‘s future based on decreasing volatility indicated by Bollinger Bands and persistent optimistic investor attitude.

Moreover, the RSI above the neutral level and trending upwards further confirmed this trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-01 16:08