-

SOL’s short and long-term prospects depend on breaking two significant resistance levels

An uptick to over $188 in the short term seems feasible

As a seasoned researcher with a knack for deciphering complex market trends, I find myself intrigued by the current state of Solana (SOL). While it may seem like a rollercoaster ride, my analysis points towards an uptick in SOL’s short-term prospects.

In the past few weeks, SOL‘s price patterns have been somewhat inconsistent. Its monthly and weekly statistics indicate modest increases of about 7.64% and 5.38%, respectively. However, it experienced a daily setback of approximately 1.49% upon encountering a resistance barrier.

Regardless of recent ups and downs, there’s been a lot of uncertainty in the market lately, as predictions have shifted from pessimistic to increasingly hopeful.

Resistance levels challenge SOL’s upward momentum

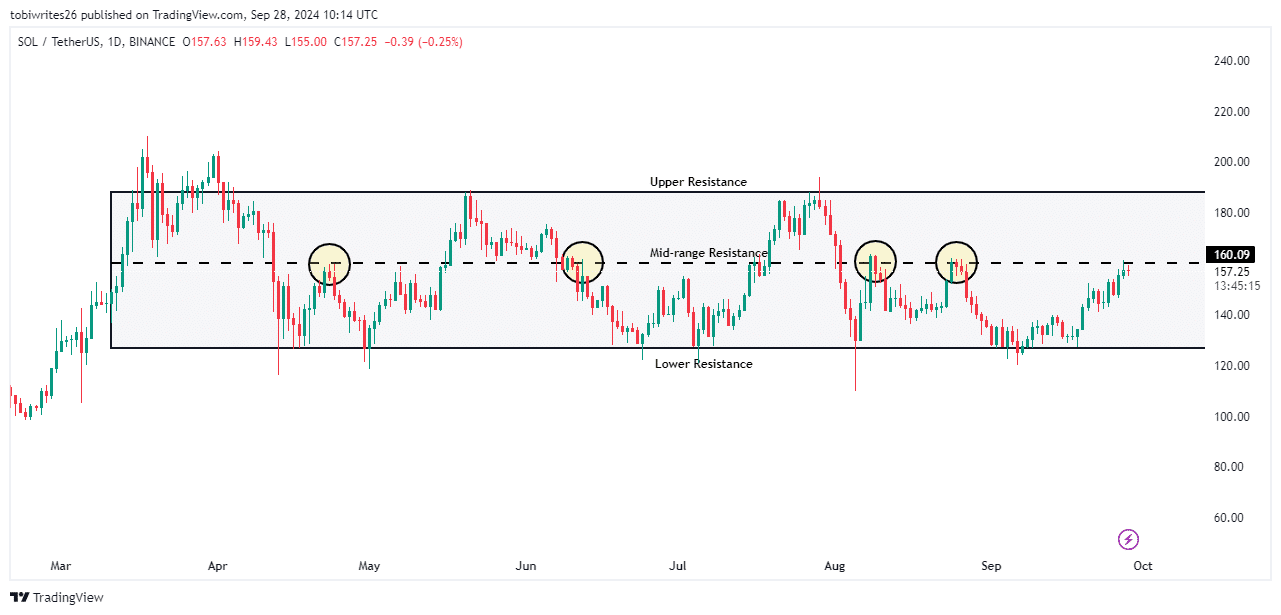

Currently, SOL is being contained within a period of sideways movement or consolidation, with distinct resistance points at the top, mid-level, and bottom.

In simpler terms, the movement of SOL, whether it’s over a short period or long-term, is heavily impacted by middle and higher resistance levels. These levels have often led to price drops in the past. For SOL to continue its upward trend, it needs to surpass the upper limit.

For a while, the price of SOL might encounter obstacles near its middle range. Historically, such resistance has caused decreases in price. If SOL manages to surpass this level, it could be pushed towards the upper limit, potentially reaching $188 – the highest point of the consolidation channel.

However, failure to breach this resistance could cause the price to fall to $126 or even lower.

Although historical data shows that the current resistance zone may have sparked sell-offs, AMBCrypto’s analysis indicates that Solana (SOL) could potentially surge toward $188.

Market sentiment supports short-term rally for SOL

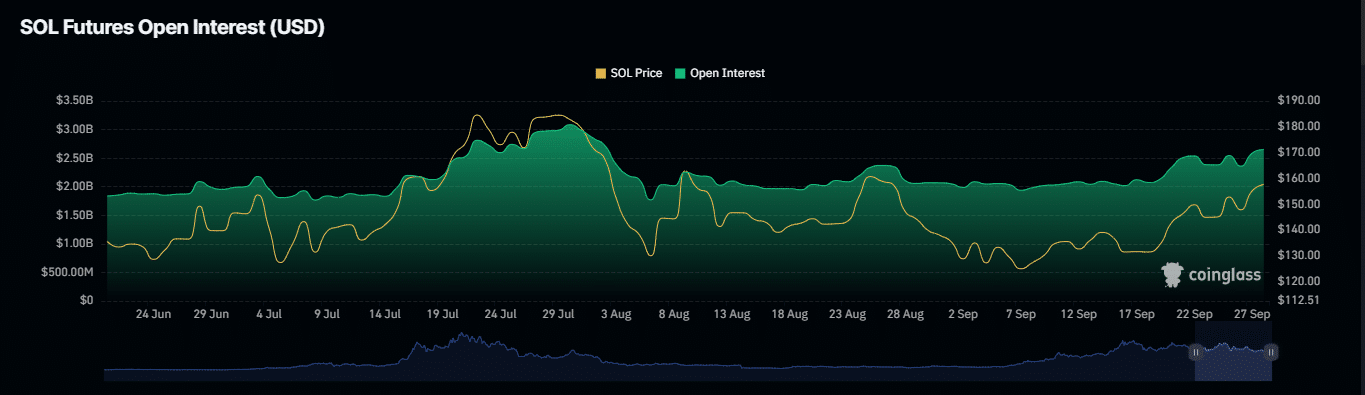

As a researcher, I’ve observed a noticeable shift in market sentiment, leaning more towards a bullish trend. This is supported by AMBCrypto’s observations of increased bullish activity. The evidence for this optimistic outlook can be seen in the spike of short liquidations and the surge in Open Interest, suggesting growing confidence among traders.

Indeed, data about quick liquidations showed an increase, amounting to approximately $3.27 million in closed short positions. This suggests that the market may have been acting against what short traders had anticipated, potentially pointing towards a new peak for SOL.

Additionally strengthening this optimistic outlook is the rise in Open Interest (OI), which increased by a substantial $290 million from September 26th up until now.

This rise indicates an enhancement of investor confidence in the market, leading them to either start fresh investments or broaden their current holdings.

Additionally, AMBCrypto also identified indicators that supported a bullish advance for SOL.

Buying pressure is expected to intensify for SOL

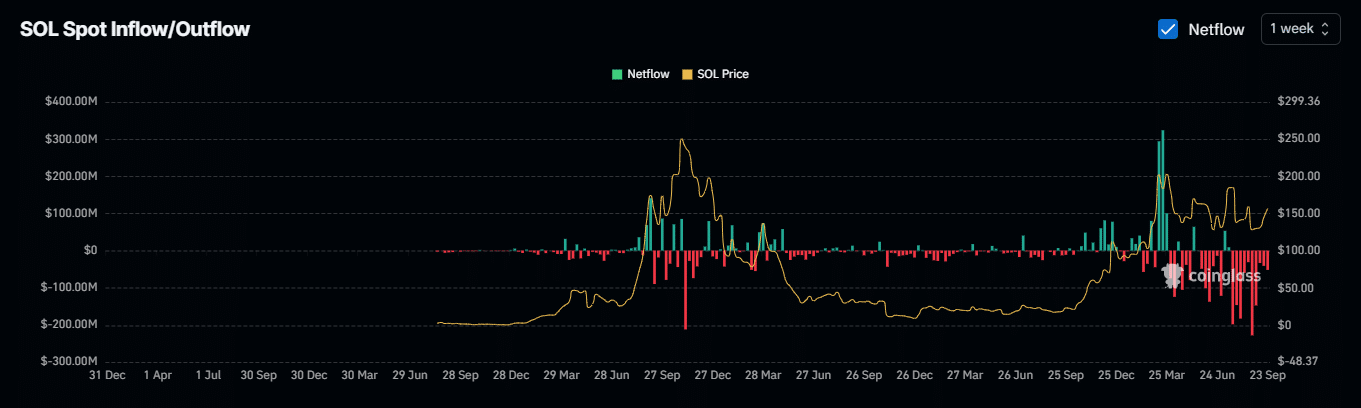

Over the last week, data from Coinglass shows that more Solana cryptocurrency has been withdrawn from exchanges than deposited, indicating a net outflow.

This means that more SOL is being withdrawn from exchanges, than is being deposited.

Based on data from Coinglass, it appears that investors are choosing to keep their SOL, hoping for an increase in value. Consequently, this action has led to a decrease in the amount of SOL available on exchanges.

Should this pattern persist, a positive short-term forecast is likely for Solana (SOL). This might help it surmount the current resistance barrier, possibly pushing the value up towards $188.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-29 00:08