- Solana ETF process moves forward with four 19b-4 filings.

- SOL has hit a new ATH since November 2021.

As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed the ebb and flow of countless regulatory decisions and market trends. The recent flurry of Solana ETF filings is an intriguing development that I find myself closely following.

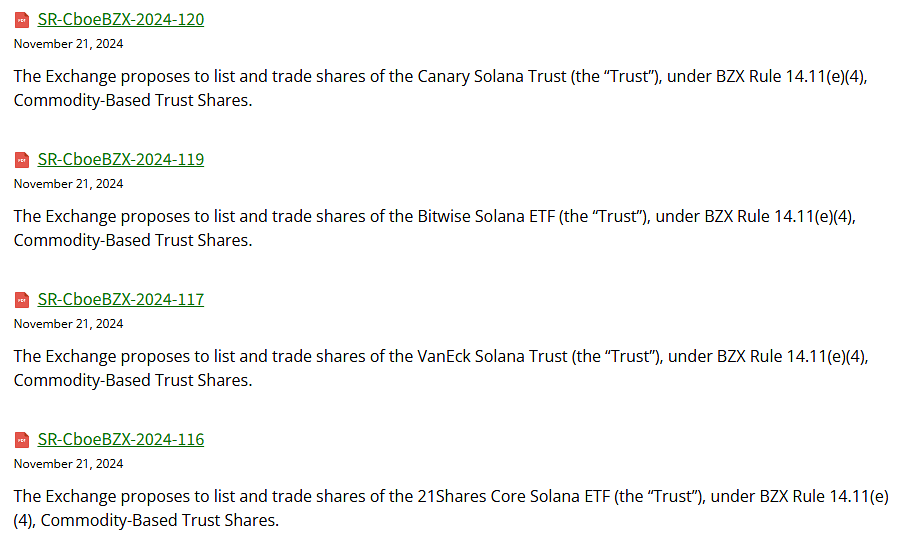

Four proposals for Solana spot ETFs have been submitted by CBOE to the U.S. Securities and Exchange Commission (SEC). These proposals are from asset management firms Bitwise, VanEck, 21Shares, and Canary Capital.

Should they gain approval, these ETFs will become available for trading on the Chicago Board Options Exchange’s BZX Exchange within the United States.

Highlighting the filings, Bloomberg ETF analyst James Seyffart said on X (formerly Twitter):

“The ball is in SEC’s court now.”

He added that it’s expected the due date for this task could be in early August, if the SEC approves it.

19b-4 filings are petitions made by self-regulatory bodies seeking to modify or establish new regulations. The Securities and Exchange Commission (SEC) reviews these submissions, encouraging public feedback prior to deciding whether to approve or reject them.

Bitwise joins the Solana ETF race

It’s noteworthy that Bitwise has joined the competition for the SolidX Bitcoin ETF, having filed its application after submissions from VanEck, 21Shares, and Canary Capital in June and October respectively.

20th November marked the registration of a statutory trust in Delaware by Bitwise, for a Solana ETF focusing on spots. To further solidify this move, they submitted their S-1 filing the next day.

Solana ETFs: A wait-and-see game?

Although a large number of submissions suggest excitement among investment managers, it doesn’t mean that the Securities and Exchange Commission (SEC) will automatically approve these applications.

Eric Balchunas, a senior ETF analyst at Bloomberg, raised doubts about whether the SEC will recognize these applications within two weeks, or instead ask the submitters to retract their filings.

According to Balchunas, it seems like CBOE might be exploring the limits for a potential procedural recognition. He mentioned this could be due to the upcoming management transitions at the Securities and Exchange Commission (SEC).

However, the analyst stated that before approval,

“Lawsuits that mention Solana as a security would have to be dropped first.”

Balchunas noted that the recent efforts suggest a more optimistic outlook, but they do not necessarily signal a change in the SEC’s position.

Notably, the submission emerged following the post by Fox Business journalist, Eleanor Terret, on X, where she suggested a “fair probability” of the event occurring.

Still, she noted that history offers a note of caution. Previous 19b-4 filings from VanEck and 21Shares were quietly removed from CBOE’s website in August, reportedly due to a lack of support from the SEC under Gary Gensler’s leadership.

On the other hand, Terret indicated that issuers are expressing heightened interaction with the SEC team and the prospect of a pro-cryptocurrency government as factors contributing to renewed optimism.

“A Solana ETF could be approved sometime in 2025.”

SOL hits all-time high

It’s worth noting that the submission of Solana ETF documents appears to align with a significant date in the crypto market. In a recent statement, the chair of the SEC has announced his resignation, effective January 20, 2025. This announcement has sparked discussions about potential changes in regulatory perspectives.

The recent advancements caused Solana’s value to reach a new all-time high of $264, momentarily, before dipping slightly to $262.49, representing an 8.95% rise over the past day, as reported by CoinMarketCap.

Due to the increase, the market capitalization of SOL soared to an impressive $124.62 billion, and the trading volumes jumped by a substantial 59.14%, reaching a significant $11.06 billion.

As regulatory changes approach, the story surrounding the Solana ETF is likely to stay relevant. Whether it gets approved or not remains uncertain; we’ll find out with time.

Read More

2024-11-22 14:32