- Solana ETFs approved by Brazil, set to begin trading this month.

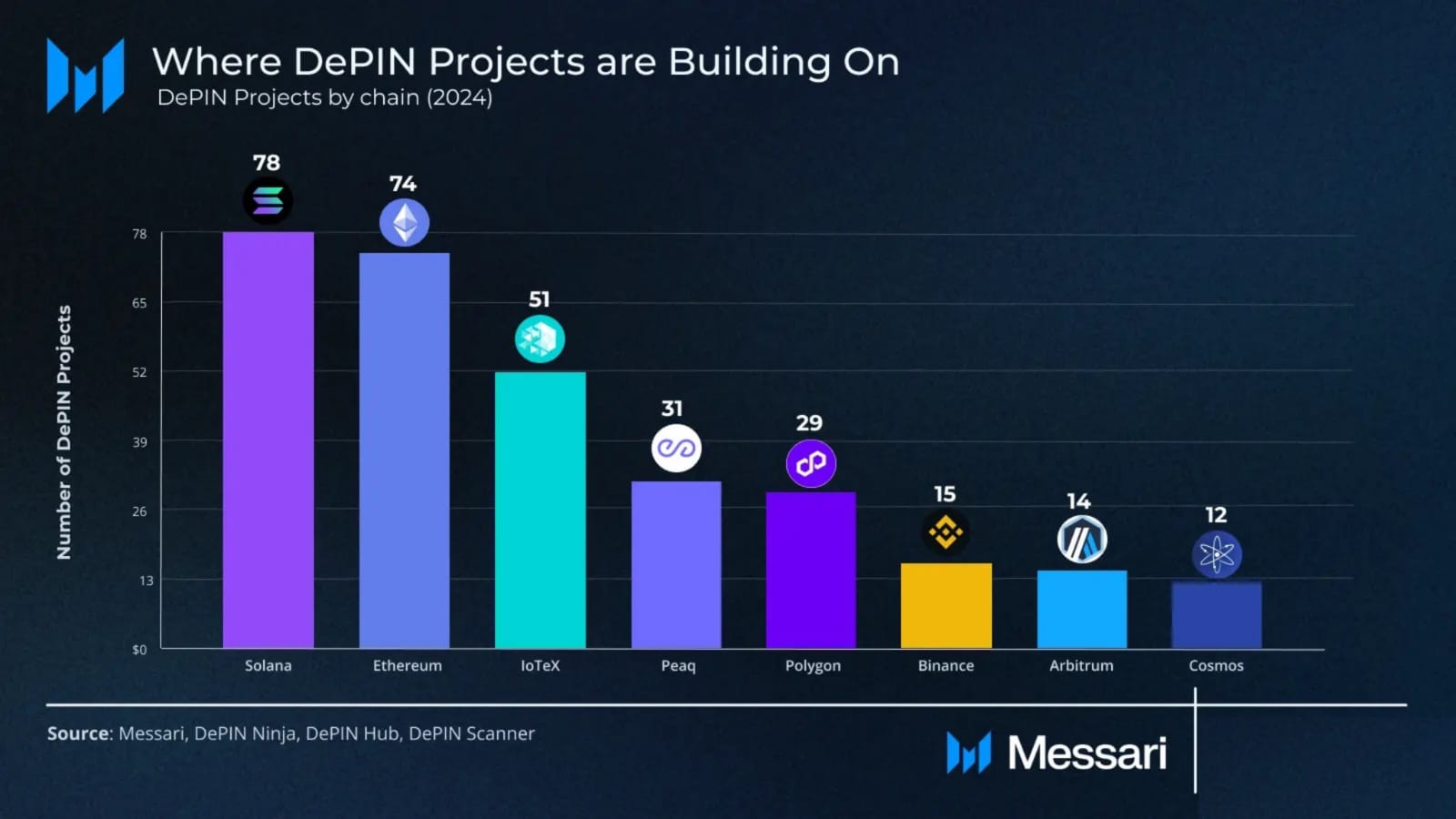

- Most DePIN projects are built on the Solana blockchain.

As a seasoned researcher who has witnessed the evolution of blockchain and cryptocurrency markets for over a decade, I must admit that the recent developments with Solana are nothing short of intriguing. The approval of the world’s first Solana ETF by Brazil is a significant milestone in global adoption, and it seems like only a matter of time before other major financial hubs follow suit.

Brazil has made a substantial move towards worldwide cryptocurrency acceptance, as they’ve given their approval for the debut of the first Exchange Traded Fund (ETF) based on Solana [SOL].

According to a report by Solana Floor on X (previously known as Twitter), this newly established fund will commence trading in August.

Although financial centers such as the United States and the UK haven’t greenlighted Solana ETFs just yet, it’s anticipated that this approval process will only be a short-term matter. Once they do give the go-ahead, these ETFs will become available for trading on their respective markets.

Solana dominates DePIN sector

SOL is leading the DePIN sector with 78 projects, outperforming all other blockchain networks.

The emphasis underscores Solana’s increasing supremacy against Ethereum [ETH], implying it could emerge as the favored blockchain platform for developers in the future.

It’s clear that Solana outpaced Ethereum significantly, as it boasted a 4% greater adoption rate in decentralized finance (DeFi) projects, based on findings from Messari Crypto Research.

TVL rebounds by 20% after fall

Recently, Circle has minted approximately $250 million worth of US Dollar Coins (USDC) on the Solana platform. At the moment of reporting, this accounted for around 70% of the total stablecoin supply on Solana, whereas only about 30% is found on Ethereum.

As a researcher examining the dynamics of various stablecoins, I’ve observed an interesting development with PayPal’s PYUSD. Launched barely two months ago, this new stablecoin contributes significantly to Solana’s stablecoin pool, accounting for approximately 11% of its total supply.

The dominance of USDC on Solana is due to efforts by Circle and the Solana Foundation to attract developers and integrate trading platforms.

Launching Circle’s CCTP on the Solana platform has boosted the convenience and accessibility of USDC, as well as increased its liquidity. Even though Solana’s value has dipped recently, its Total Value Locked (TVL) has made a comeback by approximately 20%.

SOL/ETH price action makes a new ATH

As a seasoned cryptocurrency investor with years of experience under my belt, I have seen many market fluctuations and trends come and go. The latest data showing that the SOL/ETH trading pair has reached a new all-time high (ATH) despite Solana experiencing significant losses during the recent market downturn is a testament to the resilience and potential of this particular trading pair. While I have witnessed numerous instances where market volatility can be overwhelming, I’ve also learned that it often presents opportunities for savvy investors to capitalize on undervalued assets. In my opinion, this latest development could be one such opportunity worth exploring, given the underlying strength and growth potential of both Solana (SOL) and Ethereum (ETH). However, as always, it’s essential to conduct thorough research, manage risk, and make informed decisions when investing in any asset.

Such a remarkable milestone by SOL could potentially lead investors to revise their long-term perspectives regarding both Solana and Ethereum.

Regardless of SOL‘s recent turbulence and drop in value, its current peak versus ETH indicates that the relationship between these digital currencies is evolving. This pivotal juncture warrants a reevaluation of investment tactics for both assets.

ETH gets smoked by SOL on the rebound

SOL surged over 13% in value, while Ethereum has dropped by 1.03% after the crash.

Realistic or not, here’s SOL’s market cap in BTC’s terms

This sharp contrast in performance highlights Solana’s strong momentum compared to ETH.

Based on the current trend, Solana’s remarkable progress indicates a strong possibility that it might surpass Ethereum in terms of performance during this market cycle.

Read More

2024-08-09 00:08