As a seasoned crypto investor with a knack for spotting trends and reading charts, I find Solana’s recent surge particularly intriguing. Over the past few days, I’ve watched SOL climb steadily, defying the market’s usual volatility.

For approximately eleven days now, Solana (SOL) has been showing an impressive upward trend on its price charts. Following a dip to around $155 earlier this month at a local minimum, the cryptocurrency swiftly climbed up to reach a high of $225, reflecting a robust increase of 45.15% in just weeks.

Over the course of each day, Solana (SOL) experienced a 4.67% increase in value. Similarly, its performance improved on both the weekly and monthly scales, registering gains of 9.85% and 44.46%, respectively.

It’s clear that recent market trends have sparked curiosity about the reasons behind the surge in question. As per AMBCrypto’s examination, one key factor fueling this upward trend appears to be the growing demand and enthusiasm for SOL.

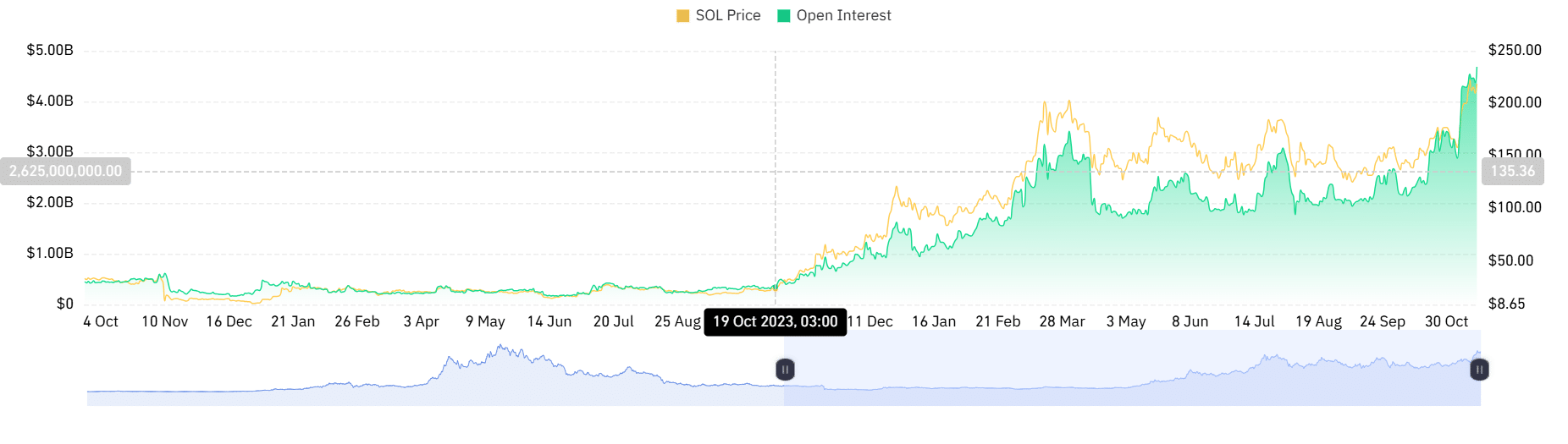

Solana Open interest hits a new ATH

The increasing appetite for this altcoin is clearly demonstrated as more and more investors keep creating fresh investment opportunities.

Based on information from Coinglass, the open interest for Solana’s futures contracts increased significantly within the past day, reaching a fresh all-time high (ATH) on the price charts.

In simpler terms, the value of trades involving this particular altcoin (alternative coin) reached an all-time high of $4.68 billion, indicating increased interest and more people jumping on board as both new and existing investors are actively trading it.

Generally speaking, when Open Interest is high for an asset, it suggests increased popularity among investors because they predict potential future price increases based on chart analysis.

As the entire cryptocurrency market soars and surpasses a total market capitalization of $3 trillion, Solana investors foresee opportunities within this bull market, thereby choosing to maintain their investments and enticing additional participants.

What do SOL’s charts say?

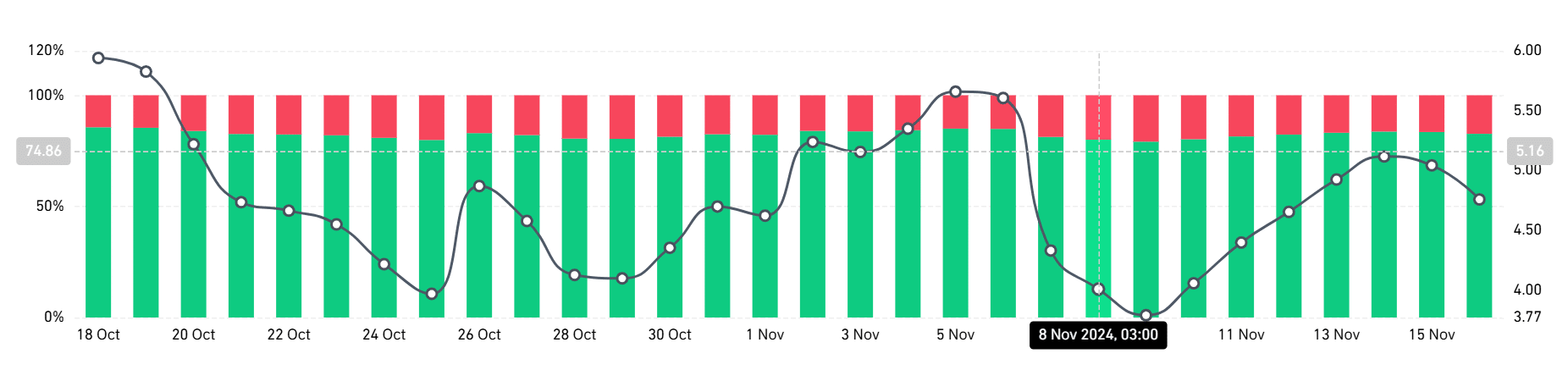

Recently, there’s been an increase in interest towards Solana, particularly for long-term investments. This surge in demand for futures contracts is evident as holders of long positions have been controlling a significant portion of the market.

According to the daily chart analysis, it was observed that long positions accounted for approximately 82.56%, whereas short positions were at around 17.44% in the Solana perpetuals market.

This implied that a majority of the investors are betting on the crypto’s price to hike.

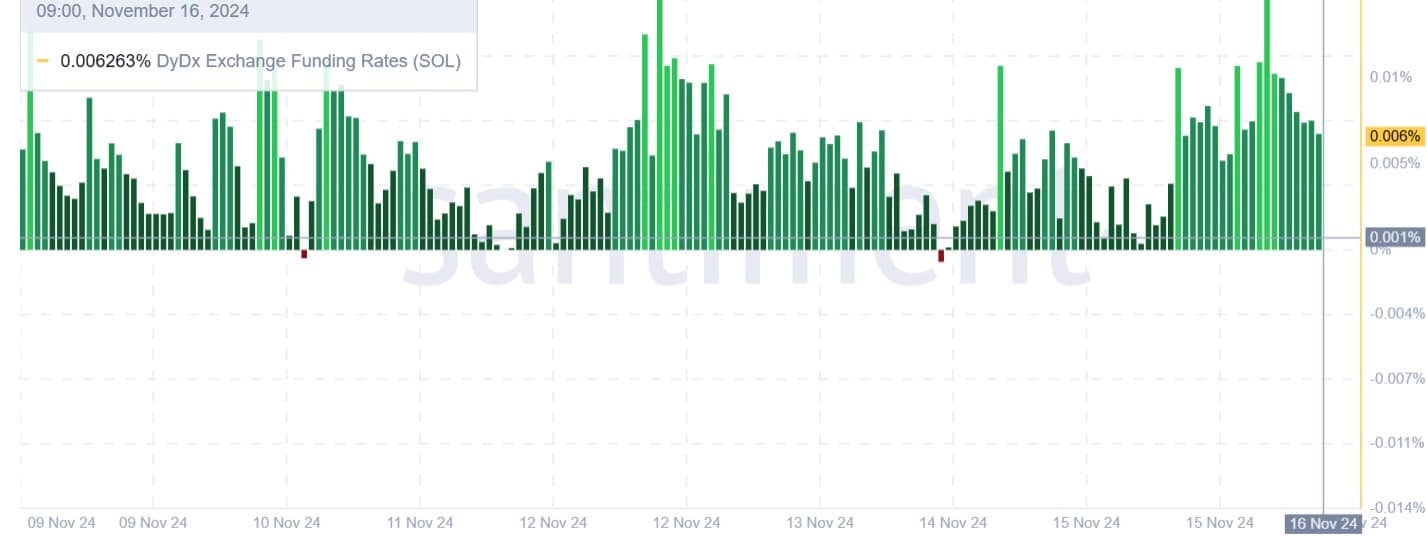

This demand for long positions is further supported by a positive DyDx exchange funding rate.

Over the past week, I’ve observed that the figures have predominantly stayed optimistic, suggesting that investors are willing to pay a premium to maintain their positions even during market dips. This trend in the market can be interpreted as a strong display of investor confidence.

What next for the altcoin?

Given that Solana’s Open Interest has reached an all-time peak, this points towards a current market sentiment that is overwhelmingly optimistic. Consequently, many investors are hopeful and anticipate further price growth. Notably, the majority of these investments have been in the form of long positions.

Given these advantageous circumstances, Solana (SOL) might see further increases in its pricing graph. Should this occur, SOL could surpass the $222 resistance barrier. If it successfully breaks through this level, the altcoin may encounter its next resistance at approximately $242.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-11-17 01:11