-

Solana’s native token, SOL, was on the verge of forming a ‘death cross’ on the daily chart.

A decline below the $120 mark could disrupt sustained range trading since March 2024.

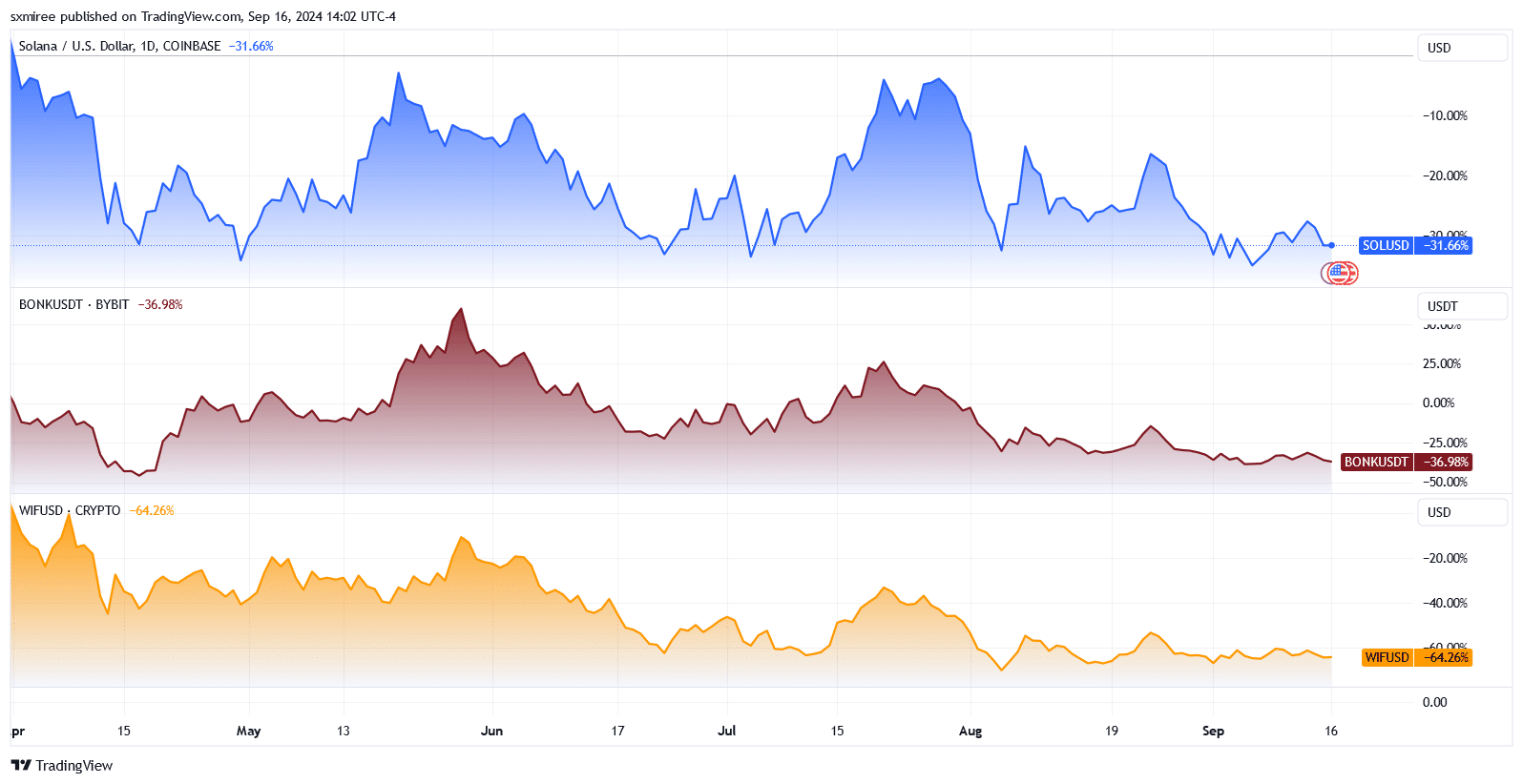

As a seasoned researcher with years of experience in the ever-evolving crypto market, I find myself closely monitoring Solana’s [SOL] current trajectory. The six-fold price surge over the past 12 months, largely fueled by memecoin frenzy, has been quite an interesting ride. However, the recent decline and the pronounced dip in Solana-based memecoins such as dogwifhat [WIF] and Bonk [BONK], down 64% and 36% since April respectively, has raised some red flags.

Over the past year, Solana’s [SOL] value experienced a nearly six-fold increase, largely due to the distribution of free tokens (airdrops) and the popularity of meme-based cryptocurrencies on its blockchain network.

This frenzy has seen a pronounced decline over the last few months to extremely low levels.

As a crypto investor, I’ve noticed a significant drop in the value of my investments in Solana-based DogWhats (WIF) and Bonk (BONK). According to CoinMarketCap data, these coins have plummeted by 64% and 36%, respectively, since April. It seems that the bullish momentum from earlier in the year has cooled off for these coins.

Solana has equally struggled – it is down 31% during this period.

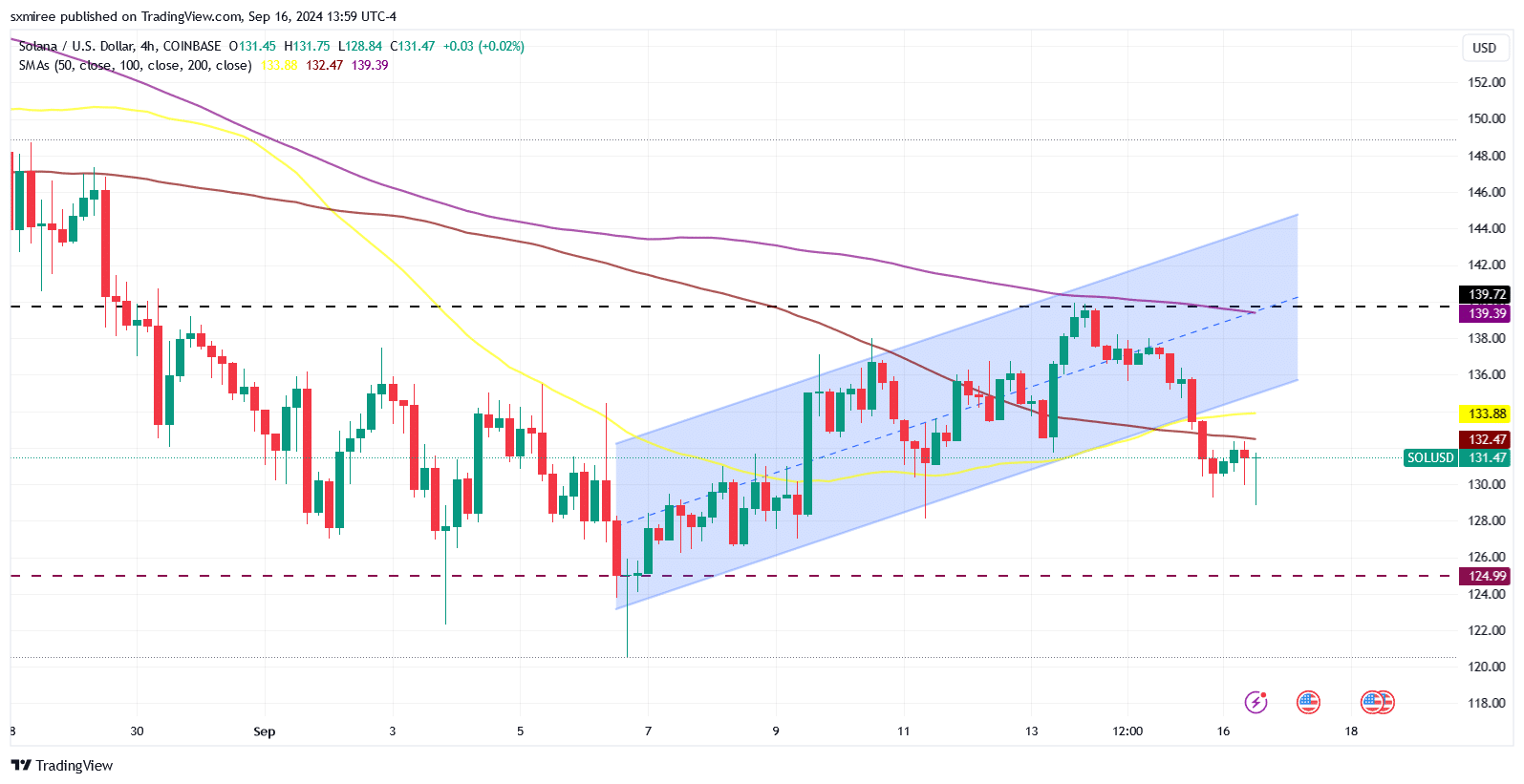

On Sunday, Solana (SOL) broke out from its upwardly sloping channel in the 4-hour SOL/USD chart, indicating a possible shift in this temporary downward price pattern.

A price resurgence could save the day

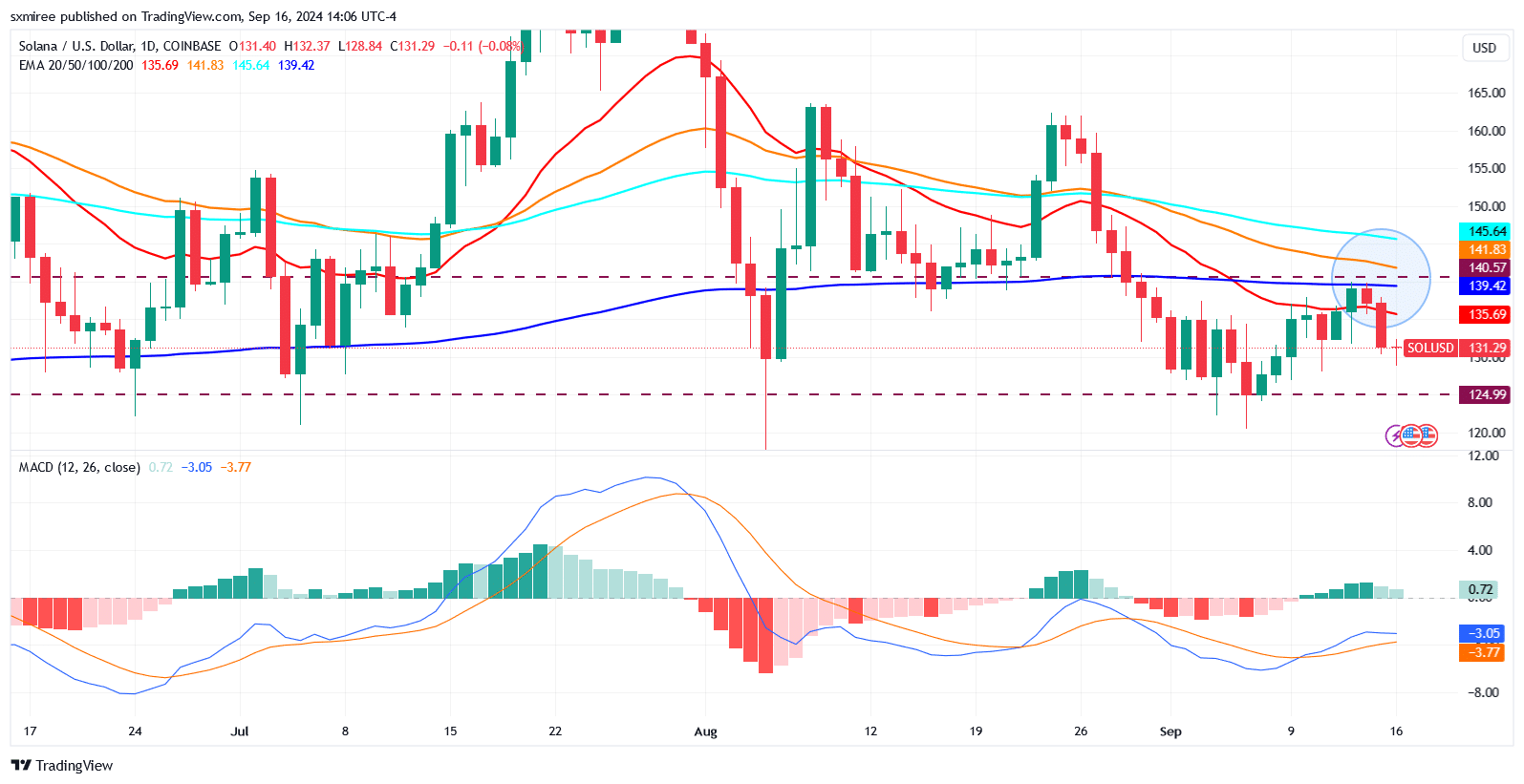

As a researcher studying the SOL/USD pair, I’ve observed an impending “death cross” pattern on the daily chart. This is where our 50-day Exponential Moving Average (EMA), which has been trending downward, is about to dip below the 200-day EMA.

As an analyst, I would interpret such a crossover as a bearish signal, suggesting that the market may experience a downturn or decreased momentum in the near future.

A well-executed death cross signal could strengthen indications of ongoing selling pressure for SOL, as it aligns with recent downward trends. This is because the overall market sentiment seems to be moving towards a bearish-neutral stance over the long term.

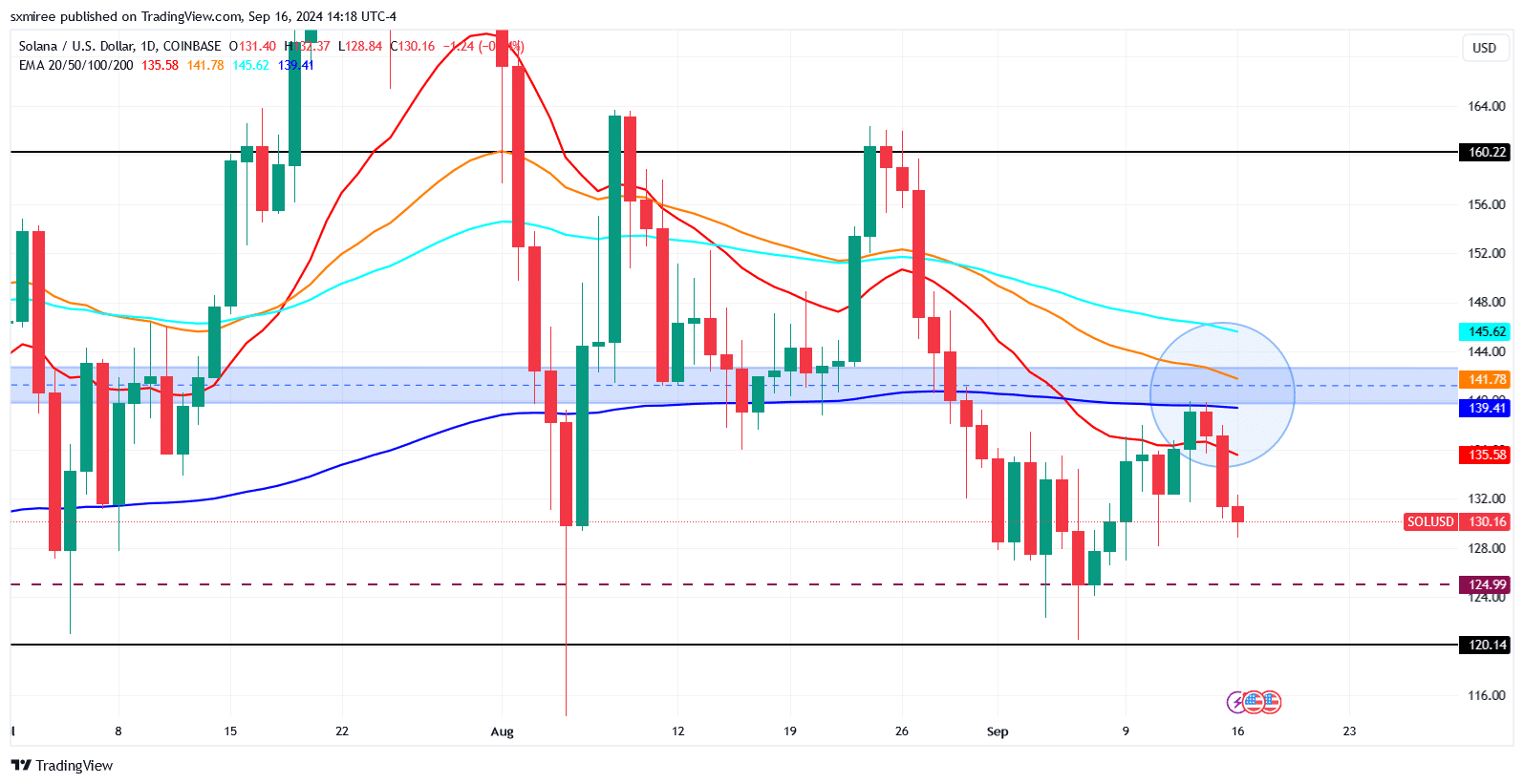

If the “death cross” is indeed validated, the $120 level could then emerge as a significant focal point, shaping whether Solana (SOL) may experience a substantial pullback.

As an analyst, I must acknowledge that a sudden surge in bullish momentum might challenge this existing bearish structure, considering that false ‘death cross’ signs are rather common occurrences.

If bulls manage to push the price beyond the $139 resistance level, it may hinder the anticipated bearish crossover and potentially avert additional price drops.

Some technical indicators suggest Solana’s macro momentum still subsists.

Last week, there was a bullish signal generated by the Moving Average Convergence Divergence (MACD) as its line intersected and moved above the signal line, which happened specifically on September 9.

SOL/USD key price levels

At the moment of reporting, Solana was priced at $131. It had previously made an unsuccessful effort to transform the $136 level into a robust support area following the weekend.

Notably, Solana (SOL) has struggled to convincingly break through $140 since August 30th, even with consistent buying activity following its support test at $125 on September 6th.

Achieving success at this point might give us the momentum needed to help Solana (SOL) climb towards the significant $160 barrier.

Read Solana’s [SOL] Price Prediction 2024–2025

Currently, the area where the 200-day Exponential Moving Average is at $139 and the 50-day EMA is at $141 serves as a significant barrier to move through for now. According to chart analyst Dom, this is the immediate challenge to overcome.

It’s crucial for SOL to recover the $140 mark promptly. Over the past 5 months, dips have been followed by less vigorous rebounds. Recently, we’ve dropped below the 200 Exponential Moving Average (EMA) and haven’t managed to quickly regain the $140 level. This situation makes me cautious about potential further declines.

For a sustained increase in price, Solana (SOL) needs to break through the resistance presented by these moving averages positioned above it.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-09-17 13:44