- Solana ETFs could attract little demand from U.S. investors, per Sygnum’s exec.

- However, Syncracy Capital’s co-founder claimed that Solana could break out through DePIN.

As a seasoned researcher with over two decades of experience in the financial industry, I have witnessed numerous predictions that didn’t quite pan out as expected. However, my perspective is always grounded in data and market trends.

A representative from crypto bank Sygnum predicts that U.S.-listed Solana (SOL) exchange-traded funds (ETFs) may not experience substantial inflows if they get approved.

Katalin Tischhauser, the Head of Research at Sygnum, has stated to Cointelegraph that the inflows into Solana (SOL) will likely be small due to the relatively low assets under management in Grayscale’s SOL trust (GSOL).

She added,

“The small AUM reflects the relative name recognition of Solana versus Bitcoin,”

Solana ETF flow outlook

Currently, when I’m writing this, GSOL’s Assets Under Management (AUM) stood at approximately $67 million. This figure pales in comparison to GBTC’s AUM of almost $30 billion prior to its ETF conversion in January.

Per Tischhauser, this demonstrated a likely weak demand for future SOL ETFs from U.S. investors.

The perspective emerges several weeks following submissions by financial managers such as VanEck, Franklin Templeton, and 21Shares of an application for a Solana-based Spot ETF to the U.S. Securities and Exchange Commission (SEC).

In contrast, BlackRock has announced that they won’t be seeking approval for the SOL ETF at this point, due to insufficient client interest in the immediate future.

Remarkably, Tishchhauser’s projected flows for their ETH ETF seem to have aligned with Eric Balchunas’s outlook for the same ETF prior to its launch on July 23rd.

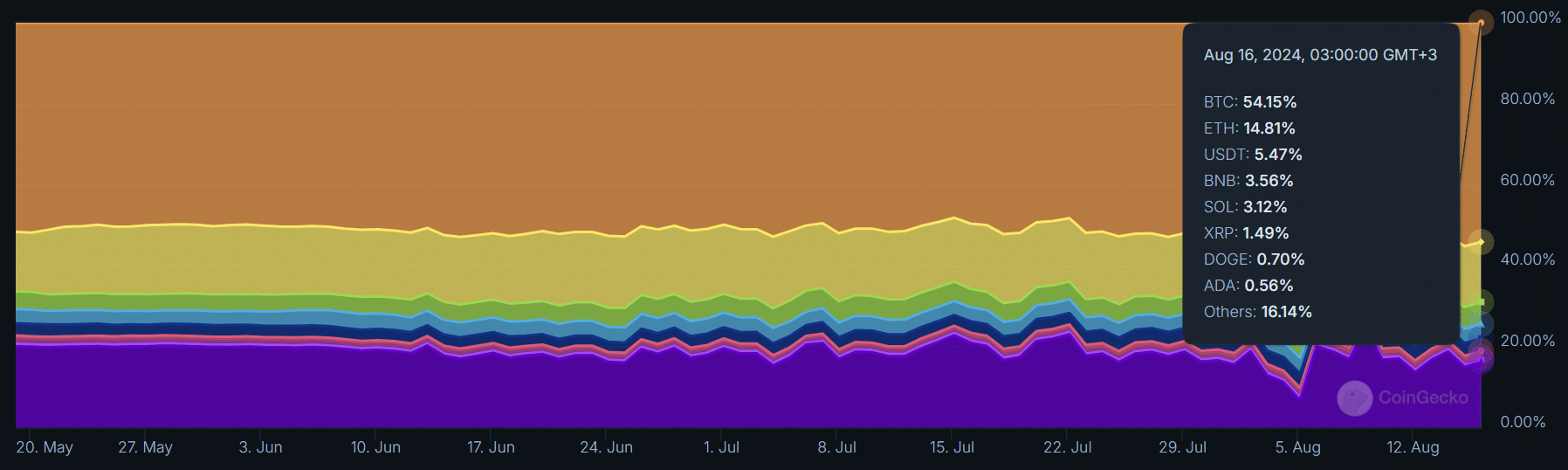

Balchunas estimated that the flows could follow the asset’s dominance based on market cap.

In my analysis as a financial analyst, I had anticipated that if a Bitcoin ETF were launched, approximately 15% to 20% of its flows might be directed towards it on its first day. At that time, Ethereum‘s dominance in the market was roughly 15%. Interestingly, the Ethereum ETF surpassed expectations on its debut day, recording slightly higher performance than what I had anticipated.

At the time of writing, SOL’s market dominance stood at 3.12%, per CoinGecko data.

If the market trend continues towards dominance and Assets Under Management (AUM), as suggested by Tischhauser, then it’s possible that there could be a decrease in the number of flows for their ETF products.

Will Solana’s DePIN change the odds?

On the other hand, Ryan Watkins, a co-founder of crypto hedge fund Syncracy Capital and a previous analyst at Messari Crypto, opined that SOL might experience its breakthrough linked to DePIN (Decentralized Physical Infrastructure Network).

‘It seems that Solana is on the verge of experiencing a significant surge, much like Ethereum did in 2020, due to its integration with DePin.’

Watkins noted that DePIN could be the next segment with real-world adoption after stablecoins.

The strong popularity of DePIN initiatives such as Helium (HNT) may significantly enhance Solana’s reputation within this sector, implying that its position might become even more prominent.

However, whether this would change U.S. investor sentiment towards SOL remains to be seen.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-16 17:28